- Page 2 and 3:

EFFECTIVE SUCCESSION PLANNING THIRD

- Page 4 and 5:

EFFECTIVE SUCCESSION PLANNING THIRD

- Page 6 and 7:

TO MY WIFE MARCELINA, MY DAUGHTER C

- Page 8 and 9:

CONTENTS List of Exhibits Preface t

- Page 10 and 11:

Contents ix Linking Succession Plan

- Page 12 and 13:

Contents xi Where to Apply Technolo

- Page 14 and 15:

LIST OF EXHIBITS Exhibit P-1. Age D

- Page 16 and 17:

List of Exhibits xv Exhibit 8-2. A

- Page 18 and 19:

PREFACE TO THE THIRD EDITION A coll

- Page 20 and 21:

Preface to the Third Edition xix co

- Page 22 and 23:

Preface to the Third Edition xxi Ex

- Page 24 and 25:

Preface to the Third Edition xxiii

- Page 26 and 27:

Preface to the Third Edition xxv Th

- Page 28 and 29:

Preface to the Third Edition xxvii

- Page 30 and 31:

Preface to the Third Edition xxix

- Page 32 and 33:

ACKNOWLEDGMENTS Writing a book rese

- Page 34 and 35:

ADVANCE ORGANIZER FOR THIS BOOK Com

- Page 36 and 37:

Advance Organizer for This Book 3 Y

- Page 38 and 39:

PART I BACKGROUND INFORMATION ABOUT

- Page 40 and 41:

C H A P T E R 1 WHAT IS SUCCESSION

- Page 42 and 43:

What Is Succession Planning and Man

- Page 44 and 45:

What Is Succession Planning and Man

- Page 46 and 47:

What Is Succession Planning and Man

- Page 48 and 49:

What Is Succession Planning and Man

- Page 50 and 51:

What Is Succession Planning and Man

- Page 52 and 53:

What Is Succession Planning and Man

- Page 54 and 55:

What Is Succession Planning and Man

- Page 56 and 57:

What Is Succession Planning and Man

- Page 58 and 59:

What Is Succession Planning and Man

- Page 60 and 61:

What Is Succession Planning and Man

- Page 62 and 63:

What Is Succession Planning and Man

- Page 64 and 65:

What Is Succession Planning and Man

- Page 66 and 67:

What Is Succession Planning and Man

- Page 68 and 69:

What Is Succession Planning and Man

- Page 70 and 71:

What Is Succession Planning and Man

- Page 72 and 73:

What Is Succession Planning and Man

- Page 74 and 75:

C H A P T E R 2 TRENDS INFLUENCING

- Page 76 and 77:

Trends Influencing Succession Plann

- Page 78 and 79:

Trends Influencing Succession Plann

- Page 80 and 81:

Trends Influencing Succession Plann

- Page 82 and 83:

Trends Influencing Succession Plann

- Page 84 and 85:

Trends Influencing Succession Plann

- Page 86 and 87:

Trends Influencing Succession Plann

- Page 88 and 89:

Trends Influencing Succession Plann

- Page 90 and 91:

Moving to a State-of-the-Art Approa

- Page 92 and 93:

Moving to a State-of-the-Art Approa

- Page 94 and 95:

F G Established a written policy st

- Page 96 and 97:

S T U V W X Y Z Established a means

- Page 98 and 99:

Moving to a State-of-the-Art Approa

- Page 100 and 101:

Moving to a State-of-the-Art Approa

- Page 102 and 103:

Moving to a State-of-the-Art Approa

- Page 104 and 105:

Moving to a State-of-the-Art Approa

- Page 106 and 107:

Moving to a State-of-the-Art Approa

- Page 108 and 109: Moving to a State-of-the-Art Approa

- Page 110 and 111: Moving to a State-of-the-Art Approa

- Page 112 and 113: Moving to a State-of-the-Art Approa

- Page 114 and 115: Moving to a State-of-the-Art Approa

- Page 116 and 117: Competency Identification and Value

- Page 118 and 119: Competency Identification and Value

- Page 120 and 121: Competency Identification and Value

- Page 122 and 123: Competency Identification and Value

- Page 124 and 125: Competency Identification and Value

- Page 126 and 127: PART II LAYING THE FOUNDATION FOR A

- Page 128 and 129: C H A P T E R 5 MAKING THE CASE FOR

- Page 130 and 131: Making the Case for Major Change 97

- Page 132 and 133: Making the Case for Major Change 99

- Page 134 and 135: Making the Case for Major Change 10

- Page 136 and 137: Making the Case for Major Change 10

- Page 138 and 139: Making the Case for Major Change 10

- Page 140 and 141: Making the Case for Major Change 10

- Page 142 and 143: Making the Case for Major Change 10

- Page 144 and 145: Making the Case for Major Change 11

- Page 146 and 147: Making the Case for Major Change 11

- Page 148 and 149: Making the Case for Major Change 11

- Page 150 and 151: Making the Case for Major Change 11

- Page 152 and 153: Making the Case for Major Change 11

- Page 154 and 155: Making the Case for Major Change 12

- Page 156 and 157: Making the Case for Major Change 12

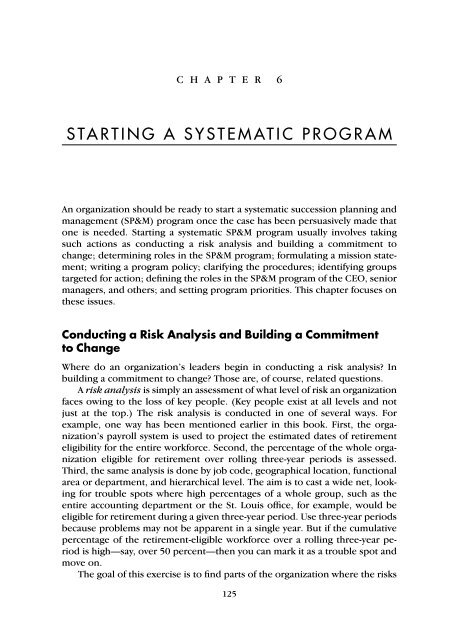

- Page 160 and 161: Starting a Systematic Program 127 r

- Page 162 and 163: Starting a Systematic Program 129 E

- Page 164 and 165: Starting a Systematic Program 131 W

- Page 166 and 167: Starting a Systematic Program 133 E

- Page 168 and 169: Starting a Systematic Program 135 1

- Page 170 and 171: Starting a Systematic Program 137 E

- Page 172 and 173: Starting a Systematic Program 139 E

- Page 174 and 175: Starting a Systematic Program 141 1

- Page 176 and 177: Starting a Systematic Program 143 i

- Page 178 and 179: Starting a Systematic Program 145 c

- Page 180 and 181: Starting a Systematic Program 147 1

- Page 182 and 183: Starting a Systematic Program 149 c

- Page 184 and 185: Starting a Systematic Program 151 E

- Page 186 and 187: Starting a Systematic Program 153 E

- Page 188 and 189: Starting a Systematic Program 155 S

- Page 190 and 191: Refining the Program 157 ▲ Where

- Page 192 and 193: Refining the Program 159 bad, good

- Page 194 and 195: Refining the Program 161 (The coord

- Page 196 and 197: Refining the Program 163 3. When sh

- Page 198 and 199: Refining the Program 165 ▲ How sh

- Page 200 and 201: Refining the Program 167 Outline—

- Page 202 and 203: Refining the Program 169 IV. Review

- Page 204 and 205: Refining the Program 171 ▲ Ask an

- Page 206 and 207: Refining the Program 173 3. Keep th

- Page 208 and 209:

Refining the Program 175 competenci

- Page 210 and 211:

PART III ASSESSING THE PRESENT AND

- Page 212 and 213:

C H A P T E R 8 ASSESSING PRESENT W

- Page 214 and 215:

Assessing Present Work Requirements

- Page 216 and 217:

Assessing Present Work Requirements

- Page 218 and 219:

Assessing Present Work Requirements

- Page 220 and 221:

Assessing Present Work Requirements

- Page 222 and 223:

Assessing Present Work Requirements

- Page 224 and 225:

Assessing Present Work Requirements

- Page 226 and 227:

Assessing Present Work Requirements

- Page 228 and 229:

Assessing Present Work Requirements

- Page 230 and 231:

Assessing Present Work Requirements

- Page 232 and 233:

Assessing Present Work Requirements

- Page 234 and 235:

Assessing Present Work Requirements

- Page 236 and 237:

C H A P T E R 9 ASSESSING FUTURE WO

- Page 238 and 239:

Assessing Future Work Requirements

- Page 240 and 241:

Assessing Future Work Requirements

- Page 242 and 243:

Assessing Future Work Requirements

- Page 244 and 245:

Assessing Future Work Requirements

- Page 246 and 247:

Assessing Future Work Requirements

- Page 248 and 249:

Assessing Future Work Requirements

- Page 250 and 251:

Assessing Future Work Requirements

- Page 252 and 253:

Assessing Future Work Requirements

- Page 254 and 255:

Assessing Future Work Requirements

- Page 256 and 257:

Assessing Future Work Requirements

- Page 258 and 259:

PART IV CLOSING THE ‘‘DEVELOPME

- Page 260 and 261:

C H A P T E R 1 0 DEVELOPING INTERN

- Page 262 and 263:

Developing Internal Successors 229

- Page 264 and 265:

Developing Internal Successors 231

- Page 266 and 267:

Developing Internal Successors 233

- Page 268 and 269:

Developing Internal Successors 235

- Page 270 and 271:

Developing Internal Successors 237

- Page 272 and 273:

Developing Internal Successors 239

- Page 274 and 275:

Developing Internal Successors 241

- Page 276 and 277:

Developing Internal Successors 243

- Page 278 and 279:

Exhibit 10-8. Methods of Grooming I

- Page 280 and 281:

Developing Internal Successors 247

- Page 282 and 283:

Developing Internal Successors 249

- Page 284 and 285:

Developing Internal Successors 251

- Page 286 and 287:

Developing Internal Successors 253

- Page 288 and 289:

Developing Internal Successors 255

- Page 290 and 291:

C H A P T E R 1 1 ASSESSING ALTERNA

- Page 292 and 293:

Assessing Alternatives to Internal

- Page 294 and 295:

Assessing Alternatives to Internal

- Page 296 and 297:

Assessing Alternatives to Internal

- Page 298 and 299:

Assessing Alternatives to Internal

- Page 300 and 301:

Assessing Alternatives to Internal

- Page 302 and 303:

Assessing Alternatives to Internal

- Page 304 and 305:

Assessing Alternatives to Internal

- Page 306 and 307:

273 C LOSING THE ‘‘DEVELOPMENTA

- Page 308 and 309:

5. Able to provide the kind of repo

- Page 310 and 311:

Using Technology to Support Success

- Page 312 and 313:

Using Technology to Support Success

- Page 314 and 315:

Exhibit 12-4. A Worksheet for Brain

- Page 316 and 317:

Using Technology to Support Success

- Page 318 and 319:

Using Technology to Support Success

- Page 320 and 321:

Using Technology to Support Success

- Page 322 and 323:

Using Technology to Support Success

- Page 324 and 325:

Using Technology to Support Success

- Page 326 and 327:

Evaluating Succession Planning and

- Page 328 and 329:

Evaluating Succession Planning and

- Page 330 and 331:

Exhibit 13-2. Guidelines for Evalua

- Page 332 and 333:

Evaluating Succession Planning and

- Page 334 and 335:

301 C LOSING THE ‘‘DEVELOPMENTA

- Page 336 and 337:

Evaluating Succession Planning and

- Page 338 and 339:

Evaluating Succession Planning and

- Page 340 and 341:

Evaluating Succession Planning and

- Page 342 and 343:

The Future of Succession Planning a

- Page 344 and 345:

3 Have a global impact. □ □ 4 B

- Page 346 and 347:

The Future of Succession Planning a

- Page 348 and 349:

Exhibit 14-2. A Worksheet to Struct

- Page 350 and 351:

13 Trading needed talent, temporari

- Page 352 and 353:

The Future of Succession Planning a

- Page 354 and 355:

The Future of Succession Planning a

- Page 356 and 357:

323 C LOSING THE ‘‘DEVELOPMENTA

- Page 358 and 359:

The Future of Succession Planning a

- Page 360 and 361:

The Future of Succession Planning a

- Page 362 and 363:

The Future of Succession Planning a

- Page 364 and 365:

A P P E N D I X I FREQUENTLY ASKED

- Page 366 and 367:

Frequently Asked Questions (FAQs) A

- Page 368 and 369:

Frequently Asked Questions (FAQs) A

- Page 370 and 371:

A P P E N D I X I I CASE STUDIES ON

- Page 372 and 373:

Case Studies on Succession Planning

- Page 374 and 375:

Case Studies on Succession Planning

- Page 376 and 377:

Case Studies on Succession Planning

- Page 378 and 379:

Case Studies on Succession Planning

- Page 380 and 381:

Case Studies on Succession Planning

- Page 382 and 383:

Case Studies on Succession Planning

- Page 384 and 385:

Case Studies on Succession Planning

- Page 386 and 387:

Case Studies on Succession Planning

- Page 388 and 389:

Case Studies on Succession Planning

- Page 390 and 391:

Case Studies on Succession Planning

- Page 392 and 393:

Case Studies on Succession Planning

- Page 394 and 395:

Case Studies on Succession Planning

- Page 396 and 397:

Case Studies on Succession Planning

- Page 398 and 399:

Case Studies on Succession Planning

- Page 400 and 401:

NOTES Preface 1. Warren Bennis and

- Page 402 and 403:

Notes 369 18. Norman H. Carter, ‘

- Page 404 and 405:

Notes 371 12. Peter Cappelli, ‘

- Page 406 and 407:

Notes 373 Chapter 3 1. This paragra

- Page 408 and 409:

Notes 375 Competency Identification

- Page 410 and 411:

Notes 377 3. ‘‘Choosing Your Su

- Page 412 and 413:

Notes 379 ship Perspective,’’ H

- Page 414 and 415:

Notes 381 Management of Human Resou

- Page 416 and 417:

Notes 383 Mentoring Process,’’

- Page 418 and 419:

Notes 385 Personnel Today, June 15,

- Page 420 and 421:

WHAT’S ON THE CD? Selected Worksh

- Page 422 and 423:

What’s on the CD? 389 Also: ▲ E

- Page 424 and 425:

INDEX ABCD model, 118-121 accomplis

- Page 426 and 427:

Index 393 elderly people, 318 e-lea

- Page 428 and 429:

Index 395 job description, 184, 283

- Page 430 and 431:

Index 397 Rhodes, Frank, 12, 13 rif

- Page 432 and 433:

ABOUT THE AUTHOR William J. Rothwel