You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Development of the<br />

OeNBÕs Currency<br />

Positions in the Financial<br />

Year <strong>2004</strong><br />

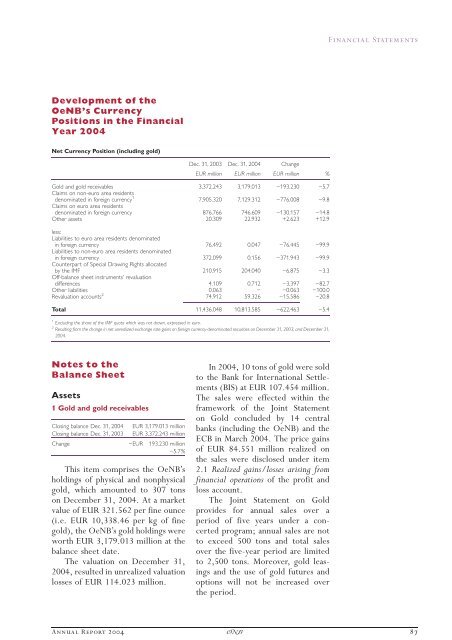

Net Currency Position (including gold)<br />

Notes to the<br />

Balance Sheet<br />

Assets<br />

1 Gold and gold receivables<br />

Closing balance Dec. 31, <strong>2004</strong> EUR 3,179.013 million<br />

Closing balance Dec. 31, 2003 EUR 3,372.243 million<br />

Change —EUR 193.230 million<br />

—5.7%<br />

This item comprises the OeNBÕs<br />

holdings of physical and nonphysical<br />

gold, which amounted to 307 tons<br />

on December 31, <strong>2004</strong>. At a market<br />

value of EUR 321.562 per fine ounce<br />

(i.e. EUR 10,338.46 per kg of fine<br />

gold), the OeNBÕs gold holdings were<br />

worth EUR 3,179.013 million at the<br />

balance sheet date.<br />

The valuation on December 31,<br />

<strong>2004</strong>, resulted in unrealized valuation<br />

losses of EUR 114.023 million.<br />

Dec. 31, 2003 Dec. 31, <strong>2004</strong> Change<br />

EUR million EUR million EUR million %<br />

Gold and gold receivables<br />

Claims on non-euro area residents<br />

3,372.243 3,179.013 —193.230 —5.7<br />

denominated in foreign currency 1<br />

Claims on euro area residents<br />

7,905.320 7,129.312 —776.008 —9.8<br />

denominated in foreign currency 876.766 746.609 —130.157 —14.8<br />

Other assets 20.309 22.932 +2.623 +12.9<br />

less:<br />

Liabilities to euro area residents denominated<br />

in foreign currency<br />

Liabilities to non-euro area residents denominated<br />

76.492 0.047 —76.445 —99.9<br />

in foreign currency<br />

Counterpart of Special Drawing Rights allocated<br />

372.099 0.156 —371.943 —99.9<br />

by the IMF<br />

Off-balance sheet instrumentsÕ revaluation<br />

210.915 204.040 —6.875 —3.3<br />

differences 4.109 0.712 —3.397 —82.7<br />

Other liabilities<br />

Revaluation accounts<br />

0.063 — —0.063 —100.0<br />

2<br />

74.912 59.326 —15.586 —20.8<br />

Total 11,436.048 10,813.585 —622.463 —5.4<br />

1<br />

Excluding the share of the IMF quota which was not drawn, expressed in euro.<br />

2<br />

Resulting from the change in net unrealized exchange rate gains on foreign currency-denominated securities on December 31, 2003, and December 31,<br />

<strong>2004</strong>.<br />

In <strong>2004</strong>, 10 tons of gold were sold<br />

to the Bank for International Settlements<br />

(BIS) at EUR 107.454 million.<br />

The sales were effected within the<br />

framework of the Joint Statement<br />

on Gold concluded by 14 central<br />

banks (including the OeNB) and the<br />

ECB in March <strong>2004</strong>. The price gains<br />

of EUR 84.551 million realized on<br />

the sales were disclosed under item<br />

2.1 Realized gains/losses arising from<br />

financial operations of the profit and<br />

loss account.<br />

The Joint Statement on Gold<br />

provides for annual sales over a<br />

period of five years under a concerted<br />

program; annual sales are not<br />

to exceed 500 tons and total sales<br />

over the five-year period are limited<br />

to 2,500 tons. Moreover, gold leasings<br />

and the use of gold futures and<br />

options will not be increased over<br />

the period.<br />

Financial Statements<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2004</strong> ×<br />

87