Delay and Haircuts in Sovereign Debt - University of St Andrews

Delay and Haircuts in Sovereign Debt - University of St Andrews

Delay and Haircuts in Sovereign Debt - University of St Andrews

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1 Introduction<br />

There is considerable evidence which show that countries have repeatedly<br />

defaulted on their external obligations (Re<strong>in</strong>hart <strong>and</strong> Rogo¤, 2009). What<br />

are the common features associated with default on sovereign debts? On several<br />

occasions, debt reschedul<strong>in</strong>g or negotiated partial default <strong>of</strong>ten <strong>in</strong>volve<br />

a reduction <strong>of</strong> <strong>in</strong>terest rates, if not pr<strong>in</strong>cipal, <strong>and</strong> typically saddle creditors<br />

with illiquid assets that may not pay o¤ for an extended period <strong>of</strong> time<br />

(Re<strong>in</strong>hart <strong>and</strong> Rogo¤, 2009). Illiquidity <strong>and</strong> reduction <strong>in</strong> debt repayment,<br />

two strik<strong>in</strong>g aspects <strong>of</strong> recent sovereign debt negotiations, could impose a<br />

huge cost to <strong>in</strong>vestors.<br />

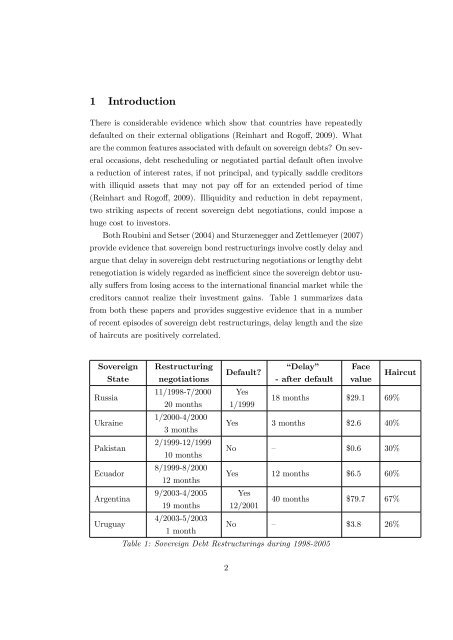

Both Roub<strong>in</strong>i <strong>and</strong> Setser (2004) <strong>and</strong> <strong>St</strong>urzenegger <strong>and</strong> Zettlemeyer (2007)<br />

provide evidence that sovereign bond restructur<strong>in</strong>gs <strong>in</strong>volve costly delay <strong>and</strong><br />

argue that delay <strong>in</strong> sovereign debt restructur<strong>in</strong>g negotiations or lengthy debt<br />

renegotiation is widely regarded as <strong>in</strong>e¢ cient s<strong>in</strong>ce the sovereign debtor usually<br />

su¤ers from los<strong>in</strong>g access to the <strong>in</strong>ternational …nancial market while the<br />

creditors cannot realize their <strong>in</strong>vestment ga<strong>in</strong>s. Table 1 summarizes data<br />

from both these papers <strong>and</strong> provides suggestive evidence that <strong>in</strong> a number<br />

<strong>of</strong> recent episodes <strong>of</strong> sovereign debt restructur<strong>in</strong>gs, delay length <strong>and</strong> the size<br />

<strong>of</strong> haircuts are positively correlated.<br />

<strong>Sovereign</strong> Restructur<strong>in</strong>g<br />

“<strong>Delay</strong>” Face<br />

Default?<br />

<strong>St</strong>ate negotiations<br />

- after default value<br />

Haircut<br />

Russia<br />

11/1998-7/2000 Yes<br />

20 months 1/1999<br />

18 months $29.1 69%<br />

Ukra<strong>in</strong>e<br />

1/2000-4/2000<br />

3 months<br />

Yes 3 months $2.6 40%<br />

Pakistan<br />

2/1999-12/1999<br />

10 months<br />

No – $0.6 30%<br />

Ecuador<br />

8/1999-8/2000<br />

12 months<br />

Yes 12 months $6.5 60%<br />

Argent<strong>in</strong>a<br />

9/2003-4/2005 Yes<br />

19 months 12/2001<br />

40 months $79.7 67%<br />

Uruguay<br />

4/2003-5/2003<br />

1 month<br />

No – $3.8 26%<br />

Table 1: <strong>Sovereign</strong> <strong>Debt</strong> Restructur<strong>in</strong>gs dur<strong>in</strong>g 1998-2005<br />

2