PwC Insurance Facts and Figures 2011 - PricewaterhouseCoopers

PwC Insurance Facts and Figures 2011 - PricewaterhouseCoopers

PwC Insurance Facts and Figures 2011 - PricewaterhouseCoopers

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

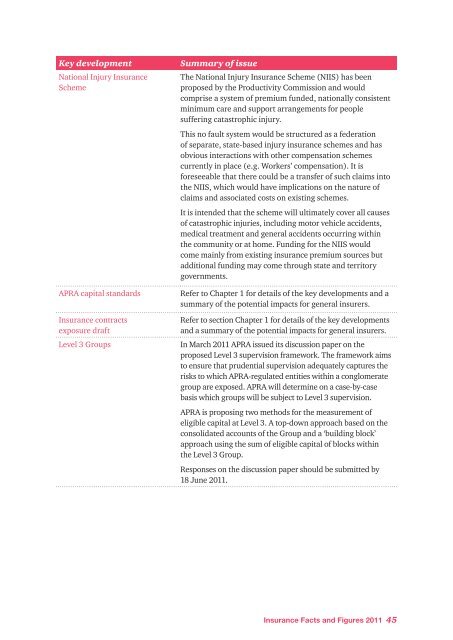

Key development<br />

National Injury <strong>Insurance</strong><br />

Scheme<br />

APRA capital st<strong>and</strong>ards<br />

<strong>Insurance</strong> contracts<br />

exposure draft<br />

Level 3 Groups<br />

Summary of issue<br />

The National Injury <strong>Insurance</strong> Scheme (NIIS) has been<br />

proposed by the Productivity Commission <strong>and</strong> would<br />

comprise a system of premium funded, nationally consistent<br />

minimum care <strong>and</strong> support arrangements for people<br />

suffering catastrophic injury.<br />

This no fault system would be structured as a federation<br />

of separate, state-based injury insurance schemes <strong>and</strong> has<br />

obvious interactions with other compensation schemes<br />

currently in place (e.g. Workers’ compensation). It is<br />

foreseeable that there could be a transfer of such claims into<br />

the NIIS, which would have implications on the nature of<br />

claims <strong>and</strong> associated costs on existing schemes.<br />

It is intended that the scheme will ultimately cover all causes<br />

of catastrophic injuries, including motor vehicle accidents,<br />

medical treatment <strong>and</strong> general accidents occurring within<br />

the community or at home. Funding for the NIIS would<br />

come mainly from existing insurance premium sources but<br />

additional funding may come through state <strong>and</strong> territory<br />

governments.<br />

Refer to Chapter 1 for details of the key developments <strong>and</strong> a<br />

summary of the potential impacts for general insurers.<br />

Refer to section Chapter 1 for details of the key developments<br />

<strong>and</strong> a summary of the potential impacts for general insurers.<br />

In March <strong>2011</strong> APRA issued its discussion paper on the<br />

proposed Level 3 supervision framework. The framework aims<br />

to ensure that prudential supervision adequately captures the<br />

risks to which APRA-regulated entities within a conglomerate<br />

group are exposed. APRA will determine on a case-by-case<br />

basis which groups will be subject to Level 3 supervision.<br />

APRA is proposing two methods for the measurement of<br />

eligible capital at Level 3. A top-down approach based on the<br />

consolidated accounts of the Group <strong>and</strong> a ‘building block’<br />

approach using the sum of eligible capital of blocks within<br />

the Level 3 Group.<br />

Responses on the discussion paper should be submitted by<br />

18 June <strong>2011</strong>.<br />

<strong>Insurance</strong> <strong>Facts</strong> <strong>and</strong> <strong>Figures</strong> <strong>2011</strong> 45