ä¿¡ææ天 - é¦æ¸¯æµ·æ´å ¬åä¿è²åºé

ä¿¡ææ天 - é¦æ¸¯æµ·æ´å ¬åä¿è²åºé

ä¿¡ææ天 - é¦æ¸¯æµ·æ´å ¬åä¿è²åºé

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

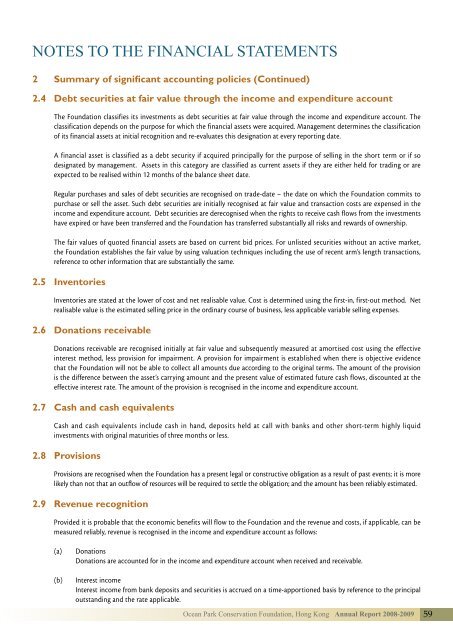

NOTES TO THE FINANCIAL STATEMENTS<br />

2 Summary of significant accounting policies (Continued)<br />

2.4 Debt securities at fair value through the income and expenditure account<br />

The Foundation classifies its investments as debt securities at fair value through the income and expenditure account. The<br />

classification depends on the purpose for which the financial assets were acquired. Management determines the classification<br />

of its financial assets at initial recognition and re-evaluates this designation at every reporting date.<br />

A financial asset is classified as a debt security if acquired principally for the purpose of selling in the short term or if so<br />

designated by management. Assets in this category are classified as current assets if they are either held for trading or are<br />

expected to be realised within 12 months of the balance sheet date.<br />

Regular purchases and sales of debt securities are recognised on trade-date – the date on which the Foundation commits to<br />

purchase or sell the asset. Such debt securities are initially recognised at fair value and transaction costs are expensed in the<br />

income and expenditure account. Debt securities are derecognised when the rights to receive cash flows from the investments<br />

have expired or have been transferred and the Foundation has transferred substantially all risks and rewards of ownership.<br />

The fair values of quoted financial assets are based on current bid prices. For unlisted securities without an active market,<br />

the Foundation establishes the fair value by using valuation techniques including the use of recent arm’s length transactions,<br />

reference to other information that are substantially the same.<br />

2.5 Inventories<br />

Inventories are stated at the lower of cost and net realisable value. Cost is determined using the first-in, first-out method. Net<br />

realisable value is the estimated selling price in the ordinary course of business, less applicable variable selling expenses.<br />

2.6 Donations receivable<br />

Donations receivable are recognised initially at fair value and subsequently measured at amortised cost using the effective<br />

interest method, less provision for impairment. A provision for impairment is established when there is objective evidence<br />

that the Foundation will not be able to collect all amounts due according to the original terms. The amount of the provision<br />

is the difference between the asset’s carrying amount and the present value of estimated future cash flows, discounted at the<br />

effective interest rate. The amount of the provision is recognised in the income and expenditure account.<br />

2.7 Cash and cash equivalents<br />

Cash and cash equivalents include cash in hand, deposits held at call with banks and other short-term highly liquid<br />

investments with original maturities of three months or less.<br />

2.8 Provisions<br />

Provisions are recognised when the Foundation has a present legal or constructive obligation as a result of past events; it is more<br />

likely than not that an outflow of resources will be required to settle the obligation; and the amount has been reliably estimated.<br />

2.9 Revenue recognition<br />

Provided it is probable that the economic benefits will flow to the Foundation and the revenue and costs, if applicable, can be<br />

measured reliably, revenue is recognised in the income and expenditure account as follows:<br />

(a)<br />

(b)<br />

Donations<br />

Donations are accounted for in the income and expenditure account when received and receivable.<br />

Interest income<br />

Interest income from bank deposits and securities is accrued on a time-apportioned basis by reference to the principal<br />

outstanding and the rate applicable.<br />

Ocean Park Conservation Foundation, Hong Kong Annual Report 2008-2009 59