News@agcs - Allianz Global Corporate & Specialty

News@agcs - Allianz Global Corporate & Specialty

News@agcs - Allianz Global Corporate & Specialty

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

→The AGCS Financial<br />

Lines Expansion into<br />

Perth will ensure that<br />

AGCS is providing<br />

a greater more<br />

streamlined services<br />

to Financial Lines<br />

customers.<br />

General Manager AGCS,<br />

Holger Schaefer<br />

Edition: March/April 2012<br />

<strong>Allianz</strong> Australia Insurance Limited ABN 15 000 122 850<br />

Upfront with Holger<br />

2011 was a challenging year, with volatile financial markets and an unusually high number of natural disasters,<br />

AGCS has withstood the recent crisis-driven developments better than many competitors, which is evident in<br />

the resilient set of results released for 2011 and its 2012 strategy, which has already seen the expansion of its<br />

Financial Lines team in Perth and greater enhancements in its capabilities in Energy.<br />

<strong>Allianz</strong> <strong>Global</strong> <strong>Corporate</strong> and <strong>Specialty</strong> (AGCS) recently<br />

released its annual 2011 results., which included the<br />

following:<br />

• Achieving a stable operating profit for 2011.<br />

Revenues reached €549 million.<br />

• Gross written premium increased to €4.9 billion<br />

including <strong>Allianz</strong> Risk Transfer (2010: €4.5 billion).<br />

• Investment income continued to support operating<br />

profit at €321 million (incl. ART) for 2011.<br />

• AGCS combined ratio was stable at 94% (2010:<br />

94%).<br />

Locally, AGCS Pacific also performed well with a growth<br />

in revenue of 11%. I want to take the opportunity to<br />

thank all our partners for their support in 2011 and I look<br />

forward to continuing to strengthen our relationship<br />

with you in 2012.<br />

With increasing globalisation, new challenges<br />

continuously the risk management landscape. As<br />

we forge ahead into 2012, AGCS is working towards<br />

Copyright©2012 <strong>Allianz</strong> Australia Limited ABN 21 000 006 226<br />

<strong>Allianz</strong> <strong>Global</strong> <strong>Corporate</strong> and <strong>Specialty</strong><br />

