CEB Investors' and Analysts' Briefing 2Q11 - Cebu Pacific Air

CEB Investors' and Analysts' Briefing 2Q11 - Cebu Pacific Air

CEB Investors' and Analysts' Briefing 2Q11 - Cebu Pacific Air

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Cebu</strong> <strong>Air</strong>, Inc. (<strong>CEB</strong>)<br />

2Q2011 Results of Operations<br />

Investors’ <strong>and</strong> Analysts’ <strong>Briefing</strong><br />

August 2011<br />

Strictly Private <strong>and</strong> Confidential

Disclaimer<br />

This information provided in this presentation is provided only for your reference. Such information has not been independently verified <strong>and</strong>, as such, is not guaranteed to<br />

be accurate nor complete. Neither <strong>Cebu</strong> <strong>Air</strong>, Inc. (“<strong>CEB</strong>” or the “Company”) nor any of its affiliates, shareholders, directors, employees, agents or advisers makes<br />

expressed or implied representations or warranties as to the accuracy or completeness of the information contained herein <strong>and</strong> neither of them shall accept any<br />

responsibility or liability (including any third party liability) for any loss or damage, whether or not arising from any error or omission in compiling such information or as a<br />

result of any party’s reliance or use of such information. The information <strong>and</strong> opinions in this presentation are subject to change without notice.<br />

EBITDAR, EBITDA, EBITDAR Margin, EBIT <strong>and</strong> core net income are not measures of performance under the Philippine Financial Reporting St<strong>and</strong>ards (“PFRS”), <strong>and</strong><br />

should not be considered in isolation or as alternatives to net income as an indicator of <strong>CEB</strong>’s operating performance or to cash flow from operating, investing <strong>and</strong><br />

financing activities as a measure of liquidity, or any other measures of performance under PFRS. Because there are various EBITDAR, EBITDA, EBITDAR Margin, EBIT<br />

<strong>and</strong> core net income calculation methods, <strong>CEB</strong>’s presentation of these measures may not be comparable to similarly titled measures used by other companies.<br />

This presentation also contains certain “forward-looking statements.” These forward-looking statements include words or phrases such as <strong>CEB</strong> or its management<br />

“believes”, “expects”, “anticipates”, “intends”, “plans”, “foresees”, or other words or phrases of similar import. Similarly, statements that describe <strong>CEB</strong>’s objectives, plans<br />

or goals are also forward-looking statements. All such forward-looking statements are subject to certain risks <strong>and</strong> uncertainties that could cause actual results to differ<br />

materially from those contemplated by the relevant forward-looking statement. Such forward looking statements are made based on management’s current expectations<br />

or beliefs as well as assumptions made by, <strong>and</strong> information currently available to, management. There is no assurance that expected events will occur, that projections<br />

will be achieved, or that the Company <strong>and</strong> its management’s assumptions are correct.

Quarter Highlights<br />

1<br />

2<br />

14.8% traffic growth<br />

88.6% load factor<br />

44.6% domestic<br />

market share<br />

8<br />

Php12.4 billion<br />

cash 2<br />

1.08x adjusted<br />

net D-E ratio<br />

3<br />

21.0% international<br />

passenger growth<br />

7<br />

26.7% EBITDAR<br />

margin<br />

14.5% pre-tax core<br />

net income margin<br />

4<br />

14.3 block hours/day 1<br />

8.3 turns/day<br />

6<br />

5.3% reduction in<br />

cost ex-fuel per ASK<br />

5<br />

2.6% increase in total<br />

revenue (ex-cargo)<br />

per passenger<br />

Note: All figures are for 2Q2011; growth figures are 2Q2011 year-on-year comparison<br />

1Average utilization for <strong>Air</strong>bus fleet only<br />

2Includes financial assets at FVPL <strong>and</strong> available-for-sale investments<br />

3

What’s In Store?<br />

Business Updates Financial Results Looking Ahead

1. Business Updates

Load Factors Hit All-Time High<br />

<strong>CEB</strong> posted record seat load factors of 88.6% in 2Q2011 <strong>and</strong> 87.8% in 1H2011.<br />

