OEFFA and OEFFA Certification Board Meetings 10 October 2010 ...

OEFFA and OEFFA Certification Board Meetings 10 October 2010 ...

OEFFA and OEFFA Certification Board Meetings 10 October 2010 ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

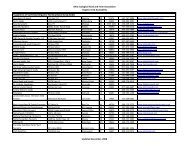

Form 990-T (2009) OHIO ECOLOGICAL FOOD AND FARM ASSOCIATIO 34-1638273<br />

Page<br />

85<br />

Schedule C - Rent Income (From Real Property <strong>and</strong> Personal Property Leased With Real Property) (see instr. on pg 18)<br />

3<br />

1. Description of property<br />

(1)<br />

(2)<br />

(3)<br />

(4)<br />

(1)<br />

(2)<br />

(3)<br />

(a)<br />

2.<br />

From personal property (if the percentage of<br />

rent for personal property is more than<br />

<strong>10</strong>% but not more than 50%)<br />

Rent received or accrued<br />

(b) From real <strong>and</strong> personal property (if the percentage<br />

of rent for personal property exceeds 50% or if<br />

the rent is based on profit or income)<br />

3(a)<br />

Deductions directly connected with the income in<br />

columns 2(a) <strong>and</strong> 2(b) (attach schedule)<br />

(4)<br />

Total<br />

0. Total<br />

0.<br />

(c) Total income. Add totals of columns 2(a) <strong>and</strong> 2(b). Enter<br />

(b) Total deductions.<br />

Enter here <strong>and</strong> on page 1,<br />

here <strong>and</strong> on page 1, Part I, line 6, column (A) | 0. Part I, line 6, column (B) |<br />

0.<br />

Schedule E - Unrelated Debt-Financed Income (See instructions on page 19)<br />

3. Deductions directly connected with or allocable<br />

2. Gross income from<br />

to debt-financed property<br />

1. Description of debt-financed property<br />

or allocable to debtfinanced<br />

property<br />

(a) Straight line depreciation (b) Other deductions<br />

(attach schedule)<br />

(attach schedule)<br />

(1)<br />

(2)<br />

(3)<br />

(4)<br />

(1)<br />

(2)<br />

(3)<br />

(4)<br />

4. Amount of average acquisition<br />

5. Average adjusted basis 6. Column 4 divided<br />

7. Gross income<br />

8. Allocable deductions<br />

debt on or allocable to debt-financed<br />

of or allocable to<br />

by column 5<br />

reportable (column<br />

(column 6 x total of columns<br />

property (attach schedule)<br />

debt-financed property<br />

2 x column 6)<br />

3(a) <strong>and</strong> 3(b))<br />

(attach schedule)<br />

Enter here <strong>and</strong> on page 1,<br />

Part I, line 7, column (A).<br />

Enter here <strong>and</strong> on page 1,<br />

Part I, line 7, column (B).<br />

Totals ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ |<br />

0. 0.<br />

Total dividends-received deductions included in column 8 |<br />

0.<br />

Schedule F - Interest, Annuities, Royalties, <strong>and</strong> Rents From Controlled Organizations (See instructions on page 20)<br />

Exempt Controlled Organizations<br />

1. Name of controlled organization<br />

2. 3. 4. 5. Part of column 4 that is 6. Deductions directly<br />

Employer identification Net unrelated income Total of specified included in the controlling connected with income<br />

number<br />

(loss) (see instructions) payments made organization’s gross income in column 5<br />

%<br />

%<br />

%<br />

%<br />

(1)<br />

(2)<br />

(3)<br />

(4)<br />

Nonexempt Controlled Organizations<br />

7. Taxable Income 8. Net unrelated income (loss) 9. Total of specified payments <strong>10</strong>. Part of column 9 that is included 11. Deductions directly connected<br />

(see instructions) made<br />

in the controlling organization’s<br />

with income in column <strong>10</strong><br />

gross income<br />

(1)<br />

(2)<br />

(3)<br />

(4)<br />

Add columns 5 <strong>and</strong> <strong>10</strong>.<br />

Enter here <strong>and</strong> on page 1, Part I,<br />

line 8, column (A).<br />

Add columns 6 <strong>and</strong> 11.<br />

Enter here <strong>and</strong> on page 1, Part I,<br />

line 8, column (B).<br />

Totals<br />

J<br />

0. 0.<br />

923721 01-08-<strong>10</strong><br />

Form 990-T (2009)<br />

16<br />

15270930 795380 <strong>OEFFA</strong> 2009.03051 OHIO ECOLOGICAL FOOD AND FA <strong>OEFFA</strong>__1