Download - SA TREADS

Download - SA TREADS

Download - SA TREADS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

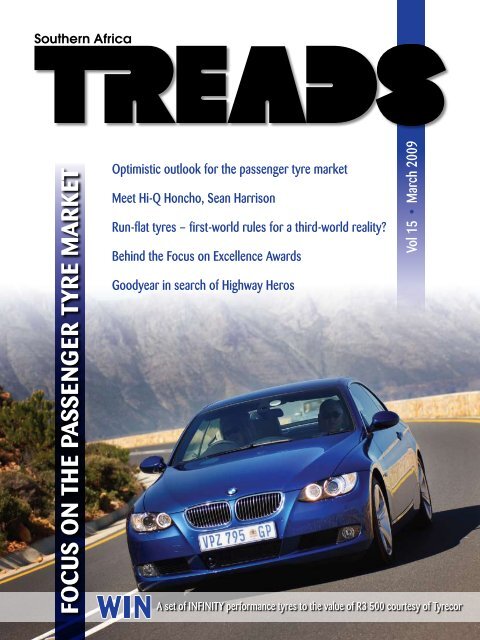

Focus on the PASSENGER tyre market<br />

Optimistic outlook for the passenger tyre market<br />

Meet Hi-Q Honcho, Sean Harrison<br />

Run-flat tyres – first-world rules for a third-world reality?<br />

Behind the Focus on Excellence Awards<br />

Goodyear in search of Highway Heros<br />

Vol 15 • March 2009<br />

A set of INFINITY performance tyres to the value of R3 500 courtesy of Tyrecor

Introduction • 1<br />

Contents<br />

One-on-One<br />

With Hi-Q Honcho, Sean Harrison....................................................................................................... 3<br />

Focus on<br />

Optimistic outlook for passenger tyre replacement market................................... 11<br />

Focus on Excellence<br />

Behind the Focus on Excellence Awards...................................................................................... 23<br />

Manufacturing<br />

New MD for Goodyear <strong>SA</strong>............................................................................................................................ 26<br />

Passmore’s career is shortlived................................................................................................................ 26<br />

Dunlop flights striking new TV ad......................................................................................................... 28<br />

Talking tyres<br />

Run-flat tyres – First-world rules for third-world reality.............................................. 30<br />

Dealer profile<br />

Speedy does it!............................................................................................................................................................ 30<br />

New initiative<br />

Goodyear on the hunt for Highway Heros.................................................................................. 34<br />

Company profile<br />

Tyrecor extends product range and moves into own premises............................. 36<br />

ProFleet<br />

ProFleet promises tyre management excellence.................................................................... 38<br />

Distribution<br />

TrenTyre celebrates successful 2008 ............................................................................................. 40<br />

Conti Corner<br />

Tonway Tyres consolidates, following its best trading year yet.......................... 42<br />

Ask the tyre experts..................................................................................................................................... 44<br />

World news<br />

Goodyear details actions to address market, economic challenges................ 46<br />

Brembo, Marelli and Pirelli launch technology collaboration............................... 46<br />

Michelin cuts back in light of economic environment.................................................. 46<br />

No deal for Pirelli and Continental....................................................................................................... 46<br />

Competition, Subscription, Website................................................................................... 48<br />

Editor<br />

Photography<br />

Technical Consultant<br />

Reproduction<br />

Printing<br />

Distribution<br />

Advertising<br />

Liana Shaw<br />

Wray Shaw<br />

Wray Shaw<br />

Trend Dynamix<br />

Trend Dynamix<br />

Prestige Bulk Mailers<br />

Liana Shaw<br />

Publishers<br />

Sky Publications cc<br />

PO Box 702<br />

Douglasdale, 2165<br />

Tel: (011) 658 0011<br />

Fax: (011) 658 0010<br />

Cell: 082 851 6777<br />

E-mail:<br />

satreads@mweb.co.za<br />

Website: www.satreads.co.za<br />

A note from<br />

the editor<br />

The unprecedented global economic<br />

crisis has thrown a real spanner in the<br />

works. Worst of all, no-one can predict<br />

its duration. Hardly surprising that the<br />

motor industry was one of the first to<br />

feel the ripple effects of this unusually<br />

dire cycle, with motor manufacturers<br />

around the world having to rely on<br />

government hand-outs, laying off<br />

staff, even temporarily shutting down<br />

production plants.<br />

Ultimately, this is bound to have an<br />

effect on the tyre sector. Already, we’re hearing of global tyre manufacturing<br />

giants cutting thousands of jobs, with more, sure to follow. The question for<br />

us in South Africa, is how well placed are we to weather the ill-effects of the<br />

economic downturn? This issue takes a dedicated look at the passenger tyre<br />

sector, as we ask some major players for their impressions on the short-term<br />

impact of this looming recession, in light of decreased consumer spending.<br />

Sean Harrison, Managing Director of Hi-Q also lends his thoughts on the<br />

economic crunch, while also outlining strategy for Hi-Q as it celebrates more<br />

than a decade of successful trading in the marketplace.<br />

If you’re wondering whether your set of run flat tyres fitted to your BMW<br />

was a worthwhile invention, and more important, whether the South African<br />

distribution network is adequately geared up to meet this latest demand, you<br />

won’t want to miss the story written by our new columnist, Colin Mileman.<br />

Also in this issue, we introduce you to the new kid on the block – South<br />

African tyre distributor and importer, Tyrecor – who despite the credit crunch<br />

and in contrast with the current trend that finds most companies downscaling,<br />

is placing utmost confidence in the South African market via the relocation to<br />

its very own premises in Cape Town and the expansion of its product range.<br />

Tyrecor – sole distributor of the INFINITY range of performance tyres - is also<br />

the sponsor of this quarter’s competition, so check out the story on page 36,<br />

click onto the competition option on page 48, answer a simple question and<br />

stand in line to win a set of performance tyres to the value of R3 500.00!<br />

Good luck!<br />

EDITOR

One-on-One • 3<br />

One-on-One with<br />

Hi-Q Honcho,<br />

Sean Harrison<br />

In keeping with the overall theme of this issue in<br />

which we take a dedicated look at what’s in store<br />

for the passenger tyre market, we decided it was<br />

time to pay homage to the man currently at the<br />

helm of Hi-Q – the successful retail franchise<br />

that was benchmarked in a recent survey.<br />

Sean Harrison is no stranger to the motor<br />

industry. His passion for marketing and his<br />

experience in the motor trade and in franchising,<br />

spans 19 years, courtesy of a number of posts<br />

within the motor sector, among them, a stint<br />

as Marketing Director of PG Glass prior to<br />

his current appointment. We asked him what<br />

drew him to the tyre retail business and for his<br />

thoughts on the current economic crisis.

4 • One-on-One<br />

Sean, perhaps we should dive right in and ask what you believe the<br />

industry should be doing to combat this economic crisis?<br />

The economy is largely driven by three factors: Consumer spend,<br />

government spend and direct foreign investment. When one considers that<br />

consumer spend alone accounts for as much as 70%, coupled with the fact<br />

that foreign investment is likely to dry up in the immediate term, chances<br />

are we’re in for a torrid time.<br />

However, my view is this: Why worry about things over which you have<br />

no influence? Instead, concentrate on your immediate business interests<br />

over which you have some control. Are we in for a rough period? Most<br />

definitely. But let’s not forget that from a retail perspective we’ve just come<br />

out of four years of unprecedented vehicle growth which means the car<br />

park is already out there.<br />

Even with consumers tightening the belt and reducing mileages, there’s no<br />

reason why the long-term effects should be catastrophic. Solid operators<br />

and networks will weather the storm.<br />

As far as what we should be doing as an industry to<br />

minimise casualties, I think the time has come for us to<br />

abandon that ‘one-size-fits-all’ mentality in favour of a more<br />

tailored approach, taking into account the varying needs of<br />

retailers positioned in different parts of the country.<br />

The other area of concern for me is the industry’s<br />

seeming obsession with buying rather than selling! I find<br />

it astonishing that the industry functions on its purchasing<br />

capability rather than on its sell-out, which is where the<br />

money is made! To effect change in this area however, will<br />

require a collective mind shift – a retailer can’t do it alone.<br />

As far as the manufacturing sector is concerned, I believe<br />

there’s work to be done on their part with respect to<br />

streamlining and aligning their product and service<br />

offering.<br />

You’ve been with Hi-Q for just over a year and have had time to get a feel<br />

for the industry. What drew you to your current position?<br />

I first became familiar with the Hi-Q group while I was still with PG Glass. For<br />

