Annual Report for the year 2012

Annual Report for the year 2012

Annual Report for the year 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MANAGEMENT DISCUSSION AND ANALYSIS<br />

A detailed review of <strong>the</strong> operations, per<strong>for</strong>mance and future<br />

outlook of <strong>the</strong> Company and its business is given in <strong>the</strong><br />

Management Discussion and Analysis appearing as Annexure I to<br />

this <strong>Report</strong>.<br />

TRANSFER TO THE INVESTOR EDUCATION AND<br />

PROTECTION FUND<br />

In terms of Section 205C of <strong>the</strong> Companies Act, 1956 an amount of<br />

` 2.98 lacs being unclaimed dividend (interim dividend) <strong>for</strong> <strong>the</strong><br />

st<br />

<strong>year</strong> ending 31 March, 2005 was transferred during <strong>the</strong> <strong>year</strong> to<br />

<strong>the</strong> Investor Education and Protection Fund established by <strong>the</strong><br />

Central Government.<br />

QUALITY<br />

Quality, integrity and safety have been core to <strong>the</strong> Company. We<br />

firmly believe that <strong>the</strong> pursuit of excellence is one of <strong>the</strong> most<br />

critical components <strong>for</strong> success in <strong>the</strong> competitive market and<br />

<strong>the</strong>re<strong>for</strong>e, consistently strive to adhere to <strong>the</strong> highest quality<br />

standards. Shreyas has been re-certified by DNV Quality Registrar<br />

st<br />

in accordance with <strong>the</strong> Standard ISO 9001:2008 upto 31 October,<br />

<strong>2012</strong>.<br />

Moving <strong>for</strong>ward, <strong>the</strong> Company shall continue to fur<strong>the</strong>r streng<strong>the</strong>n<br />

its processes by adopting best-in-class standards.<br />

FIXED DEPOSITS<br />

The Company has not accepted fixed deposits from <strong>the</strong> public<br />

during <strong>the</strong> <strong>year</strong> under review.<br />

DIRECTORS<br />

Mr. D. T. Joseph and Capt. P. P. Radhakrishnan retire by rotation at<br />

<strong>the</strong> ensuing <strong>Annual</strong> General Meeting, and being eligible, offer<br />

<strong>the</strong>mselves <strong>for</strong> re-appointment.<br />

Mr. Ritesh Ramakrishnan was appointed as an Additional Director<br />

th<br />

w.e.f 30 May, <strong>2012</strong>.<br />

The above appointment and re-appointments <strong>for</strong>m part of <strong>the</strong><br />

Notice of <strong>the</strong> <strong>Annual</strong> General Meeting and <strong>the</strong> Resolutions are<br />

recommended <strong>for</strong> your approval.<br />

Profiles of <strong>the</strong>se Directors, as required by Clause 49 of <strong>the</strong> Listing<br />

Agreement, are given in <strong>the</strong> <strong>Report</strong> on Corporate Governance<br />

<strong>for</strong>ming part of this <strong>Report</strong>.<br />

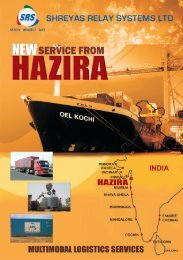

SUBSIDIARY COMPANY<br />

In compliance with <strong>the</strong> provisions of Section 212 of <strong>the</strong> Companies<br />

Act, 1956, <strong>the</strong> audited statement of accounts alongwith <strong>the</strong><br />

st<br />

Directors' and Auditors' report <strong>for</strong> <strong>the</strong> <strong>year</strong> ended 31 March, <strong>2012</strong><br />

of Shreyas Relay Systems Ltd, <strong>the</strong> wholly owned subsidiary and<br />

Haytrans (India) Ltd, <strong>the</strong> subsidiary of Shreyas Relay Systems<br />

Limited are annexed.<br />

DIRECTORS' RESPONSIBILITY STATEMENT<br />

Pursuant to <strong>the</strong> requirement under section 217(2AA) of <strong>the</strong><br />

Companies Act, 1956, <strong>the</strong> Directors confirm that, to <strong>the</strong> best of<br />

st<br />

<strong>the</strong>ir knowledge and belief, in respect of <strong>the</strong> <strong>year</strong> ended on 31<br />