<strong>News@agcs</strong><br />

accommodating the shifting business needs and<br />

expectations with improved efficiency through a globally<br />

coordinated approach.<br />

AGCS has a long and established reputation as a leading<br />

provider of bespoke international insurance programs<br />

(IIP) for multinational clients. In fact in 2011, AGCS<br />

Pacific experienced a significant increase in the number<br />

of IIPs, proving our initiative a successful one.<br />

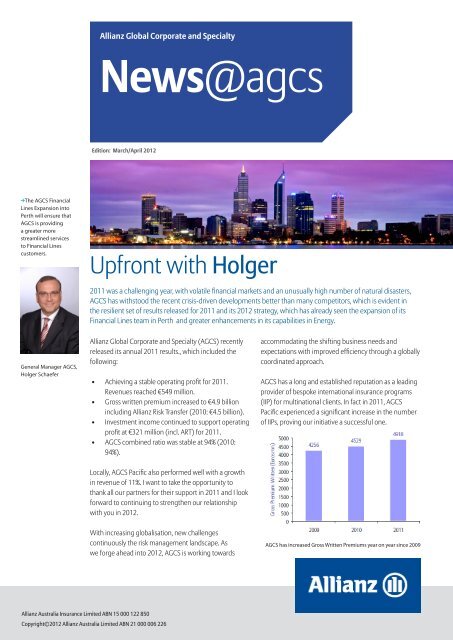

AGCS has increased Gross Written Premiums year on year since 2009

Board Member, Andreas<br />

Berger.<br />

2<br />

→AGCS Market<br />

Manager, Willem Van<br />

Wyk and a local broker<br />

at the event.<br />

Continued from page 1...<br />

This growth can be attributed to the shift in our risk<br />

appetite, particularly in the long-tail lines - Financial Lines<br />

and Liability, over the last 18 months. Aligning with the<br />

AGCS’s global business model to position ourselves as lead<br />

carriers within the primary market, we have developed<br />

a balance between achieving strong sales numbers and<br />

sound underwriting ethics, which have seen our business<br />

grow in this area.<br />

Few, if any, insurance companies are able to match our<br />

ability to offer clients such a harmonised approach to risk<br />

management on an international basis. With a network<br />

spanning across more than 150 countries, we are well<br />

positioned to harness the combined resources of not only<br />

AGCS but the <strong>Allianz</strong> Group. We operate on a single risk<br />

carrier focusing on international clients and benefiting<br />

from a single global balance sheet, a strong security rating<br />

and a clear and diverse business strategy.<br />

At a recent Town Hall, hosted by AGCS, visiting board<br />

member Andreas Berger, who is responsible for Regions<br />

and Markets, revealed our market segmentation strategy<br />

on mature and growing markets. AGCS will make better<br />

use of our existing <strong>Allianz</strong> network in Africa, which will also<br />

benefit our Australian clients. Over the last few months,<br />

we have explored how AGCS Pacific could better support<br />

Australian investors operating in Africa by leveraging<br />

our strong African footprint. We are in the process of<br />

developing an insurance offering and will inform our<br />

partners of this exciting development in due course.<br />

While in Australia, Andreas also met with key broking<br />

partners in Perth for the launch of our Financial Lines<br />

Team. Integral to the launch were the two key senior<br />

appointments - Neil Bowdrey, Manager, Financial Lines,<br />

Western Australia and Jack Chia, Senior Underwriter,<br />

Financial Lines, Western Australia. Both roles will report to<br />

the Regional Manager, Financial Lines, Bill Hassos.<br />

Neil has substantial experience in the broking and<br />

underwriting Financial Lines markets locally and<br />

internationally and will be responsible for managing and<br />

underwriting the AGCS Financial Lines products in<br />

Western Australia. While Jack, who has extensive<br />

knowledge of financial institutions and mining sectors ,<br />

will use his specialist background in the marketing and<br />

underwriting of Directors’ and Officers’ Insurance in<br />

Western Australia to ensure we continue to deliver the<br />

high level of service our brokers and clients expect.<br />

During the launch, Andreas also introduced Andrew<br />

Seeley has taken up a new joint position as Underwriting<br />

Manager Property / Energy. He is responsible for the<br />

development of the Energy portfolio in the Pacific region<br />

as an integral part of AGCS‘ growth strategy for Energy.<br />

This position enhances AGCS Pacific‘s commitment<br />

to existing clients and brokers whilst embracing the<br />

challenges of the large and mid-market Oil and Gas<br />

projects being developed in both Australia and New<br />

Zealand.<br />

The requirement to establish a Perth-based team and<br />

an Energy underwriter was identified through our Net<br />

Promoter Score (NPS), an annual survey that allows<br />

brokers and clients the opportunity to provide feedback.<br />

Further outcomes from our NPS survey are featured in this<br />

edition of News@AGCS, which collectively have assisted<br />

us in tailoring and driving our business to meet the needs<br />

of our brokers.<br />

With a strong global strategy, enhanced focus, and new<br />

resources, AGCS Pacific remains your committed and<br />

trusted partner in 2012. We thank you for your continued<br />

support and look forward to working even closer with you<br />

in the year ahead.<br />

Yours sincerely,<br />

Holger Schaefer General Manager,<br />

<strong>Allianz</strong> <strong>Global</strong> <strong>Corporate</strong> and <strong>Specialty</strong><br />