Total passenger volume grew 14.8% YoY in 2Q2011 <strong>and</strong> 13.4% YoY in 1H2011, led by the international<br />

segment.<br />

Load<br />

Factor<br />

80.9% 78.0% 77.4%<br />

85.4% 85.4%<br />

87.8% 88.2%<br />

88.6%<br />

(m)<br />

10.5<br />

9.0<br />

7.5<br />

6.0<br />

4.5<br />

3.0<br />

1.5<br />

CAGR: 24.4%<br />

6.7<br />

5.4 1.4<br />

1.0<br />

5.3<br />

4.4<br />

8.7<br />

1.6<br />

7.1<br />

10.4<br />

2.2<br />

8.2<br />

YoY Growth:<br />

13.4%<br />

5.2<br />

1.1<br />

5.9<br />

1.4<br />

4.1 4.5<br />

YoY Growth:<br />

14.8%<br />

2.7<br />

0.6<br />

3.1<br />

0.7<br />

2.1 2.4<br />

<strong>2Q11</strong> Y-o-Y Growth<br />

Passengers 14.8%<br />

Domestic 13.1%<br />

International 21.0%<br />

Seats 14.2%<br />

Domestic 10.5%<br />

International 28.2%<br />

1H2011 Y-o-Y Growth<br />

Passengers 13.4%<br />

Domestic 10.1%<br />

International 26.0%<br />

Seats 10.2%<br />

Domestic 5.5%<br />

International 28.1%<br />

-<br />

2007 2008 2009 2010 1H10 1H11 2Q10 <strong>2Q11</strong><br />

6<br />

Domestic<br />

International

Sustained Domestic Market Leadership<br />

<strong>CEB</strong> continues to dominate the domestic air travel market<br />

Domestic<br />

Passengers 1<br />

(‘000)<br />

3,49<br />

9<br />

3,881 3,655 4,289 3,887 4,573 4,510 5,148<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

1.3% 0.7% 1.5% 0.8% 1.8% 1.0% 1.4% 1.0%<br />

6.5% 7.4% 5.8% 7.6% 6.5% 11.3% 8.1% 12.1%<br />

40.9% 31.3% 38.6% 28.3% 36.0% 25.6% 32.9% 23.7%<br />

1.9% 11.7% 2.4% 17.0% 5.2% 19.5% 10.3% 18.6%<br />

49.5% 48.9% 51.7% 46.3%<br />

50.6%<br />

42.6%<br />

47.3% 44.6%<br />

3Q09 3Q10 4Q09 4Q10 1Q10 1Q11 2Q10 <strong>2Q11</strong><br />

<strong>CEB</strong> <strong>Air</strong>Phil Express PAL Zest <strong>Air</strong> Seair<br />

In 2Q2011, <strong>CEB</strong> remains<br />

the no.1 domestic carrier<br />

with a market share of<br />

44.6%.<br />

<strong>CEB</strong> maintains a CPI (2) of<br />

1.04, higher than all of its<br />

domestic competitors.<br />

<strong>CEB</strong> will take 7 aircraft in<br />

the next 7 months,<br />

outpacing growth plans<br />

of other domestic carriers<br />

Source: Civil Aeronautics Board, Company data.<br />

(1) Passenger numbers include <strong>CEB</strong>’s non-revenue passengers <strong>and</strong> excludes no-shows. Figures should not be compared with <strong>CEB</strong>’s<br />

internal passenger count..<br />

(2) CPI (Competitive Performance Index ) is computed by dividing market share by capacity share<br />