March, <strong>2012</strong>;<br />

a) in <strong>the</strong> preparation of <strong>the</strong> annual accounts, <strong>the</strong> applicable<br />

accounting standards have been followed along with proper<br />

explanation relating to material departures;<br />

b) appropriate accounting policies have been selected and<br />

applied consistently, and such judgments and estimates have<br />

been made that are reasonable and prudent so as to give a<br />

true and fair view of <strong>the</strong> state of affairs of <strong>the</strong> Company as at<br />

st<br />

31 March, <strong>2012</strong> and of <strong>the</strong> profit of <strong>the</strong> Company <strong>for</strong> <strong>the</strong> <strong>year</strong><br />

st<br />

ended on 31 March, <strong>2012</strong>;<br />

c) proper and sufficient care has been taken <strong>for</strong> <strong>the</strong><br />

maintenance of adequate accounting records in accordance<br />

with <strong>the</strong> provisions of <strong>the</strong> Companies Act, 1956, <strong>for</strong><br />

safeguarding <strong>the</strong> assets of <strong>the</strong> Company and <strong>for</strong> preventing<br />

and detecting fraud and o<strong>the</strong>r irregularities; and<br />

d) <strong>the</strong> annual accounts have been prepared on a 'going concern'<br />

basis.<br />

CORPORATE GOVERNANCE<br />

As required by Clause 49 of <strong>the</strong> Listing agreement entered into<br />

with <strong>the</strong> Stock Exchanges, a detailed <strong>Report</strong> on Corporate<br />

Governance is given as Annexure II to this <strong>Report</strong> alongwith <strong>the</strong><br />

Auditors' Certificate on its compliance by <strong>the</strong> Company (Annexure<br />

IV) and applicable certification of <strong>the</strong> Chief Executive Officer and<br />

Chief Financial Officer (Annexure III).<br />

AUDITORS<br />

M/s. PKF Sridhar & Santhanam, Chartered Accountants, retire at<br />

th<br />

<strong>the</strong> conclusion of <strong>the</strong> 24 <strong>Annual</strong> General Meeting and offer<br />

<strong>the</strong>mselves <strong>for</strong> re-appointment. A Certificate from <strong>the</strong> Auditors<br />

has been received to <strong>the</strong> effect that <strong>the</strong>ir re-appointment, if made,<br />

would be within <strong>the</strong> limits prescribed under Section 224(1B) of <strong>the</strong><br />

Companies Act, 1956.<br />

As regards <strong>the</strong> observation made in <strong>the</strong> Auditor's report, your<br />

Directors wish to state that <strong>the</strong> interpretation of <strong>the</strong> Institute of<br />

Chartered Accountants of India is not found in <strong>the</strong> notification<br />

issued by <strong>the</strong> Government of India and hence has no legal<br />

sanction. Accounting Standard-16 covers capitalisation of interest<br />

in projects in respect of 'qualifying assets' and cannot be applied to<br />

all cases of capital expenditure. Such an interpretation by <strong>the</strong><br />

Institute of Chartered Accountants of India has <strong>the</strong> effect of taking<br />

<strong>for</strong>eign exchange gains to <strong>the</strong> credit of capital expenditure but a<br />

major part of <strong>for</strong>eign exchange loss to interest expenditure, which<br />

cannot be <strong>the</strong> intention of <strong>the</strong> Government notification, which is to<br />

give relief to industries from violent negative fluctuations in<br />

<strong>for</strong>eign exchange. In our view <strong>the</strong> accounting treatment given by<br />

<strong>the</strong> Company is correct and helps reflect a true and fair view of<br />

profit of <strong>the</strong> <strong>year</strong>.<br />

COST AUDIT<br />

The Central Government has not recommended cost audit of <strong>the</strong><br />

Company during <strong>the</strong> <strong>year</strong> under consideration.<br />

CONSERVATION OF ENERGY, TECHNOLOGY ABSORPTION,<br />

FOREIGN EXCHANGE EARNING AND OUTGO<br />

st<br />

Under <strong>the</strong> Notification No.GSR 1029, dated 31 December, 1988,<br />

companies are required to furnish prescribed in<strong>for</strong>mation<br />

regarding conservation of energy and technology absorption. This,<br />

however, does not apply to your Company, as <strong>the</strong> shipping industry<br />

is not included in <strong>the</strong> Schedule to <strong>the</strong> relevant rules.<br />

10 24th <strong>Annual</strong> <strong>Report</strong> 2011-12