National Intergrated Resource Plan 2 - PBMR

National Intergrated Resource Plan 2 - PBMR

National Intergrated Resource Plan 2 - PBMR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

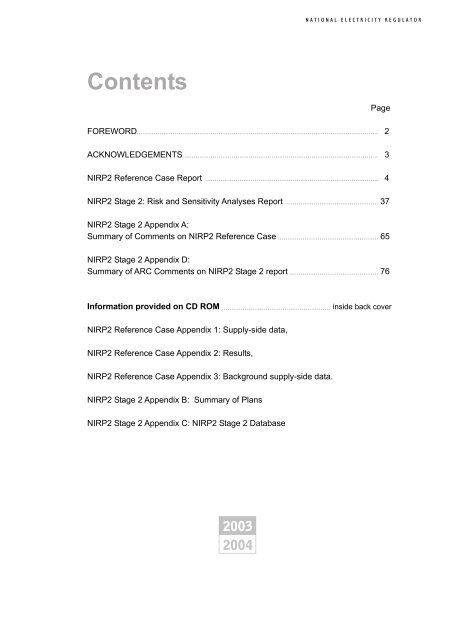

Contents<br />

Page<br />

FOREWORD 2<br />

ACKNOWLEDGEMENTS 3<br />

NIRP2 Reference Case Report 4<br />

NIRP2 Stage 2: Risk and Sensitivity Analyses Report 37<br />

NIRP2 Stage 2 Appendix A:<br />

Summary of Comments on NIRP2 Reference Case 65<br />

NIRP2 Stage 2 Appendix D:<br />

Summary of ARC Comments on NIRP2 Stage 2 report 76<br />

Information provided on CD ROM<br />

inside back cover<br />

NIRP2 Reference Case Appendix 1: Supply-side data,<br />

NIRP2 Reference Case Appendix 2: Results,<br />

NIRP2 Reference Case Appendix 3: Background supply-side data.<br />

NIRP2 Stage 2 Appendix B: Summary of <strong>Plan</strong>s<br />

NIRP2 Stage 2 Appendix C: NIRP2 Stage 2 Database

Foreword<br />

Background<br />

In the light of the Energy Policy White Paper for South Africa and the recent government initiatives for<br />

restructuring of the ESI, the NER introduced the development of a <strong>National</strong> Integrated <strong>Resource</strong> <strong>Plan</strong> (NIRP)<br />

as an independent information source to stakeholders and decision-makers for insuring security of the supply.<br />

The first <strong>National</strong> IRP (NIRP1) was completed and published in March 2002.<br />

At the beginning of the year 2003, the NER established the NIRP Advisory and Review Committee (ARC) with<br />

the function to provide wide stakeholders' guidance and contribution to the NIRP development process.<br />

Unlike its predecessor the NIRP 2003/4 (NIRP2) relies on average international data (modified to reflect South<br />

African labor and exchange rates) for the cost and performance of new generation plants. Other important<br />

change from NIRP1 is the inclusion of sensitivity analysis and scenarios to address risk factors and<br />

uncertainties. Further the NIRP2 takes into account the transmission integration costs and losses associated<br />

with the location of the new generation plants.<br />

NIRP2 Studies<br />

2<br />

The NIRP2 has been generated under the guidance of the NER NIRP Advisory and Review Committee (ARC)<br />

by a NIRP team comprising Eskom <strong>Resource</strong>s and Strategy Group, Energy Research Institute of UCT and the<br />

NER. The work carried out for NIRP2 is divided into two stages:<br />

& Stage 1: Development of a reference case<br />

& Stage 2: Development of risk and sensitivity analyses<br />

The NIRP2 reference case was completed and published on the NER Web site on 3 March 2004 while NIRP2<br />

Stage 2: Risk and Sensitivity Analysis - on 22 September 2004.<br />

This publication consists of NIRP2 Stage 1 and 2 reports. Some of the Appendices associated with the main<br />

reports are provided in an electronic format (CD).<br />

The NIRP 2 Reference Case publication contains the following parts:<br />

& NIRP2 Reference Case Report<br />

& Appendix 1: Supply-side data<br />

& Appendix 2: Results<br />

& Appendix 3: Background supply-side data.<br />

The NIRP 2 Stage 2: Risk and Sensitivity analysis includes the following five parts:<br />

& NIRP2 Stage 2 Report,<br />

& Appendix A: Summary of comments on NIRP2 Reference Case<br />

& Appendix B: Summary of <strong>Plan</strong>s<br />

& Appendix C: NIRP2 Stage 2 Data Base Summary<br />

& Appendix D: Summary of ARC Comments on NIRP2 Stage 2 report.

Acknowledgements<br />

The NER acknowledge the guidance, contribution and<br />

valuable suggestions of:<br />

NER NIRP Advisory and Review Committee (ARC):<br />

Project Team:<br />

Chairman: Prof A Eberhard, NER Board<br />

Dr Bianka Belinska, NER<br />

Members: Smunda Mokoena, CEO NER Steve McFadzean, Eskom ISEP<br />

Naresh Singh, EM NER<br />

Johan Prinsloo, Eskom ISEP<br />

Andre Otto, DME<br />

Zaheer Khan, Eskom ISEP<br />

Dr Elsa Du Toit, DME<br />

Andrew Etzinger, Eskom ISEP<br />

Robert Maake, DME<br />

Mavo Solomon, Eskom ISEP<br />

Tseliso Magubela, DME<br />

Moonlight Mbatha, Eskom ISEP<br />

Chris Gadsden, NT<br />

Mark Howells, ERI UCT<br />

Justice Mavhungu, DPE<br />

Glen Heinrich, ERI UCT<br />

Arnot Hepburn, EIUG<br />

Thomas Alfstadt, ERI UCT<br />

Piet van Staden, EIUG<br />

Andrew Kenny, ERI UCT<br />

Dick Kruger, Chamber of Mines<br />

Alison Hughes, ERI UCT<br />

Danny Vengedasamy, SACOB<br />

Rizia Buckas, NER<br />

Manfred Kuster, AMEU<br />

Willie Boeije, NER<br />

Mandla Tshabalala, AMEF<br />

Lambert du Plessis, NER<br />

Gerhard Loedolff, Eskom Generation<br />

Lynette Vajeth, Eskom Generation<br />

WEB Publisher:<br />

June Willis, Eskom Transmission<br />

Michael Barry, Eskom Transmission<br />

Correy Sutherland, NER<br />

Segomoco Scheppers, Eskom Transmission<br />

Erica Johnson, Eskom Transmission<br />

NIRP Contact Person:<br />

Jean Louis Pabot, Eskom KSACS<br />

Hermann FW Oelsner, Darling Windfarm IPP<br />

Dr Bianka Belinska, NER<br />

Robert Siemers, Kelvin IPP Tel: 012-4014650<br />

Donald Bennett, Kelvin IPP Fax: 012-4014687<br />

Prof K Bennett, ERI UCT<br />

Email: bianka.belinska@ner.org.za<br />

3<br />

ARC Management Officer:<br />

Dr Bianka Belinska, NER

<strong>National</strong> Integrated <strong>Resource</strong> <strong>Plan</strong> 2<br />

Reference Case<br />

4<br />

COMPILED BY<br />

ISEP Eskom (<strong>Resource</strong>s and Strategy)<br />

AND<br />

Energy Research Institute<br />

University Of Cape Town<br />

AND<br />

The <strong>National</strong> Electricity Regulator<br />

27 February 2004

Reference Case<br />

Executive Summary<br />

INTRODUCTION<br />

In the light of the Energy Policy White Paper for South Africa and the recent government initiatives for<br />

restructuring of the ESI, the NER introduced the development of a <strong>National</strong> Integrated <strong>Resource</strong> <strong>Plan</strong> (NIRP)<br />

as an independent information source to stakeholders and decision-makers for insuring security of the supply.<br />

The first <strong>National</strong> IRP (NIRP1) was completed and published in March 2002.<br />

At the beginning of the year 2003, the NER established an IRP Advisory and Review Committee (ARC) to<br />

provide wide stakeholders' contribution to the NIRP process. The main functions of the ARC are to approve the<br />

primary assumptions (technical, economical, environmental and social), evaluate the supply- and demand<br />

options for inclusion in the plan and oversee the development process.<br />

This NIRP is a revision of the first NIRP issued in March 2002 and published on the NER Web site. For the<br />

purposes of these analyses the first NIRP is referred as NIRP1 and the current study as NIRP2.<br />

The NIRP2 has been generated under the guidance and approval of the NER NIRP Advisory and Review<br />

Committee (ARC) by a NIRP team comprising Eskom <strong>Resource</strong>s and Strategy Group, Energy Research<br />

