Employer's guide to pay as you earn in kenya revised edition - 2006

Employer's guide to pay as you earn in kenya revised edition - 2006

Employer's guide to pay as you earn in kenya revised edition - 2006

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

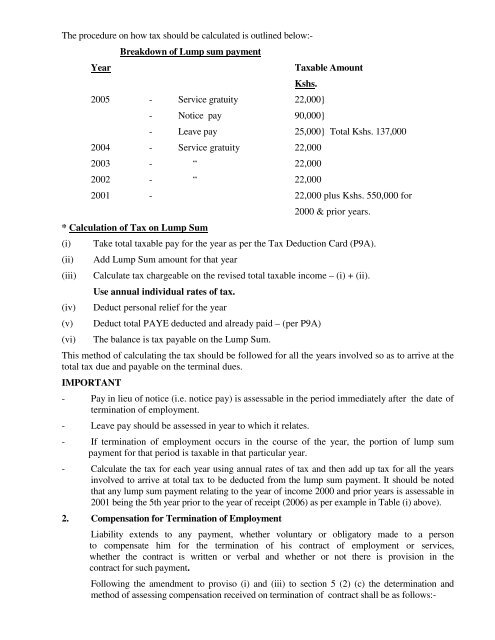

The procedure on how tax should be calculated is outl<strong>in</strong>ed below:-<br />

Year<br />

Breakdown of Lump sum <strong>pay</strong>ment<br />

Taxable Amount<br />

Kshs.<br />

2005 - Service gratuity 22,000}<br />

- Notice <strong>pay</strong> 90,000}<br />

- Leave <strong>pay</strong> 25,000} Total Kshs. 137,000<br />

2004 - Service gratuity 22,000<br />

2003 - “ 22,000<br />

2002 - “ 22,000<br />

2001 - 22,000 plus Kshs. 550,000 for<br />

* Calculation of Tax on Lump Sum<br />

(i)<br />

(ii)<br />

(iii)<br />

(iv)<br />

(v)<br />

(vi)<br />

2000 & prior years.<br />

Take <strong>to</strong>tal taxable <strong>pay</strong> for the year <strong>as</strong> per the Tax Deduction Card (P9A).<br />

Add Lump Sum amount for that year<br />

Calculate tax chargeable on the <strong>revised</strong> <strong>to</strong>tal taxable <strong>in</strong>come – (i) + (ii).<br />

Use annual <strong>in</strong>dividual rates of tax.<br />

Deduct personal relief for the year<br />

Deduct <strong>to</strong>tal PAYE deducted and already paid – (per P9A)<br />

The balance is tax <strong>pay</strong>able on the Lump Sum.<br />

This method of calculat<strong>in</strong>g the tax should be followed for all the years <strong>in</strong>volved so <strong>as</strong> <strong>to</strong> arrive at the<br />

<strong>to</strong>tal tax due and <strong>pay</strong>able on the term<strong>in</strong>al dues.<br />

IMPORTANT<br />

- Pay <strong>in</strong> lieu of notice (i.e. notice <strong>pay</strong>) is <strong>as</strong>sessable <strong>in</strong> the period immediately after the date of<br />

term<strong>in</strong>ation of employment.<br />

- Leave <strong>pay</strong> should be <strong>as</strong>sessed <strong>in</strong> year <strong>to</strong> which it relates.<br />

- If term<strong>in</strong>ation of employment occurs <strong>in</strong> the course of the year, the portion of lump sum<br />

<strong>pay</strong>ment for that period is taxable <strong>in</strong> that particular year.<br />

- Calculate the tax for each year us<strong>in</strong>g annual rates of tax and then add up tax for all the years<br />

<strong>in</strong>volved <strong>to</strong> arrive at <strong>to</strong>tal tax <strong>to</strong> be deducted from the lump sum <strong>pay</strong>ment. It should be noted<br />

that any lump sum <strong>pay</strong>ment relat<strong>in</strong>g <strong>to</strong> the year of <strong>in</strong>come 2000 and prior years is <strong>as</strong>sessable <strong>in</strong><br />

2001 be<strong>in</strong>g the 5th year prior <strong>to</strong> the year of receipt (<strong>2006</strong>) <strong>as</strong> per example <strong>in</strong> Table (i) above).<br />

2. Compensation for Term<strong>in</strong>ation of Employment<br />

Liability extends <strong>to</strong> any <strong>pay</strong>ment, whether voluntary or obliga<strong>to</strong>ry made <strong>to</strong> a person<br />

<strong>to</strong> compensate him for the term<strong>in</strong>ation of his contract of employment or services,<br />

whether the contract is written or verbal and whether or not there is provision <strong>in</strong> the<br />

contract for such <strong>pay</strong>ment.<br />

Follow<strong>in</strong>g the amendment <strong>to</strong> proviso (i) and (iii) <strong>to</strong> section 5 (2) (c) the determ<strong>in</strong>ation and<br />

method of <strong>as</strong>sess<strong>in</strong>g compensation received on term<strong>in</strong>ation of contract shall be <strong>as</strong> follows:-