PwC Insurance Facts and Figures 2011 - PricewaterhouseCoopers

PwC Insurance Facts and Figures 2011 - PricewaterhouseCoopers

PwC Insurance Facts and Figures 2011 - PricewaterhouseCoopers

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

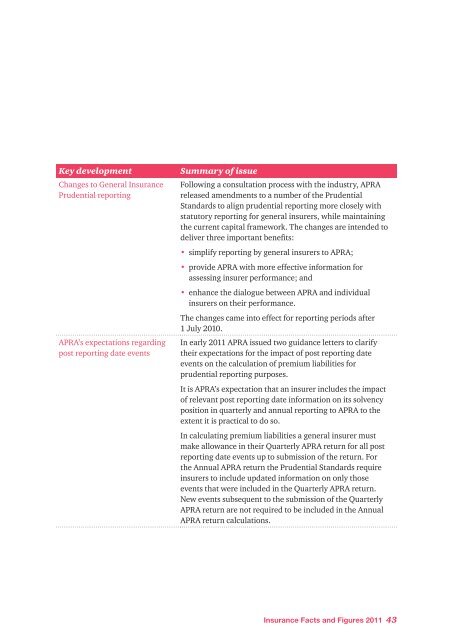

Key development<br />

Changes to General <strong>Insurance</strong><br />

Prudential reporting<br />

APRA’s expectations regarding<br />

post reporting date events<br />

Summary of issue<br />

Following a consultation process with the industry, APRA<br />

released amendments to a number of the Prudential<br />

St<strong>and</strong>ards to align prudential reporting more closely with<br />

statutory reporting for general insurers, while maintaining<br />

the current capital framework. The changes are intended to<br />

deliver three important benefits:<br />

• simplify reporting by general insurers to APRA;<br />

• provide APRA with more effective information for<br />

assessing insurer performance; <strong>and</strong><br />

• enhance the dialogue between APRA <strong>and</strong> individual<br />

insurers on their performance.<br />

The changes came into effect for reporting periods after<br />

1 July 2010.<br />

In early <strong>2011</strong> APRA issued two guidance letters to clarify<br />

their expectations for the impact of post reporting date<br />

events on the calculation of premium liabilities for<br />

prudential reporting purposes.<br />

It is APRA’s expectation that an insurer includes the impact<br />

of relevant post reporting date information on its solvency<br />

position in quarterly <strong>and</strong> annual reporting to APRA to the<br />

extent it is practical to do so.<br />

In calculating premium liabilities a general insurer must<br />

make allowance in their Quarterly APRA return for all post<br />

reporting date events up to submission of the return. For<br />

the Annual APRA return the Prudential St<strong>and</strong>ards require<br />

insurers to include updated information on only those<br />

events that were included in the Quarterly APRA return.<br />

New events subsequent to the submission of the Quarterly<br />

APRA return are not required to be included in the Annual<br />

APRA return calculations.<br />

<strong>Insurance</strong> <strong>Facts</strong> <strong>and</strong> <strong>Figures</strong> <strong>2011</strong> 43