one, we shared the same media house. For another, I had become familiar<br />

with the brand and its history (having benchmarked against it in the past)<br />

and could therefore identify with the brand’s positioning.<br />

Hi-Q is an incredible success story, having speedily grown to a franchise<br />

boasting well over 175 franchise outlets across the country, and for that, full<br />

credit must go to my predecessors who engineered the company’s path to<br />

success in only 10 years. As the foundation of the company had already<br />

been laid, I felt excited at the prospect of channelling my motor trade and<br />

franchise experience into taking the brand to the next level, ensuring that it<br />

evolves alongside its customer base.<br />

❝<br />

Even with consumers<br />

tightening the belt<br />

and reducing mileage,<br />

there’s no reason why<br />

the long-term effects<br />

should be catastrophic.<br />

Solid operators and<br />

networks will weather<br />

the storm.<br />

Hi-Q was benchmarked in a recent survey. What do you believe were the<br />

key factors that contributed to this accomplishment?<br />

As I’ve just mentioned, the founders of this franchise developed a sound,<br />

trustworthy brand in a relatively short space of time, with limited resources,<br />

but a brand cannot survive on image and perception alone – it has to<br />

deliver!<br />

This might sound clichéd but we truly believe we have the best network<br />

in the country, one that is built on collaboration and close interaction. We<br />

share books, make decisions collectively and consult rather than dictate, all<br />

of which is not only refreshingly unique for me, but makes for an unbeatable<br />

combination.<br />

To go back to branding for a moment, external findings indicate the brand<br />

is moving in the right direction. It is funky, well accepted by the consumer<br />

and perhaps most important of all, is viewed as a mature product offering<br />

by the network despite its chronological age.<br />

Interestingly, external research further indicates that Hi-Q<br />

❞<br />

has a particularly high retention and referral rate, and for<br />

that, we’re immensely proud.<br />

How would you describe your role as franchisor?<br />

We are a support centre for the network – nothing more.<br />

Ours is a humble, non-intrusive role. Having elected<br />

to become inwardly focused in my first year in office,<br />

we’ve generated an important mind shift that included<br />

restructuring the team, altering remuneration packages<br />

and formalising quarterly national and regional councils<br />

to which the network can address immediate concerns,<br />

requests, suggestions and so on.<br />

Regional and national chairmans – who give of their time<br />

freely and for no personal gain – are elected by the group at large to<br />

represent the network and address issues, concerns and problem areas.<br />

The system has been in existence for some time, but a lot of dedicated<br />

time was spent this year working out the mechanics and fine-tuning the<br />

concept to everyone’s satisfaction. We’ve found the system works well and<br />

is in keeping with the consultative approach of the business. Plus, it ably<br />

demonstrates to the network that we take their suggestions and concerns<br />

to heart.<br />

Does this mean the network is not encouraged to come to you directly<br />

in the event of a problem?<br />

Not at all, my door is always open to address issues and concerns of<br />

grave importance that cannot wait to be addressed at the next quarterly<br />

meeting.

6 • One-on-One<br />

What sort of assistance do you provide apart from the norm?<br />

We have something we refer to as the ‘outlets in intensive care’ programme<br />

which provides specific timely assistance to any franchise within the group<br />

that might be experiencing a fundamental problem in their area. This is not to<br />

be viewed as a negative. Quite the opposite in fact, as the system enables us<br />

to identify a particular need, thereby allowing us to focus our full attention and<br />

whatever resources may be required on the franchise in question (at no extra<br />

cost) in order to help them out of their immediate situation.<br />

A network is only as strong as its standards and I’d like to believe our<br />

franchisees understand that. With everyone contributing to the collective<br />

with respect to aligning perspectives, we can achieve our goals both at a<br />

franchisee level and a franchisor level.<br />

Whenever I get to visit one of our franchisees (not as often as I would like),<br />

I constantly remind myself of my goal - to ascertain how I can add value to<br />

him, rather than what I’m going to get out of this meeting?<br />

What is your view on multiple brand-cum-franchise alliances?<br />

I must confess this was new to me. I found it a real challenge when I first<br />

began my career with Hi-Q as I had not previously been exposed to multibrand<br />

or multi-franchise arrangements. Ideally, I would prefer it if our network<br />

So where to from here?<br />

The strategy is simple. Go back to basics, achieve growth through our<br />

network rather than at its expense, and don’t attempt to grow the company<br />

at the expense of existing dealers by opening shops nilly-willy.<br />

was made up of single franchise alliances but I’ve come to<br />

understand that this market and the business model of the<br />

Can we take that to mean you’re not planning on opening<br />

industry as a whole, doesn’t always allow that. ❝<br />

new Hi-Q outlets in the immediate future?<br />

On a positive note, multi-franchising can ease the load Go back to basics,<br />

It’s not our primary focus, although we are looking to fill<br />

for a sole franchisor, whilst also making us aware of rival<br />

offerings that could be seen as adding more value to their achieve growth through<br />

some gaps in what we term ‘open points’. That said we are<br />

reaching the point of diminishing return. By and large, our<br />

businesses.<br />

the network rather than footprint is established which makes the decision to open<br />

a new outlet all that more drawn-out.<br />

at its expense, and don’t<br />

Yes, but don’t you run the risk of a breach in confidentiality?<br />

While there is always that risk, bear in mind, mature attempt to grow the<br />

operators want to make money out of all their outlets<br />

What is your stance on price discounting?<br />

and as such, are highly unlikely to jeopardise one for the company at the expense If you’re not market-related on price you’re out<br />

next. Our attitude is this: If you can’t control the situation,<br />

of the game! However, surveys have shown that<br />

of existing dealers.<br />

the next best thing is to be in a position to influence it.<br />

price only rates third in the list of requirements<br />

You certainly can’t concern yourself with the notion that<br />

❞ that drive consumer choice. At Hi‐Q, we live by the<br />

important information of a confidential nature might leak to<br />

your competitors. That is when you run the risk of becoming dictatorial.<br />

Suffice it to say we make a point of aligning ourselves with responsible<br />

operators and strive to keep in mind that competition is a good thing for<br />

both industry and consumer, in that it helps you to raise your game.<br />

simple principle of ASK (attitude, skills, knowledge),<br />

recognising that if the network fully embraces this concept, other<br />

more important elements such as brand and quality will automatically<br />

take preference over price.<br />

The important message we constantly communicate to the network is,<br />

‘how hard did you work for this particular margin?’ In life, you get what<br />

Are you a multi-brand operation?<br />

Yes. Goodyear is our biggest sell-out brand by far, followed by Pirelli,<br />

you deserve. The key in today’s market is to know who you are, position<br />

yourself accordingly and upsell!<br />

Michelin and Yokohama (accredited suppliers) and anything that is<br />

produced locally (approved suppliers). We pride ourselves in giving the<br />

customer what he wants but do not carry warranties for products that are<br />

not on our approved list.<br />

Are you enjoying your time in the tyre retail sector?<br />

Yes, I am. In many ways it’s familiar territory, while in others it’s a complete<br />

departure for me. As a corporate person, this has been a big learning curve<br />

What happens should someone within the group breach franchise<br />

as this is not a game whereby success is determined by the big leading the<br />

protocol?<br />

Our relationship with our network is very much like a marriage. If you keep<br />

raising the issue of breaches, you stand the risk of alienating your franchises.<br />

As mentioned previously, we prefer to adopt a consultative approach.<br />

small, but rather by the fast leading the slow.<br />

An Ivory Tower mentality won’t work here. Retailers need to come up with<br />

innovative solutions to problems on a regular basis. More important, their

8 • One-on-One<br />

response time to situations must stay true to their entrepreneurial instincts<br />

by reacting faster than the next guy, if they are to succeed.<br />

This requires empowering your management team as well as the network.<br />

I always strive to keep in mind that we must respect the faith a franchisee<br />

has placed in our brand. We owe it to him to support him! We cannot let<br />

him down!<br />

How would you sum up your vision for Hi-Q?<br />

In a nutshell, to entrench Hi-Q as the market leader. In many respects<br />

we’ve already achieved this, but have yet to come full circle. Our immediate<br />

challenge is to ensure a multi-product offering throughout the group that<br />

encompasses all under body components as well as tyres, so as to be able to<br />

come to market as a complete entity. If we manage this, the return is large.<br />

