Annual Report - Orascom Development

Annual Report - Orascom Development

Annual Report - Orascom Development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

46 | consolidated financial statements | OHD <strong>Annual</strong> <strong>Report</strong> 2006<br />

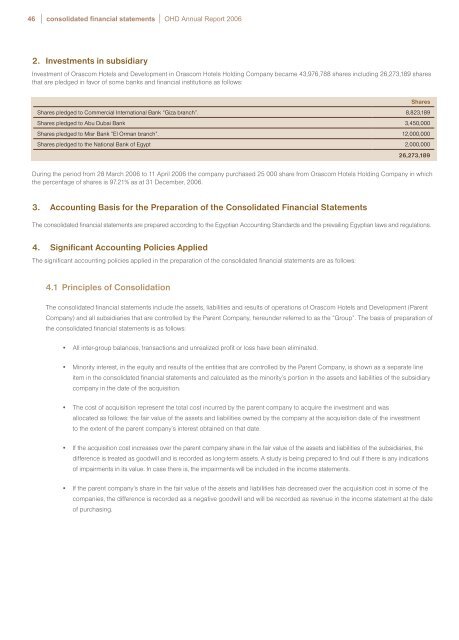

2. Investments in subsidiary<br />

Investment of <strong>Orascom</strong> Hotels and <strong>Development</strong> in <strong>Orascom</strong> Hotels Holding Company became 43,976,788 shares including 26,273,189 shares<br />

that are pledged in favor of some banks and financial institutions as follows:<br />

Shares<br />

Shares pledged to Commercial International Bank “Giza branch”. 8,823,189<br />

Shares pledged to Abu Dubai Bank 3,450,000<br />

Shares pledged to Misr Bank “El Orman branch”. 12,000,000<br />

Shares pledged to the National Bank of Egypt 2,000,000<br />

26,273,189<br />

During the period from 28 March 2006 to 11 April 2006 the company purchased 25 000 share from <strong>Orascom</strong> Hotels Holding Company in which<br />

the percentage of shares is 97.21% as at 31 December, 2006.<br />

3. Accounting Basis for the Preparation of the Consolidated Financial Statements<br />

The consolidated financial statements are prepared according to the Egyptian Accounting Standards and the prevailing Egyptian laws and regulations.<br />

4. Significant Accounting Policies Applied<br />

The significant accounting policies applied in the preparation of the consolidated financial statements are as follows:<br />

4.1 Principles of Consolidation<br />

The consolidated financial statements include the assets, liabilities and results of operations of <strong>Orascom</strong> Hotels and <strong>Development</strong> (Parent<br />

Company) and all subsidiaries that are controlled by the Parent Company, hereunder referred to as the “Group”. The basis of preparation of<br />

the consolidated financial statements is as follows:<br />

• All inter-group balances, transactions and unrealized profit or loss have been eliminated.<br />

• Minority interest, in the equity and results of the entities that are controlled by the Parent Company, is shown as a separate line<br />

item in the consolidated financial statements and calculated as the minority’s portion in the assets and liabilities of the subsidiary<br />

company in the date of the acquisition.<br />

• The cost of acquisition represent the total cost incurred by the parent company to acquire the investment and was<br />

allocated as follows: the fair value of the assets and liabilities owned by the company at the acquisition date of the investment<br />

to the extent of the parent company’s interest obtained on that date.<br />

• If the acquisition cost increases over the parent company share in the fair value of the assets and liabilities of the subsidiaries, the<br />

difference is treated as goodwill and is recorded as long-term assets. A study is being prepared to find out if there is any indications<br />

of impairments in its value. In case there is, the impairments will be included in the income statements.<br />

• If the parent company’s share in the fair value of the assets and liabilities has decreased over the acquisition cost in some of the<br />

companies, the difference is recorded as a negative goodwill and will be recorded as revenue in the income statement at the date<br />

of purchasing.