Oil Supply Routes in the Asia Pacific: China's Strategic Calculations

Oil Supply Routes in the Asia Pacific: China's Strategic Calculations

Oil Supply Routes in the Asia Pacific: China's Strategic Calculations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

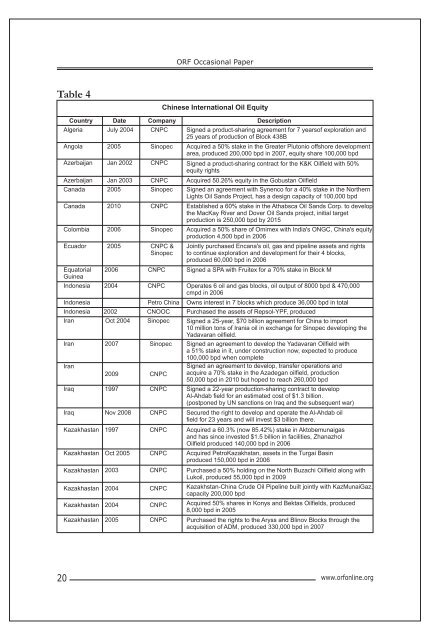

ORF Occasional Paper<br />

Table 4<br />

Ch<strong>in</strong>ese International <strong>Oil</strong> Equity<br />

Country Date<br />

Algeria July 2004<br />

Angola 2005<br />

Azerbaijan Jan 2002<br />

Azerbaijan Jan 2003<br />

Canada 2005<br />

Company<br />

CNPC<br />

S<strong>in</strong>opec<br />

CNPC<br />

CNPC<br />

S<strong>in</strong>opec<br />

Canada 2010 CNPC<br />

Colombia 2006 S<strong>in</strong>opec<br />

Ecuador 2005 CNPC &<br />

S<strong>in</strong>opec<br />

Equatorial<br />

Gu<strong>in</strong>ea<br />

Description<br />

Signed a product-shar<strong>in</strong>g agreement for 7 yearsof exploration and<br />

25 years of production of Block 438B<br />

Acquired a 50% stake <strong>in</strong> <strong>the</strong> Greater Plutonio offshore development<br />

area, produced 200,000 bpd <strong>in</strong> 2007, equity share 100,000 bpd<br />

Signed a product-shar<strong>in</strong>g contract for <strong>the</strong> K&K <strong>Oil</strong>field with 50%<br />

equity rights<br />

Acquired 50.26% equity <strong>in</strong> <strong>the</strong> Gobustan <strong>Oil</strong>field<br />

Signed an agreement with Synenco for a 40% stake <strong>in</strong> <strong>the</strong> Nor<strong>the</strong>rn<br />

Lights <strong>Oil</strong> Sands Project, has a design capacity of 100,000 bpd<br />

Established a 60% stake <strong>in</strong> <strong>the</strong> Athabsca <strong>Oil</strong> Sands Corp. to develop<br />

<strong>the</strong> MacKay River and Dover <strong>Oil</strong> Sands project, <strong>in</strong>itial target<br />

production is 250,000 bpd by 2015<br />

Acquired a 50% share of Omimex with India's ONGC, Ch<strong>in</strong>a's equity<br />

production 4,500 bpd <strong>in</strong> 2006<br />

Jo<strong>in</strong>tly purchased Encana's oil, gas and pipel<strong>in</strong>e assets and rights<br />

to cont<strong>in</strong>ue exploration and development for <strong>the</strong>ir 4 blocks,<br />

produced 60,000 bpd <strong>in</strong> 2006<br />

2006 CNPC Signed a SPA with Fruitex for a 70% stake <strong>in</strong> Block M<br />

Indonesia 2004 CNPC Operates 6 oil and gas blocks, oil output of 8000 bpd & 470,000<br />

cmpd <strong>in</strong> 2006<br />

Indonesia Petro Ch<strong>in</strong>a Owns <strong>in</strong>terest <strong>in</strong> 7 blocks which produce 36,000 bpd <strong>in</strong> total<br />

Indonesia 2002 CNOOC Purchased <strong>the</strong> assets of Repsol-YPF, produced<br />

Iran Oct 2004 S<strong>in</strong>opec Signed a 25-year, $70 billion agreement for Ch<strong>in</strong>a to import<br />

10 million tons of Irania oil <strong>in</strong> exchange for S<strong>in</strong>opec develop<strong>in</strong>g <strong>the</strong><br />

Yadavaran oilfield.<br />

Iran 2007 S<strong>in</strong>opec Signed an agreement to develop <strong>the</strong> Yadavaran <strong>Oil</strong>field with<br />

a 51% stake <strong>in</strong> it, under construction now, expected to produce<br />

100,000 bpd when complete<br />

Iran<br />

Signed an agreement to develop, transfer operations and<br />

2009 CNPC acquire a 70% stake <strong>in</strong> <strong>the</strong> Azadegan oilfield, production<br />

50,000 bpd <strong>in</strong> 2010 but hoped to reach 260,000 bpd<br />

Iraq 1997 CNPC<br />

Iraq Nov 2008 CNPC<br />

Kazakhastan 1997 CNPC<br />

Kazakhastan Oct 2005 CNPC<br />

Kazakhastan 2003 CNPC<br />

Kazakhastan 2004 CNPC<br />

Kazakhastan 2004 CNPC<br />

Kazakhastan 2005 CNPC<br />

Signed a 22-year production-shar<strong>in</strong>g contract to develop<br />

Al-Ahdab field for an estimated cost of $1.3 billion.<br />

(postponed by UN sanctions on Iraq and <strong>the</strong> subsequent war)<br />

Secured <strong>the</strong> right to develop and operate <strong>the</strong> Al-Ahdab oil<br />

field for 23 years and will <strong>in</strong>vest $3 billion <strong>the</strong>re.<br />

Acquired a 60.3% (now 85.42%) stake <strong>in</strong> Aktobemunaigas<br />

and has s<strong>in</strong>ce <strong>in</strong>vested $1.5 billion <strong>in</strong> facilities, Zhanazhol<br />

<strong>Oil</strong>field produced 140,000 bpd <strong>in</strong> 2006<br />

Acquired PetroKazakhstan, assets <strong>in</strong> <strong>the</strong> Turgai Bas<strong>in</strong><br />

produced 150,000 bpd <strong>in</strong> 2006<br />

Purchased a 50% hold<strong>in</strong>g on <strong>the</strong> North Buzachi <strong>Oil</strong>field along with<br />

Lukoil, produced 55,000 bpd <strong>in</strong> 2009<br />

Kazakhstan-Ch<strong>in</strong>a Crude <strong>Oil</strong> Pipel<strong>in</strong>e built jo<strong>in</strong>tly with KazMunaiGaz,<br />

capacity 200,000 bpd<br />

Acquired 50% shares <strong>in</strong> Konys and Bektas <strong>Oil</strong>fields, produced<br />

8,000 bpd <strong>in</strong> 2005<br />

Purchased <strong>the</strong> rights to <strong>the</strong> Aryss and Bl<strong>in</strong>ov Blocks through <strong>the</strong><br />

acquisition of ADM, produced 330,000 bpd <strong>in</strong> 2007<br />

20<br />

www.orfonl<strong>in</strong>e.org