Do you have any thoughts on the industry at large?<br />

Our biggest challenge is skills development. We need to begin to take<br />

training a lot more seriously in this industry. That’s the only way to<br />

accomplish our collective goals as an industry.<br />

After completing a National Diploma in sales and marketing at NMMU<br />

in Port Elizabeth in 1989, followed by an Advanced Management<br />

Development Programme through Manchester Business School,<br />

ironically, Sean Harrison’s paying job was with Algorax in Port Elizabeth,<br />

so you could say, he’s come full circle.<br />

Sean Harrison joined General Motors as a Graduate in Training in 1990<br />

and spent time in their distribution division selling to the dealer network.<br />

In 1994 he joined Shatterprufe (Pty) Ltd (a division of the PG Group),<br />

and began a 14 year career with the company that encompassed: Export<br />

Services Team Leader, Sales Manager Aftermarket Division, National<br />

Sales and Marketing Manager. Later, he moved into the retail division<br />

(PG Glass) as General Manager Sales, Marketing and Operations and was<br />

finally promoted to Marketing Director of the retail division. A year and<br />

two months ago, he joined Hi-Q.<br />

Sean and his wife, Henriette, live in Port Elizabeth with the youngest<br />

of their three children aged 8 (the two eldest reside in Johannesburg).<br />

When he’s not solving the problems of the tyre retail sector, he can be<br />

found harnessing his skills on the golf course, scuba diving or on his<br />

off-road motorbike.

Focus on • 11<br />

Optimistic outlook for passenger<br />

tyre replacement market despite<br />

economic downturn<br />

With the global economic downturn uppermost on everyone’s mind, this year promises to be<br />

particularly challenging, even for South Africa, which thanks to its prudent monetary policies and<br />

more stringent credit lending practices, has not fallen victim to the credit control governance issues<br />

plaguing the US, Europe and the East. That said, we are not an island and are bound to feel the knockon<br />

effects of unstable markets, fluctuating currencies and global downsizing. The manufacturing and<br />

retail sectors are already being affected, as are imports and exports. Worst hit perhaps, is the motor<br />

industry, with vehicle sales slowing considerably as disposable income dwindles and consumer<br />

confidence wanes. Which begs the question: How will the economic downturn impact passenger<br />

tyre sales over the next 12 months?

The average age of the car park in <strong>SA</strong> is<br />

12 years but newer vehicles are fitted with<br />

low profile tyres which means the trade has<br />

to suitably cater for a diverse market.<br />

According to <strong>SA</strong>TMC spokesman, Dr. Etienne Human, South Africa’s<br />

total vehicle park is well over nine million vehicles, of which passenger<br />

vehicles account for approximately 58%. If we add caravans, other light<br />

load vehicles and unregistered vehicles, passenger tyres account for<br />

about 66% (or six million vehicles) of total market share.<br />

Says Human: “The average age of the car park for light passenger<br />

vehicles carrying less than 12 people is estimated at over 12 years (CSIR<br />

Transportek), the majority being older vehicles, which run on high profile<br />

tyres.”<br />

Newer vehicles are fitted with low profile tyres, thereby posing massive<br />

headaches for tyre manufacturers and distributors alike, who now have to<br />

suitably cater for both ends of the spectrum.<br />

Catering for a diverse market<br />

Says Dr. Luis Ceneviz, CEO of Dunlop Tyres: “We are focusing on<br />

producing the most popular sizes where we have economy of scale and are<br />

importing small volumes from Japan and Europe (origin of manufacture) in<br />

order to fulfil our obligation across all market sectors. I think it’s a good<br />

strategy since it wouldn’t be economically feasible to produce small runs<br />

of all the tyre sizes required.”<br />

Adds Derek de Villiers, Managing Director of Goodyear: “For a number<br />

of years now, local manufacturers have balanced viable local production<br />

with import of low volume sizes to be able to serve the market.”<br />

Of course, getting the mix right is not unique to the manufacturing trade.<br />

Carrying sufficient stock levels alongside running a lean operation remains<br />

a constant challenge for the distribution trade as well.<br />

Says Dave Davie, owner of 10 tyre shops in Kwazulu-Natal: “Diversity of<br />

sizes is a huge challenge, particularly as we strive to introduce new line<br />

items on a daily basis and pride ourselves in often carrying product the<br />

manufacturers don’t have. Storage space at smaller branches is a major<br />

issue, but we carry as much stock as space will allow.”<br />

Concurs Jody Roby, of the well known Jody’s Tyres Group: “Optimising<br />

stock levels is an ongoing challenge with the only positive being that<br />

one can probably reach turnover objectives with less units sold, through<br />

selling a bigger tyre.”<br />

Adds Mike King, Managing Director of Trentyre: “Stock is always a challenge<br />

but we carry out an in-depth analysis of size and type movement through<br />

our locations as well as assess any lost sales to determine model stocks.”<br />

As for Michelin, according to Chaumuzeau, the supply chain in South<br />

Africa poses an even greater challenge. He says: “This year we started<br />

working directly with our customers, dealers and retailers to define<br />

what we call ‘personalised forecasts’ with regard to stock requirements,<br />

price and commercial policy. Our main objective for the coming years<br />

is to establish a real and strong partnership with our dealers in order<br />

to help them secure their future. The next priority is securing a similar

Focus on • 13<br />

partnership with our industrial end users to help them increase their own<br />

competitiveness and remain strong in a difficult context.”<br />

Impact to the bottom line<br />

It is widely understood that a diverse product range carries with it cost<br />

implications, not only in terms of logistics but also with respect to duties<br />

to which imported tyres are subject.<br />

Add to that fluctuating raw material and oil prices coupled with a weak<br />

rand, and local tyre makers say they have little choice but to up tyre prices<br />

in the first quarter of 2009.<br />

Says Romano Daniels, General Manager Group Public Relations and General<br />

Manager for Marketing, Bridgestone: “Tyre prices will be adjusted in the<br />

first half of 2009 and on average, sell-in prices will go up by about 7%.”<br />

Michelin Tyres confirmed they too would be upping their prices on 1<br />

March by between 7-10% and further said prices could spiral yet again<br />

during the course of the year if the rand remains weak.<br />

When similarly questioned, Goodyear and Dunlop remained noncommittal,<br />

claiming they were monitoring the situation and that a lot<br />

would depend on currency movements and raw material costs.<br />

Says Eddie Jordaan, General Manager: Sales and Marketing, Continental<br />

Tyre: “Raw materials remain expensive. Of course the oil price and price<br />

of natural rubber has reduced just as dramatically as it escalated in 2008,

Focus on • 15<br />

but is now climbing again. However, the price of energy escalated<br />

dramatically, as has the cost of labour, steel and specialised chemicals and<br />

additives, not to mention the weak rand. Unfortunately all the manufacturers<br />

purchase raw materials from similar sources and as we cannot control the<br />

cost, it will inevitably have to be passed onto the consumer.”<br />

Pirelli Tyres also made mention of the raw material purchasing price<br />

and said they were hoping to keep these costs down through rigorous<br />

renegotiation of raw material purchasing agreements as well as by taking<br />

advantage of a phase of falling prices.<br />

When asked how they planned to remain competitive in the face of<br />

looming price increases and decreased consumer spending, improving<br />

plant efficiencies topped the list with all four local tyre makers.<br />

Says Daniels: “South Africa is moving from an exporter of raw materials to<br />

an exporter of finished goods in the quest to become a truly competitive<br />

participant in the global economy. To this end, plant efficiencies are part<br />

and parcel of every manufacturing plant in South Africa if we are to remain<br />

cost competitive.”<br />

Echoes de Villiers: “Management of cost and production efficiencies<br />

will always be the tools to remain efficient. Balancing supply and<br />

demand from both the local and export markets is and will remain the<br />

responsibility of management. This is part of an ongoing improvement<br />

process, irrespective of the economic situation.”<br />

Adds Ceneviz: “We have several plans in place to bring our plants’ output<br />

and efficiency in line with market demands. As our major endeavour is to<br />

maintain jobs, we are also exploring other options.”<br />

Alessandro Marchi, Managing Director of Pirelli Tyres <strong>SA</strong> concurs:<br />