7

Growing Share in Robust International Market<br />

<strong>CEB</strong> gaining international market share<br />

International<br />

Passengers 12,542 14,013 3,441 3,832<br />

(‘000) (1)<br />

100.0%<br />

80.0%<br />

40.3% 38.7% 38.0% 40.8%<br />

<strong>CEB</strong> grew its international<br />

segment by 21.0% YoY in<br />

2Q2011 as ASEAN <strong>and</strong> North<br />

Asia destinations continue to<br />

show robust dem<strong>and</strong>.<br />

60.0%<br />

40.0%<br />

20.0%<br />

0.0%<br />

4.2% 4.2% 5.0%<br />

4.1%<br />

4.6% 4.7% 5.2% 4.2%<br />

9.6%<br />

11.0%<br />

10.1% 9.0%<br />

27.0%<br />

28.1% 27.6% 26.3%<br />

12.9% 14.7% 14.1% 15.8%<br />

FY 2009 FY 2010 1Q2010 1Q2011<br />

Based on official data <strong>CEB</strong><br />

captured 15.8% international<br />

market share in 1Q2011.<br />

<strong>CEB</strong> has been gaining traction<br />

in the international market since<br />

2009, while market shares of<br />

top competitors have been<br />

contracting.<br />

<strong>CEB</strong> Philippine <strong>Air</strong>lines Cathay <strong>Pacific</strong> Singapore <strong>Air</strong>lines Asiana Others (2)<br />

Source: Civil Aeronautics Board, DMIA (for carriers with Clark operations) .<br />

(1) Passenger numbers include <strong>CEB</strong>’s non-revenue passengers <strong>and</strong> excludes no-shows.<br />

(2) Others include 36 other airlines each with market share not higher than 4%<br />

8

Revenue Growth Outpaces Traffic Growth<br />

<strong>CEB</strong>’s total revenue growth <strong>and</strong> breakdown<br />

18.00<br />

15.00<br />

YoY Growth:<br />

12.1% 16.73<br />

14.92<br />

Total revenues increased 16.3%<br />

YoY in 2Q2011, faster than traffic<br />

growth of 14.8%.<br />

12.00<br />

9.00<br />

6.00<br />

3.00<br />

-<br />

(Php billion)<br />

1H10 1H11 2Q10 <strong>2Q11</strong><br />

Cargo Revenue 1.00 0.96 0.52 0.50<br />

Ancillary Revenue 1.03 1.90 0.54 1.15<br />

Pax Revenue 12.89 13.87 6.85 7.56<br />

Pax Revenue Ancillary Revenue Cargo Revenue<br />

YoY Growth:<br />

16.3% 9.21<br />

7.92<br />

Average<br />

Fare (Php) 2,469 2,343 2,528 2,431<br />

Ancillary<br />

Revenue per<br />

Pax (Php)<br />

Total Rev<br />

(ex-Cargo)<br />

per Pax (Php)<br />

198 321 200 368<br />

2,667 2,664 2,728 2,799<br />

<strong>CEB</strong> has successfully unbundled<br />

<strong>and</strong> improved take up of ancillary<br />

products <strong>and</strong> services. Ancillary<br />

revenue per passenger<br />

increased significantly by 83.9%<br />

YoY to Php368 in 2Q2011.<br />

Fuel surcharges began to impact,<br />

slowing down YoY decline in<br />

average fares to 3.8% in 2Q2011<br />

from 6.6% in 1Q2011.<br />

Cargo revenues down 4.1% YoY<br />

due to lower volumes in 2Q2011<br />

compared to 2Q2010 base<br />

period which was high due to<br />

national elections.<br />

9

Effective Marketing <strong>and</strong> Distribution Network<br />

Breakdown of sales by distribution channel<br />

100.0%<br />

Success in increasing online presence <strong>and</strong> proportion of web bookings<br />

80.0%<br />

44.1% 40.6% 36.1%<br />

29.9%<br />

60.0%<br />

40.0%<br />

22.2% 25.4%<br />

22.2%<br />

22.0%<br />

20.0%<br />

33.8% 34.0%<br />

41.7%<br />

48.1%<br />

0.0%<br />

2008 2009 2010 1H2011<br />

Internet Booking <strong>CEB</strong> Ticket Offices <strong>and</strong> Call Centers Third Party Sales Agents<br />

