Delay and Haircuts in Sovereign Debt - University of St Andrews

Delay and Haircuts in Sovereign Debt - University of St Andrews

Delay and Haircuts in Sovereign Debt - University of St Andrews

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Length <strong>of</strong> Default (<strong>Delay</strong>) <strong>and</strong> Haricuts<br />

<strong>Haircuts</strong> (%)<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

0 5 10 15 20 25 30<br />

<strong>Delay</strong> Length (years)<br />

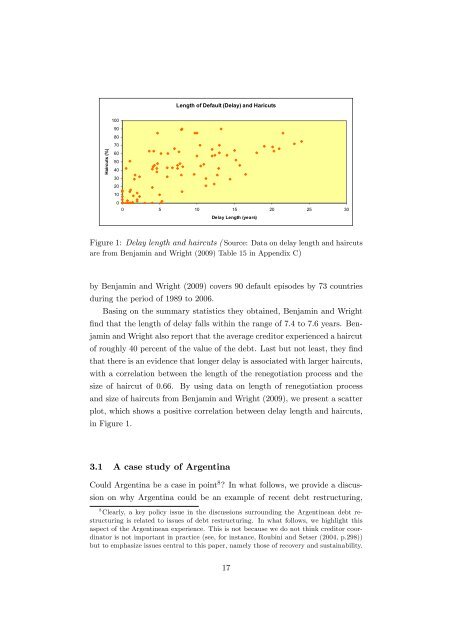

Figure 1: <strong>Delay</strong> length <strong>and</strong> haircuts ( Source: Data on delay length <strong>and</strong> haircuts<br />

are from Benjam<strong>in</strong> <strong>and</strong> Wright (2009) Table 15 <strong>in</strong> Appendix C)<br />

by Benjam<strong>in</strong> <strong>and</strong> Wright (2009) covers 90 default episodes by 73 countries<br />

dur<strong>in</strong>g the period <strong>of</strong> 1989 to 2006.<br />

Bas<strong>in</strong>g on the summary statistics they obta<strong>in</strong>ed, Benjam<strong>in</strong> <strong>and</strong> Wright<br />

…nd that the length <strong>of</strong> delay falls with<strong>in</strong> the range <strong>of</strong> 7.4 to 7.6 years. Benjam<strong>in</strong><br />

<strong>and</strong> Wright also report that the average creditor experienced a haircut<br />

<strong>of</strong> roughly 40 percent <strong>of</strong> the value <strong>of</strong> the debt. Last but not least, they …nd<br />

that there is an evidence that longer delay is associated with larger haircuts,<br />

with a correlation between the length <strong>of</strong> the renegotiation process <strong>and</strong> the<br />

size <strong>of</strong> haircut <strong>of</strong> 0.66. By us<strong>in</strong>g data on length <strong>of</strong> renegotiation process<br />

<strong>and</strong> size <strong>of</strong> haircuts from Benjam<strong>in</strong> <strong>and</strong> Wright (2009), we present a scatter<br />

plot, which shows a positive correlation between delay length <strong>and</strong> haircuts,<br />

<strong>in</strong> Figure 1.<br />

3.1 A case study <strong>of</strong> Argent<strong>in</strong>a<br />

Could Argent<strong>in</strong>a be a case <strong>in</strong> po<strong>in</strong>t 8 ? In what follows, we provide a discussion<br />

on why Argent<strong>in</strong>a could be an example <strong>of</strong> recent debt restructur<strong>in</strong>g,<br />

8 Clearly, a key policy issue <strong>in</strong> the discussions surround<strong>in</strong>g the Argent<strong>in</strong>ean debt restructur<strong>in</strong>g<br />

is related to issues <strong>of</strong> debt restructur<strong>in</strong>g. In what follows, we highlight this<br />

aspect <strong>of</strong> the Argent<strong>in</strong>ean experience. This is not because we do not th<strong>in</strong>k creditor coord<strong>in</strong>ator<br />

is not important <strong>in</strong> practice (see, for <strong>in</strong>stance, Roub<strong>in</strong>i <strong>and</strong> Setser (2004, p.298))<br />

but to emphasize issues central to this paper, namely those <strong>of</strong> recovery <strong>and</strong> susta<strong>in</strong>ability.<br />

17