“Globally, the Pirelli group has begun a profound restructuring plan<br />

as a way of confronting the effects of the current economic climate,<br />

the aim being, to guarantee conditions of maximum efficiency and<br />

competitiveness. This will be achieved through rationalisation of<br />

manufacturing structures, savings from lower energy costs and logistics<br />

and growth of manufacturing capacity in emerging markets such Latin<br />

America, Turkey and Romania.”<br />

Cheap imports may not decline<br />

Providing some likely respite for local manufacturers is the anticipated<br />

decline in the sale of imports courtesy of a weaker rand, although some<br />

suggest the current economic climate will have little or no effect on the<br />

demand and supply for cheapies.<br />

Explains Arthur Chaumuzeau, Marketing Manager for Michelin Tyres <strong>SA</strong>:<br />

“The South African market is not as attractive as it used to be due to

16 • Focus on<br />

the value of the rand versus the Euro and US dollar, thereby impacting<br />

cheap imports from Asian countries which are subject to 30% duty and<br />

currency movements such as the yen to the rand. This could actually<br />

help local producers by narrowing the gap between cheap imports and<br />

locally-made tyres.”<br />

Agrees Ceneviz, but cautions: “I think cheap imports won’t grow and<br />

might even decline since the rand devaluation has put pressure on<br />

imports in general. That said, the excess of production capacity around<br />

the world is another factor to be considered since manufacturers will be<br />

happy to export products on a marginal cost basis to keep their factories<br />

running to capacity.”<br />

Concurs Jordaan: “Cheap imports will always present a great challenge<br />

in that they occupy a high share of the growing market where consumer<br />

need is for a cheap product and where brand or performance is not part<br />

of the buying decision. I believe that cheap imports will find a way to keep<br />

and even grow their market presence.”<br />

OE versus replacement<br />

A dramatic decrease in the number of new vehicles sold will undoubtedly<br />

impact tyre sales to OE (original equipment) this year. According to<br />

Continental - an important contributor to the OE sector – OE sales are<br />

expected to drop by 20-30% this year, but they say the drop could be<br />

even more dramatic.<br />

Further suggests Marchi: “The global estimated effect will likely equate to<br />

an overall decrease of between 15-18%. Pirelli’s goal is to create value by<br />

confirming the selective partnership strategy in OE, focusing on quality<br />

and profitability. In addition, we will continue reinforcing our leadership in<br />

the high performance sector in the replacement market.”<br />

Says de Villiers: “The demand for new vehicles in South Africa has<br />

tapered down to the 2005 level of sales. There is clearly an impact as<br />

OEM’s are adjusting structurally to ensure their business is sustainable<br />

during the global economic tightening. In South Africa in particular, whilst<br />

reportedly endorsed by the Minister of Finance in his budget speech, the<br />

prospective buyer is subjected to the National Credit Act which has a<br />

significant impact on the rate of financing by banks.”<br />

Adds Jordaan: “On the positive side, the reduction in OE volume will<br />

mean that more key sizes will be available to be sold into the replacement<br />

market (there has been a shortage of key sizes especially in the high<br />

performance market segments).”<br />

Solid tyre retailers are likely<br />

to weather the storm.<br />

So while some of the shortfall could possibly be absorbed by the<br />

replacement sector, the question is, will it be enough to negate the losses<br />

incurred through poorer OE performance? Time alone will tell.

Tyre technology that’s<br />

miles ahead<br />

In fact, Bridgestone’s proprietary technologies put<br />

our truck and bus tyres in a league of their own.<br />

Thanks to exhaustive work at Bridgestone R&D centres<br />

in Japan, the U<strong>SA</strong>, Italy and elsewhere,<br />

every aspect of our tyres is superior.<br />

That means they are suited to all the demands<br />

of new generation high-speed heavy vehicles.<br />

Furthermore, they meet all local requirements,<br />

delivering the ultimate in performance<br />

at a lower operational cost.<br />

Discover the differences for yourself.<br />

BS511022<br />

Bridgestone R227 Bridgestone M729 Bridgestone M840<br />

Bridgestone R184

18 • Focus on<br />

Passenger tyre sales in the replacement<br />

market are expected to grow by up to 5%<br />

Dealers are optimistic<br />

According to King, replacement market sales in 2009 will continue to be<br />

under pressure, although less affected than OE.<br />

Says King: “Cars sold two to three years ago when OEMs were selling<br />

significant volumes, are now coming up for tyre replacement, which is<br />

good for the replacement market. Notwithstanding, the next few months<br />

or perhaps years will require innovative retailing and serious customer<br />

service.”<br />

Davie is similarly optimistic: “Year to date we’re having our best year yet, with<br />

seven of our 10 branches recording their best month ever this last December!<br />

I don’t expect any major effect to the replacement sector this year. The fuel<br />

price is down so people will continue to use their cars. Granted, they do tend<br />

to squeeze a few more kilometres out of their tyres when times are tight, but<br />

as far as the current recession goes, I’m not all that sure precisely how it will<br />

affect the industry. Frankly, I’ve decided not to take part. Instead, I intend<br />

remaining 100% focused on my business. No serious retailer these days can<br />

afford to take his eye of the ball for one second!<br />

Roby agrees: “If anything, we’re expecting passenger sales in the<br />

replacement market to grow steadily this year, by as much as 4-5%. For<br />

our group of companies the current emphasis is on ensuring we live by<br />

the ‘good, better & best’ concept with respect to brands, optimising gross<br />

profit via services available, plus selling on a need satisfaction basis.”<br />

Adds Davie: “I only wish law enforcement would come to the party. Have<br />

you ever had your tyres checked by a traffic officer? I certainly haven’t –<br />

not in 32 years!”<br />

The last word<br />

Just how long this gloomy economic picture is likely to last or what the<br />

long-lasting effects to the industry will be are difficult to predict.<br />

Tyre sales to the OE sector will certainly reduce this year – everyone<br />

seems to be in agreement on that score. However, the recent boom<br />

years which resulted in a significantly high number of vehicles being sold<br />

should counter some of the ill-effects as many of these vehicles are now<br />

due for tyre replacement.<br />

Some dealers we spoke with are noticing a drop in demand for imported<br />

premium brands, while others say there’s been no effect whatsoever.<br />

Claims Davie: “We are not finding a drop in demand for imported top end<br />

product, quite the opposite in fact, due to the increasing number of sizes<br />

that aren’t being produced locally. Local manufacturers must be careful<br />

not to out-price themselves on their imported products.”

20 • Focus on<br />

Robey agrees: “You will always get the money shopper in the smaller<br />

sizes, but we don’t believe the premium brands in the larger sizes such as<br />

17, 18 and 19 inch are affected at this point in time.”<br />

Whilst also acknowledging that car owners with motor/mobility plans<br />

were sticking to the OE brands fitted, King said: “However, for vehicles<br />

out of warranty, drivers are definitely buying down.”<br />

Offers de Villiers: “Sales in the replacement market must be contextualised<br />

since OE vehicle sales only realise replacement sales later – therefore the<br />

impact is latent and the immediate impact is the character of the market,<br />

as consumers become ever more vigilant in the manner in which they<br />

apply their discretionary income.<br />

In short, and to quote one of King’s earlier statements, for now, the<br />

replacement market probably holds the key to survival and growth, but<br />

success in this area will likely depend on each operator’s ability to think<br />

out of the box, retail innovatively and provide unparalleled customer<br />

service.

