INSTITUTIONAL INVESTOR SENTIMENT SURVEy - PEI Media

INSTITUTIONAL INVESTOR SENTIMENT SURVEy - PEI Media

INSTITUTIONAL INVESTOR SENTIMENT SURVEy - PEI Media

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Fundraising by Strategy<br />

150<br />

institutional<br />

investor<br />

sentiment<br />

survey<br />

foreword<br />

executive summary<br />

allocation<br />

fees<br />

lp – gp relationship<br />

future investments<br />

and concerns<br />

appendix: global<br />

•<br />

fundraising<br />

page 38<br />

Aggregate Capital Raised ($bn)<br />

120<br />

90<br />

60<br />

30<br />

0<br />

Mezzanine Buyout Growth /<br />

Expansion<br />

Capital<br />

Venture<br />

Capital<br />

Fund of<br />

Funds<br />

n 2009 n 2010 n 2011 n 2012YTD<br />

Source: Private Equity International<br />

Secondaries<br />

Turnaround<br />

/<br />

Distressed<br />

Co-investment<br />

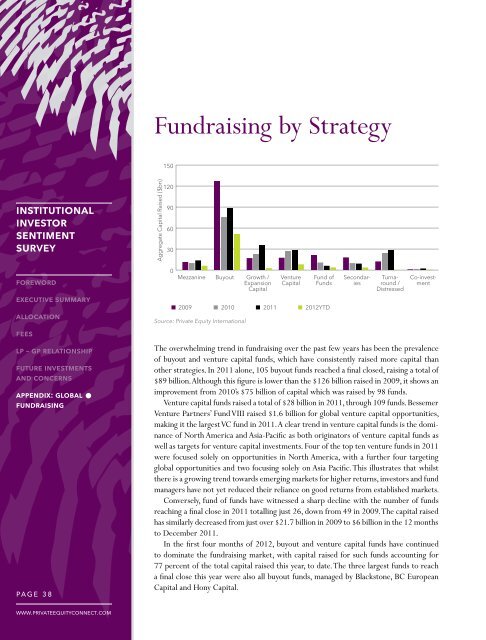

The overwhelming trend in fundraising over the past few years has been the prevalence<br />

of buyout and venture capital funds, which have consistently raised more capital than<br />

other strategies. In 2011 alone, 105 buyout funds reached a final closed, raising a total of<br />

$89 billion. Although this figure is lower than the $126 billion raised in 2009, it shows an<br />

improvement from 2010’s $75 billion of capital which was raised by 98 funds.<br />

Venture capital funds raised a total of $28 billion in 2011, through 109 funds. Bessemer<br />

Venture Partners’ Fund VIII raised $1.6 billion for global venture capital opportunities,<br />

making it the largest VC fund in 2011. A clear trend in venture capital funds is the dominance<br />

of North America and Asia-Pacific as both originators of venture capital funds as<br />

well as targets for venture capital investments. Four of the top ten venture funds in 2011<br />

were focused solely on opportunities in North America, with a further four targeting<br />

global opportunities and two focusing solely on Asia Pacific. This illustrates that whilst<br />

there is a growing trend towards emerging markets for higher returns, investors and fund<br />

managers have not yet reduced their reliance on good returns from established markets.<br />

Conversely, fund of funds have witnessed a sharp decline with the number of funds<br />

reaching a final close in 2011 totalling just 26, down from 49 in 2009. The capital raised<br />

has similarly decreased from just over $21.7 billion in 2009 to $6 billion in the 12 months<br />

to December 2011.<br />

In the first four months of 2012, buyout and venture capital funds have continued<br />

to dominate the fundraising market, with capital raised for such funds accounting for<br />

77 percent of the total capital raised this year, to date. The three largest funds to reach<br />

a final close this year were also all buyout funds, managed by Blackstone, BC European<br />

Capital and Hony Capital.<br />

www.privateequityconnect.com