Board member meets with brokers<br />

During March 2012, AGCS Board member and Chief<br />

Regions amd Markets Officer, Andreas Berger, met with<br />

key broker partners at a series of meetings and events<br />

during his visit to Australia. At a key networking event<br />

aboard a cruise liner docked off Nielson Park in Sydney<br />

Harbour, Mr Berger met with with 35 brokers from AON,<br />

Marsh, Willis and JLT .<br />

Brokers were welcomed by the General Manager, AGCS<br />

Pacific, Holger Schaefer, “2011 was a year largely defined<br />

by natural catastrophic events, I want to express my<br />

appreciation to our brokers for their commitment and<br />

support in working with us to manage the outcomes of<br />

these events and the after effects.”<br />

Mr Berger also commented that ” following a sound<br />

performance in 2011 AGCS Pacific has well established<br />

itself as a lead insurer. Now more than ever we are<br />

focusing on our clients and I have full confidence that<br />

AGCS Pacific will continue to deliver a high quality service<br />

to all its clients when they need us most,” he said.

Regional Manager Marine,<br />

AGCS, Ron Johnson<br />

→Gail Bowman and<br />

Tricia Koh, of AGCS,<br />

welcomed brokers to<br />

the event.<br />

Grounding of container vessel in NZ sparks<br />

questions about insurance<br />

A vessel has grounded with your cargo onboard. What<br />

do you do in case of potential loss? Could you face<br />

hefty costs associated with the vessel’s salvage?<br />

These are some of the questions answered in <strong>Allianz</strong><br />

<strong>Global</strong> <strong>Corporate</strong> & <strong>Specialty</strong>’s (AGCS) most recent<br />