Focus on Excellence Awards • 23<br />

Behind the Focus<br />

on Excellence Awards<br />

The story we ran on the Focus on Excellence Awards in December,<br />

sparked mixed reaction from the trade. We asked Charleen Clarke, editor<br />

or Focus Transport and Logistics magazine and awards administrator, to<br />

address some of the concerns raised by our readers.<br />

A late January 2009 weekend in the Western Cape witnessed the death<br />

of 24 people – six of them children – with a further 35 injured due to<br />

road accidents. Of the eight accidents reported, five were caused by<br />

burst tyres.<br />

According to the Department of Transport (DoT), 937 people died in 733<br />

vehicle accidents between 1 December 2008 and 5 January 2009 across<br />

the country. A Government website also reports that more than 15 000<br />

people die in traffic accidents each year in South Africa at a cost of R46<br />

billion to the economy.<br />

With such overwhelming statistics, several NGOs have launched marketing<br />

and education drives tackling the issue. The DoT too has taken proactive<br />

steps in targeting this epidemic, this year declaring that it would give priority<br />

attention to “road traffic law enforcement of public transport legislation;<br />

improved co-ordination amongst role players for increased targeted road<br />

traffic law enforcement; improved identification and management of<br />

hazardous locations; implementation of special law enforcement initiatives<br />

backed by effective advertising, education and communication campaigns”.<br />

Of concern is that, in practice, this increased traffic law enforcement keenly<br />

focus on monitoring the condition of vehicle tyres since, according to the CSIR,<br />

tyre failure is responsible for almost 20% of minibus accidents. Also, a 2002<br />

study by the DoT found that vehicle componentry factors were responsible for<br />

10% of road accidents; 56% of these were due to tyre bursts.<br />

Driving standards<br />

It was in support of such life-saving initiatives that the FOCUS on Excellence<br />

Awards was first conceptualised.<br />

“Our thinking at the time,” explains Charleen Clarke, managing editor of<br />

the awards administrator, FOCUS on Transport and Logistics magazine,<br />

“was that the commercial vehicle industry had much to offer in raising its<br />

own best practice standards, and in so doing improving South Africa’s road<br />

safety record.”<br />

The Excellence Awards is the only awards programme recognising the best<br />

of the freight and public transport industries, both in terms of product<br />

quality and service delivery.<br />

“Fitting the correct tyre, for example, can ensure reduced fuel consumption,<br />

and increased reliability, safety and cost efficiency,” Clarke continues.<br />

To ensure that the finalists are scientifically and objectively elected and<br />

evaluated, leading market research consultancy Scott Byers randomly<br />

selects companies from its database of over 20 000 transport operators and<br />

conducts a comprehensive telephonic survey. The company was chosen for<br />

its established reputation as market researcher in the commercial vehicle<br />

market. PricewaterhouseCoopers validates the final results.<br />

For further information or comments on the awards programme, please<br />

email Charleen Clarke at charleen@focusontransport.co.za

THE GOODYEAR<br />

HIGHWAY HEROES ARE HERE!<br />

;OLYLHYLO\UKYLKZVMOLYVLZVU[OLYVHKZVM:V\[O(MYPJH.VVK`LHY^HU[Z[VRUV^^OV[OL`HYL>LOH]LSH\UJOLKHWYVNYHTTL[VÄUKHUK<br />

OVUV\Y[OVZLJVTTLYJPHSKYP]LYZ^OVZLZLSÅLZZHJ[ZVMOLYVPZTOH]LZH]LK[OLKH`TH`ILL]LUZH]LKSP]LZ<br />

0[»ZJHSSLK;OL.VVK`LHY/PNO^H`/LYVLZHUK`V\HYLPU]P[LK[VNL[PU]VS]LK/H]L`V\^P[ULZZLKHJHZLVMSPMLZH]PUNIYH]LY`VUV\YYVHKZ&<br />

+V`V\RUV^VMHKYP]LY^OVOHZWLYMVYTLKHUV\[Z[HUKPUNO\THUP[HYPHUHJ[&<br />

Nominate them as your Highway Hero! Go to www.goodyear.co.za<br />

;OL/LYVVM[OL`LHY^PSSILJYV^ULK^P[OMHTLHUKMVY[\ULUH[PVUHSTHNHaPULL_WVZ\YL9PUJHZOHUKH[YPW[V3\_LTIV\YN,\YVWL<br />

;VNL[OLY.VVK`LHYZ[YP]LZ[VTHRL[OLYVHKZVM:V\[O(MYPJHZHMLYMVYHSS You can help – nominate your Hero!

15025

26 • Manufacturing<br />

New MD for<br />

Goodyear <strong>SA</strong><br />

Goodyear’s EEMEA (Eastern Europe, Middle East and Africa) President, Michel Rzonzef, has<br />

announced the appointment of Jean-Jacques Wiroth as Managing Director for Goodyear Tyre and<br />

Rubber Holdings. He replaces Derek de Villiers who is retiring after more than 34 years’ service<br />

with the company. Wiroth, currently Managing Director for Dunlop in Germany, will be based in Port<br />

Elizabeth and will report to Rzonzef. The appointment is effective 1 April.<br />

Says Rzonzef: “Jean-Jacques is a very experienced professional, having held senior appointments in both<br />

regional and country positions. I am very pleased that he will be leading our South African operation,<br />

which has made a great deal of progress in the past few years under Derek’s leadership. In Germany<br />

Jean-Jacques has done an excellent job, developing the Dunlop brand to the point that it is now the leading<br />

brand in the marketplace.”<br />

Wiroth joined Goodyear in Luxembourg in 1982 as a chemical engineer, working in the compounding<br />

section. He held several assignments, mainly working in OE (Original Equipment) tread compounding,<br />

before being appointed Product Manager Consumer Tyres Europe in 1994.<br />

In 1997 he moved to the U<strong>SA</strong> as Marketing Director for North American Tyre’s consumer tyres. In 2001<br />

he moved to Brussels, Belgium, as Director OE Sales and Marketing and in 2005, transferred to Germany<br />

as Managing Director for the Dunlop brand. Wiroth received his degree in chemistry from ETH University<br />

in Switzerland. The 52-year old Wiroth, who is a citizen of Luxembourg, is married to Petra and they have a<br />

daughter.<br />

Paying tribute to de Villiers, Rzonzef says: “Derek has been a strong leader for many years, both in South Africa<br />

and the Middle East. He is highly regarded by his peers both inside and outside the company. We thank him<br />

for his considerable contributions.”<br />

De Villiers was appointed Managing Director in South Africa in 2006, having previously been Managing Director<br />

of Goodyear’s Middle East region since 2001. Prior to that, he was Managing Director of Tredcor (the holding<br />

company for Mastertreads and Trentyre) in Cape Town. The company later became consolidated as Trentyre,<br />

owned by Goodyear Tyre and Rubber Holdings.<br />

Passmore’s <strong>SA</strong> career is shortlived<br />

At the time the March issue of <strong>SA</strong> <strong>TREADS</strong> went to press we got word that our former interviewee, Mr Gareth<br />

Passmore, had unexpectedly left Continental Tyre <strong>SA</strong>, so we asked Eddie Jordaan, General Manager: Sales &<br />

Marketing for an official comment on the matter:<br />

“Gareth Passmore left Continental by mutual agreement in order to pursue other opportunities outside of<br />

Continental.”<br />

The position is yet to be filled. We will report on a new replacement in due course.

28 • Manufacturing<br />

Dunlop flights<br />

striking new TV ad<br />

Picture this – fast cars, amazing precision driving stunts and an impressive<br />

finale – no – it’s not the newest James Bond release, it’s the new Dunlop<br />

Tyres commercial that was recently created by Durban-based advertising<br />

agency, O’Donoghue & Associates.<br />

The commercial, which is currently being flighted on television channels<br />

in South Africa, sees a host of yellow Dunlop Tyre clad cars converging on<br />

the city of Cape Town to perform a series of impressive high-tech precision<br />

driving stunts that ultimately enable the cars to form the word ‘Dunlop’.<br />

The advertisement has met with positive feedback. Having recently rebranded<br />

their identity, Dunlop Tyres approached O’Donoghue & Associates<br />

to develop an advertising campaign that would be both memorable and<br />

unique. They were looking for ‘the big idea’ that would cut through advertising<br />

clutter and be unmistakably Dunlop; essentially separating them from other<br />

tyre brands.

