Employer's guide to pay as you earn in kenya revised edition - 2006

Employer's guide to pay as you earn in kenya revised edition - 2006

Employer's guide to pay as you earn in kenya revised edition - 2006

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

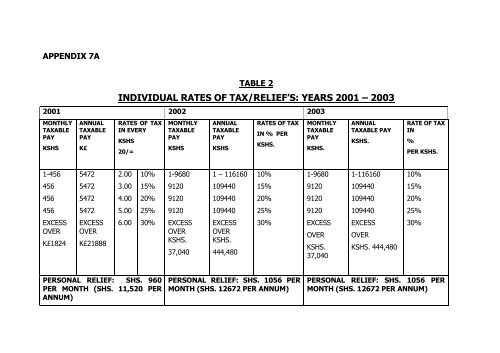

APPENDIX 7A<br />

TABLE 2<br />

INDIVIDUAL RATES OF TAX/RELIEF’S: YEARS 2001 – 2003<br />

2001 2002 2003<br />

MONTHLY<br />

TAXABLE<br />

PAY<br />

KSHS<br />

ANNUAL<br />

TAXABLE<br />

PAY<br />

K£<br />

RATES OF TAX<br />

IN EVERY<br />

KSHS<br />

20/=<br />

MONTHLY<br />

TAXABLE<br />

PAY<br />

KSHS<br />

ANNUAL<br />

TAXABLE<br />

PAY<br />

KSHS<br />

RATES OF TAX<br />

IN % PER<br />

KSHS.<br />

MONTHLY<br />

TAXABLE<br />

PAY<br />

KSHS.<br />

ANNUAL<br />

TAXABLE PAY<br />

KSHS.<br />

RATE OF TAX<br />

IN<br />

%<br />

PER KSHS.<br />

1-456<br />

5472<br />

2.00<br />

10%<br />

1-9680<br />

1 – 116160<br />

10%<br />

1-9680<br />

1-116160<br />

10%<br />

456<br />

5472<br />

3.00<br />

15%<br />

9120<br />

109440<br />

15%<br />

9120<br />

109440<br />

15%<br />

456<br />

5472<br />

4.00<br />

20%<br />

9120<br />

109440<br />

20%<br />

9120<br />

109440<br />

20%<br />

456<br />

5472<br />

5.00<br />

25%<br />

9120<br />

109440<br />

25%<br />

9120<br />

109440<br />

25%<br />

EXCESS<br />

OVER<br />

K£1824<br />

EXCESS<br />

OVER<br />

K£21888<br />

6.00<br />

30%<br />

EXCESS<br />

OVER<br />

KSHS.<br />

37,040<br />

EXCESS<br />

OVER<br />

KSHS.<br />

444,480<br />

30%<br />

EXCESS<br />

OVER<br />

KSHS.<br />

37,040<br />

EXCESS<br />

OVER<br />

KSHS. 444,480<br />

30%<br />

PERSONAL RELIEF: SHS. 960<br />

PER MONTH (SHS. 11,520 PER<br />

ANNUM)<br />

PERSONAL RELIEF: SHS. 1056 PER<br />

MONTH (SHS. 12672 PER ANNUM)<br />

PERSONAL RELIEF: SHS. 1056 PER<br />

MONTH (SHS. 12672 PER ANNUM)