INSTITUTIONAL INVESTOR SENTIMENT SURVEy - PEI Media

INSTITUTIONAL INVESTOR SENTIMENT SURVEy - PEI Media

INSTITUTIONAL INVESTOR SENTIMENT SURVEy - PEI Media

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

LP-GP<br />

Relationship<br />

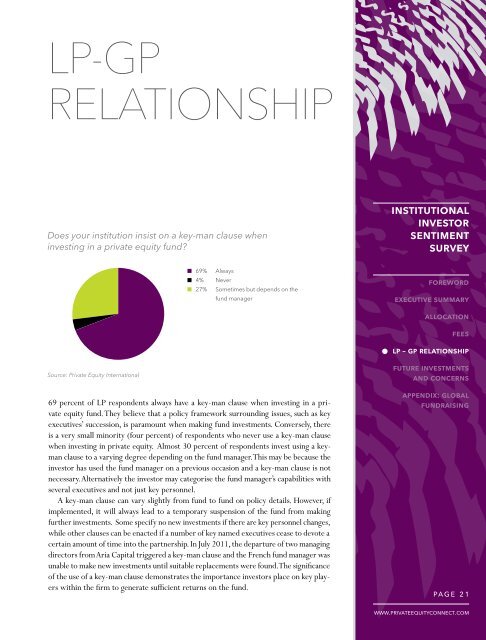

Does your institution insist on a key-man clause when<br />

investing in a private equity fund?<br />

institutional<br />

investor<br />

sentiment<br />

survey<br />

n<br />

n<br />

n<br />

69%<br />

4%<br />

27%<br />

Always<br />

Never<br />

Sometimes but depends on the<br />

fund manager<br />

foreword<br />

executive summary<br />

allocation<br />

Source: Private Equity International<br />

69 percent of LP respondents always have a key-man clause when investing in a private<br />

equity fund. They believe that a policy framework surrounding issues, such as key<br />

executives’ succession, is paramount when making fund investments. Conversely, there<br />

is a very small minority (four percent) of respondents who never use a key-man clause<br />

when investing in private equity. Almost 30 percent of respondents invest using a keyman<br />

clause to a varying degree depending on the fund manager. This may be because the<br />

investor has used the fund manager on a previous occasion and a key-man clause is not<br />

necessary. Alternatively the investor may categorise the fund manager’s capabilities with<br />

several executives and not just key personnel.<br />

A key-man clause can vary slightly from fund to fund on policy details. However, if<br />

implemented, it will always lead to a temporary suspension of the fund from making<br />

further investments. Some specify no new investments if there are key personnel changes,<br />

while other clauses can be enacted if a number of key named executives cease to devote a<br />

certain amount of time into the partnership. In July 2011, the departure of two managing<br />

directors from Aria Capital triggered a key-man clause and the French fund manager was<br />

unable to make new investments until suitable replacements were found. The significance<br />

of the use of a key-man clause demonstrates the importance investors place on key players<br />

within the firm to generate sufficient returns on the fund.<br />

fees<br />

• lp – gp relationship<br />

future investments<br />

and concerns<br />

appendix: global<br />

fundraising<br />

page 21<br />

www.privateequityconnect.com