◆ O'DONOGHUE & ASSOCIATES 26654/E<br />

Available from all reputable stockists<br />

FOR MORE INFORMATION AND YOUR NEAREST DUNLOP DEALER CALL TOLLFREE 0800 335 722<br />

OR VISIT www.dunloptyres.co.za

30 • Talking Tyres<br />

by Colin Mileman Run-flat<br />

Tyres<br />

First-world rules for third-world reality<br />

The concept of run-flat tyres is a brilliant one, with the main advantages<br />

revolving around improved driving safety. But is it really suitable for South<br />

African roads?<br />

Despite being a first-world solution, on face value, run-flat tyres make fantastic<br />

sense in South Africa.<br />

No-one wants to become another devastating addition to the deplorable<br />

crime statistics after being forced to stop on the side of the road to change a<br />

tyre, or facing the dangers of doing so in traffic. Therefore the ability to drive<br />

to a safe location, even at a snail’s pace, has real merit.<br />

Also, the general calibre of driving talent in this country is less than<br />

commendable, so the prospect of swapping a horrendous blow-out for<br />

stable handling characteristics, backed up by a monitoring system’s subtle<br />

electronic warning that a tyre is losing pressure has great appeal.<br />

Car designers will also tell you that throwing the spare wheel and jack in<br />

the bin frees up the creativity of their pen strokes, while engineers will point<br />

to the complementary benefits of reduced vehicle weight and the resultant<br />

improved fuel efficiency, as well as the increased boot space it achieves.<br />

But this is where I stick my flag in the ground and say that currently in <strong>SA</strong>,<br />

unless you habitually travel no more than 80 km from a mainstream metro<br />

tyre dealer (which in a car-mad country devoid of public transport is highly<br />

unlikely), run-flat tyres are totally unsuitable and irreconcilable with <strong>SA</strong><br />

motorists’ needs.<br />

My main rationale revolves around the South African map. Examining a run-flat<br />

tyre support network map provided by one tyre manufacturer, I was drawn to<br />

the vast 1 200 km void that separates Bloemfontein and Cape Town on the N1.<br />

Now I, for one, don’t want to be stranded with a flat, um… run-flat tyre in the<br />

middle of a 45-degree Karoo summer, literally hundreds of kilometres away<br />

from a suitably qualified and (expensively) equipped RFT centre where the 80<br />

km range at 80 km/h just won’t cut it.<br />

In Europe, 1 200 km will get you from Paris in France, through Germany to<br />

Austria’s capital Vienna – and you’ll probably never be more than 50 km away<br />

from a major city, or a first-world run-flat specialist. So there the concept<br />

works. But in good ol’ <strong>SA</strong>, where vast open spaces abound (think Northern<br />

Cape, where most tyre companies have just one run-flat centre for the largest<br />

province in the country), that’s simply not the case.<br />

And that’s assuming you’re able to drive the nominal ‘run-flat’ distance in the<br />

first place. Considering the decrepit nature of many local roads, a complete<br />

tyre-and-rim write-off due to a pot-hole or a strategically placed rock will<br />

stop you dead in your tracks, and could leave you totally immobile for many<br />

lonely and potentially dangerous hours, and hundreds of kilometres away<br />

from help.<br />

Without giving the customer any choice in the matter, and based on the<br />

Eurocentric nature of the <strong>SA</strong> market, BMW insists on fitting run-flats to its<br />

new-generation products including the popular 3-Series, along with the 1<br />

and 5-Series, the MINI, the X5 and X6. Why run-flats are specified on a sport<br />

utility vehicle (or whatever BMW chooses to call their X-models) is beyond<br />

me, considering their supposedly multi-terrain nature.<br />

BMW backs this up with the supposed reassurance of BMW On-Call<br />

assistance in the event of a flat tyre. But if I’m stranded in Putsonderwater<br />

where the one and only horse died long ago, I’ll face a similar fate before a<br />

replacement tyre arrives.<br />

This brings me to the issue of availability. On a recent media event, of all the<br />

vehicles on the trip, a BMW X6’s 20-inch 35-profile tyre was the one and only

Talking Tyres • 31<br />

casualty after encountering an errant rock on a gravel road. As no replacement<br />

tyre (naturally, fitted to the appropriate and costly rim) was immediately<br />

available, the 800-grand X6 had to endure the ignominy of travelling back to<br />

Pretoria on a flat-bed. Imagine the fury if you were the owner …<br />

And it’s not just the ultra-exclusive sizes that are problem. I contacted a<br />

couple of tyre dealers around the country to determine the availability of<br />

various sizes of run-flats. Several dealers indicated that they didn’t carry stock<br />

of run-flats at all. Some had a few of the more ‘popular’ sizes, but would<br />

have to call on regional or national distribution centres for the most part.<br />

Therefore, expect a delay ranging from one hour, or even one to two days<br />

to get your rubber – and that’s assuming there are any suitable tyres in the<br />

country which, shockingly, isn’t always the case.<br />

The main reasons the tyre dealers cited for the lack of run-flat stock were<br />

the huge variety of sizes and tread patterns, the very low demand and the<br />

massive cost. One multi-brand tyre dealer suggested an outlay of R100 000<br />

would be required just to carry a single set of run-flat tyres for each brand<br />

he represents.<br />

That cost also relates to the consumer. Based on my brief survey, which<br />

priced a total of 10 tyres from various brands and tyre dealers across the<br />

country, run-flats are on average 35-percent more expensive than standard<br />

replacement rubber – with a high of 65 % and an unusual low of 10 %.<br />

Add in the additional expense of a mandatory tyre pressure monitoring<br />

system (about R5 000) and that run-flat repairs are generally discouraged<br />

(or very expensive to do, by specialists only), and the whole run-flat concept<br />

becomes rather costly.<br />

Run-flat repairs are<br />

generally discouraged<br />

which adds to the cost.<br />

Fitment capability<br />

and availability remain<br />

a problem.<br />

Factor in the huge complexity of the technology, with all the confusing jargon<br />

and marketing-driven acronyms: full marks for Yokohama simply referring to<br />

Run Flat, while Bridgestone uses RFT, Dunlop DSST, Goodyear EMT and ROF,<br />

Michelin ZP and Continental SSR, while BMW has its very own RSC mark.<br />

Plus there’s unresolved issues surrounding the additional unsprung mass of<br />

the tyre necessitated by the extensive sidewall strengthening. Logically, this<br />

makes it both less efficient due to increased rotational mass, and reduces the<br />

pliancy and comfort of the tyre – although tyre and car manufacturers are<br />

making ongoing progress in these areas.<br />

All considered, if I lived in Europe, run-flats would be a no-brainer. But I don’t,<br />

so they’re not.<br />

Colin Mileman is a freelance motoring journalist, photographer<br />

and advanced driving specialist with over 13 years of experience<br />

in this field. As a former editor of Topcar and Topbike magazines,<br />

he’s as enthusiastic about cars and bikes as they come, and has<br />

extensive knowledge of all motoring-related matters, including<br />

the topic of tyres, having run the annual and highly regarded<br />

Topcar tyre tests for several years.

32 • Dealer profile<br />

Speedy Witbank has achieved<br />

growth in recent years despite<br />

stiff competition.<br />

Speedy does it!<br />

Johan Grobler

Dealer profile • 33<br />

On the face of harsh economic times, quite<br />

surprisingly, one fitment centre in Mmpumalanga’s<br />

fastest growing city – Witbank – is experiencing<br />

unprecedented growth. Former farmer and<br />

businessman, Johan Grobler, attributes this to his<br />

long-standing track record in the community as<br />

well as to his ability to read the marketplace and<br />

react quickly to changing market conditions.<br />

Service packages exclusive to the Speedy Group of companies (now<br />

numbering 140 across the country), such as the ‘Miles More’ programme<br />

which offers motorists free tyre puncture repair, tyre rotation and rebalancing<br />

for the duration of the tyre’s life, have gone a long way towards<br />

attracting customers to his doors. Add to this his decision last year to lower<br />

his GPs in reaction to the economic crisis, and Johan says what he’s lost in<br />

margin he’s made up for in volume.<br />

More important, Johan is a sterling example of the adage that when it comes<br />

to purchases of any kind, people buy people. His father was the Mayor<br />

of Witbank, his wife is a respected member of the community courtesy<br />

of her position of Science teacher at the local high school, while Johan is<br />

