JANUARY 2013 In This Issue... Toys 4 Tots Paso Robles Wine Tour ...

JANUARY 2013 In This Issue... Toys 4 Tots Paso Robles Wine Tour ...

JANUARY 2013 In This Issue... Toys 4 Tots Paso Robles Wine Tour ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Show Me The Money<br />

Story by Dave Humphreys<br />

As you will recall from a previous<br />

article, when you buy your Porsche, you<br />

are essentially putting your money into<br />

a declining value savings account - in<br />

that you rarely get as much out as you<br />

put in. When you come right down to<br />

it, purchasing any automobile is a pretty<br />

dismal investment by any measure.<br />

You might say that leasing is<br />

somewhat similar to buying, but without<br />

the so-called equity “savings account.”<br />

With leasing, you have the option of<br />

putting your “savings“ (the difference<br />

between the monthly costs of buying<br />

vs. leasing; which can be substantial)<br />

into more productive investments.<br />

As a matter of fact, many financial<br />

advisors and accountants are currently<br />

encouraging exactly this practice as one<br />

of the benefits of leasing.<br />

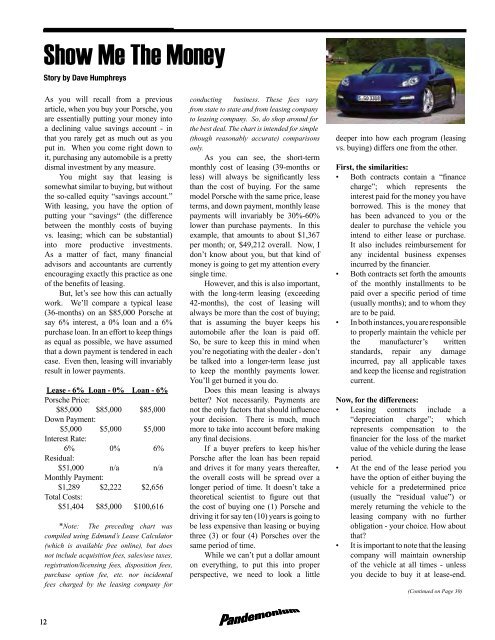

But, let’s see how this can actually<br />

work. We’ll compare a typical lease<br />

(36-months) on an $85,000 Porsche at<br />

say 6% interest, a 0% loan and a 6%<br />

purchase loan. <strong>In</strong> an effort to keep things<br />

as equal as possible, we have assumed<br />

that a down payment is tendered in each<br />

case. Even then, leasing will invariably<br />

result in lower payments.<br />

Lease - 6% Loan - 0% Loan - 6%<br />

Porsche Price:<br />

$85,000 $85,000 $85,000<br />

Down Payment:<br />

$5,000 $5,000 $5,000<br />

<strong>In</strong>terest Rate:<br />

6% 0% 6%<br />

Residual:<br />

$51,000 n/a n/a<br />

Monthly Payment:<br />

$1,289 $2,222 $2,656<br />

Total Costs:<br />

$51,404 $85,000 $100,616<br />

*Note: The preceding chart was<br />

compiled using Edmund’s Lease Calculator<br />

(which is available free online), but does<br />

not include acquisition fees, sales/use taxes,<br />

registration/licensing fees, disposition fees,<br />

purchase option fee, etc. nor incidental<br />

fees charged by the leasing company for<br />

conducting business. These fees vary<br />

from state to state and from leasing company<br />

to leasing company. So, do shop around for<br />

the best deal. The chart is intended for simple<br />

(though reasonably accurate) comparisons<br />

only.<br />

As you can see, the short-term<br />

monthly cost of leasing (39-months or<br />

less) will always be significantly less<br />

than the cost of buying. For the same<br />

model Porsche with the same price, lease<br />

terms, and down payment, monthly lease<br />

payments will invariably be 30%-60%<br />

lower than purchase payments. <strong>In</strong> this<br />

example, that amounts to about $1,367<br />

per month; or, $49,212 overall. Now, I<br />

don’t know about you, but that kind of<br />

money is going to get my attention every<br />

single time.<br />

However, and this is also important,<br />

with the long-term leasing (exceeding<br />

42-months), the cost of leasing will<br />

always be more than the cost of buying;<br />

that is assuming the buyer keeps his<br />

automobile after the loan is paid off.<br />

So, be sure to keep this in mind when<br />

you’re negotiating with the dealer - don’t<br />

be talked into a longer-term lease just<br />

to keep the monthly payments lower.<br />

You’ll get burned it you do.<br />

Does this mean leasing is always<br />

better? Not necessarily. Payments are<br />

not the only factors that should influence<br />

your decision. There is much, much<br />

more to take into account before making<br />

any final decisions.<br />

If a buyer prefers to keep his/her<br />

Porsche after the loan has been repaid<br />

and drives it for many years thereafter,<br />

the overall costs will be spread over a<br />

longer period of time. It doesn’t take a<br />

theoretical scientist to figure out that<br />

the cost of buying one (1) Porsche and<br />

driving it for say ten (10) years is going to<br />

be less expensive than leasing or buying<br />

three (3) or four (4) Porsches over the<br />

same period of time.<br />

While we can’t put a dollar amount<br />

on everything, to put this into proper<br />

perspective, we need to look a little<br />

deeper into how each program (leasing<br />

vs. buying) differs one from the other.<br />

First, the similarities:<br />

• Both contracts contain a “finance<br />

charge”; which represents the<br />

interest paid for the money you have<br />

borrowed. <strong>This</strong> is the money that<br />

has been advanced to you or the<br />

dealer to purchase the vehicle you<br />

intend to either lease or purchase.<br />

It also includes reimbursement for<br />

any incidental business expenses<br />

incurred by the financier.<br />

• Both contracts set forth the amounts<br />

of the monthly installments to be<br />

paid over a specific period of time<br />

(usually months); and to whom they<br />

are to be paid.<br />

• <strong>In</strong> both instances, you are responsible<br />

to properly maintain the vehicle per<br />

the manufacturer’s written<br />

standards, repair any damage<br />

incurred, pay all applicable taxes<br />

and keep the license and registration<br />

current.<br />

Now, for the differences:<br />

• Leasing contracts include a<br />

“depreciation charge”; which<br />

represents compensation to the<br />

financier for the loss of the market<br />

value of the vehicle during the lease<br />

period.<br />

• At the end of the lease period you<br />

have the option of either buying the<br />

vehicle for a predetermined price<br />

(usually the “residual value”) or<br />

merely returning the vehicle to the<br />

leasing company with no further<br />

obligation - your choice. How about<br />

that?<br />

• It is important to note that the leasing<br />

company will maintain ownership<br />

of the vehicle at all times - unless<br />

you decide to buy it at lease-end.<br />

(Continued on Page 30)<br />

12