Group Financial Statements 2012 - Riverside

Group Financial Statements 2012 - Riverside

Group Financial Statements 2012 - Riverside

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

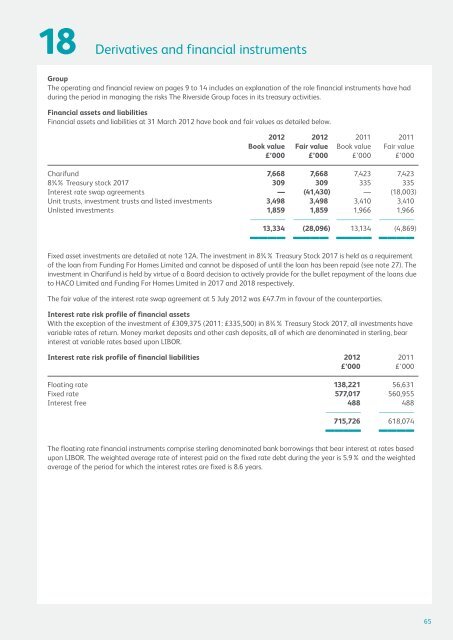

18<br />

Derivatives and financial instruments<br />

<strong>Group</strong><br />

The operating and financial review on pages 9 to 14 includes an explanation of the role financial instruments have had<br />

during the period in managing the risks The <strong>Riverside</strong> <strong>Group</strong> faces in its treasury activities.<br />

<strong>Financial</strong> assets and liabilities<br />

<strong>Financial</strong> assets and liabilities at 31 March <strong>2012</strong> have book and fair values as detailed below.<br />

<strong>2012</strong> <strong>2012</strong> 2011 2011<br />

Book value Fair value Book value Fair value<br />

£’000 £’000 £’000 £’000<br />

Charifund 7,668 7,668 7,423 7,423<br />

8¾% Treasury stock 2017 309 309 335 335<br />

Interest rate swap agreements — (41,430) — (18,003)<br />

Unit trusts, investment trusts and listed investments 3,498 3,498 3,410 3,410<br />

Unlisted investments 1,859 1,859 1,966 1,966<br />

———— ———— ———— ————<br />

————<br />

13,334<br />

————<br />

(28,096)<br />

————<br />

13,134<br />

————<br />

(4,869)<br />

Fixed asset investments are detailed at note 12A. The investment in 8¾% Treasury Stock 2017 is held as a requirement<br />

of the loan from Funding For Homes Limited and cannot be disposed of until the loan has been repaid (see note 27). The<br />

investment in Charifund is held by virtue of a Board decision to actively provide for the bullet repayment of the loans due<br />

to HACO Limited and Funding For Homes Limited in 2017 and 2018 respectively.<br />

The fair value of the interest rate swap agreement at 5 July <strong>2012</strong> was £47.7m in favour of the counterparties.<br />

Interest rate risk profile of financial assets<br />

With the exception of the investment of £309,375 (2011: £335,500) in 8¾% Treasury Stock 2017, all investments have<br />

variable rates of return. Money market deposits and other cash deposits, all of which are denominated in sterling, bear<br />

interest at variable rates based upon LIBOR.<br />

Interest rate risk profile of financial liabilities <strong>2012</strong> 2011<br />

£’000 £’000<br />

Floating rate 138,221 56,631<br />

Fixed rate 577,017 560,955<br />

Interest free 488 488<br />

———— ————<br />

————<br />

715,726<br />

————<br />

618,074<br />

The floating rate financial instruments comprise sterling denominated bank borrowings that bear interest at rates based<br />

upon LIBOR. The weighted average rate of interest paid on the fixed rate debt during the year is 5.9% and the weighted<br />

average of the period for which the interest rates are fixed is 8.6 years.<br />

65