Institute of UCT and the NER.<br />

Unlike its predecessor the NIRP2 relies on average international data (modified to reflect South African labor<br />

and exchange rates) for the cost and performance of new generation plants.<br />

Other important change from NIRP1 is the inclusion of sensitivity analysis and scenarios to address risk<br />

factors and uncertainties such as performance of existing generation plants (Eskom and non-Eskom),<br />

sustainability and delivery of Demand-side Management (DSM) options (including Interruptible load supplies<br />

(ILS)) and changes in the electricity demand load shape. Further the NIRP2 takes into account Transmission<br />

integration costs and credit for regional location of new capacity not included previously.<br />

5<br />

The growth in demand for electricity over the next twenty-year planning horizon is consistent with that<br />

predicted in NIRP1 and follows a moderate forecast with moderate weather conditions.<br />

OBJECTIVE AND PRIMARY ASSUMPTIONS<br />

The objective of the <strong>National</strong> Integrated <strong>Resource</strong> <strong>Plan</strong> (NIRP) is to determine the least cost supply options to<br />

the country, provide information to market participants on opportunities for investment in new power stations<br />

and evaluate the security of the supply.<br />

The NIRP2 reference case is based on the following primary assumptions approved by the ARC:<br />

& The net discount rate (before tax) agreed for the studies is 10 % internal to South Africa;<br />

& Options are compared on the basis of 1 January 2003 prices. Foreign capital is converted to South African<br />

Rand at the exchange rate of R9/$ reflective of a long-term planning approach;<br />

& <strong>Plan</strong>t availabilities for new plants are based on the World Energy Council (WEC) best quartile results for<br />

2002. For existing plants the studies use the current targets in Eskom adjusted independently for each<br />

individual station to give a weighted average for base-load capacity of 88% EAF; (7% PCLF: 3% UCLF with a<br />

provision of 2% for OCLF to cater for risk).<br />

& The planning horizon for the study is 20 years from 2003 to 2022;<br />

& Moderate electricity consumption and demand growth;<br />

& Low DSM penetration;<br />

& Inflation for all fuels and new technologies was at South African PPI.

<strong>National</strong> Integrated <strong>Resource</strong> <strong>Plan</strong> 2<br />

CAPACITY OUTLOOK FOR NIRP2 REFERENCE PLAN<br />

The capacity outlook for the NIRP Reference plan developed in Stage 1 is illustrated graphically in Figure 1.<br />

Reference capacity plan (10% Reserve margin) 2004 to 2022<br />

Capacity (MW)<br />

58000<br />

56000<br />

54000<br />

52000<br />

50000<br />

48000<br />

46000<br />

44000<br />

42000<br />

40000<br />

38000<br />

Greenfield <strong>PBMR</strong> (Base) - Earliest end 2013<br />

Greenfield PF (Base) - Earliest end 2013<br />

Greenfield Pumped Storage - Earliest 2013<br />

FBC (Base) - Earliest end 2009<br />

CCGT (Base) - Earliest end 2008<br />

Komati PF - Earliest 2010<br />

OCGT - Earliest 2008<br />

Grootvlei PF - 2007<br />

Camden<br />

36000<br />

Eskom Existing Capacity with Decommissioning Non-Eskom Existing Capacity with Decommissioning<br />

34000<br />

Imports-Cahora Bassa Hydro<br />

Simunye Eskom mothballed plants<br />

Pumped Storage capacity<br />

Peaking capacity<br />

32000<br />

Base load capacity Peak Demand before DSM<br />

Peak Demand after DSM<br />

Required capacity<br />

30000<br />

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022<br />

6<br />

Figure 1: Capacity Outlook for NIRP2 Reference <strong>Plan</strong><br />

CONCLUSIONS<br />

The main conclusions drawn from the NIRP2 reference case study could be summarised as follows:<br />

1) Options for diversification are insufficient to meet all of the forecast demand for electricity over the next 20-<br />

year planning horizon. Coal-fired options are still required for expansion during this period. For<br />

environmental benefit it is imperative to continue with efforts to reduce the costs of implementing clean<br />

coal technologies and improve the efficiency of coal-fired plants;<br />

2) Base load plants are required for commercial operation from 2010. Base load options competing, include;<br />

Pulverised Fuel Coal-fired (PF); Fluidised Bed Combustion (FBC); Combined Cycle Gas Turbine (CCGT).<br />

Given the cost and performance data used in the plan these options are broadly comparable, at 10% net<br />

discount rate, if regional siting and transmission benefits are included;<br />

3) At the current assumed cost of capital (10% net discount rate) and after returning the Eskom mothballed<br />

plant to service, fluidised bed combustion technologies are South Africa's most economic option, followed<br />

by investment in coal-fired plant. This in turn is followed by importing gas / LNG for CCGT plant in the<br />

Cape;<br />

4) It will be difficult to justify diversification on an economic basis, unless penalties for not doing so are<br />

included in future analyses. As the cost for diversification is becoming increasingly more expensive these<br />

penalties (or opportunities for emissions trading) will need to be substantial to offset the economic benefits<br />

of remaining with coal;<br />

5) The NIRP plans are based on attainment and sustainability of the DSM targets , power plants availability,<br />

imports and interruptible loads;<br />

6) The NIRP plans indicate that 920 MW OCGT peak load plants must begin commissioning from 2008;

Reference Case<br />

7) Maintaining a higher reserve margin of 15% over the planning period will require acceleration of the RTS of<br />

the mothballed plants and coal-fired options together with commissioning of additional base load capacity<br />

(CCGT);<br />

8) Diversified options are new technologies to South Africa. If these options for whatever reason are not able<br />

to be implemented it will mean a return to a dependency on new pulverised coal-fired plants earlier than<br />

shown in these plans;<br />

9) There are supply options that have not been considered such as co-generation in industry, converting<br />

OCGT to CCGT, adding units onto existing power stations and new imports resulting from the<br />

development of Electricity Supply in the Southern African region;<br />

10) Should interruptible supply and / or OCGT capacity not be implemented this will significantly advance new<br />

base-load capacity;<br />

7

<strong>National</strong> Integrated <strong>Resource</strong> <strong>Plan</strong> 2<br />

