Delay and Haircuts in Sovereign Debt - University of St Andrews

Delay and Haircuts in Sovereign Debt - University of St Andrews

Delay and Haircuts in Sovereign Debt - University of St Andrews

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

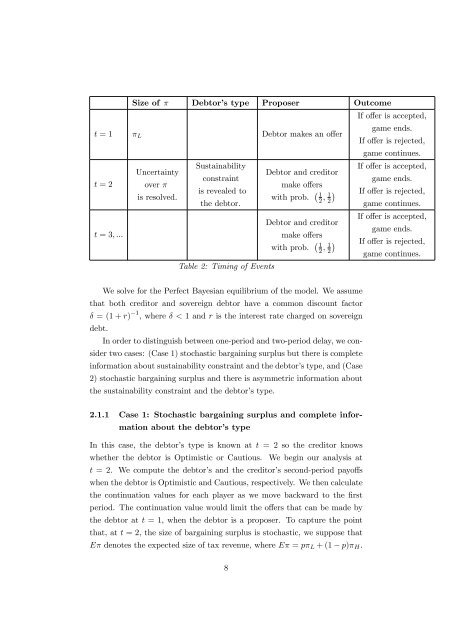

Size <strong>of</strong> <strong>Debt</strong>or’s type Proposer Outcome<br />

t = 1 L <strong>Debt</strong>or makes an o¤er<br />

t = 2<br />

t = 3; :::<br />

Uncerta<strong>in</strong>ty<br />

over <br />

is resolved.<br />

Susta<strong>in</strong>ability<br />

constra<strong>in</strong>t<br />

is revealed to<br />

the debtor.<br />

Table 2: Tim<strong>in</strong>g <strong>of</strong> Events<br />

<strong>Debt</strong>or <strong>and</strong> creditor<br />

make o¤ers<br />

1<br />

with prob.<br />

2 ; 1 <br />

2<br />

<strong>Debt</strong>or <strong>and</strong> creditor<br />

make o¤ers<br />

1<br />

with prob.<br />

2 ; 1 <br />

2<br />

If o¤er is accepted,<br />

game ends.<br />

If o¤er is rejected,<br />

game cont<strong>in</strong>ues:<br />

If o¤er is accepted,<br />

game ends.<br />

If o¤er is rejected,<br />

game cont<strong>in</strong>ues:<br />

If o¤er is accepted,<br />

game ends.<br />

If o¤er is rejected,<br />

game cont<strong>in</strong>ues.<br />

We solve for the Perfect Bayesian equilibrium <strong>of</strong> the model. We assume<br />

that both creditor <strong>and</strong> sovereign debtor have a common discount factor<br />

= (1 + r) 1 , where < 1 <strong>and</strong> r is the <strong>in</strong>terest rate charged on sovereign<br />

debt.<br />

In order to dist<strong>in</strong>guish between one-period <strong>and</strong> two-period delay, we consider<br />

two cases: (Case 1) stochastic barga<strong>in</strong><strong>in</strong>g surplus but there is complete<br />

<strong>in</strong>formation about susta<strong>in</strong>ability constra<strong>in</strong>t <strong>and</strong> the debtor’s type, <strong>and</strong> (Case<br />

2) stochastic barga<strong>in</strong><strong>in</strong>g surplus <strong>and</strong> there is asymmetric <strong>in</strong>formation about<br />

the susta<strong>in</strong>ability constra<strong>in</strong>t <strong>and</strong> the debtor’s type.<br />

2.1.1 Case 1: <strong>St</strong>ochastic barga<strong>in</strong><strong>in</strong>g surplus <strong>and</strong> complete <strong>in</strong>formation<br />

about the debtor’s type<br />

In this case, the debtor’s type is known at t = 2 so the creditor knows<br />

whether the debtor is Optimistic or Cautious. We beg<strong>in</strong> our analysis at<br />

t = 2. We compute the debtor’s <strong>and</strong> the creditor’s second-period payo¤s<br />

when the debtor is Optimistic <strong>and</strong> Cautious, respectively. We then calculate<br />

the cont<strong>in</strong>uation values for each player as we move backward to the …rst<br />

period. The cont<strong>in</strong>uation value would limit the o¤ers that can be made by<br />

the debtor at t = 1, when the debtor is a proposer. To capture the po<strong>in</strong>t<br />

that, at t = 2, the size <strong>of</strong> barga<strong>in</strong><strong>in</strong>g surplus is stochastic, we suppose that<br />

E denotes the expected size <strong>of</strong> tax revenue, where E = p L + (1 p) H .<br />

8