report ‘General Average and Salvage Charges’, which<br />

responds to brokers’ frequently asked questions on how<br />

marine insurance policies respond in the event of a<br />

grounded vessel.<br />

AGCS Australia released the report following the recent<br />

grounding a fully loaded cargo vessel on a reef off the<br />

coast of New Zealand. Such cases are complex and<br />

potentially touch on several aspects of maritime law<br />

not regularly encountered by cargo owners – such as<br />

General Average and Salvage Charges.<br />

It is often difficult to stay abreast of policies covering<br />

General Average and Salvage Costs. The Report offers<br />

technical content on what General Average is and some<br />

of the salient clauses in the standard marine insurance<br />

wordings in use where General Average is applied.<br />

The Report will assist brokers to understand how their<br />

clients’ marine insurance policies may respond to such<br />

events. It also provides some points for consideration<br />

when placing cargo insurance for projects, especially<br />

risks with items critical for the completion of the project<br />

on time.<br />

AGCS has placed a lot of empahsis on strategically<br />

investing into its Marine segment. Since the<br />

appointment of Marine Risk Consultant, Captain Joseph<br />

Alphonse, AGCS has become the only carrier with marine<br />

- specific expertise available in house.<br />

For further information or to request an electronic copy<br />

of the Report, please contact Ron Johnson on<br />

(03) 6332-3184.<br />

AGCS hosts women‘s networking event<br />

Each year AGCS hosts its annual Ladies High Tea<br />

Networking Event. In November 2011, more than 35 of<br />

the Insurance Industry’s top female brokers attended<br />

the event, in recognition of their dedication to the<br />

Industry and AGCS’ commitment to strengthening key<br />

relationships.<br />

Held at the Sebel Pier One, Walsh Bay, brokers were<br />

welcomed by Regional Manager Claims Financial Lines,<br />

Elizabeth Lough and Business Analyst, Tricia Koh.<br />

Both Elizabeth and Tricia took the opportunity to provide<br />

an overview of AGCS Pacific‘s solid performance in 2011<br />

and reaffirmed AGCS’ commitment to continue to work<br />

with brokers and their clients, to understand their needs<br />

and help grow their businesses in 2012.<br />

As the champagne flowed and food was served,<br />

brokers were further indulged with a complimentary<br />

presentation on makeup techniques and latest summer<br />

trends by two Bobby Brown makeup experts.<br />

The Event was supported by Bobby Brown Skincare and<br />

Cosmetics.<br />

3

Regional Manager Financial<br />

Lines, AGCS, Bill Hassos.<br />

* This option runs a<br />

risk of uncertainty if<br />

something is missed<br />

in the endorsement<br />

drafting. Other issues<br />

may include the<br />

availability of additional<br />

insurer capacity and<br />

that the additional<br />

cover would result in<br />

premium increases.<br />

4<br />

NZ High Court<br />

Adversely affecting D&O policies<br />

A recent ruling by the Auckland Court has caused<br />

uncertainty for directors of companies with regard<br />

to the extent to which they can fund defence costs<br />

through their Directors’ and Officers’ (D&O) liability<br />

insurance cover.<br />

This is concerning not only for New Zealand directors<br />

but also for Australian directors given there is similar<br />

legislation in three states:- s6 LRA 1946 (NSW),s26-28<br />

LRA1956 (NT); and s206-209 CLA 2002 (ACT) .<br />

Regional Manager Financial Lines, AGCS, Bill Hassos said<br />

that “there are a number of ways in which insurers and<br />

insureds can safeguard against any potentially adverse<br />

consequences of the Bridgecorp decision.”<br />

One method is to consider purchasing a separate policy<br />

designed specifically for defence costs. If the traditional<br />

D&O policy is to be maintained directors and their<br />

brokers should consider the following options:<br />

1. Amend the coverage to create separate limits for<br />

damages or compensation claims and another limit for<br />

defence costs.<br />

2. In the event that the D&O policy is purchased with<br />

Entity/Company Securities (‘Side C’) cover, directors<br />

and companies need to decide whether the ‘separate’<br />

defence costs are for the benefit of the directors and<br />

officers only, or in the event of a securities claim against<br />

the company, the company will also have access to such<br />

costs.<br />

3. Include an endorsement, which provides additional<br />

defence costs only, in the event that the blended defence<br />

costs cover is prevented by a statutory charge.*<br />

“Whatever the outcome of the appeal, it is prudent<br />

for Australian and New Zealand directors to review<br />

their policies and talk to their brokers. Changes may be<br />

required to ensure that they are appropriately covered,”<br />

Bill said.<br />

AGCS have two options available for their clients.<br />

A traditional D&O policy with separate limits for<br />

damages or compensation and a separate limit for<br />

Defence costs; and A separate ‘Defence Costs‘ only<br />

Excess Policy.<br />

Clients will also benefit from the expansion of the<br />

Financial Lines Team, with the the appointment of two<br />

new senior positions in Perth.<br />

Neil Bowdrey, Manager, Financial Lines, Western<br />

Australia and Jack Chia, Senior Underwriter, Financial<br />

Lines, Western Australia have joined the AGCS Team<br />

to manage and underwite for Financial Lines clients<br />

in Western Australia. Both roles will report to Regional<br />

Manager, Financial Lines, Bill Hassos.<br />

Case in brief<br />

The case relates to the collapse of the Bridgecorp<br />

companies in 2007, which left some 14,300<br />

investors out of pocket by more than $450 million.<br />

The former company directors were faced with<br />

criminal and civil proceedings and by 2009<br />

directors, having exhausted statuary liability policy<br />

with a limit of NZ$2 million for their defence costs,<br />

sought to access Bridgecorp’s $20 million D&O<br />

policy, with QBE, to fund their defence costs.<br />

The Bridgecorp receivers opposed any attempt<br />

to access any defence funds, claiming that they<br />

intend to bring civil proceedings against the<br />

directors, and that they have first claim over the<br />

insurance monies because of s9 of the Law Reform<br />

Act 1936 (New Zealand). The Auckland High Court<br />

agreed, and ruled that the directors were denied<br />

access.<br />

This means that if a civil claim that exceeds<br />

the policy limit has been, or will be made, then<br />

directors cannot rely on the policy to pay defence<br />

costs even if the civil claim has not yet been filed,<br />

quantified or the chances of success are not clear.<br />

Therefore a charge has effect over ‘all insurance<br />

money’ that is, or may become, payable in respect<br />

of that liability.<br />

While the judgment is under appeal, if upheld, the<br />

decision could potentially affect many Australian<br />

and New Zealand company directors.