Table of Contents<br />

EXECUTIVE SUMMARY 5<br />

TABLE OF CONTENTS 8<br />

LIST OF TABLES 9<br />

LIST OF FIGURES 9<br />

ABBREVIATIONS 10<br />

1.INTRODUCTION - THE INTEGRATED RESOURCE PLANNING PROCESS 11<br />

2.STRATEGIC FRAMEWORK AND PRIMARY ASSUMPTIONS 11<br />

2.1 STRATEGIC POSITION (DEFINED BY THE ADVISORY AND REVIEW COMMITTEE (ARC)<br />

OF THE NER) 12<br />

2.2 PRIMARY ASSUMPTIONS 12<br />

2.3 RISKS AND UNCERTAINTIES 12<br />

2.4 OPTIMISATION PARAMETERS 13<br />

2.5 CRITERIA FOR INCLUSION OF SUPPLY-SIDE AND DEMAND-SIDE OPTIONS 13<br />

8<br />

3.NATIONAL ELECTRICITY FORECAST 13<br />

3.1 ECONOMIC GROWTH 16<br />

3.2 LARGE INDUSTRIAL PROJECTS 16<br />

3.3 ELECTRIFICATION 16<br />

3.4 ELECTRICITY INTENSITY 17<br />

3.5 NATURAL GAS 17<br />

3.6 FOREIGN FORECAST COMPONENT 17<br />

3.7 DEMAND PROFILES 18<br />

4.DEMAND-SIDE OPTIONS (DSM) 18<br />

4.1 THE DEMAND SIDE PLANNING BASIS FOR NIRP2 20<br />

4.2 INTRODUCTION TO THE DEMAND-SIDE SCREENING RESULTS 20<br />

4.2.1 Residential Energy Efficiency - REE 21<br />

4.2.2 Industrial, Mining and Commercial Energy Efficiency 22<br />

4.2.3 Residential Load Management (RLM) 23<br />

4.2.4 Industrial and Mining Load Management (IMLM) 23<br />

4.3 UNCERTAINTY AND RISK ASSOCIATED WITH DSM 23<br />

4.4 PRIORITIES FOR THE DEVELOPMENT OF DEMAND-SIDE RESOURCES 24<br />

5.SUPPLY-SIDE OPTIONS 25<br />

5.1 ESKOM SYSTEM - EXISTING AND COMMITTED CAPACITY 25<br />

5.2 NON-ESKOM SYSTEM - EXISTING CAPACITY 25<br />

5.3 RETURN TO SERVICE OF ESKOM MOTHBALLED PLANT (SIMUNYE) 25

Reference Case<br />

5.4 NEW SUPPLY-SIDE OPTIONS 26<br />

5.4.1 New Pulverised Fuel (PF) Coal-Fired Stations 26<br />

5.4.2 New Gas-Fired <strong>Plan</strong>t 26<br />

5.4.3 New Pumped Storage Schemes 27<br />

5.4.4 Greenfield Fluidised Bed Combustion 27<br />

5.4.5 Conventional Nuclear (Advanced Light Water Reactor (ALWR)) 29<br />

5.4.6 Research projects/programs 29<br />

5.4.7 Imported Hydro 29<br />

5.5 SCREENING CURVES 29<br />

5.6 OTHER: ENVIRONMENTAL, EXTERNALITIES, TRANSMISSION EXPANSION 31<br />

6.INTEGRATION AND SENSITIVITY ANALYSIS 31<br />

6.1 REFERENCE PLAN 32<br />

6.2 ALTERNATIVE PLAN 1 TO REFERENCE PLAN 33<br />

6.3 ALTERNATIVE PLAN 2 (SENSITIVITY STUDY) 33<br />

6.4 ALTERNATIVE PLAN 3 (OPTIMAL RESERVE MARGIN) 34<br />

7.SYSTEM ANNUAL AVERAGE LONG RUN MARGINAL COST 35<br />

8.CONCLUSIONS 36<br />

LIST OF TABLES<br />

Table 1: Average demand growth intervals 14<br />

Table 2: DSM aggregate megawatts displaced 19<br />

Table 3: Residential Energy Efficiency 21<br />

Table 4: Commercial energy efficiency 22<br />

Table 5: Industrial and Mining Energy Efficiency 22<br />

Table 6: Residential load management programmes 23<br />

Table 7: Industrial and mining load management 23<br />

Table 8: Summary of cost and performance data of new supply-side options 28<br />

9<br />

LIST OF FIGURES<br />

Figure 1: Electricity sales forecast range - <strong>National</strong> plus foreign 14<br />

Figure 2: Increase in annual peak demand and system losses (national plus foreign) 15<br />

Figure 3: Eskom track record 16<br />

Figure 4: RSA electricity intensity 17<br />

Figure 5: Typical hourly peak demand summer profile 18<br />

Figure 6: Typical hourly peak demand winter profile 18<br />

Figure 7: Life cycle levelised costs to build and operate base load plants 30<br />

Figure 8: Life cycle levelised costs to build and operate peaking plants 30<br />

Figure 9: Reference plan (10% Reserve Margin) 32<br />

Figure 10: Alternative 1 to reference plan (15% Reserve Margin) 33<br />

Figure 11: Alternative 2 - sensitivity to reference plan (excludes interruptible supply options) 34<br />

Figure 12: Annual average long run marginal costs of plans 35<br />

APPENDIX 1: SUPPLY SIDE MODELLING DATA SUMMARY<br />

APPENDIX 2: RESULTS<br />

APPENDIX 3: BACKGROUND SUPPLY SIDE DATA

<strong>National</strong> Integrated <strong>Resource</strong> <strong>Plan</strong> 2<br />

Abbreviations<br />

10<br />

ALWR<br />

ARC<br />

CEE<br />

CCGT<br />

CF<br />

CF (DSM)<br />

CV<br />

CUE<br />

DEAT<br />

DME<br />

DSM<br />

DWAF<br />

EAF<br />

EIA<br />

EPC<br />

ESI<br />

FBC<br />

FOR<br />

GT<br />

HELM<br />

HHV<br />

HTF<br />

ICLM<br />

IMEE<br />

IMLM<br />

IEA<br />

IRP<br />

ISEP<br />

LF<br />

LOLE<br />

LOLP<br />

LNG<br />

LPG<br />

MCR<br />

MEUL<br />

NDR<br />

MOU<br />

NER<br />

O&M<br />

OCGT<br />

OCLF<br />

PCLF<br />

<strong>PBMR</strong><br />

PF<br />

POR<br />

PPI<br />

PV<br />

PWR<br />

REE<br />

Advanced Light Water Reactor<br />

Advisory Review Committee<br />

Commercial Energy Efficiency<br />

Combined Cycle Gas Turbine<br />

Coal Fired<br />

Capacity Factor for DSM<br />

Calorific Value<br />

Cost of Unserved Energy<br />

Department of Environmental Affairs and Tourism<br />

Department of Minerals and Energy<br />

Demand Side Management<br />

Department of Water Affairs and Forestry<br />

Energy Availability Factor<br />

Energy Information Administration<br />

Engineering, Procurement and Construction<br />

Electricity Supply Industry<br />

Fluidised Bed Combustion<br />

Forced Outage Rate<br />

Gas Turbine<br />

Hourly Electricity Load Model<br />

High Heating Value<br />

Heat Transfer Fluid<br />

Industrial and Commercial Load Management<br />

Industrial and Mining Energy Efficiency<br />

Industrial and Mining Load Management<br />

International Energy Agency<br />

Integrated <strong>Resource</strong> <strong>Plan</strong><br />

Integrated Strategic Electricity <strong>Plan</strong>ning<br />

Load Factor<br />

Loss of load expectation<br />

Loss of load probability<br />

Liquefied Natural Gas<br />

Liquefied Petroleum Gas<br />

Maximum Continuous Rating<br />

Minimum Energy Utilization Level<br />

Net Discount Rate<br />

Memorandum of Understanding<br />

<strong>National</strong> Electricity Regulator<br />

Operation and Maintenance<br />

Open Cycle Gas Turbine<br />

Other Capability Loss Factor<br />

<strong>Plan</strong>ned Capability Loss Factor<br />

Pebble Bed Modular Reactor<br />

Pulverised Fuel<br />

<strong>Plan</strong>ned Outage Rate<br />

Producer Price Index<br />

Present Value<br />

Pressurised Water Reactor<br />

Residential Energy Efficiency<br />

RLM<br />

ROD<br />

UE<br />

UCLF<br />

WEC<br />

Residential Load Management<br />

Record of Decision<br />

Unserved energy<br />

Unplanned Capability Loss Factor<br />

World Energy Council

Reference Case<br />

1.INTRODUCTION THE INTEGRATED RESOURCE PLANNING PROCESS<br />

The prime objective of the <strong>National</strong> Integrated <strong>Resource</strong>s <strong>Plan</strong> (NIRP) is to provide a long-term least-cost<br />

resource plan for meeting the electricity demand consistent with the reliability of the electricity supply,<br />

environmental, social and economic policies. The NIRP also serves as an information tool for potential project<br />

developers and decision-makers.<br />

The NIRP provides an assessment of the system adequacy and also addresses other public policies such as<br />

environmental impacts and Demand Side Management (DSM).<br />

The NIRP also takes into account the “The New Partnership for African Development (NEPAD)” by<br />

incorporating committed contracts for imports and exports to South Africa from neighbouring States.<br />

This is the second NIRP carried out under the auspices of the NER. The first NIRP was carried out during 2001-<br />

2002 and published on the NER Web site. For the purposes of these analyses the first NIRP is referred as<br />

NIRP1 and the current study as NIRP2. This analysis follows the steps already defined in the NIRP 1 as<br />

follows:<br />

& Develop the primary assumptions and selection criteria;<br />

& Produce an electricity consumption and demand forecasts;<br />

& Investigate a full array of demand- and supply-side options and identify those that meet the strategic<br />

selection criteria for inclusion in the plan;<br />

& Determine an optimal combination of demand- and supply-side options from those selected for inclusion in<br />

the resource plan;<br />

& Evaluate the risk factors associated with uncertainties such as load growth, plant availability, weather<br />

conditions, DSM penetration level, level of interruptible loads etc;<br />

& Analyse the environmental, external and financial consequences;<br />

& Select a preferred plan.<br />

11<br />

The IRP studies carried out in this process use several computer software models. A major model is the RP<br />

Workstation, which consists of a suite of computer software programs, developed by the American Electricity<br />

Power Research Institute (EPRI) and specifically the optimisation module, Electric Generation Expansion<br />

Analysis System (EGEAS).<br />

Due to time constraints, the work carried out for this NIRP is divided into two stages as agreed within the terms<br />

of the <strong>National</strong> Electricity Regulator (NER) Advisory and Review Committee (ARC). These two stages consist:<br />

& Stage 1: Determine a reference plan for analysis and as basis for recommendation on capacity planning<br />

issues in the short-term;<br />

& Stage 2: Develop sensitivity studies and scenarios in order to address targeted risk factors and<br />

uncertainties.<br />

The first stage is intended for completion by Feb 2004, which constitutes this report, and the second for<br />

completion by April 2004.<br />

2.STRATEGIC FRAMEWORK AND PRIMARY ASSUMPTIONS<br />

This serves as the strategic basis for the planning assumptions for the NIRP. The NIRP2 was based on the<br />

planning assumptions approved by the ARC. These studies are based on January 2003 as its primary<br />

reference date for cost parameters and for the start of the twenty- year planning horizon. The NIRP is a longterm<br />

planning process and it is undertaken on an annual basis. The assumptions defined in this document<br />

need to be considered in that context.

