Controlling Indirect Selection under Healthcare Reform - Society of ...

Controlling Indirect Selection under Healthcare Reform - Society of ...

Controlling Indirect Selection under Healthcare Reform - Society of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

108<br />

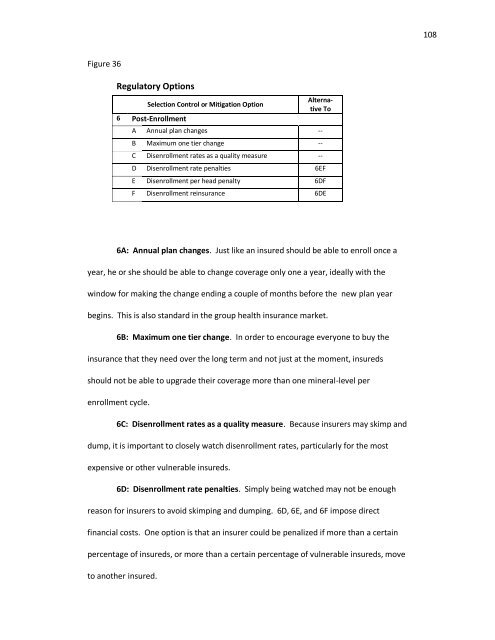

Figure 36<br />

Regulatory Options<br />

<strong>Selection</strong> Control or Mitigation Option<br />

6 Post-Enrollment<br />

Alternative<br />

To<br />

A Annual plan changes --<br />

B Maximum one tier change --<br />

C Disenrollment rates as a quality measure --<br />

D Disenrollment rate penalties 6EF<br />

E Disenrollment per head penalty 6DF<br />

F Disenrollment reinsurance 6DE<br />

6A: Annual plan changes. Just like an insured should be able to enroll once a<br />

year, he or she should be able to change coverage only one a year, ideally with the<br />

window for making the change ending a couple <strong>of</strong> months before the new plan year<br />

begins. This is also standard in the group health insurance market.<br />

6B: Maximum one tier change. In order to encourage everyone to buy the<br />

insurance that they need over the long term and not just at the moment, insureds<br />

should not be able to upgrade their coverage more than one mineral-level per<br />

enrollment cycle.<br />

6C: Disenrollment rates as a quality measure. Because insurers may skimp and<br />

dump, it is important to closely watch disenrollment rates, particularly for the most<br />

expensive or other vulnerable insureds.<br />

6D: Disenrollment rate penalties. Simply being watched may not be enough<br />

reason for insurers to avoid skimping and dumping. 6D, 6E, and 6F impose direct<br />

financial costs. One option is that an insurer could be penalized if more than a certain<br />

percentage <strong>of</strong> insureds, or more than a certain percentage <strong>of</strong> vulnerable insureds, move<br />

to another insured.