Regional Manager<br />

Engineering, AGCS, Ronan<br />

Gallagher<br />

The AGCS Engineering Team -<br />

Helping brokers with hard to place business<br />

With more than 60 years of collective experience in<br />

the construction and engineering fields, including<br />

tunneling construction, mining, electricity distribution<br />

and insurance, the AGCS Engineering Team is<br />

available to assist brokers with hard to place business.<br />

The Team, headed up by Regional Manager Engineering,<br />

Ronan Gallagher, has a thorough understanding of<br />

engineering processes that consequently demands<br />

sound and commercially competitive solutions,<br />

together with a robust and effective framework of risk<br />

management.<br />

“Large infrastructure projects often take three or more<br />

years, some more than 10 years, to complete. They are<br />

therefore particularly vulnerable to adverse external<br />

events, be it unforeseen natural disasters or the current<br />

financial woes of some of their key stakeholders,” Mr<br />

Gallagher said.<br />

“There is consequently a greater demand for enterprise<br />

risk management expertise and innovative risk solutions<br />

that will cater for all eventualities, from procurement<br />

through construction to the operational phase of a<br />

project’s lifespan,” he said.<br />

“The most pragmatic approach is to reduce risks at<br />

the source by requiring all stakeholders to minimise or<br />

eliminate the risks they create and to take ownership of<br />

the possible failure and safety outcomes. Contingency<br />

planning for the residual risk may include risk transfer by<br />

contract or insurance,” he said.<br />

If the residual risks cannot be transferred to insurance<br />

through traditional products, Alternative Risk Transfer<br />

(ART) techniques, as offered by <strong>Allianz</strong> <strong>Global</strong> <strong>Corporate</strong><br />

and <strong>Specialty</strong> can provide the necessary protection/<br />

coverage.<br />

Regional Manager Engineering, Ronan Gallagher is a<br />

mining engineer and the AGCS <strong>Global</strong> Practice Leader<br />

for Heavy Civil Risks. Prior to joining AGCS Ronan was<br />

responsible for project managing large metropolitan<br />

tunneling projects in North America and Europe for a<br />

variety of specialised construction companies.<br />

AGCS Engineering Appetite<br />

AGCS Engineering focuses on:<br />

• All Power and Oil and Gas business irrespective<br />

of contract value.<br />

• Any type of project with a value of $200<br />

million or more.<br />

• All annual business for clients with a turnover<br />

above $1 billion.<br />

The global engineering network is defined in seven<br />

specialist technical segments where we can offer<br />

focused expertise and risk management. These are:<br />

• Power & Utilities<br />

• Transportation<br />

• Oil, Gas & Chemical<br />

• Heavy Industries<br />

• Construction / IDI<br />

• Heavy Civils<br />

• Electronic Equipment<br />

AGCS can provide these engineering and<br />

construction products and solutions worldwide<br />

through the <strong>Allianz</strong> global network for pacific clients.<br />

5

Underwriting Manager,<br />

AGCS, Andrew Seeley<br />

6<br />

Enhancing capabilities in energy<br />

<strong>Allianz</strong> <strong>Global</strong> <strong>Corporate</strong> and <strong>Specialty</strong> (AGCS) Pacific<br />