<strong>National</strong> Integrated <strong>Resource</strong> <strong>Plan</strong> 2<br />

2.1 Strategic position (defined by the Advisory and Review Committee (ARC) of the NER)<br />

The following key points are worth highlighting:<br />

& The aim of the modelling is to determine the long-term least-cost electricity supply options to the country,<br />

independent of ESI structure and subject to the primary assumptions and constraints;<br />

& The NIRP includes the electricity market within and external to South Africa (imports to and exports from<br />

South Africa);<br />

& The NIRP may be used as a basis for identifying investment opportunities for suppliers in the ESI;<br />

& The NIRP's objective is to optimise the supply-side and demand-side mix to keep the price of electricity to the<br />

consumers as low as possible.<br />

2.2 Primary Assumptions<br />

The NIRP2 reference case is based on the following primary assumptions approved by the ARC:<br />

12<br />

& The net discount rate (before tax) agreed for the study is 10 % internal to South Africa;<br />

& Options are compared on the basis of 1 January 2003 prices. Foreign capital is converted to South African<br />

rands at the exchange rate of R9/$ reflective of a long-term planning approach;<br />

& <strong>Plan</strong>t availabilities for new plants are based on the World Energy Council (WEC) best quartile results for<br />

2002. For existing plants the studies use the current targets in Eskom adjusted independently for each<br />

individual station to give a weighted average for base-load capacity of 88% EAF; (7% PCLF: 3% UCLF with a<br />

provision of 2% for OCLF to cater for risk).<br />

& The planning horizon for the study is 20 years, from 2003 until 2022;<br />

& <strong>National</strong> moderate electricity consumption and demand growth;<br />

& Low DSM penetration;<br />

& Inflation for O&M and fuel resources at South African PPI unless stated otherwise;<br />

& New technologies costs are adjusted for Transmission integration or where applicable the avoided<br />

Transmission costs (and losses) according to regional site selection;<br />

& The NIRP2 does not make any assumptions on the ownership of the plants.<br />

2.3 Risks and Uncertainties<br />

This Report does not address risk rigorously but rather addresses it through imposing a minimum reserve<br />

margin on the plan of 10%. Imposing a deterministic reliability index (reserve margin of 10%) as a constraint<br />

does not directly reflect specific risk factors such as FOR, generation mix and unit size. However, it does<br />

provide a reasonable estimate of reliability performance when other parameters remain constant over the<br />

planning period.<br />

Due to time constraints, it was agreed at the ARC as a first pass, to develop a reference plan using a 10%<br />

reserve margin constraint as proxy for risk. The 10% reserve margin is reflective of current inter utility<br />

agreements in the Southern African Power Pool (SAPP). In addition, a second plan is developed based on a<br />

15% reserve margin constraint reflective of international practise.<br />

There are a large number of risks confronting the ESI in the future. These risks are both short-term and longterm.<br />

For example in terms of the load forecast a short-term risk could consist of an unexpected cold weather<br />

snap, whereas a long-term risk could be unexpected sustained increase in demand for electricity. Some of<br />

these risks include:<br />

& <strong>Plan</strong>t failure leading to longer than expected plant outage;<br />

& Unavailability of municipal / Eskom / imported generating capacity;<br />

& Degree of market penetration of DSM and maintaining current level of interruptible loads;

Reference Case<br />

& Unexpected decrease / increase, spurious or sustained, of electricity demand;<br />

& Changes to the load shape associated with the forecast electricity demand;<br />

& Unexpected decommissioning / de-rating of existing generating capacity<br />

& Uncertain and prolonged lead times for building new plant;<br />

& Project slippage<br />

& Inclusion of co-generation options;<br />

& Embargoes on nuclear energy;<br />

& Shortage of skills to maintain and grow the system;<br />

& Other energy forms displacing electricity in the energy market;<br />

& Revolutionary technologies coming on the scene and stranding existing assets;<br />

& Internalisation of externalities, such as Introduction of a carbon tax and environmental levy;<br />

& <strong>Plan</strong>t life expectations not met;<br />

& Retail choice;<br />

& Deterioration in credit rating, exchange rates etc. resulting in a higher cost of capital;<br />

& Electricity supply and sales contracts (import and export contracts) being reneged upon;<br />

& Effect of AIDS on the electricity market.<br />

& Drought and Floods<br />

2.4 Optimisation parameters<br />

The basis for the optimisation of this NIRP is the least cost of electricity for the supply life cycle. This takes into<br />

consideration the cost of un-served energy (CUE) to the consumer. For this NIRP2, the CUE is assumed to be<br />

R20 666/MWh (Eskom 2003).<br />

This CUE was derived from a customer survey of the market sectors of the electricity supply industry (ESI).<br />

Because of an expected marketing drive for DSM, mainly in the residential sector, but also in the commercial<br />

and industrial sectors, the high CUE associated with the industrial sector was chosen as representative. This is<br />

because DSM initiatives that could change the load profile may become exhausted over the 20-year planning<br />

horizon. Previous NIRP1 used CUE of R 19000/MWh associated with the industrial sector.<br />

13<br />

2.5 Criteria for inclusion of Supply-side and Demand-side options<br />

The criteria listed below have been approved by the NER's Advisory and Review Committee (ARC) and are<br />

intended to give guidance in determining whether an option is formally included in the base case.<br />

Technologies that are not included in the base case will be evaluated in sensitivity studies. For technologies to<br />

be included in the reference case they should:<br />

& Be technologically feasible;<br />

& Be economically viable;<br />

& Have adequate accuracy of costs;<br />

& Be under national control either via equity participation, ownership or secure contracts;<br />

& Be socially, politically and environmentally acceptable;<br />

& Be dispatchable;<br />

& In line with World Bank emission standards.<br />

3.NATIONAL ELECTRICITY FORECAST<br />

The load forecast is the foundation upon which resources planning is based. It is an endeavour to forecast the<br />

most likely futures based on selected long-term Southern African economic forecasts. The forecast takes as its<br />

starting point the current position in the electricity supply market but in projecting the future, it excludes any<br />

further demand-side interventions.<br />

A detailed sectoral approach has been used over the last ten years to develop the long-term energy (GWh)

<strong>National</strong> Integrated <strong>Resource</strong> <strong>Plan</strong> 2<br />

forecast. This method has been improved and refined over time. Using a sectoral approach, which considers<br />

about 110 sectors or major customers individually, is one of the ways to lower the forecast risk. The forecast<br />

has also been updated on average more than once per year during the past ten years.<br />

The national plus foreign electricity forecast used in these studies is based on an average annual economic<br />

growth rate of 2.8%, over the planning horizon and moderate temperatures throughout the year. The foreign<br />

portion includes normal sales to traditional neighbouring states plus the Scorpion zinc project in Namibia and<br />

the aluminium smelters Mozal 1 & 2 in Mozambique.<br />

To address the major inherent uncertainty in the environment, a cone of uncertainty approach is used to<br />

develop low, moderate and high-energy forecasts. The electricity database consists of the best quality of data<br />

for all the 110 individual sectors, going back as far as 1980. The load forecast has been developed by Eskom<br />

together with contributions from major sectors/customers and wide consultations inside and outside Eskom.<br />

The <strong>National</strong> forecast range is illustrated in Figure 1 below.<br />

Electricity sales forecasts - national plus foreign<br />

400000<br />

350000<br />

High<br />

Moderate<br />

Low<br />

14<br />

GWh<br />

300000<br />

250000<br />

200000<br />

150000<br />

2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022<br />

Figure 1: Electricity sales forecast range - <strong>National</strong> plus foreign<br />

The average growth in energy in intervals over a five-year period within the planning horizon is given in Table 1:<br />

Table 1: Average demand growth intervals<br />

High (%) Moderate (%) Low (%)<br />

2003 - 2008 4.3 3.2 1.6<br />

2008 - 2013 3.1 2.3 1.0<br />

2013 - 2018 2.6 1.8 0.9<br />

2018 - 2022 2.5 1.8 0.8<br />

The electricity growth in the early years until 2006 is high (4% pa) due in part to cater for major expansions in<br />

platinum mining and high demand for ferrochrome as experienced in 2002 and 2003 and one further 850MW<br />

aluminium smelter at Coega. However this high growth is not sustained after 2006. Eskom sales growth has<br />

been high in 2002 and 2003 but the average sales growth is only 2.2% per annum over the last six years. The<br />

long-term forecast allows for a growth in fixed investment but there are currently no new major projects, which<br />

have been officially approved, other than the platinum mine expansions.

