Employer's guide to pay as you earn in kenya revised edition - 2006

Employer's guide to pay as you earn in kenya revised edition - 2006

Employer's guide to pay as you earn in kenya revised edition - 2006

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

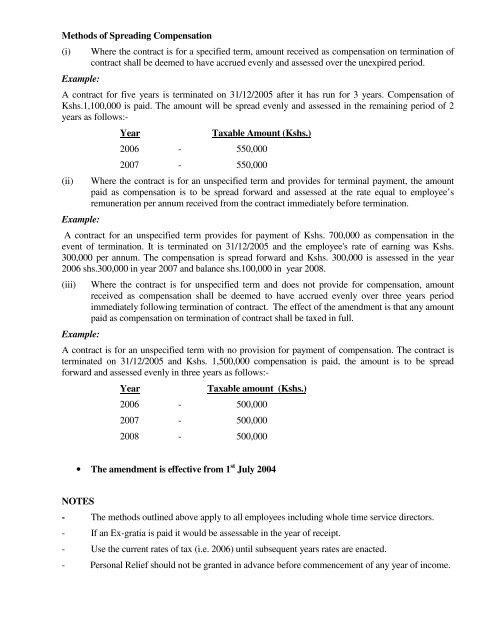

Methods of Spread<strong>in</strong>g Compensation<br />

(i)<br />

Example:<br />

Where the contract is for a specified term, amount received <strong>as</strong> compensation on term<strong>in</strong>ation of<br />

contract shall be deemed <strong>to</strong> have accrued evenly and <strong>as</strong>sessed over the unexpired period.<br />

A contract for five years is term<strong>in</strong>ated on 31/12/2005 after it h<strong>as</strong> run for 3 years. Compensation of<br />

Kshs.1,100,000 is paid. The amount will be spread evenly and <strong>as</strong>sessed <strong>in</strong> the rema<strong>in</strong><strong>in</strong>g period of 2<br />

years <strong>as</strong> follows:-<br />

(ii)<br />

Example:<br />

Year<br />

Taxable Amount (Kshs.)<br />

<strong>2006</strong> - 550,000<br />

2007 - 550,000<br />

Where the contract is for an unspecified term and provides for term<strong>in</strong>al <strong>pay</strong>ment, the amount<br />

paid <strong>as</strong> compensation is <strong>to</strong> be spread forward and <strong>as</strong>sessed at the rate equal <strong>to</strong> employee’s<br />

remuneration per annum received from the contract immediately before term<strong>in</strong>ation.<br />

A contract for an unspecified term provides for <strong>pay</strong>ment of Kshs. 700,000 <strong>as</strong> compensation <strong>in</strong> the<br />

event of term<strong>in</strong>ation. It is term<strong>in</strong>ated on 31/12/2005 and the employee's rate of <strong>earn</strong><strong>in</strong>g w<strong>as</strong> Kshs.<br />

300,000 per annum. The compensation is spread forward and Kshs. 300,000 is <strong>as</strong>sessed <strong>in</strong> the year<br />

<strong>2006</strong> shs.300,000 <strong>in</strong> year 2007 and balance shs.100,000 <strong>in</strong> year 2008.<br />

(iii)<br />

Example:<br />

Where the contract is for unspecified term and does not provide for compensation, amount<br />

received <strong>as</strong> compensation shall be deemed <strong>to</strong> have accrued evenly over three years period<br />

immediately follow<strong>in</strong>g term<strong>in</strong>ation of contract. The effect of the amendment is that any amount<br />

paid <strong>as</strong> compensation on term<strong>in</strong>ation of contract shall be taxed <strong>in</strong> full.<br />

A contract is for an unspecified term with no provision for <strong>pay</strong>ment of compensation. The contract is<br />

term<strong>in</strong>ated on 31/12/2005 and Kshs. 1,500,000 compensation is paid, the amount is <strong>to</strong> be spread<br />

forward and <strong>as</strong>sessed evenly <strong>in</strong> three years <strong>as</strong> follows:-<br />

Year<br />

Taxable amount (Kshs.)<br />

<strong>2006</strong> - 500,000<br />

2007 - 500,000<br />

2008 - 500,000<br />

• The amendment is effective from 1 st July 2004<br />

NOTES<br />

- The methods outl<strong>in</strong>ed above apply <strong>to</strong> all employees <strong>in</strong>clud<strong>in</strong>g whole time service direc<strong>to</strong>rs.<br />

- If an Ex-gratia is paid it would be <strong>as</strong>sessable <strong>in</strong> the year of receipt.<br />

- Use the current rates of tax (i.e. <strong>2006</strong>) until subsequent years rates are enacted.<br />

- Personal Relief should not be granted <strong>in</strong> advance before commencement of any year of <strong>in</strong>come.