Sales made through the <strong>CEB</strong> website has significantly increased. In 1H11, the share of web bookings to<br />

total sales reached 48.1%.<br />

<strong>CEB</strong> continues to increase on-line presence through Facebook <strong>and</strong> Twitter<br />

<strong>CEB</strong> will further strengthen br<strong>and</strong> equity through co-br<strong>and</strong>ing arrangements<br />

10

Constantly Improving Operational Efficiency<br />

2Q2010 2Q2011 %Change 1H2010 1H2011 %Change<br />

No. of Sectors Flown 22,358 24,816 11.0% 43,844 47,310 7.9%<br />

Domestic 18,534 19,972 7.8% 36,168 37,601 4.0%<br />

International 3,824 4,844 26.7% 7,676 9,709 26.5%<br />

ASK (millions) 2,562 3,136 22.4% 5,101 6,076 19.1%<br />

Domestic 1,346 1,513 12.4% 2,668 2,864 7.3%<br />

International 1,216 1,623 33.5% 2,433 3,213 32.0%<br />

RPK (millions) 2,272 2,722 19.8% 4,368 5,214 19.4%<br />

Domestic 1,203 1,378 14.6% 2,322 2,580 11.1%<br />

International 1,069 1,344 25.7% 2,046 2,633 28.7%<br />

Ave. Daily <strong>Air</strong>craft Utilization (Block Hours) 12.62 13.25 5.0% 12.44 12.95 4.1%<br />

<strong>Air</strong>bus 13.89 14.32 3.1% 13.85 13.96 0.8%<br />

ATR 9.30 9.92 6.7% 8.73 9.63 10.3%<br />

Ave. Turns per Day 8.47 8.26 -2.5% 8.35 8.06 -3.5%<br />

<strong>Air</strong>bus 8.21 7.95 -3.2% 8.22 7.73 -6.0%<br />

ATR 9.16 9.23 0.8% 8.69 9.12 4.9%<br />

On-Time Performance (OTP) 87% 71% (16.5) 89% 76% (13.8)<br />

11

2. Financial Results

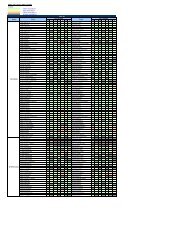

Resilient Profits Amidst Tough Business Environment<br />

For the Quarter Ended For the Six Months Year-on-Year Change<br />

30-Jun-10 30-Jun-11 30-Jun-10 30-Jun-11 1Q2011 2Q2011 1H2011<br />

Passengers ('000) 2,712 3,112 5,219 5,918 11.9% 14.8% 13.4%<br />

Total Revenue (Php m) 7,918 9,210 14,920 16,730 7.4% 16.3% 12.1%<br />

Average Fare (Php) 2,528 2,431 2,469 2,343 -6.6% -3.8% -5.1%<br />

Ancillary Revenue per Passenger (Php) 200 368 198 321 37.1% 84.3% 62.1%<br />

EBITDAR (Php m) 3,040 2,460 5,424 4,237 -25.4% -19.1% -21.9%<br />

EBIT (Php m) 2,147 1,394 3,646 2,135 -50.6% -35.1% -41.4%<br />

Net Income (Php m) 1,609 1,239 3,166 2,440 -22.9% -23.0% -22.9%<br />

Pre-tax Core Net Income (Php m) 1,957 1,339 3,231 2,010 -47.4% -31.6% -37.8%<br />

EBITDAR Margin 38.4% 26.7% 36.4% 25.3% -10.4 -11.7 -11.0<br />

EBIT Margin 27.1% 15.1% 24.4% 12.8% -11.6 -12.0 -11.7<br />

Net Income Margin 20.3% 13.5% 21.2% 14.6% -6.3 -6.9 -6.6<br />

Pre-tax Core Net Income Margin 24.7% 14.5% 21.7% 12.0% -9.3 -10.2 -9.6<br />

<strong>CEB</strong> delivered comfortable margins in 2Q2011 despite continued rise in jet fuel prices to an average of<br />