Reference Case<br />

An hourly electricity load model (HELM) is used to develop the maximum demand forecast where the annual<br />

energy forecast has been converted to an annual maximum demand forecast using updated sectoral<br />

customer usage profiles. It is expected that system energy utilisation with respect to annual peak demand will<br />

deteriorate slightly over time and the system annual load factor worsen from a current average of 74% to about<br />

73% by 2017.<br />

Of specific importance is the impact of system losses on the forecast demand. The Eskom system losses have<br />

been increasing over the last number of years from 5% in 1990 to 7.7% in 2002. The system losses for the<br />

<strong>National</strong> forecast are estimated to be currently 9% increasing to in excess of 10% over the planning horizon.<br />

Details of the moderate annual forecast (energy and demand) are shown in the Tables given in Appendix 2 to<br />

this report. The demand forecast is illustrated in Figure 2: Increase in annual peak demand and system losses<br />

(national plus foreign) below.<br />

Increase in forecast annual peak demand (<strong>National</strong> + Foreign) and losses<br />

12.0%<br />

10.0%<br />

(%) Increase<br />

8.0%<br />

6.0%<br />

4.0%<br />

<strong>National</strong> + Foreign annual<br />

system losses (%)<br />

Annual Increase in peak<br />

Demand (<strong>National</strong> + Foreign) (%)<br />

Forecast Annual Peak Demand in<br />

2022 = 53256MW<br />

I e. Growth from 2004 to 2022 =<br />

19611MW<br />

15<br />

2.0%<br />

Forecast Annual<br />

Peak Demand in<br />

2004 = 33645MW<br />

0.0%<br />

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022<br />

Figure 2: Increase in annual peak demand and system losses (national plus foreign)<br />

The short-term accuracy of the forecast and the track record of the long-term forecast are being monitored on<br />

an annual basis. The short-term variance is around the zero line and is not always positive or always negative.<br />

Figure 3 below tracks Eskom's (as opposed to national plus foreign) forecast predictions over the last ten years<br />

within a cone of 1.5% to 4% growth per annum. Actual sales are shown in the thick black line.<br />

Over the last few years these results show that the actual values achieved were slightly lower than the forecast<br />

values but in the last two years actual values were slightly higher. It is also important to note that the forecast<br />

value for the year 2007, as seen at this stage is very close to the value forecasted for the same year in 1996.

<strong>National</strong> Integrated <strong>Resource</strong> <strong>Plan</strong> 2<br />

Eskom long term sales forecast track record<br />

GWh<br />

370000<br />

320000<br />

270000<br />

220000<br />

1994<br />

1995<br />

1996<br />

1997<br />

1998<br />

1999<br />

2000<br />

2001<br />

2002<br />

2003<br />

Actual<br />

High 4%<br />

Low 1.5%<br />

170000<br />

120000<br />

1990 1995 2000 2005 2010 2015<br />

16<br />

Figure 3: Eskom track record<br />

The following is a brief summary of the main assumptions of the long-term forecast (national plus foreign).<br />

3.1 Economic Growth<br />

Long term economic growth rate for the moderate forecast is 2.8% average annual growth over the planning<br />

horizon. This economic growth rate takes into account the impact of HIV / AIDS.<br />

3.2 Large Industrial Projects<br />

New large industrial projects, such as the proposed Pechiney aluminium smelter, Billiton Hillside aluminium<br />

smelter expansions, Columbus Stainless Steel expansions, Sasol new projects and expansions and Mozal 2,<br />

have been included in the forecast. Further expansions to ferrochrome plants are also provided for. Current<br />

platinum mining expansions have been included, with provision for limited expansions after 2007/8. It was<br />

assumed that new gold mining projects would replace old ones. Gold production in South Africa is assumed to<br />

continue to decrease slightly over the long term. With regard to the longer term, allowance had also been made<br />

in the energy forecast for unknown new projects, based on past experience. A list is regularly revised for all<br />

possible new electricity intensive projects, including projects with a very low probability of occurrence.<br />

3.3 Electrification<br />

The forecast makes provision for the electrification of homes by Eskom and the municipalities. Electrification<br />

carried out by Eskom forms the bulk of its prepaid sales category. The number of connections obtained from<br />

planners and an estimated consumption per connection are used as a guide. It is assumed that the<br />

electrification rate will level off over time. The prepaid category only formed about 2.5% of total 2002 electricity<br />

sales in the country.

Reference Case<br />

3.4 Electricity Intensity<br />

The growth in the long term forecast is high in the near term due to major expansions of some electricity<br />

intensive industries. However, the growth is expected to reduce in the latter period of the planning horizon due<br />

to the fact that the electricity intensity of the South African economy is expected to decrease over time. This is<br />

characteristic of an economy, which is moving towards a more service based structure as is the case in South<br />

Africa and implies that the GDP growth rate in future will be consistently higher on average than the electricity<br />

growth rate. This has already been experienced in South Africa during the four-year period 1998 to 2001.<br />

The electricity intensity of the South African economy is shown in Figure 4. The current major expansions of<br />

electricity intensive industries are expected to decline and platinum mining is not expected to continue to<br />

maintain the current high growth rates after 2007/8. With more beneficiation of minerals, less energy will be<br />

required per unit of production. Once there is no more excess generating capacity, electricity prices will have to<br />

increase in real terms. Although it is assumed that this increase will not be extraordinary, it is expected that it<br />

will marginally affect electricity consumption.<br />

0.35<br />

RSA electricity intensity<br />

0.30<br />

0.25<br />

kWh / rand<br />

0.20<br />

0.15<br />

17<br />

0.10<br />

0.05<br />

0.00<br />

1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000<br />

Figure 4: RSA electricity intensity<br />

3.5 Natural Gas<br />

Allowance is made for the loss in electricity sales due to consumers switching from the use of electricity to the<br />

use of natural gas.<br />

3.6 Foreign Forecast component<br />

This part of the forecast includes sales that are currently in place - mostly under contract. Also included are the<br />

Mozal aluminium smelter in Mozambique and the Skorpion zinc project in Namibia. Provision had also been<br />

made for the Corridor heavy mineral sands project in Mozambique over the longer term.

<strong>National</strong> Integrated <strong>Resource</strong> <strong>Plan</strong> 2<br />

3.7 Demand Profiles<br />

Figure 5 shows a typical demand profile for the total Eskom system for a summer week.<br />

27000<br />

25000<br />

Eskom integrated system typical summer week hourly demand profile<br />

January/February<br />

2002<br />

2001<br />

2000<br />

23000<br />

MW<br />

21000<br />

19000<br />

17000<br />

15000<br />

Mon Tue Wed Thu Fri Sat Sun<br />

Figure 5: Typical hourly peak demand summer profile<br />

Figure 6 and shows a typical demand profile for the total Eskom system for a winter week.<br />

18<br />

33000<br />

31000<br />

29000<br />

27000<br />

Eskom integrated system typical winter week hourly peak demand<br />

July<br />

2002<br />

2001<br />

2000<br />

MW<br />

25000<br />

23000<br />

21000<br />

19000<br />

17000<br />

15000<br />

Mon Tue Wed Thu Fri Sat Sun<br />

Figure 6: Typical hourly peak demand winter profile<br />

4.DEMAND-SIDE OPTIONS (DSM)<br />

This NIRP2 assumes a significantly (approximately 50%) lower penetration of DSM programmes than the<br />

previously in NIRP1. Previous estimates were based on desktop studies. Pilots and experience in the field<br />

now indicate that a more conservative approach should be followed in the estimates for DSM programmes<br />

both in terms of capacity and cost. Five DSM programmes are targeted:

Reference Case<br />

& Residential Energy Efficiency (REE)<br />

& Commercial Energy Efficiency (CEE)<br />

& Industrial and Mining Efficiency (IMEE)<br />

& Residential Load Management (RLM)<br />

& Industrial and Mining Load Management (IMLM)<br />

Each programme has been modelled on a basis that capital will be expended over a nine-year period to ensure<br />

increasing annual displacements of aggregate Megawatts will be deducted from the load associated with a<br />

specified energy usage profile as indicated in the Table 2.<br />

Table 2: DSM aggregate megawatts displaced<br />

Programme Annual MW Displacements Annual Energy Displaced GWh<br />

Residential Energy Efficiency 32 129<br />

Commercial Energy Efficiency 14 69<br />

Industrial and Mining Efficiency 16 101<br />

Residential Load Management 49<br />

Industrial and Mining Load Management 41<br />

Each aggregate annual displacement is maintained over a period of twenty years to ensure no deterioration of<br />

displacement takes place. (I.e. maintenance will continue for a further 11 years beyond the nine-year<br />

investment period).<br />

Interruptible supply options are modelled separately to the above DSM programmes. Eskom has several<br />

interruptible supply agreements with key customers. These agreements are severely energy constrained and<br />

their capacity impact in the long-term has been reduced. There have been several comments by various ARC<br />

members to consider these interruptible supply agreements as emergency capacity only. This issue will be<br />

addressed in the next round of the NIRP in terms of the uncertainty inherent in this assumption.<br />