has strengthened its foothold in the Energy Segment<br />

through the expansion of its in-house capabilities,<br />

with the internal appointment of Underwriting<br />

Manager, Andrew Seeley.<br />

Based in the Melbourne office, Andrew will report to<br />

the Asia Pacific Regional Manager, Tom Taberner, who is<br />

based in Singapore.<br />

General Manager for AGCS Pacific, Holger Schaefer said<br />

that the appointment of an Energy Underwriter was a<br />

strategic investment into the region, providing brokers<br />

and clients with a local service and access to the <strong>Global</strong><br />

Energy Team.<br />

“Andrew will enable us to work with our clients and<br />

brokers more effectively, to help us better understand<br />

their needs as their businesses grow and develop, in<br />

what is currently a very dynamic sector,” he said.<br />

“From a day to day operational viewpoint, having an<br />

underwriter in the Pacific Region will enhance the level<br />

and speed of service we can give to our brokers and<br />

clients,” he said.<br />

“The Pacific Region is an area of great activity and<br />

interest for AGCS as we continue to invest in the Oil and<br />

Gas Sector both onshore and offshore,” he said.<br />

AGCS Energy has also been strategically recruiting in<br />

its existing offices in London, Houston and Singapore<br />

with future expansion expected to take place in Canada,<br />

Brazil, Italy, Thailand and Japan.<br />

AGCS Energy is a leading global provider of cover for<br />

the Oil and Gas Industry for assets from Upstream<br />

construction and operational risks through to Onshore<br />

operational Refining and Petrochemical risks.<br />

AGCS Energy Appetite<br />

AGCS Energy focuses on:<br />

Onshore<br />

• Refining<br />

• Petrochemical<br />

• Hydrocarbon storage<br />

• Distribution facilities<br />

Offshore<br />

• Ooperational exploration and production<br />

• Construction<br />

AGCS is also targeting LNG Facilities, Offshore<br />

construction and Coal Seam Gas.<br />

AGCS can provide these eenergy products and<br />

solutions worldwide through the <strong>Allianz</strong> global<br />

network for pacific clients.

AGCS <strong>Global</strong> study finds:<br />

Companies fear economic risks and business<br />

interruption.<br />

Which risks do businesses fear the most in 2012?<br />

Economic risks, business interruption and destructive<br />

natural catastrophes are the most pressing business<br />

risks for many companies. Cyber risks, in turn, remain<br />

widely underestimated. These are some of the results<br />

of a study conducted by <strong>Allianz</strong> <strong>Global</strong> <strong>Corporate</strong> &<br />

