Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Statements<br />

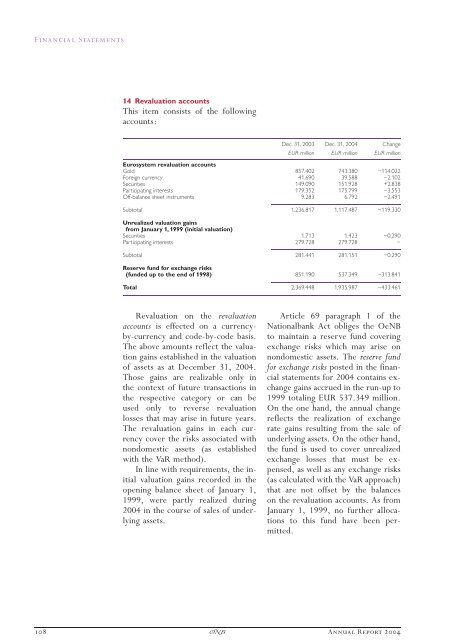

14 Revaluation accounts<br />

This item consists of the following<br />

accounts:<br />

Dec. 31, 2003 Dec. 31, <strong>2004</strong> Change<br />

EUR million EUR million EUR million<br />

Eurosystem revaluation accounts<br />

Gold 857.402 743.380 —114.022<br />

Foreign currency 41.690 39.588 —2.102<br />

Securities 149.090 151.928 +2.838<br />

Participating interests 179.352 175.799 —3.553<br />

Off-balance sheet instruments 9.283 6.792 —2.491<br />

Subtotal 1,236.817 1,117.487 —119.330<br />

Unrealized valuation gains<br />

from January 1, 1999 (initial valuation)<br />

Securities 1.713 1.423 —0.290<br />

Participating interests 279.728 279.728 —<br />

Subtotal 281.441 281.151 —0.290<br />

Reserve fund for exchange risks<br />

(funded up to the end of 1998) 851.190 537.349 —313.841<br />

Total 2,369.448 1,935.987 —433.461<br />

Revaluation on the revaluation<br />

accounts is effected on a currencyby-currency<br />

and code-by-code basis.<br />

The above amounts reflect the valuation<br />

gains established in the valuation<br />

of assets as at December 31, <strong>2004</strong>.<br />

Those gains are realizable only in<br />

the context of future transactions in<br />

the respective category or can be<br />

used only to reverse revaluation<br />

losses that may arise in future years.<br />

The revaluation gains in each currency<br />

cover the risks associated with<br />

nondomestic assets (as established<br />

with the VaR method).<br />

In line with requirements, the initial<br />

valuation gains recorded in the<br />

opening balance sheet of January 1,<br />

1999, were partly realized during<br />

<strong>2004</strong> in the course of sales of underlying<br />

assets.<br />

Article 69 paragraph 1 of the<br />

Nationalbank Act obliges the OeNB<br />

to maintain a reserve fund covering<br />

exchange risks which may arise on<br />

nondomestic assets. The reserve fund<br />

for exchange risks posted in the financial<br />

statements for <strong>2004</strong> contains exchange<br />

gains accrued in the run-up to<br />

1999 totaling EUR 537.349 million.<br />

On the one hand, the annual change<br />

reflects the realization of exchange<br />

rate gains resulting from the sale of<br />

underlying assets. On the other hand,<br />

the fund is used to cover unrealized<br />

exchange losses that must be expensed,<br />

as well as any exchange risks<br />

(as calculated with the VaR approach)<br />

that are not offset by the balances<br />

on the revaluation accounts. As from<br />

January 1, 1999, no further allocations<br />

to this fund have been permitted.<br />

108 ×<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2004</strong>