well-known to the residents of this predominantly mining community for<br />

his previous, 15-year involvement in two service stations which he owned<br />

and managed. As a keen sportsman, Johan is also passionate about his golf,<br />

and tennis (his team won the trophy four years in a row for the Waterberg<br />

District), something which stands him in equally good stead with the city’s<br />

residents.<br />

Not taking anything for granted, Johan has also made a point of building up<br />

a strong rapport with the motor dealerships in his area, whose support he<br />

continues to enjoy, despite the presence of numerous rival shops on his<br />

very own street.<br />

Says Johan: “I’m lucky to have the loyal following of so many Witbank<br />

residents. Notwithstanding, I fully recognise that we need to deliver on our<br />

service offering if we are to retain our clientele.”<br />

Retaining customers probably rates as his biggest challenge in the current<br />

economic climate where a mere R5.00 can make all the difference between<br />

gaining and losing a sale.<br />

Unlike most Speedy outlets for which tyres make up a smaller portion of<br />

the business, Johan’s operation boasts a 50/50 split between tyres and<br />

underbody components such as exhausts, shocks, batteries, brake pads,<br />

bull bars, tow bars and nitrogen in tyres.<br />

Explains Johan: “Selling tyres is a lot easier in that it helps to draw customers<br />

to your doors. It’s also the ideal time to pick up on secondary sales resulting<br />

from worn shocks, brakes and the like.”<br />

Interestingly too, contrary to what has become the norm due to market<br />

trends, Johan’s exhaust fitment side to the business is buzzing with three<br />

of his 12 fitment bays dedicated exclusively to the exhaust portion of the<br />

business.<br />

Says Johan: “There’s only one other company offering an exhaust service in<br />

this city which probably accounts for our success in this area.”<br />

To add to his product range, Johan is also considering introducing a<br />

suspension service to further provide his loyal customers with yet another<br />

important service at a reasonable price.<br />

Adds Johan: “Consumers are being quoted outrageous prices on tyres,<br />

towbars and suspension systems in particular, and perhaps our willingness<br />

to accept their financial constraints owing to the economy, also accounts<br />

for the fact that our shop is close on ¾ full at all times.<br />

“Add to that the ongoing support from Bridgestone and Speedy’s head<br />

office, and we’re luckily well placed to weather the current storm.”<br />

The immediate focus is on providing customers with a good shopping<br />

experience that keeps them coming back as well as preparing for the future<br />

boom, which according to Johan, is inevitable given the proposed growth<br />

of the region.<br />

Claims Johan: “Eskom’s second power plant opens in Witbank next year<br />

and this should draw thousands of new people to the region. And the<br />

development of Ernie Els’ golf estate, as well as other similar projects,<br />

should spur further growth in the not too distant future. The boom times<br />

will return, and new tyre shops will open in response to this. We must do<br />

everything in our power to ensure we’re ahead of the game as we prepare<br />

to take on new competitors head on.”<br />

Plans to expand his operation are on the cards with the prospect of<br />

additional stores in and around Witbank, which should also serve to secure<br />

current and future market share, particularly if Johan sticks with his current<br />

formula which arguably, is reaping dividends.

34 • New Initiative<br />

ON THE HUNT FOR HIGHWAY HEROES - Dustine Gascoyne<br />

(Goodyear Marketing Director) heads up the new national<br />

campaign aimed at recognising the valuable contributions<br />

truck and bus drivers are making to road safety.<br />

Goodyear on the hunt<br />

for Highway Heroes<br />

With traffic expected to mount over the Easter<br />

holiday season and South Africa steels itself for<br />

an increasing number of accidents on its roads,<br />

Goodyear’s ongoing commitment to safety has<br />

been boosted with the launch of its prestigious<br />

new Highway Hero campaign, launched in<br />

Johannesburg in December 2008.<br />

The programme aims to scout out, recognise and reward some of our<br />

country’s least acknowledged road warriors: the professional truck and<br />

bus drivers who have performed barely noticed yet frequently life-saving<br />

acts of heroism or humanitarian deeds while going about their daily work<br />

on our busy highways.<br />

The Goodyear Highway Hero is already recognised as one of the truck and<br />

bus industry’s most respected award programmes in places like the United<br />

States, Australia, Germany and Latin America.<br />

Goodyear Marketing Director, Dustine Gascoyne said the programme was<br />

founded in America in 1983, when long-hauler, Ronnie Stapleton, was<br />

named Goodyear’s first Highway Hero. Ronnie used his bare hands to tear off<br />

the back door of a burning car, then broke the vehicle’s back seat in two to<br />

save the vehicle’s unconscious occupants.

New Initiative • 35<br />

“Through innovation and technology<br />

Goodyear has made great strides<br />

in the field of safety. The launch of<br />

the Highway Hero programme in<br />

South Africa reflects this important<br />

contribution and reinforces Goodyear’s<br />

new brand positioning of ‘Safety<br />

Together’,” Dustine explained.<br />

glittering final award ceremony, to be held in January 2010, where South<br />

Africa’s first Goodyear Highway Hero will be announced,” he added.<br />

The rewards include not only a prestigious trophy but also R10 000 in cash, an<br />

all-expenses paid trip to Goodyear’s exciting Technical Centre in Luxembourg,<br />

Europe, for the winner as well as the same trip for one management<br />

representative from his or her company and, of course, the well-deserved glory<br />

of being recognised as the Goodyear Highway Hero 2009.<br />

“Almost every day, truck and bus drivers<br />

make valuable contributions to road<br />

safety. We want to elevate their image<br />

and create public awareness of those<br />

responsible members of the industry<br />

who go beyond the call of duty. ‘Hero’<br />

is a special label, but there certainly are unsung heroes on our roads who<br />

deserve to be rewarded for their selfless efforts.”<br />

Highway Heroes in other parts of the Goodyear world have included those<br />

who have pulled injured passengers from burning vehicles, one who rescued<br />

an old woman from her sinking car after it veered off the road into a river,<br />

another who displayed huge posters on his rig of missing children to raise<br />

awareness as he drove and yet another who swerved his truck to avoid three<br />

street-racing cars and veered off the highway to avoid colliding with oncoming<br />

traffic. This last courageous and selfless driver died in the accident.<br />

Goodyear’s nationwide search for its own South African Highway Hero will<br />

run throughout 2009 and repeated annually thereafter. The programme<br />

was launched to prominent players and the media in the truck and bus<br />

sector on 10 December. The call for nominations from the general public,<br />

the truck industry and law enforcement agencies will be supported by<br />

various marketing initiatives via the media, industry associations and law<br />

enforcement agencies. “We will also publicise the campaign on late-night<br />

radio programmes – when many truckers are driving and tuned in – in<br />

which people can call in and tell their stories of heroism. Toll gate flyers are<br />

another innovative way in which we plan to spread the word and there will<br />

also be information at Trentyre, Tirepoint and Hi-Q dealerships. Nomination<br />

forms will also be available online through www.goodyear.co.za,” said Myles<br />

Dent, Marketing and Communications Manager for Goodyear <strong>SA</strong>.<br />

“Nominations will be tallied and judged every three months. The finalists<br />

from each quarter will receive media recognition and will go forward to a<br />

NATIONWIDE SEARCH FOR <strong>SA</strong>’s OWN HIGHWAY HERO - Sharmini Naidoo (Road Freight<br />

Association CEO), Dustine Gascoyne (Goodyear Marketing Director) and Gary Ronald<br />

(Automobil Association Public Affairs Manager) at the launch of the prestigious new<br />

Highway Hero campaign. Various road safety and transport related associations such as<br />

these are endorsing this campaign with enthusiasm.<br />

SEARCHING FOR OUR COUNTRY’s LEAST ACKNOWLEDGED ROAD WORRIORS -<br />

Sharmini Naidoo (Road Freight Association CEO), Derek de Villiers (Goodyear Managing<br />