US$130.76/bbl (published MOPS) in 2Q2011, 45.5% higher YoY.<br />

EBITDAR margin <strong>and</strong> pre-tax core net income margin were at 26.7% <strong>and</strong> 14.5%, respectively, in 2Q2011;<br />

25.3% <strong>and</strong> 12.0%, respectively in 1H2011.<br />

13

Continued Efforts to Lower Unit Cost<br />

hp - Cost per ASK<br />

For the Quarter Ended For the Six Months Ended Year-on-Year Change<br />

30-Jun-10 30-Jun-11 30-Jun-10 30-Jun-11 2Q2011 1H2011<br />

lying Operations 1.149 1.461 1.108 1.351 27.2% 21.9%<br />

Fuel 0.989 1.295 0.947 1.201 30.9% 26.8%<br />

Others 0.160 0.166 0.161 0.150 3.9% -6.7%<br />

aintenance 0.218 0.194 0.220 0.197 -11.0% -10.2%<br />

epreciation <strong>and</strong> Amortization 0.195 0.209 0.195 0.211 7.1% 8.2%<br />

ircraft <strong>and</strong> Traffic Servicing 0.261 0.241 0.261 0.247 -7.8% -5.4%<br />

ircraft <strong>and</strong> Engine Lease 0.154 0.131 0.153 0.135 -14.7% -12.1%<br />

eservation <strong>and</strong> Sales 0.134 0.117 0.130 0.123 -12.4% -5.8%<br />

assenger Service 0.062 0.061 0.062 0.062 -0.9% -0.2%<br />

eneral <strong>and</strong> Administrative 0.071 0.063 0.073 0.064 -11.4% -12.9%<br />

ther Expenses 0.009 0.014 0.007 0.012 67.7% 77.0%<br />

otal Cost per ASK 2.253 2.492 2.210 2.402 10.6% 8.7%<br />

otal Cost per ASK ex- Fuel 1.264 1.197 1.263 1.201 -5.3% -4.9%<br />

otal Cost per ASK (in US$ cents) 4.948 5.763 4.828 5.519 16.5% 14.3%<br />

otal Cost per ASK ex- Fuel (in US$ cents) 2.776 2.769 2.759 2.760 -0.3% 0.0%<br />

ote: Converted based on average exchange rate for the period: 2Q2011 at Php43.24/US$, 2Q2010 at Php46.53/US$, 1H2011 at Php43.52/US$, 1H2010 at Php45.77/US$<br />

Unit cost increased 10.6% YoY in 2Q2011 <strong>and</strong> 8.7% YoY in 1H11 primarily due to higher fuel prices<br />

Cost per ASK ex-fuel dropped 5.3% YoY in 2Q2011 <strong>and</strong> 4.9% YoY in 1H11 .<br />

14

Summary of Income Statement<br />

15<br />

For the Quarter Ended For the Six Months Ended<br />

Year-on-Year Change<br />

Php Millions<br />

30-Jun-10 30-Jun-11 30-Jun-10 30-Jun-11 2Q2011 1H2011 2Q2011 1H2011<br />

% Revenue<br />

Passenger Revenue 6,854 7,564 12,885 13,865 10.4% 7.6% 82.1% 82.9%<br />

Cargo Revenue 522 500 1,000 963 -4.1% -3.7% 5.4% 5.8%<br />

Ancillary revenue 542 1,146 1,034 1,902 111.5% 83.8% 12.4% 11.4%<br />

Total Revenue 7,918 9,210 14,920 16,730 16.3% 12.1%<br />

% Operating Cost<br />

Flying Operations 2,942 4,582 5,653 8,210 55.7% 45.2% 58.6% 56.2%<br />

Fuel 2,533 4,061 4,831 7,296 60.3% 51.0% 52.0% 50.0%<br />

Others 409 521 822 913 27.2% 11.1% 6.7% 6.3%<br />

Maintenance 559 609 1,120 1,197 9.0% 6.9% 7.8% 8.2%<br />

Depreciation <strong>and</strong> Amortization 500 655 996 1,284 31.1% 28.9% 8.4% 8.8%<br />

