INSTITUTIONAL INVESTOR SENTIMENT SURVEy - PEI Media

INSTITUTIONAL INVESTOR SENTIMENT SURVEy - PEI Media

INSTITUTIONAL INVESTOR SENTIMENT SURVEy - PEI Media

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

fees<br />

institutional<br />

investor<br />

sentiment<br />

survey<br />

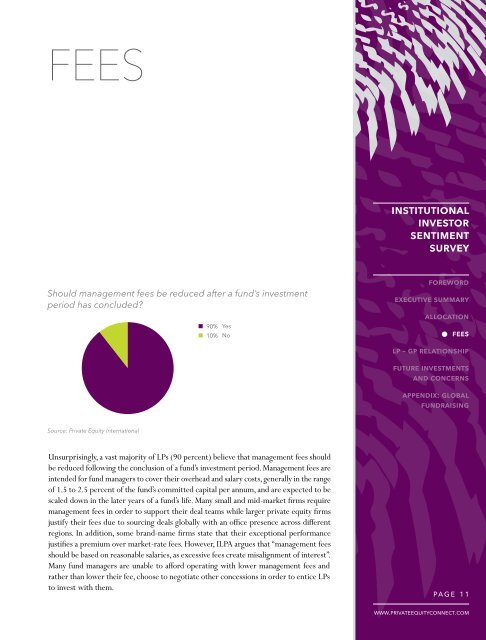

Should management fees be reduced after a fund’s investment<br />

period has concluded?<br />

n 90% Yes<br />

n 10% No<br />

foreword<br />

executive summary<br />

allocation<br />

• fees<br />

lp – gp relationship<br />

future investments<br />

and concerns<br />

appendix: global<br />

fundraising<br />

Source: Private Equity International<br />

Unsurprisingly, a vast majority of LPs (90 percent) believe that management fees should<br />

be reduced following the conclusion of a fund’s investment period. Management fees are<br />

intended for fund managers to cover their overhead and salary costs, generally in the range<br />

of 1.5 to 2.5 percent of the fund’s committed capital per annum, and are expected to be<br />

scaled down in the later years of a fund’s life. Many small and mid-market firms require<br />

management fees in order to support their deal teams while larger private equity firms<br />

justify their fees due to sourcing deals globally with an office presence across different<br />

regions. In addition, some brand-name firms state that their exceptional performance<br />

justifies a premium over market-rate fees. However, ILPA argues that “management fees<br />

should be based on reasonable salaries, as excessive fees create misalignment of interest”.<br />

Many fund managers are unable to afford operating with lower management fees and<br />

rather than lower their fee, choose to negotiate other concessions in order to entice LPs<br />

to invest with them.<br />

page 11<br />

www.privateequityconnect.com