preliminary final report & june quarterly update - Leighton Holdings

preliminary final report & june quarterly update - Leighton Holdings

preliminary final report & june quarterly update - Leighton Holdings

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes continued<br />

for the year ended 30 June 2011<br />

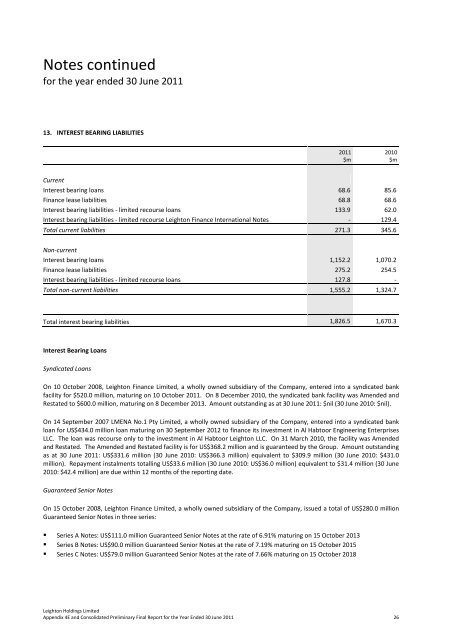

13. INTEREST BEARING LIABILITIES<br />

2011<br />

$m<br />

2010<br />

$m<br />

Current<br />

Interest bearing loans 68.6 85.6<br />

Finance lease liabilities 68.8 68.6<br />

Interest bearing liabilities - limited recourse loans 133.9 62.0<br />

Interest bearing liabilities - limited recourse <strong>Leighton</strong> Finance International Notes - 129.4<br />

Total current liabilities 271.3 345.6<br />

Non-current<br />

Interest bearing loans 1,152.2 1,070.2<br />

Finance lease liabilities 275.2 254.5<br />

Interest bearing liabilities - limited recourse loans 127.8 -<br />

Total non-current liabilities 1,555.2 1,324.7<br />

Total interest bearing liabilities 1,826.5 1,670.3<br />

Interest Bearing Loans<br />

Syndicated Loans<br />

On 10 October 2008, <strong>Leighton</strong> Finance Limited, a wholly owned subsidiary of the Company, entered into a syndicated bank<br />

facility for $520.0 million, maturing on 10 October 2011. On 8 December 2010, the syndicated bank facility was Amended and<br />

Restated to $600.0 million, maturing on 8 December 2013. Amount outstanding as at 30 June 2011: $nil (30 June 2010: $nil).<br />

On 14 September 2007 LMENA No.1 Pty Limited, a wholly owned subsidiary of the Company, entered into a syndicated bank<br />

loan for US$434.0 million loan maturing on 30 September 2012 to finance its investment in Al Habtoor Engineering Enterprises<br />

LLC. The loan was recourse only to the investment in Al Habtoor <strong>Leighton</strong> LLC. On 31 March 2010, the facility was Amended<br />

and Restated. The Amended and Restated facility is for US$368.2 million and is guaranteed by the Group. Amount outstanding<br />

as at 30 June 2011: US$331.6 million (30 June 2010: US$366.3 million) equivalent to $309.9 million (30 June 2010: $431.0<br />

million). Repayment instalments totalling US$33.6 million (30 June 2010: US$36.0 million) equivalent to $31.4 million (30 June<br />

2010: $42.4 million) are due within 12 months of the <strong>report</strong>ing date.<br />

Guaranteed Senior Notes<br />

On 15 October 2008, <strong>Leighton</strong> Finance Limited, a wholly owned subsidiary of the Company, issued a total of US$280.0 million<br />

Guaranteed Senior Notes in three series:<br />

• Series A Notes: US$111.0 million Guaranteed Senior Notes at the rate of 6.91% maturing on 15 October 2013<br />

• Series B Notes: US$90.0 million Guaranteed Senior Notes at the rate of 7.19% maturing on 15 October 2015<br />

• Series C Notes: US$79.0 million Guaranteed Senior Notes at the rate of 7.66% maturing on 15 October 2018<br />

<strong>Leighton</strong> <strong>Holdings</strong> Limited<br />

Appendix 4E and Consolidated Preliminary Final Report for the Year Ended 30 June 2011 26