<strong>Specialty</strong> (AGCS).<br />

AGCS, the global corporate and specialty insurer in<br />

the <strong>Allianz</strong> Group, carried out a survey among its risk<br />

consultants, internationally, in the second half of 2011 to<br />

identify the risks they expect to trouble companies most<br />

during the coming year.<br />

The most frequently mentioned type of risk was<br />

economic risk (25 percent of respondents). Specifically,<br />

companies are concerned about a looming recession<br />

and the sovereign debt crisis as well as about rising<br />

commodity prices and foreign currency fluctuations.<br />

Business interruption ranks second (16 percent of<br />

respondents).<br />

Centralised procurement, global purchasing, increasing<br />

outsourcing to suppliers and just-in-time production<br />

reduce costs, but also render companies more<br />

vulnerable to process interruptions.Natural catastrophes<br />

are ranked third among the greatest business risks for<br />

2012.<br />

From floods and torrential rains to hurricanes,<br />

typhoons or earthquakes – economic development<br />

and technological progress multiply the cost of natural<br />

catastrophes.<br />

In fact, insured claims related to weather-related natural<br />

catastrophes have increased from $5 billion USD to more<br />

than $40 billion USD over the last 30 years.<br />

General Manager AGCS Pacific, Holger Schaefer said<br />

“that while Australia is concerned with the increasingly<br />

volatile economic climate, it is reassuring to see<br />

the Government’s continued effort to invest in the<br />

economy’s productive capacity and infrastructure<br />

projects.”<br />

“The investment of $36billion in roads, rail and ports,<br />

and the removal of tax impediments to infrastructure<br />

investment will encourage a boost in the number of<br />

projects in 2012,” he said.<br />

“In line with the changing economy and to support our<br />

business partners, AGCS Pacific is constantly reviewing<br />

our products and services. We are in the midst of<br />

developing a number of new products which will provide<br />

our clients with broader and more comprehensive<br />

insurance coverage,” he said.<br />

7

8<br />

AGCS seeks broker feedback<br />

with pleasing outcomes<br />

Between August and October 2011, AGCS asked its<br />

broker partners and clients to provide feedback on its<br />

performance *, which delivered positive results.<br />

AGCS achieved a very solid outcome as a result of its<br />

underwriting turnaround time, industry knowledge,<br />

accuracy, relationship with underwriters and<br />

international capabilities. Key stand out areas highly<br />

regarded by brokers included AGCS’s aviation, financial<br />

lines and engineering teams.<br />

Holger Schaefer, General Manager, AGCS Pacific<br />

commented: “ that the survey is not only a simple<br />

and effective way of measuring how well we deliver<br />

a positive experience for brokers and customers, but<br />

it is also an opportunity to identify initiatives that will<br />

enhance our service offering and deliver against broker<br />

expectations.”<br />

“We take our broker feedback very seriously and after a<br />

careful consideration we have responded to feedback<br />

by implementing a number of key initiatives to help<br />

augment our service,” he said.<br />

Key initiatives include:<br />

• The implementation of a new Operations Team,<br />

which was created to provide administrative<br />

support for all AGCS Pacific business, particularly<br />

the International Insurance Program. The Team<br />

ensures a more standardised approach to working<br />

across all lines of business in Australia and New<br />

Zealand with greater accuracy in documentation<br />

and faster and more efficient processes. especially<br />

in the area of IIPs.<br />

• The expansion of the Financial Lines Team in Perth,<br />

which will result in far reaching benefits for buyers<br />

of financial lines products, particularly in Western<br />

Australia.<br />

• Communicating to brokers AGCS’s capabilities and<br />

underwriting appetite and our strong capabilities<br />

to manage global programs.<br />

• Continue to upskill our employees through<br />

programs such as our new Sales Transformation<br />

Program, which I expect will help us to target our<br />

business more effectively and place a greater focus<br />

on the needs of brokers and customers, in order to<br />

provide tailored solutions.<br />

“Broker relationships are critical to our success and I<br />

thank all our partners who participated in the survey.<br />

NPS allows us to continually improve the way we<br />

conduct business. It ensures we are able to identify<br />

areas for improvement and strive to deliver against<br />

brokers’ expectations,” Holger said said.<br />

* The results are calculated via an internationally recognised<br />

methodology, called the Net Promoter Score (NPS), which is a simple<br />

and effective way of measuring how well customers think AGCS<br />

delivers the <strong>Allianz</strong> Experience.<br />

About <strong>Allianz</strong> <strong>Global</strong> <strong>Corporate</strong> & <strong>Specialty</strong><br />

<strong>Allianz</strong> <strong>Global</strong> <strong>Corporate</strong> & <strong>Specialty</strong> (AGCS) is a dedicated global carrier for corporate and specialty insurance<br />

solutions. We are structured to service the specific needs of the most complex international businesses, working in<br />

partnership with our clients and brokers to help them manage their risks responsibly.<br />

