Employer's guide to pay as you earn in kenya revised edition - 2006

Employer's guide to pay as you earn in kenya revised edition - 2006

Employer's guide to pay as you earn in kenya revised edition - 2006

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

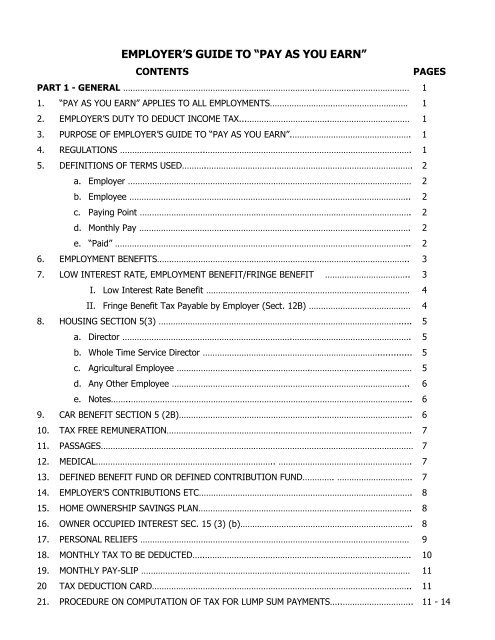

EMPLOYER’S GUIDE TO “PAY AS YOU EARN”<br />

CONTENTS<br />

PAGES<br />

PART 1 - GENERAL …………………………………………………………………….………………………………… 1<br />

1. “PAY AS YOU EARN” APPLIES TO ALL EMPLOYMENTS………………………………………………… 1<br />

2. EMPLOYER’S DUTY TO DEDUCT INCOME TAX...…………………………….…………………………… 1<br />

3. PURPOSE OF EMPLOYER’S GUIDE TO “PAY AS YOU EARN”.…………………………………………. 1<br />

4. REGULATIONS ……………………………..…………………………………………………………………………. 1<br />

5. DEFINITIONS OF TERMS USED……….………………………………………………………………………….<br />

a. Employer ………………………………………………………………………………………………………<br />

b. Employee ……………………………………………………………………………………………………..<br />

c. Pay<strong>in</strong>g Po<strong>in</strong>t ………………………………………………………………………………………………….<br />

d. Monthly Pay ………………………………………………………………………………………………….<br />

e. “Paid” …………………………………………………………………………………………………………..<br />

2<br />

2<br />

2<br />

2<br />

2<br />

2<br />

6. EMPLOYMENT BENEFITS………………………………………………………………………………………….. 3<br />

7. LOW INTEREST RATE, EMPLOYMENT BENEFIT/FRINGE BENEFIT …………………………….. 3<br />

I. Low Interest Rate Benefit …………………………………………………………………………<br />

II. Fr<strong>in</strong>ge Benefit Tax Payable by Employer (Sect. 12B) ……………………………………<br />

4<br />

4<br />

8. HOUSING SECTION 5(3) ……………………………………………………………………………………….....<br />

a. Direc<strong>to</strong>r …………………………………………………………….………………………………………….<br />

b. Whole Time Service Direc<strong>to</strong>r ……………………………………………………………….............<br />

c. Agricultural Employee ……………………………………………….……………………………………<br />

d. Any Other Employee ……………………………………………………………………………………..<br />

e. Notes……..……………………………………………………………………………………………………..<br />

5<br />

5<br />

5<br />

5<br />

6<br />

6<br />

9. CAR BENEFIT SECTION 5 (2B)………………………………………………….……………………………….. 6<br />

10. TAX FREE REMUNERATION……………………………………….………………………………………………. 7<br />

11. PASSAGES………………………………………………………………………………………………………………… 7<br />

12. MEDICAL……………………………………………………………….. ………………………………………………. 7<br />

13. DEFINED BENEFIT FUND OR DEFINED CONTRIBUTION FUND…………. …………………………. 7<br />

14.<br />

15.<br />

EMPLOYER’S CONTRIBUTIONS ETC…………………………………………………………………………….<br />

HOME OWNERSHIP SAVINGS PLAN…………………………………………………………………………….<br />

8<br />

8<br />

16. OWNER OCCUPIED INTEREST SEC. 15 (3) (b)…………………………………………………………….. 8<br />

17. PERSONAL RELIEFS ………………………………………………………………………………………………… 9<br />

18. MONTHLY TAX TO BE DEDUCTED…..…………………………………………………………………………. 10<br />

19. MONTHLY PAY-SLIP ………………………………………………………………………………………………… 11<br />

20 TAX DEDUCTION CARD…………………………………………………………………………………………….. 11<br />

21. PROCEDURE ON COMPUTATION OF TAX FOR LUMP SUM PAYMENTS…..……………………….. 11 - 14