preliminary final report & june quarterly update - Leighton Holdings

preliminary final report & june quarterly update - Leighton Holdings

preliminary final report & june quarterly update - Leighton Holdings

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes continued<br />

for the year ended 30 June 2011<br />

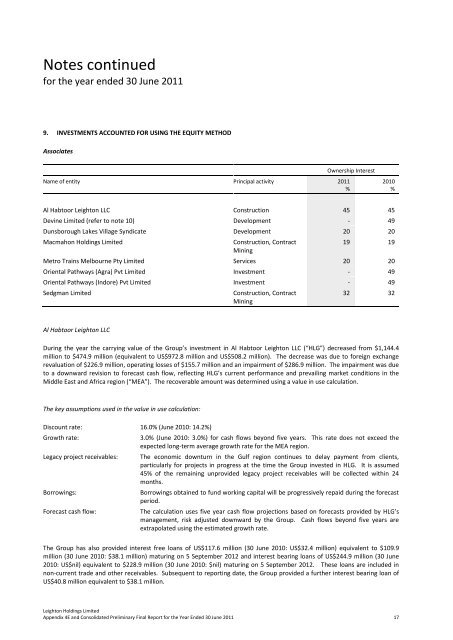

9. INVESTMENTS ACCOUNTED FOR USING THE EQUITY METHOD<br />

Associates<br />

Ownership Interest<br />

Name of entity Principal activity 2011<br />

%<br />

2010<br />

%<br />

Al Habtoor <strong>Leighton</strong> LLC Construction 45 45<br />

Devine Limited (refer to note 10) Development - 49<br />

Dunsborough Lakes Village Syndicate Development 20 20<br />

Macmahon <strong>Holdings</strong> Limited<br />

Construction, Contract<br />

19 19<br />

Mining<br />

Metro Trains Melbourne Pty Limited Services 20 20<br />

Oriental Pathways (Agra) Pvt Limited Investment - 49<br />

Oriental Pathways (Indore) Pvt Limited Investment - 49<br />

Sedgman Limited<br />

Construction, Contract<br />

Mining<br />

32 32<br />

Al Habtoor <strong>Leighton</strong> LLC<br />

During the year the carrying value of the Group’s investment in Al Habtoor <strong>Leighton</strong> LLC (“HLG”) decreased from $1,144.4<br />

million to $474.9 million (equivalent to US$972.8 million and US$508.2 million). The decrease was due to foreign exchange<br />

revaluation of $226.9 million, operating losses of $155.7 million and an impairment of $286.9 million. The impairment was due<br />

to a downward revision to forecast cash flow, reflecting HLG’s current performance and prevailing market conditions in the<br />

Middle East and Africa region (“MEA”). The recoverable amount was determined using a value in use calculation.<br />

The key assumptions used in the value in use calculation:<br />

Discount rate: 16.0% (June 2010: 14.2%)<br />

Growth rate:<br />

3.0% (June 2010: 3.0%) for cash flows beyond five years. This rate does not exceed the<br />

expected long-term average growth rate for the MEA region.<br />

Legacy project receivables: The economic downturn in the Gulf region continues to delay payment from clients,<br />

particularly for projects in progress at the time the Group invested in HLG. It is assumed<br />

45% of the remaining unprovided legacy project receivables will be collected within 24<br />

months.<br />

Borrowings:<br />

Borrowings obtained to fund working capital will be progressively repaid during the forecast<br />

period.<br />

Forecast cash flow:<br />

The calculation uses five year cash flow projections based on forecasts provided by HLG’s<br />

management, risk adjusted downward by the Group. Cash flows beyond five years are<br />

extrapolated using the estimated growth rate.<br />

The Group has also provided interest free loans of US$117.6 million (30 June 2010: US$32.4 million) equivalent to $109.9<br />

million (30 June 2010: $38.1 million) maturing on 5 September 2012 and interest bearing loans of US$244.9 million (30 June<br />

2010: US$nil) equivalent to $228.9 million (30 June 2010: $nil) maturing on 5 September 2012. These loans are included in<br />

non-current trade and other receivables. Subsequent to <strong>report</strong>ing date, the Group provided a further interest bearing loan of<br />

US$40.8 million equivalent to $38.1 million.<br />

<strong>Leighton</strong> <strong>Holdings</strong> Limited<br />

Appendix 4E and Consolidated Preliminary Final Report for the Year Ended 30 June 2011 17