Client Segments<br />

Multinational Companies (International Insurance Programs) /<br />

Energy / Aviation<br />

All clients<br />

Project business (Marine and Construction) Values exceeding AU$200million<br />

Financial Lines Turnover exceeding AU$200million<br />

Property / Liability / Engineering / Marine Turnover exceeding AU$1billion

Key Contacts<br />

General Manager<br />

Holger Schaefer<br />

(02) 8258 5004<br />

holger.schaefer@allianz.com.au<br />

Financial Lines<br />

Bill Hassos<br />

(02) 8258 5496<br />

bill.hassos@allianz.com.au<br />

Liability<br />

Michael Sealy<br />

(02) 9390 6137<br />

michael.sealy@allianz.com.au<br />

Property<br />

Graham Silton<br />

(02) 8258 5209<br />

graham.silton@allianz.com.au<br />

Engineering<br />

Ronan Gallagher<br />

(02) 9390 6592<br />

ronan.gallagher@allianz.com.au<br />

Energy<br />

Andrew Seeley<br />

(03) 9224 3860<br />

andrew.seeley@allianz.com.au<br />

Market Management<br />

Willem Van Wyk<br />

(02) 8258 5032<br />

willem.vanwyk@allianz.com.au<br />

Aviation<br />

Michael Dalton<br />

(03) 9224 3043<br />

michael.dalton@allianz.com.au<br />

Risk Consulting<br />

Iain Ritchie<br />

(02) 9390 6940<br />

iain.ritchie@allianz.com.au<br />

Marine<br />

Ron Johnson<br />

(03) 6332 3184<br />

ron.johnson@allianz.com.au<br />

New Zealand<br />

David Sutcliffe<br />

(09) 354 2946<br />

david.sutcliffe@allianz.co.nz<br />

Please see over for Regional Contacts.<br />

9

10<br />

AGCS directory and regional teams<br />

Regional<br />

Energy<br />

Andrew Seeley<br />

+61 3 9224 3860 / andrew.seeley@allianz.com.au<br />

Marine<br />

Ron Johnson<br />

+61 3 9224 3184 / ron.johnson@allianz.com.au<br />

Perth<br />

Liability<br />

Doug Anderson<br />

+61 3 9224 3897 / doug.anderson@allianz.com.au<br />

Property<br />

Andrew Seeley<br />

+61 3 9224 3860 / andrew.seeley@allianz.com.au<br />

Engineering<br />

Ronan Gallagher<br />

+61 2 9390 6592 / ronan.gallagher@allianz.com.au<br />

Financial Lines<br />

Neil Bowdrey<br />

+61 8 9422 8478 / neil.bowdrey@allianz.com.au<br />

Jack Chia<br />

+61 8 9422 8479 / jack.chia@allianz.com.au<br />

Aviation<br />

Michael Dalton<br />

+61 3 9224 3043 / michael.dalton@allianz.com.au<br />

Brisbane<br />

Liability<br />

Doug Anderson<br />

+61 3 9224 3897 / doug.anderson@allianz.com.au<br />

Property<br />

David Meredith<br />

+61 2 9390 6297 / david.meredith@allianz.com.au<br />

Engineering<br />

Paul Smith<br />

+61 2 9390 6888 / paul.smith@allianz.com.au<br />

Aviation<br />

Tom Laine<br />

+61 3 9224 3068 / tom.laine@allianz.com.au<br />

Financial Lines<br />

Bill Hassos<br />

+61 2 8258 5496 / bill.hassos@allianz.com.au<br />

Adelaide<br />

Liability<br />

Doug Anderson<br />

+61 3 9224 3897 / doug.anderson@allianz.com.au<br />

Property<br />

Andrew Seeley<br />

+61 3 9224 3860 / andrew.seeley@allianz.com.au<br />

Financial Lines<br />

Michael Eastmure<br />

+61 3 9224 3811 / michael.eastmure@allianz.com.au<br />

Aviation<br />

Tom Laine<br />

+61 3 9224 3068 / tom.laine@allianz.com.au<br />

Engineering<br />

Ronan Gallagher<br />

+61 2 9390 6592 / ronan.gallagher@allianz.com.au<br />

Melbourne<br />

Liability<br />

Doug Anderson<br />

+61 3 9224 3897 / doug.anderson@allianz.com.au<br />

Property<br />

Andrew Seeley<br />

+61 3 9224 3860 / andrew.seeley@allianz.com.au<br />

Engineering<br />

Roger Errington<br />

+61 2 9390 6310 / roger.errington@allianz.com.au<br />

Financial Lines<br />

Michael Eastmure<br />

+61 3 9224 3811 / michael.eastmure@allianz.com.au<br />

Aviation<br />

Michael Dalton<br />

+61 3 9224 3043<br />

michael.dalton@allianz.com.au