PwC Insurance Facts and Figures 2011 - PricewaterhouseCoopers

PwC Insurance Facts and Figures 2011 - PricewaterhouseCoopers

PwC Insurance Facts and Figures 2011 - PricewaterhouseCoopers

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

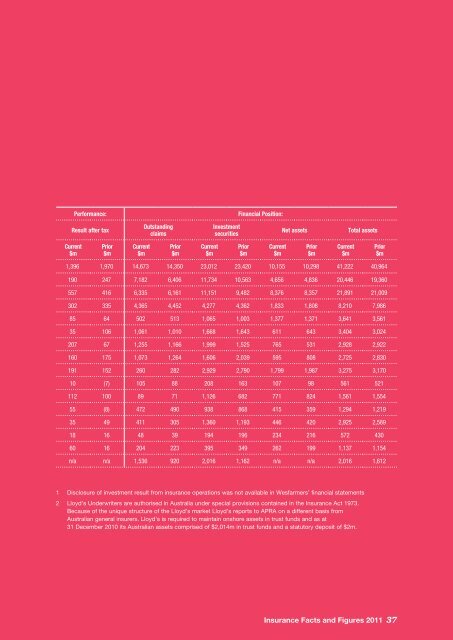

Performance:<br />

Result after tax<br />

Current<br />

$m<br />

Prior<br />

$m<br />

Current<br />

$m<br />

Outst<strong>and</strong>ing<br />

claims<br />

Prior<br />

$m<br />

Current<br />

$m<br />

Investment<br />

securities<br />

Financial Position:<br />

Prior<br />

$m<br />

Current<br />

$m<br />

Net assets<br />

Prior<br />

$m<br />

Current<br />

$m<br />

Total assets<br />

1,396 1,970 14,673 14,350 23,012 23,420 10,155 10,298 41,222 40,964<br />

190 247 7,182 6,406 11,734 10,563 4,656 4,836 20,446 19,360<br />

557 416 6,335 6,161 11,151 9,482 8,376 8,357 21,891 21,009<br />

302 335 4,365 4,452 4,277 4,362 1,833 1,808 8,210 7,986<br />

85 64 502 513 1,065 1,003 1,377 1,371 3,641 3,561<br />

35 106 1,061 1,010 1,668 1,643 611 643 3,404 3,024<br />

207 67 1,255 1,166 1,999 1,525 765 531 2,928 2,922<br />

160 175 1,073 1,264 1,606 2,039 595 808 2,725 2,830<br />

191 152 260 282 2,929 2,790 1,799 1,987 3,275 3,170<br />

10 (7) 105 88 208 163 107 98 561 521<br />

112 100 89 71 1,126 682 771 824 1,561 1,554<br />

55 (8) 472 490 938 868 415 359 1,294 1,219<br />

35 49 411 305 1,360 1,193 446 420 2,925 2,589<br />

18 16 48 39 194 196 234 216 572 430<br />

60 16 204 223 395 349 262 199 1,137 1,154<br />

n/a n/a 1,536 920 2,016 1,162 n/a n/a 2,016 1,612<br />

Prior<br />

$m<br />

1 Disclosure of investment result from insurance operations was not available in Wesfarmers’ financial statements<br />

2 Lloyd’s Underwriters are authorised in Australia under special provisions contained in the <strong>Insurance</strong> Act 1973.<br />

Because of the unique structure of the Lloyd’s market Lloyd’s reports to APRA on a different basis from<br />

Australian general insurers. Lloyd’s is required to maintain onshore assets in trust funds <strong>and</strong> as at<br />

31 December 2010 its Australian assets comprised of $2,014m in trust funds <strong>and</strong> a statutory deposit of $2m.<br />

<strong>Insurance</strong> <strong>Facts</strong> <strong>and</strong> <strong>Figures</strong> <strong>2011</strong> 37