19<br />

The DSM team of Eskom in their endeavours to continually improve decision-making on the role of DSM in<br />

resources planning have taken several actions one of which is to improve information on DSM before its<br />

inclusion.<br />

In terms of residential DSM, Eskom has good statistics on device populations and unit gains in the residential<br />

markets. The homogeneity in residential markets provides confidence in DSM planning data, because enduse<br />

devices are generally characterised within narrow ranges of diversity.<br />

The need to upgrade confidence for this NIRP was in the commercial and industrial market segments,<br />

because previously there was no sound strategy to deal with the diversity of information. Fortunately since the<br />

previous <strong>National</strong> Integrated <strong>Resource</strong>s <strong>Plan</strong>, NIRP1, the DSM team has had access to a document on market<br />

assessment for electric motors prepared for the Department of Energy (DOE) in the USA. This document<br />

clearly spells out the opportunities for energy efficiency in the majority of the commercial and industrial enduse<br />

sectors. Electric motors make up nearly 50% of Eskom's total sales, or more than 65% of the sales to<br />

industrial and commercial clients.<br />

A major task in preparation of DSM data for NIRP2 has been the mapping of the DOE information on DSM<br />

opportunities in the USA into the South African context. This has now been done, and together with other desk<br />

research it has been revealed that the situation in SA is very different to the USA. South Africa needs to devise<br />

its own strategy to contend with issues that do not exist in the case of the USA.<br />

There has been a major focus on the industrial and commercial sectors, providing a better insight into the CEE,<br />

IMEE and IMLM strategies to be adopted in the future. A further improvement in this NIRP is in the provision of

<strong>National</strong> Integrated <strong>Resource</strong> <strong>Plan</strong> 2<br />

an aggregated summary for the ICEE and ICLM programmes compared with the previous industrial and<br />

commercial components.<br />

The NIRP1 placed more emphasis on energy efficiency as opposed to load management programmes. Better<br />

experience has now shown this emphasis to be misplaced, in that energy efficiency programmes are difficult to<br />

implement and to achieve performance targets due to the many barriers involved, and are turning out more<br />

costly than previously estimated.<br />

4.1 The Demand Side <strong>Plan</strong>ning Basis for NIRP2<br />

The basis for end-use load forecasting adopted for DSM planning in this NIRP is the “moderate forecast” as<br />

detailed above. The amount of DSM resources to be developed over a planning period is very sensitive to the<br />

load forecast. For sensitivity studies there is also the facility to use a “high load growth” and a “low load growth”<br />

forecast. A high growth forecast would imply higher targets for DSM, and a low load forecast would suggest<br />

lower targets than required for the moderate forecast. This issue will also be addressed in the next round of the<br />

NIRP in terms of the uncertainty in DSM penetration.<br />

4.2 Introduction to the Demand-Side Screening Results<br />

The following summarises the DSM resources submitted for inclusion in the NIRP2. <strong>Resource</strong>s that are not<br />

currently included may qualify for inclusion in future version if further investigation provides the information<br />

needed to obtain positive screening results. The screening results for energy efficiency options are given in<br />

Table 1 to 3 below. For comparison, separate columns give the NIRP1 and NIRP2 assumed market<br />

penetration.<br />

20<br />

In Tables 6 and 7, pertaining to the load management resources, there are high and low capacity factor (CF)<br />

resource capacities, given in MW, and the balance, which is the difference between the two.<br />

Capacity factor is defined as the percentage of time that the capacity of the load management resource can be<br />

fully utilised. “Hi CF MW” means that control algorithms are utilised to achieve a high capacity factor. There is a<br />

maximum percentage of time that the residential load management (RLM) resource can be utilised. In the<br />

maximum percentage mode the system peak MW can only be reduced by the amount reflected in the “Hi CF<br />

MW” column.<br />

The system peak can be further reduced by the amount in the “Balance of MW” column, when operated in the<br />

low capacity mode. The “Lo CF MW” column indicates the total reduction of the system peak if the entire load<br />

management resource is only operated in low capacity factor mode.

Reference Case<br />

4.2.1 Residential Energy Efficiency - REE<br />

Table 3 gives the results of screening Residential Energy Efficiency.<br />

Table 3: Residential Energy Efficiency<br />

OPTION No of units Assumed Market<br />

Penetration<br />

MW/a GWh/a IN NIRP2 NIRP1 NIRP2<br />

INTEGRAL CFL'S 25.20 91.97 YES 33% 20%<br />

HOT WATER SYS. EFFICIENCY 2.93 10.13 YES 28% 10%<br />

LOW FLOW SHOWERHEADS 2.38 8.22 YES 34% 10%<br />

HOTWATER CONSERVATION 0.47 1.63 YES 30% 10%<br />

COOKING AWARENESS 1.34 3.44 YES 30% 10%<br />

EFFICIENT COOL STORAGE NO 30% 10%<br />

THERMAL EFFICIENCY NO 30% 10%<br />

DEMARKETING TO GAS NO 30% 15%<br />

MODULAR CFL'S NO 33% 20%<br />

Total 32.39 129.0<br />

The REE resources submitted for NIRP are predominated by integral CFL's.<br />

The energy efficiency measures related to hot water systems have also been included but it was decided not to<br />

include efficient cool storage appliances, thermally efficient building practices and de-marketing to gas. Also<br />

included are integral CFL's and energy efficiency measures on storage water heaters. The integral version of<br />

the CFL costs less to sustain this technology over the planning period. The major problem associated with<br />

targeting integral CFL's for the efficient residential lighting initiatives is the risk of sustainability (i.e. conversion<br />

back to inefficient incandescent light bulbs in the future).<br />

21<br />

The strategy with respect to electrical water heating is to encourage storage water heating. Indications are that<br />

residential load management is a lower cost resource than building peaking plant. Instant water heaters have<br />

not found favour, because they do not lend themselves to load shifting. For storage water heating to hold its<br />

ground in SA it is important to demonstrate that these systems can be energy efficient, and that the per capita<br />

water consumption can be contained, especially in the event of water shortages at a future time. For waterheater<br />

system efficiency measures like hot water conservation, low flow showerheads and thermal insulation<br />

are included.<br />

Other DSM options that have been included in residential energy efficiency strategies in other countries have<br />

yet to be developed to a stage where they are mature enough to include in the REE strategy with some<br />

confidence. For example energy-efficient fridges and freezers will only be included in the strategy at a later<br />

stage when there is more clarification on appliance labelling policy. Information is required on how appliance<br />

labelling would help to create demand and to make the program economically more attractive. The strategy on<br />

fridges and freezers is therefore to closely monitor the DME initiatives regarding appliance labelling.<br />

Residential space-heating loads are not included but should be targeted as a demand-side measure, because<br />

they are one of the main reasons for poor utilization of supply capacity, and therefore not very economical to<br />

supply. Previous work by the DSM team has indicated that gas heating is likely to be more expensive to the<br />

consumer, yet electrical space heating is losing market share to gas space heating. With rising oil prices, and<br />

therefore LPG prices, it is uncertain, whether there will be a significant shift to gas for space heating. Better<br />

information is needed on how thermal efficiency measures impact on space heating demand before deciding<br />

on a relevant strategy. In particular, there is a need to know what the most marketable measures are to desensitise<br />

system space-heating demand to weather-related events like falling temperatures and cloud cover<br />

during winter months.

<strong>National</strong> Integrated <strong>Resource</strong> <strong>Plan</strong> 2<br />

4.2.2 Industrial, Mining and Commercial Energy Efficiency<br />

Table 4 gives the results of screening CEE programmes. For CEE, the assumptions on market penetration<br />

remain more or less the same as with the NIRP1<br />

Table 4: Commercial energy efficiency<br />

OPTION No of units Assumed Market<br />

Penetration<br />

MW/a GWh/a IN NIRP2 NIRP1 NIRP2<br />

SUPERVISION 2.05 10.60 YES 14.1% 15%<br />

FANS/PUMPS 0.64 4.68 YES 26.0% 26.0%<br />

COMP AIR<br />

LIGHTING 9.53 43.54 YES 27.0% 27.0%<br />

VSD's 0.26 1.90 YES 3.0% 3.0%<br />

REPLACE 0.68 3.50 YES 15.0% 10.0%<br />

UPGRADE 0.66 3.40 YES 13.0% 10.0%<br />

DOWNSIZE NO<br />

COOLING SYSTEM EFF NO<br />

HEAT RECOVERY NO<br />

INSULATION NO<br />

Total 13.82 69.38<br />

22<br />

Table 5 gives the results of screening of Industrial and Mining energy efficiency programmes<br />