Director) and Jeff Osborne (Retail Motor Industry CEO) at the launch of the prestigious<br />

new Highway Hero campaign. The programme aims to recognise and reward professional<br />

truck and bus drivers who have performed barely noticed yet frequently life-saving acts of<br />

heroism while going about their daily work on our busy roads.<br />

DRIVEN BY INNOVATION<br />

BECAUSE NOT ALL TYRES<br />

ARE THE <strong>SA</strong>ME _

36 • Company Profile<br />

Tyrecor extends product range<br />

and moves into own premises<br />

In contrast to the current economic doom and gloom that surrounds<br />

us, a local tyre tyre company specialising in quality imported products,<br />

is defying the odds and is not only regularly extending its product<br />

range to cater for a diverse market sector, but is further demonstrating<br />

its commitment and confidence in the South African market via the<br />

construction of its own regional warehouse in Cape Town. On 1 March<br />

2009, Tyrecor will take occupancy of brand new facilities, as a bold<br />

statement that says to the market, ‘we’re here to stay’.<br />

Established in Johannesburg in March 2002, to primarily service the needs<br />

of end users in a growing and specialised industrial tyre market, the Tyrecor<br />

Group has since grown to include outlets in Durban and Cape Town, as a<br />

way of providing a national service to its mushrooming client base.<br />

Servicing the industrial and agricultural tyre industry in South Africa and<br />

parts of Africa, along with providing them with tailor-made solutions to<br />

their specific needs and challenges, remains the mainstay of the company’s<br />

business, although recently, Tyrecor also concluded a joint venture with a<br />

financial partner, the Al Dobowi Group.<br />

Established in 1976 to address the needs of a growing tyre management<br />

and service industry in the Middle East, Al Dobowi is now a leading global<br />

player, having moved beyond tyre management into providing customers<br />

with a complete solution when it comes to batteries for motive power,<br />

lubricants, conveyor belt systems and technical rubber products.<br />

The INFINITY brand<br />

The partnership has been worthwhile for Tyrecor on another level too, as it<br />

provided the South-African based importer with the advantage of acquiring<br />

the INFINITY range of products, thereby paving the way for entry into all<br />

sectors of the Southern African tyre market with a comprehensive range of<br />

quality products.<br />

Successfully launched in the last 24 months, the INFINITY range extends<br />

from passenger tyres, up to and including OTR, mining and industrial

Company Profile • 37<br />

Tyrecor’s new premises in Cape Town<br />

will be home to the INFINITY and<br />

Alliance tyre brands.<br />

solid tyres. Manufactured under licence in China, in a facility with an<br />

annual turnover exceeding 1.03 billion pounds, the brand has earned a<br />

reputation for attention to detail, quality and customer satisfaction. It is also<br />

manufactured to ISO14001:2004 standards, carries ECE certification and<br />

has been homologated by NRCS.<br />

Turn to our Competition section on page 48 for details on how you could<br />

stand a chance to win a set of high performance INFINITY tyres to the<br />

value of R3 500.00!<br />

Taishan finds acceptance with agricultural sector<br />

What is more, Tyrecor has secured distribution rights for the Taishan brand,<br />

as a means of further enhancing its product range in the bias agricultural<br />

tyre market, which to this day, remains an important component, both in<br />

terms of quality and affordability. Again, Taishan is manufactured to strict<br />

ISO9001 and ISO9002 quality management systems in China, which<br />

probably accounts for its ability to secure global market share in no less<br />

than 40 countries worldwide.<br />

From a South African perspective, Taishan has adopted a ‘first class or scrap’<br />

policy for all tyres manufactured which in turn, provides the assurances<br />

required by Tyrecor to represent the brand locally.<br />

Says Charl de Villiers of Tyrecor: “That the Taishan brand has already found<br />

acceptance with agricultural buyers across Southern Africa (traditionally<br />

known to only support products that deliver), is testament to the product’s<br />

integrity.”<br />

Tyrecor teams with Alliance Tire<br />

As if this weren’t enough, Tyrecor has also teamed with Alliance Tire<br />

(established in Israel in1950), a multinational company with a core team<br />

of 50 engineers in R&D, with interests in the development, manufacture<br />

and sale of tyres for agricultural, forestry, construction and earthmover<br />

applications.<br />

In July 2007, Alliance Tire was acquired by the Mahansaria family of India<br />

together with Warburg Pincus LLC. Currently, a new plant, boasting a land<br />

area of 460 000sqm is under construction in India and will be operational<br />

in June 2009.<br />

Alliance Tire has over 1 200 active and specialised items which are rapidly<br />

being expanded and the Group is focused on providing a comprehensive<br />

product range to cater to the off-the-highway tyre market, encompassing<br />

both high-end technology and mass market product lines.<br />

Tyrecor seizes window of opportunity<br />

Trust a group of talented South African entrepreneurs to look for the<br />

window of opportunity and seize it! That is precisely what Tyrecor has done,<br />

and despite the current economic challenges, the company’s future looks<br />

promising.<br />

Says de Villiers: “As importers it has become essential to find a balance<br />

between the correct stock holding and cash flow, due to the volatility of our<br />

local currency. These challenges aside, as a group, we are determined and<br />

committed to increase our product range and visibility in South Africa over<br />

the next 12 to 18 months.”

38 • ProFleet<br />

ProFleet promises tyre<br />

management excellence<br />

B550501 - AFROX<br />

Graph Details<br />

Remove 30 days<br />

10<br />

1<br />

ON Vehicle Inventory Avg Qty<br />

77 17<br />

9 Qty New Tires 171 114 1 10<br />

Description 9 1st Cap 68 4 23 38<br />

2nd Cap 430 Other Totals Filters/Selections<br />

Size: 12R22.5<br />

With 67 well-managed fleets already<br />

utilising the ProFleet software<br />

in Africa, following its official<br />

launch in South Africa in 2000,<br />

this unique tyre management<br />

tool from Bandag, appears to be<br />

gaining swift acceptance with a<br />

growing number of transport<br />

fleets, among them, Parmalat,<br />

Afrox, RTT, BP, Fast ‘n Fresh,<br />

Algoa Bus Company and<br />

Karan Beef.<br />

Research and development<br />

for this software system was first instituted in 1983, by<br />

Budini Inc. Today, ProFleet is used in 33 countries in five continents and is<br />

exclusively available to Bandag <strong>SA</strong> for sub-Saharan Africa.<br />

With scrap tyre analysis data, breakdown information and fleet survey data<br />

now all available in one system, ProFleet ensures complete cradle to grave<br />

tyre management, assisting its users in identifying problems and taking<br />

corrective action before tyre life is compromised.<br />

Close examination of why tyres fail and are scrapped, can ensure<br />

prevention of avoidable failures, while a complete breakdown history will<br />

highlight specific trends that too could be avoided, resulting in an overall<br />

cost reduction for the fleet.<br />

Issued on 19/02/09 - 11:51<br />

Tire Management System 5.x<br />

[Graph type II - Integer Graph]<br />

complete control of tyre stock and can further predict future tyre needs<br />

(by using past trends and product performance history) – a widely popular<br />

feature with many ProFleet users in that it assists with planning and in turn,<br />

results in more accurate budgeting.<br />

What is more, it comes with a set of hand-held tools to ensure fast and<br />

precise data entry, ideal for both the user who, with the device in hand, can<br />

download vehicle and tyre data to the device as well as fitters who can now<br />

easily and accurately capture tread depth and air pressure readings, which<br />

are then uploaded to ProFleet. Using the tools, tyre fitters and supervisors<br />

can now also complete tyre movements and scrap analysis.<br />

Benefits range from time saving, allowing on-site personnel to deal with<br />

maintenance and preventative issues rather than spending time on data<br />

capturing, to ensuring the correct readings are uploaded, giving you the<br />

confidence that the data stored in and extracted from ProFleet is reliable.<br />

The Fast ‘n Fresh depot in Centurion is a typical site of where the tools work<br />

best. With more than 2 000 rolling wheels to manage, the Thomas Tyres<br />

crew does a sterling job of ensuring the pressures are monitored and the<br />

tread depth adheres to the fleet’s tyre policy.<br />

For more information contact<br />

Bandag on (011) 439-6000 or<br />

visit www.bandag.co.za<br />

The report filtering feature of the system allows for performance to be drilled<br />

down to a specific wheel axle and by utilising the fleet’s own data, an analysis<br />

can be drawn up to determine which new or retread make and design is best<br />

suited to the fleet’s application, thereby further ensuring the best product is<br />

consistently selected for best maximisation of the tyre budget.<br />

And not only can ProFleet monitor tyre performance, it also ensures<br />