PwC Insurance Facts and Figures 2011 - PricewaterhouseCoopers

PwC Insurance Facts and Figures 2011 - PricewaterhouseCoopers

PwC Insurance Facts and Figures 2011 - PricewaterhouseCoopers

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

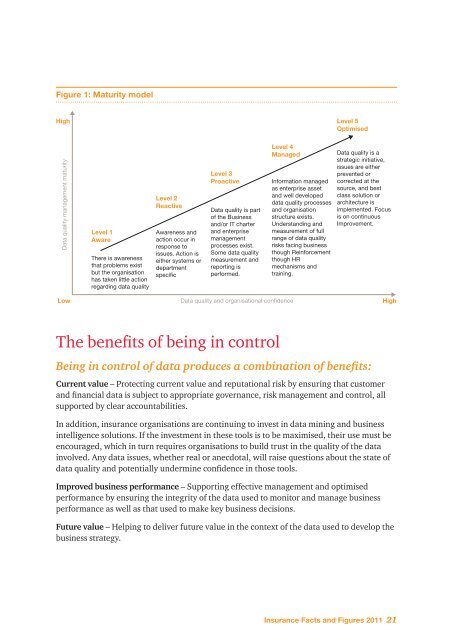

Figure 1: Maturity model<br />

High<br />

Level 5<br />

Optimised<br />

Data quality management maturity<br />

Level 1<br />

Aware<br />

There is awareness<br />

that problems exist<br />

but the organisation<br />

has taken little action<br />

regarding data quality<br />

Level 2<br />

Reactive<br />

Awareness <strong>and</strong><br />

action occur in<br />

response to<br />

issues. Action is<br />

either systems or<br />

department<br />

specific<br />

Level 3<br />

Proactive<br />

Data quality is part<br />

of the Business<br />

<strong>and</strong>/or IT charter<br />

<strong>and</strong> enterprise<br />

management<br />

processes exist.<br />

Some data quality<br />

measurement <strong>and</strong><br />

reporting is<br />

performed.<br />

Level 4<br />

Managed<br />

Information managed<br />

as enterprise asset<br />

<strong>and</strong> well developed<br />

data quality processes<br />

<strong>and</strong> organisation<br />

structure exists.<br />

Underst<strong>and</strong>ing <strong>and</strong><br />

measurement of full<br />

range of data quality<br />

risks facing business<br />

though Reinforcement<br />

though HR<br />

mechanisms <strong>and</strong><br />

training.<br />

Data quality is a<br />

strategic initiative,<br />

issues are either<br />

prevented or<br />

corrected at the<br />

source, <strong>and</strong> best<br />

class solution or<br />

architecture is<br />

implemented. Focus<br />

is on continuous<br />

Improvement.<br />

Low<br />

Data quality <strong>and</strong> organisational confidence<br />

High<br />

The benefits of being in control<br />

Being in control of data produces a combination of benefits:<br />

Current value – Protecting current value <strong>and</strong> reputational risk by ensuring that customer<br />

<strong>and</strong> financial data is subject to appropriate governance, risk management <strong>and</strong> control, all<br />

supported by clear accountabilities.<br />

In addition, insurance organisations are continuing to invest in data mining <strong>and</strong> business<br />

intelligence solutions. If the investment in these tools is to be maximised, their use must be<br />

encouraged, which in turn requires organisations to build trust in the quality of the data<br />

involved. Any data issues, whether real or anecdotal, will raise questions about the state of<br />

data quality <strong>and</strong> potentially undermine confidence in those tools.<br />

Improved business performance – Supporting effective management <strong>and</strong> optimised<br />

performance by ensuring the integrity of the data used to monitor <strong>and</strong> manage business<br />

performance as well as that used to make key business decisions.<br />

Future value – Helping to deliver future value in the context of the data used to develop the<br />

business strategy.<br />

<strong>Insurance</strong> <strong>Facts</strong> <strong>and</strong> <strong>Figures</strong> <strong>2011</strong> 21