Table 5: Industrial and Mining Energy Efficiency<br />

OPTION No of units Assumed Market<br />

Penetration<br />

MW/a GWh/a IN NIRP NIRP1 NIRP2<br />

SUPERVISION 2.24 15.33 YES 14.1% 2.0%<br />

FANS/PUMPS 1.31 9.26 YES 26.0% 5.0%<br />

COMP AIR 2.26 16.54 5.0%<br />

LIGHTING 3.77 23.44 YES 27.0% 10.0%<br />

VSD's 4.40 29.3 YES 3.0% 3.0%<br />

REPLACE 1.13 7.72 YES 15.0% 2.0%<br />

UPGRADE 1.06 7.02 YES 13.0% 2.0%<br />

DOWNSIZE NO<br />

COOLING SYSTEM EFF NO<br />

HEAT RECOVERY NO<br />

INSULATION NO<br />

Total 16.15 100.93<br />

These results suggest that most of the drive-power programs qualify for submission. The demand-side plan<br />

assumes that ESCO's will be enabled that specialize in the delivery of CEE and IMEE resources to the<br />

industrial market, and that they are competitive and operational in SA in the future. Under these assumptions it<br />

is possible that this target can be achieved within 10 years.<br />

This assumption assumes support from<br />

governance authorities in terms of policy.<br />

Additional energy efficiency resources would become available were commercial and industrial participants to

Reference Case<br />

focus their attention on heating and cooling systems that derive their energy from an electricity supply. These<br />

are indicated in the demand-side plan as a requirement for further investigation.<br />

The most viable area for industrial and commercial energy efficiency is motor supervision and control.<br />

Maintenance and supervision of compressed air or gas compressor systems is another area for potentially<br />

very cost-effective energy efficiency measures. Companies that employ the practice of re-winding motors<br />

rated lower than 45kW may require advice on the economics of re-winding versus replacing. In some cases it<br />

may even pay to upgrade motors to premium efficiency motors.<br />

It is most important to transform the market for new construction to energy efficient lighting, especially in<br />

commercial buildings. Lighting controls should be installed to avoid unnecessary lighting usage. Retrofits<br />

typically do not offer very short paybacks, but are in the range where respectable rates of return can be<br />

guaranteed. Lighting retrofits that would also reduce air-conditioning load should be targeted first. It is a matter<br />

of major concern that the majority of industrial and commercial lighting sales into the new construction market<br />

still conform to old and outdated standards for energy efficiency.<br />

Every effort should be made to apply best practices in the design of systems employing fluid or airflow. In<br />

particular excessive throttling of flow should give way to variable speed drives or staged switching of drives,<br />

and pipes and ducts should be sized to minimise total resource costs. Every effort should be made to promote<br />

the adherence to best practices on systems with pumps, fans and compressors. CEE and IMEE retrofits<br />

should initially target systems of large drives, i.e. 200 kW and larger.<br />

4.2.3 Residential Load Management (RLM)<br />

In the case of RLM, the screening criteria have led the DSM Team to firm conclusions on the RLM strategy. Up<br />

until now too many conflicting DSM strategies were considered. Table 6 gives the results of screening the<br />

various RLM strategies and options.<br />

23<br />

Table 6: Residential load management programmes<br />

SUMMARY OF RLM SCREENING RESULTS<br />

Options Hi CF MW/a Balance of MW/a Lo CF MW/a<br />

Ripple Control 49 49 98<br />

4.2.4 Industrial and Mining Load Management (IMLM)<br />

The pre-integration study data shows that for IMLM there is a potential 600 MW of controllable load that can be<br />

developed, assuming the resource is operated at high capacity factor.<br />

A summary of the first-round screening results for ICLM is given in Table 7<br />

Table 7: Industrial and mining load management<br />

Options Hi CF MW/a Balance of MW/a Lo CF MW/a<br />

INDUSTRIAL/ MINING LOAD 40.9 40.9 82<br />

Under system emergencies the resource can be operated at low capacity factor. The low capacity factor<br />

figures assume that the resource is required for 2 hours per day.<br />

4.3 Uncertainty and Risk Associated with DSM<br />

The DSM team has had to come to grips with the reality that it is developing DSM plans for a fast-changing<br />

energy market. Many of the decisions about the future structures of the Electricity Supply Industry (ESI) in

<strong>National</strong> Integrated <strong>Resource</strong> <strong>Plan</strong> 2<br />

South Africa, which have yet to be made, may impact on DSM. Utilities will have no control over the way the<br />

industry will develop in future.<br />

To deal with uncertainty about the future, the DSM team has to make certain assumptions regarding the<br />

conditions for sustainable demand-side resources to exist. The DSM programmes assume that the<br />

governance authorities in consensus will set up the specified conditions for a DSM resource market with key<br />

stakeholders and energy consumers.<br />

Risk is closely linked to a lack of dependable information. The Demand-side plans make many assumptions on<br />

important factors that affect market penetration. The DSM assumptions and resource plans are based on<br />

targets that are believed to be realistic. The demand-side plan is exposed to risk if any of the assumptions are<br />

proven to be unrealistic. It is prudent to firm up on much needed information about the market potential for<br />

demand-side resources.<br />

4.4 Priorities for the Development of Demand-Side <strong>Resource</strong>s<br />

24<br />

These demand-side plans are based on the assumption that the SA market will be willing and able to transform<br />

towards a preference for the development of demand-side resources. Historically the preference has been to<br />

develop supply-side resources, so the SA market is currently not richly endowed with the resources and skills<br />

required to deliver demand-side resources on a large scale. A prime issue of concern is the fact that DSM is<br />

often seen from a utility perspective as a loss leader in that their core business is in selling electricity. This is<br />

especially relevant to energy efficiency programmes and it is imperative that policy and legislation be adopted<br />

in future to address this problem. Another major problem is in sustainability. For example in the Table View load<br />

management pilot study, previously about 8-10MW could be achieved through geyser control. Recent tests<br />

show only 4MW can currently be switched off. Customers are bypassing the system because they see no<br />

personal benefit as no time-of-use tariff is in place for individual residential customers.

Reference Case<br />

5.SUPPLY-SIDE OPTIONS<br />

Technology options are compared on the basis of discounted cash flows (total capital & operating costs) over<br />

the option lifetime using 10% net discount rate as dictated by the ARC of the NER. The levelised cost per unit<br />

output of the option is obtained by dividing the present value by the total discounted lifetime generation.<br />

Levelised costs are calculated as a function of plant load factors (screening curves) to illustrate the relation<br />

between the levelised cost and plant load factor.<br />

5.1 Eskom System - Existing and Committed Capacity<br />

The current (2003) total net base load capacity in operation of the Eskom system is given in Appendix 1 to this<br />

report and is 33 871 MWe. The total net peaking capacity in operation is 2319 MWe. This includes Acacia and<br />

Port Rex gas turbines, Drakensberg and Palmiet pumped storage, Gariep and Vanderkloof hydro plants.<br />

Eskom has a long-term contract to purchase power from Cahora Bassa hydro plant in Mozambique. Available<br />

net capacity from Cahora Bassa is at present 912 MWe (after losses). A further 369 MWe (after losses) is<br />

committed from 2004. Eskom is importing about 100 MWe of peaking capacity from Zesco (Zambia) via<br />

Zimbabwe and about 110 MWe from the DRC. These latter are excluded from the study as Eskom has been a<br />

net exporter of similar proportions to neighbouring states. (I.e. as these imports and exports are effectively<br />

equivalent the exports are not included in the load forecast nor are the imports included in the capacity plan).<br />

5.2 Non-Eskom System - Existing Capacity<br />

The following options are considered in the plan:<br />

Appendix 1 also gives the net capacity of non-Eskom generating plant. These have been aggregated into<br />

blocks of similar capacity units for modelling purposes as follows:<br />

25<br />

& Munic 1: consisting 12x60 MW sent out coal-fired capacity<br />

& Munic 2: consisting 21x30 MW sent out coal-fired capacity<br />

& Sasol: consisting 12x60 MW sent out coal-fired capacity<br />

& Steenbras pumped storage plant: 3x60 MW sent out<br />

& Mini Hydro: 1x65 MW sent out<br />

& Minic OCGT: 6x50 MW sent out<br />

The details of these plant and capacities are given in Appendix 1.<br />

In addition to the Eskom and non-Eskom supply capacity there is a total 1510 MW interruptible supply capacity<br />

included in the plan. The interruptible load accepted for inclusion in the plan, although based on current<br />

contracts, does not necessarily represent the existing contracts. It is assumed that some level of interruptible<br />

capacity, either in the form of contracts for reserve or as a demand-side bidding option, will exist in the future. In<br />

total the existing capacity assumed on the <strong>National</strong> system in 2003 amounts to 41378 MWe sent out.<br />

