Employer's guide to pay as you earn in kenya revised edition - 2006

Employer's guide to pay as you earn in kenya revised edition - 2006

Employer's guide to pay as you earn in kenya revised edition - 2006

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

provided that;-<br />

- no relief shall be granted <strong>in</strong> respect of part of premium for an <strong>in</strong>surance which secures a benefit<br />

which may be withdrawn at any time at the option of the <strong>in</strong>sured.<br />

- premiums paid for an education policy with a maturity period of at le<strong>as</strong>t 10 years shall<br />

qualify for relief.<br />

- Only premiums paid <strong>in</strong> respect of an <strong>in</strong>surance policy taken on or after 1 st January,2003<br />

shall qualify for relief.<br />

Notes:<br />

Employees must avail <strong>to</strong> the employer a certificate from <strong>in</strong>surer show<strong>in</strong>g particulars of the<br />

policy e.g. name of <strong>in</strong>sured, type of policy, capital sum <strong>pay</strong>able, maturity date, premiums<br />

<strong>pay</strong>able and commencement date of the policy.<br />

Employers should review their <strong>pay</strong>-rolls <strong>to</strong>wards the end of the year and make necessary<br />

adjustments <strong>to</strong> ensure that the correct relief had been granted. No relief is available <strong>in</strong> respect of<br />

<strong>in</strong>surance policy that elapsed <strong>in</strong> the course of the year.<br />

(i)<br />

(ii)<br />

Example:<br />

Employer shall attach a copy of the certificate furnished by <strong>in</strong>surer, confirm<strong>in</strong>g premiums<br />

paid and that the policy w<strong>as</strong> still <strong>in</strong> force <strong>to</strong> the employee’s P9A, P9B, P9A (HOSP) Tax<br />

deduction Card for that year.<br />

For the purposes of <strong>in</strong>surance relief “child” <strong>in</strong>clude a step child and an adopted child who<br />

w<strong>as</strong> under the age of eighteen years on the date the premium w<strong>as</strong> paid.<br />

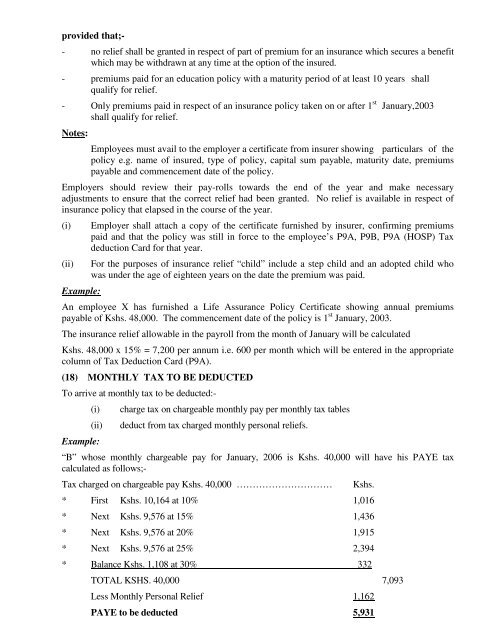

An employee X h<strong>as</strong> furnished a Life Assurance Policy Certificate show<strong>in</strong>g annual premiums<br />

<strong>pay</strong>able of Kshs. 48,000. The commencement date of the policy is 1 st January, 2003.<br />

The <strong>in</strong>surance relief allowable <strong>in</strong> the <strong>pay</strong>roll from the month of January will be calculated<br />

Kshs. 48,000 x 15% = 7,200 per annum i.e. 600 per month which will be entered <strong>in</strong> the appropriate<br />

column of Tax Deduction Card (P9A).<br />

(18) MONTHLY TAX TO BE DEDUCTED<br />

To arrive at monthly tax <strong>to</strong> be deducted:-<br />

(i)<br />

(ii)<br />

Example:<br />

charge tax on chargeable monthly <strong>pay</strong> per monthly tax tables<br />

deduct from tax charged monthly personal reliefs.<br />

“B” whose monthly chargeable <strong>pay</strong> for January, <strong>2006</strong> is Kshs. 40,000 will have his PAYE tax<br />

calculated <strong>as</strong> follows;-<br />

Tax charged on chargeable <strong>pay</strong> Kshs. 40,000 …………………………<br />

Kshs.<br />

* First Kshs. 10,164 at 10% 1,016<br />

* Next Kshs. 9,576 at 15% 1,436<br />

* Next Kshs. 9,576 at 20% 1,915<br />

* Next Kshs. 9,576 at 25% 2,394<br />

* Balance Kshs. 1,108 at 30% 332<br />

TOTAL KSHS. 40,000 7,093<br />

Less Monthly Personal Relief 1,162<br />

PAYE <strong>to</strong> be deducted 5,931