Employer's guide to pay as you earn in kenya revised edition - 2006

Employer's guide to pay as you earn in kenya revised edition - 2006

Employer's guide to pay as you earn in kenya revised edition - 2006

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

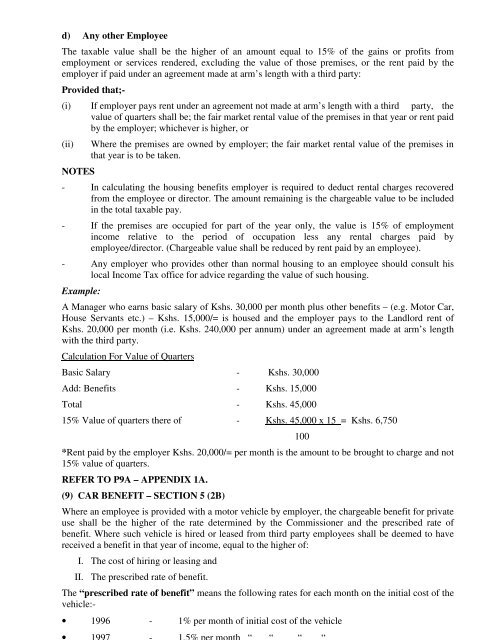

d) Any other Employee<br />

The taxable value shall be the higher of an amount equal <strong>to</strong> 15% of the ga<strong>in</strong>s or profits from<br />

employment or services rendered, exclud<strong>in</strong>g the value of those premises, or the rent paid by the<br />

employer if paid under an agreement made at arm’s length with a third party:<br />

Provided that;-<br />

(i) If employer <strong>pay</strong>s rent under an agreement not made at arm’s length with a third party, the<br />

value of quarters shall be; the fair market rental value of the premises <strong>in</strong> that year or rent paid<br />

by the employer; whichever is higher, or<br />

(ii)<br />

NOTES<br />

Where the premises are owned by employer; the fair market rental value of the premises <strong>in</strong><br />

that year is <strong>to</strong> be taken.<br />

- In calculat<strong>in</strong>g the hous<strong>in</strong>g benefits employer is required <strong>to</strong> deduct rental charges recovered<br />

from the employee or direc<strong>to</strong>r. The amount rema<strong>in</strong><strong>in</strong>g is the chargeable value <strong>to</strong> be <strong>in</strong>cluded<br />

<strong>in</strong> the <strong>to</strong>tal taxable <strong>pay</strong>.<br />

- If the premises are occupied for part of the year only, the value is 15% of employment<br />

<strong>in</strong>come relative <strong>to</strong> the period of occupation less any rental charges paid by<br />

employee/direc<strong>to</strong>r. (Chargeable value shall be reduced by rent paid by an employee).<br />

- Any employer who provides other than normal hous<strong>in</strong>g <strong>to</strong> an employee should consult his<br />

local Income Tax office for advice regard<strong>in</strong>g the value of such hous<strong>in</strong>g.<br />

Example:<br />

A Manager who <strong>earn</strong>s b<strong>as</strong>ic salary of Kshs. 30,000 per month plus other benefits – (e.g. Mo<strong>to</strong>r Car,<br />

House Servants etc.) – Kshs. 15,000/= is housed and the employer <strong>pay</strong>s <strong>to</strong> the Landlord rent of<br />

Kshs. 20,000 per month (i.e. Kshs. 240,000 per annum) under an agreement made at arm’s length<br />

with the third party.<br />

Calculation For Value of Quarters<br />

B<strong>as</strong>ic Salary - Kshs. 30,000<br />

Add: Benefits - Kshs. 15,000<br />

Total - Kshs. 45,000<br />

15% Value of quarters there of - Kshs. 45,000 x 15 = Kshs. 6,750<br />

*Rent paid by the employer Kshs. 20,000/= per month is the amount <strong>to</strong> be brought <strong>to</strong> charge and not<br />

15% value of quarters.<br />

REFER TO P9A – APPENDIX 1A.<br />

(9) CAR BENEFIT – SECTION 5 (2B)<br />

Where an employee is provided with a mo<strong>to</strong>r vehicle by employer, the chargeable benefit for private<br />

use shall be the higher of the rate determ<strong>in</strong>ed by the Commissioner and the prescribed rate of<br />

benefit. Where such vehicle is hired or le<strong>as</strong>ed from third party employees shall be deemed <strong>to</strong> have<br />

received a benefit <strong>in</strong> that year of <strong>in</strong>come, equal <strong>to</strong> the higher of:<br />

I. The cost of hir<strong>in</strong>g or le<strong>as</strong><strong>in</strong>g and<br />

II. The prescribed rate of benefit.<br />

The “prescribed rate of benefit” means the follow<strong>in</strong>g rates for each month on the <strong>in</strong>itial cost of the<br />

vehicle:-<br />

100<br />

• 1996 - 1% per month of <strong>in</strong>itial cost of the vehicle