5.3 Return to Service of Eskom Mothballed <strong>Plan</strong>t (Simunye)<br />

These are the stations that were put into storage during the period of high excess capacity on the Eskom<br />

system: Camden (1520 MW), Grootvlei (1130 MW) and Komati (909 MW). These capacities are on a sent out<br />

basis. These stations all use PF coal. When refurbished, Camden is anticipated to run as base load, whereas<br />

Grootvlei and Komati would most probably be two-shifted i.e. operating at an annual load factor of less than<br />

30%.<br />

Results of a pre-feasibility study initiated and carried out by Eskom indicate that repowering some of Eskom's<br />

old plant with Fluidised Bed Combustion (FBC) technology (such as at Komati) could be an option in

<strong>National</strong> Integrated <strong>Resource</strong> <strong>Plan</strong> 2<br />

comparison with other future base load plant. The remaining half of Komati (456 MW) could be re-powered<br />

with FBC technology to operate as base load.<br />

5.4 New Supply-Side Options<br />

Table 8 below summarises the data for all the new supply-side technologies considered in the plan. Detailed<br />

description of the cost and performance of the considered supply-side options is shown in Appendix 3. The<br />

ARC, applying the approved selection criteria, determined the inclusion of the supply side technologies in the<br />

plan. The capital costs are averages of the international data evaluated. Operating and Maintenance costs<br />

shown are averages from the international literature, after they have been adjusted for South African labour<br />

conditions. Appendix 3 contains additional information about the supply-side technologies, including costs,<br />

performance parameters, lead times and data statistics.<br />

A transmission benefit has been given to stations built in the Cape close to the load centres. This is to account<br />

for the line losses that occur when transmitting electricity from an equivalent station in the Highveld and for<br />

strengthening the grid along transmission lines.<br />

<strong>PBMR</strong> data is given for both the initial multi-module and, after several multi-modules have been deployed, a<br />

cheaper multi-module (costs are likely to decrease, benefiting from technology learning).<br />

Adding units to existing coal plants and co-generation options have not been considered in the plan.<br />

5.4.1 New Pulverised Fuel (PF) Coal-Fired Stations<br />

26<br />

In the absence of more cost competitive options, coal-fired plants are likely to remain the backbone of the<br />

electricity supply industry in South Africa for a long time. Their proven design, the vast operating experience<br />

gained locally, their wide availability, reliability and relatively low cost make them an attractive option for base<br />

1<br />

load generation. This is often the case in other parts of the world, such as China , where low-cost coal is<br />

available. The future stations considered consist of 6 units, each of 700 MW installed capacity, with drycooling<br />

(or hybrid) systems. Coal stations can operate with or without flue gas desulphurisation (FGD) to<br />

reduce emissions but only the option with FGD was considered for the plan because of the decision to adhere<br />

to World Bank emission standards. Detailed information on the cost and performance of the PF plants is<br />

shown in Appendix 3.4<br />

5.4.2 New Gas-Fired <strong>Plan</strong>t<br />

Potentially Namibia, Mozambique or Angola could supply Gas. New gas-fired plants considered are open<br />

cycle gas turbines (OCGT) and combined cycle gas turbines (CCGT). Open cycle gas turbines, by virtue of<br />

their low efficiencies and resultant high cost of fuel when operating at low load factors are considered for<br />

peaking options only. Combined cycle gas turbines with much improved efficiency levels are regarded as nonpeaking<br />

technologies due to the likely constraints on gas contracts (take or pay) although they could<br />

technically follow load.<br />

The OCGT stations considered have two 120 MW units. The CCGT stations considered have 5 x 400 MW<br />

units.<br />

If OCGT turbines were built, and in the future a gas network was developed, it is likely that OCGT plants would<br />

be converted to CCGT plants, which would increase the capacity and efficiency of the stations. This has not<br />

been taken into account in the plan.<br />

1 Future Implications of China’s Energy-Technology Choices, July 2001

Reference Case<br />

Fuels considered for OCGT plants are kerosene, LPG, local syngas and LNG. Fuels considered for CCGT are<br />

pipeline gas and LNG. Fuel prices for the gas options are given for all the fuels considered for each technology.<br />

Detailed information on the cost and performance of the OCGT and CCGT plants is shown in Appendix 3.2 and<br />

3.3 respectively.<br />

5.4.3 New Pumped Storage Schemes<br />

Two pumped-storage schemes have been considered in the plan. Braamhoek (which has already received a<br />

record of decision (ROD)) and a generic scheme which would follow Braamhoek. Braamhoek consists of four<br />

333 MW units, while the generic option consists of three 333 MW units. It must be noted that the costing of<br />

pumped storage schemes is site specific. Additional details on the pumped storage plants are provided in<br />

Appendix 3.8.<br />

5.4.4 Greenfield Fluidised Bed Combustion<br />

The fluidised bed combustion (FBC) stations considered have an installed capacity of 500 MW. They are<br />

comprised of two 250 MW boilers and a 500 MW turbine, and have a 35 year lifetime. The price of duff coal will<br />

have to be negotiated between the station and the mines. Additional information on the FBC is provided in<br />

Appendix 3.5.<br />

27

<strong>National</strong> Integrated <strong>Resource</strong> <strong>Plan</strong> 2<br />

28<br />

Table 8: Summary of cost and performance data of new supply-side options

Reference Case<br />

5.4.5 Conventional Nuclear (Advanced Light Water Reactor (ALWR))<br />

The new nuclear plant considered is an advanced light water reactor. It consists of two 900 MW units and will<br />

be built at the Koeberg (existing nuclear) site near Cape Town.<br />

The ALWRs are based on existing light water reactors but are designed for simplicity and ease of construction<br />

and maintenance. They have a considerable degree of inherent safety (safety built in to the design rather than<br />

reliant on active safety mechanisms). Examples of such reactors are the Westinghouse AP1000 and the<br />

General Electric ABWR. There are currently no ALWR plants in operation. Additional information on the ALWR<br />

is provided in Appendix 3.6.<br />

5.4.6 Research projects/programs<br />

In addition to the “mainstream” supply-side options listed above, the following are amongst the technologies<br />

that are being researched and are considered in the screening curve analysis:<br />

5.4.6.1 Wind energy<br />

There are several areas in South Africa, particularly in the coastal regions, which have been identified as<br />

having good potential for wind power. The proposed wind farm consists of twenty (1 MW) wind turbines.<br />

There is little detailed data available for specific sites in South Africa. Additional details on wind turbines are<br />

provided in Appendix 3.9.<br />

5.4.6.2 Solar thermal<br />

The Solar Thermal power station would be built near Upington in the Northern Cape. It would have three 110<br />

MW units and the capacity for storage. It is therefore regarded as a dispatchable station in the plan. Additional<br />

details on solar thermal power stations are provided in Appendix 3.10.<br />

29<br />

5.4.6.3 <strong>PBMR</strong><br />

If the necessary approvals are given and a commercial decision is taken to build one, the first full-sized<br />

demonstration unit should be on line by 2008. If successful, further units will be built with the aim of producing<br />

a power station consisting of eight units, each unit with an installed capacity of 170 MW. Additional details on<br />

the <strong>PBMR</strong> plant are provided in Appendix 3.7<br />

5.4.7 Imported Hydro<br />

There is a large potential for South Africa to import hydro-electricity from the rest of Africa. A promising site is at<br />

Mepanda Uncua in Mozambique about 60 km downstream of the existing Cahora Bassa Power Station on the<br />

Zambezi River. In the first stage of this project the installed capacity at the HV terminals would be 1300 MW.<br />

The firm power capacity at 95% availability is 827 MWe. Additional details on the imported hydro option are<br />

provided in Appendix 3.11.<br />

5.5 Screening Curves<br />

To evaluate the cost of generation from new options, a screening curve analysis was undertaken. A screening<br />

curve evaluates the cost of generating electricity at different average levels of production or load factors over<br />

the life of the plant. This gives an indication of the economics of running the plant at these load factors.<br />

The following screening curves have been drawn from the levelised capital, O&M and fuel costs for the various<br />

technologies at different load factors. The analysis has been split into two sections: non-peaking stations<br />

(plants expected to run at high load factors) and peaking stations (plants expected to run at low load factors).<br />

Non-peaking plants operate as base load when their operating (including fuel) costs are lower than peaking

<strong>National</strong> Integrated <strong>Resource</strong> <strong>Plan</strong> 2<br />

stations. There are some exceptions where stations with high operating costs are included as must run plants<br />

by virtue of fixed price contracts or technical constraints. CCGT options are examples whereby the gas<br />

contracts are placed on the basis of firm commitments to take minimum quantities by virtue of purchasing<br />

power agreements. These plants can be considered as inflexible options to system dispatch and construed as<br />

must run options.<br />

Peaking stations run at low load factors by virtue of their high operating costs generally have lower capital and<br />