Delay and Haircuts in Sovereign Debt - University of St Andrews

Delay and Haircuts in Sovereign Debt - University of St Andrews

Delay and Haircuts in Sovereign Debt - University of St Andrews

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

For less extreme beliefs, 0 < q 1 < 1, the creditor’s expected payo¤<br />

from a high o¤er <strong>of</strong> ( s)<br />

2<br />

, which is acceptable to both types <strong>of</strong> debtor,<br />

<br />

2 <br />

is<br />

2 ( s), while the creditor’s expected payo¤ from a low o¤er <strong>of</strong><br />

<br />

2 , which is only acceptable to the Optimistic debtor is q <br />

<br />

1 <br />

2 . If<br />

<br />

<br />

q 1 <br />

2 ><br />

2 <br />

2 ( s), the creditor will do better by mak<strong>in</strong>g a low<br />

<br />

<br />

o¤er but otherwise for q 1 <br />

2 <<br />

2 <br />

2 ( s). When<br />

q1 <br />

2 =<br />

<br />

2 <br />

2 ( s), the two o¤ers give the creditor the same expected payo¤.<br />

This condition implies that the posterior belief <strong>of</strong> the creditor is q 1 = s<br />

.<br />

S<strong>in</strong>ce 0 < s < , it follows that q 1 < 1. We assume that, if the creditor is<br />

<strong>in</strong>di¤erent between a low <strong>and</strong> a high o¤er, he will choose to make a high o¤er.<br />

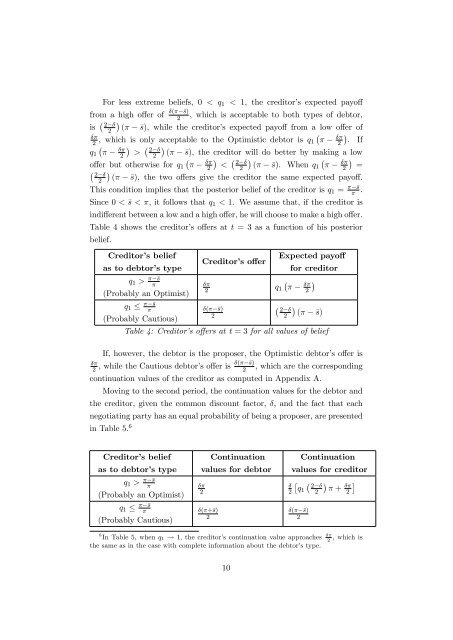

Table 4 shows the creditor’s o¤ers at t = 3 as a function <strong>of</strong> his posterior<br />

belief.<br />

Creditor’s belief<br />

as to debtor’s type<br />

q 1 > s<br />

<br />

(Probably an Optimist)<br />

q 1 s<br />

<br />

(Probably Cautious)<br />

Expected payo¤<br />

Creditor’s o¤er<br />

for creditor<br />

<br />

<br />

<br />

2<br />

q 1 <br />

2<br />

( s)<br />

2<br />

<br />

2 <br />

2 (<br />

Table 4: Creditor’s o¤ers at t = 3 for all values <strong>of</strong> belief<br />

If, however, the debtor is the proposer, the Optimistic debtor’s o¤er is<br />

<br />

( s)<br />

2<br />

, while the Cautious debtor’s o¤er is<br />

2<br />

, which are the correspond<strong>in</strong>g<br />

cont<strong>in</strong>uation values <strong>of</strong> the creditor as computed <strong>in</strong> Appendix A.<br />

Mov<strong>in</strong>g to the second period, the cont<strong>in</strong>uation values for the debtor <strong>and</strong><br />

the creditor, given the common discount factor, , <strong>and</strong> the fact that each<br />

negotiat<strong>in</strong>g party has an equal probability <strong>of</strong> be<strong>in</strong>g a proposer, are presented<br />

<strong>in</strong> Table 5. 6<br />

s)<br />

Creditor’s belief<br />

as to debtor’s type<br />

q 1 > s<br />

<br />

(Probably an Optimist)<br />

q 1 s<br />

<br />

(Probably Cautious)<br />

Cont<strong>in</strong>uation<br />

values for debtor<br />

<br />

2<br />

(+s)<br />

2<br />

<br />

2<br />

Cont<strong>in</strong>uation<br />

values for creditor<br />

<br />

q1<br />

2 <br />

2<br />

( s)<br />

2<br />

<br />

+<br />

<br />

2<br />

6 In Table 5, when q 1 ! 1, the creditor’s cont<strong>in</strong>uation value approaches , which is<br />

2<br />

the same as <strong>in</strong> the case with complete <strong>in</strong>formation about the debtor’s type.<br />

10