Employee Benefit Guide 2012 - City of Oklahoma City

Employee Benefit Guide 2012 - City of Oklahoma City

Employee Benefit Guide 2012 - City of Oklahoma City

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

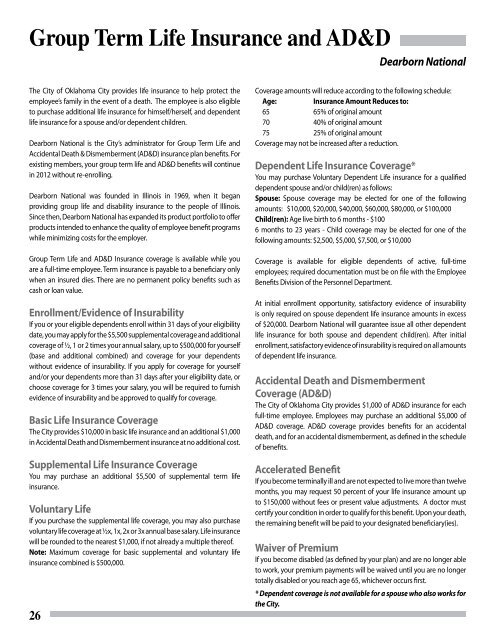

Group Term Life Insurance and AD&D<br />

Dearborn National<br />

The <strong>City</strong> <strong>of</strong> <strong>Oklahoma</strong> <strong>City</strong> provides life insurance to help protect the<br />

employee’s family in the event <strong>of</strong> a death. The employee is also eligible<br />

to purchase additional life insurance for himself/herself, and dependent<br />

life insurance for a spouse and/or dependent children.<br />

Dearborn National is the <strong>City</strong>’s administrator for Group Term Life and<br />

Accidental Death & Dismemberment (AD&D) insurance plan benefits. For<br />

existing members, your group term life and AD&D benefits will continue<br />

in <strong>2012</strong> without re-enrolling.<br />

Dearborn National was founded in Illinois in 1969, when it began<br />

providing group life and disability insurance to the people <strong>of</strong> Illinois.<br />

Since then, Dearborn National has expanded its product portfolio to <strong>of</strong>fer<br />

products intended to enhance the quality <strong>of</strong> employee benefit programs<br />

while minimizing costs for the employer.<br />

Group Term Life and AD&D Insurance coverage is available while you<br />

are a full-time employee. Term insurance is payable to a beneficiary only<br />

when an insured dies. There are no permanent policy benefits such as<br />

cash or loan value.<br />

Enrollment/Evidence <strong>of</strong> Insurability<br />

If you or your eligible dependents enroll within 31 days <strong>of</strong> your eligibility<br />

date, you may apply for the $5,500 supplemental coverage and additional<br />

coverage <strong>of</strong> ½, 1 or 2 times your annual salary, up to $500,000 for yourself<br />

(base and additional combined) and coverage for your dependents<br />

without evidence <strong>of</strong> insurability. If you apply for coverage for yourself<br />

and/or your dependents more than 31 days after your eligibility date, or<br />

choose coverage for 3 times your salary, you will be required to furnish<br />

evidence <strong>of</strong> insurability and be approved to qualify for coverage.<br />

Basic Life Insurance Coverage<br />

The <strong>City</strong> provides $10,000 in basic life insurance and an additional $1,000<br />

in Accidental Death and Dismemberment insurance at no additional cost.<br />

Supplemental Life Insurance Coverage<br />

You may purchase an additional $5,500 <strong>of</strong> supplemental term life<br />

insurance.<br />

Voluntary Life<br />

If you purchase the supplemental life coverage, you may also purchase<br />

voluntary life coverage at ½x, 1x, 2x or 3x annual base salary. Life insurance<br />

will be rounded to the nearest $1,000, if not already a multiple there<strong>of</strong>.<br />

Note: Maximum coverage for basic supplemental and voluntary life<br />

insurance combined is $500,000.<br />

26<br />

Coverage amounts will reduce according to the following schedule:<br />

Age:<br />

Insurance Amount Reduces to:<br />

65 65% <strong>of</strong> original amount<br />

70 40% <strong>of</strong> original amount<br />

75 25% <strong>of</strong> original amount<br />

Coverage may not be increased after a reduction.<br />

Dependent Life Insurance Coverage*<br />

You may purchase Voluntary Dependent Life insurance for a qualified<br />

dependent spouse and/or child(ren) as follows:<br />

Spouse: Spouse coverage may be elected for one <strong>of</strong> the following<br />

amounts: $10,000, $20,000, $40,000, $60,000, $80,000, or $100,000<br />

Child(ren): Age live birth to 6 months - $100<br />

6 months to 23 years - Child coverage may be elected for one <strong>of</strong> the<br />

following amounts: $2,500, $5,000, $7,500, or $10,000<br />

Coverage is available for eligible dependents <strong>of</strong> active, full-time<br />

employees; required documentation must be on file with the <strong>Employee</strong><br />

<strong>Benefit</strong>s Division <strong>of</strong> the Personnel Department.<br />

At initial enrollment opportunity, satisfactory evidence <strong>of</strong> insurability<br />

is only required on spouse dependent life insurance amounts in excess<br />

<strong>of</strong> $20,000. Dearborn National will guarantee issue all other dependent<br />

life insurance for both spouse and dependent child(ren). After initial<br />

enrollment, satisfactory evidence <strong>of</strong> insurability is required on all amounts<br />

<strong>of</strong> dependent life insurance.<br />

Accidental Death and Dismemberment<br />

Coverage (AD&D)<br />

The <strong>City</strong> <strong>of</strong> <strong>Oklahoma</strong> <strong>City</strong> provides $1,000 <strong>of</strong> AD&D insurance for each<br />

full-time employee. <strong>Employee</strong>s may purchase an additional $5,000 <strong>of</strong><br />

AD&D coverage. AD&D coverage provides benefits for an accidental<br />

death, and for an accidental dismemberment, as defined in the schedule<br />

<strong>of</strong> benefits.<br />

Accelerated <strong>Benefit</strong><br />

If you become terminally ill and are not expected to live more than twelve<br />

months, you may request 50 percent <strong>of</strong> your life insurance amount up<br />

to $150,000 without fees or present value adjustments. A doctor must<br />

certify your condition in order to qualify for this benefit. Upon your death,<br />

the remaining benefit will be paid to your designated beneficiary(ies).<br />

Waiver <strong>of</strong> Premium<br />

If you become disabled (as defined by your plan) and are no longer able<br />

to work, your premium payments will be waived until you are no longer<br />

totally disabled or you reach age 65, whichever occurs first.<br />

* Dependent coverage is not available for a spouse who also works for<br />

the <strong>City</strong>.