<strong>Air</strong>craft <strong>and</strong> Traffic Servicing 670 755 1,333 1,501 12.8% 12.6% 9.7% 10.3%<br />

<strong>Air</strong>craft <strong>and</strong> Engine Lease 394 411 782 819 4.4% 4.7% 5.3% 5.6%<br />

Reservation <strong>and</strong> Sales 343 368 664 745 7.3% 12.2% 4.7% 5.1%<br />

Passenger Service 159 193 317 376 21.4% 18.9% 2.5% 2.6%<br />

General <strong>and</strong> Administrative 182 198 374 388 8.5% 3.8% 2.5% 2.7%<br />

Other Expenses 22 45 36 75 105.3% 110.8% 0.6% 0.5%<br />

Total Operating Expenses 5,770 7,816 11,273 14,595 35.4% 29.5%<br />

% Revenue<br />

EBIT 2,147 1,394 3,646 2,135 -35.1% -41.4% 15.1% 12.8%<br />

Fuel hedging gains / (losses) -6 -64 8 560 933.7% 6678.3% -0.7% 3.3%<br />

Fair value gains / (losses) 0 11 0 -13 nm nm 0.1% -0.1%<br />

Foreign exchange gains / (losses) -430 88 -68 187 nm nm 1.0% 1.1%<br />

Interest expense - net -200 -63 -429 -142 -68.5% -66.8% -0.7% -0.8%<br />

Equity in net income (loss) of a JV 10 8 14 17 -16.4% 23.0% 0.1% 0.1%<br />

Provision for Tax -88 135 5 303 nm 6139.8% 1.5% 1.8%<br />

Net Income / (Loss) after Tax 1,609 1,239 3,166 2,440 -23.0% -22.9% 13.5% 14.6%<br />

Pre-Tax Core Net Income 1,957 1,339 3,231 2,010 -31.6% -37.8% 14.5% 12.0%

Strong Balance Sheet Allows for Further Expansion<br />

Php Millions<br />

As of Dec-31 As of Jun-30<br />

2010 2011<br />

Cash <strong>and</strong> cash equivalents (1) 13,267 12,391<br />

Current assets 15,139 14,366<br />

Plant <strong>and</strong> equipment 33,986 36,623<br />

Other noncurrent assets 812 1,063<br />

Total assets 49,937 52,052<br />

Total debt (2) 20,503 20,794<br />

Other liabilities 11,527 12,906<br />

Total liabilities 32,030 33,699<br />

Cash balance (including financial<br />

assets at FVPL) after cash<br />

dividend payout stood at Php12.4<br />

billion as at end 2Q2011.<br />

Strong gearing <strong>and</strong> debt service<br />

ability allow <strong>CEB</strong> to tap financing<br />

for aircraft acquisition.<br />

Total equity 17,907 18,353<br />

Capitalized lease (3) 11,234 11,490<br />

Net debt 7,236 8,403<br />

Adjusted net debt 18,470 19,893<br />

Net debt-to-equity (x) 0.40 0.46<br />

Adjusted net debt-to-equity (x) 1.03 1.08<br />

Adjusted net debt/EBITDAR (x) (4) 1.82 2.22<br />

Cash-to-sales ratio (5) 45.6% 40.1%<br />

(1) Cash balance includes financial assets held-for-trading (at fair value) as well as available for sale assets.<br />

(2) Includes LT debt, current portion of LT debt, <strong>and</strong> ARO liability<br />

(3) Capitalized lease for June 30, 2011 is based on LTM aircraft <strong>and</strong> engine lease expense x7<br />

(4) EBITDAR for June 30, 2011 is based on LTM EBITDAR<br />

(5) Sales for June 30, 2011 is based on LTM Revenues<br />

16

3. Looking Ahead

Taking Fleet Expansion Forward<br />

Disciplined <strong>and</strong> flexible fleet expansion plan<br />

48 49<br />

37 41<br />

11 7<br />

29 32<br />

8<br />

8<br />

9 9<br />

11<br />

11<br />

8 8 8<br />

8<br />

12 15 18 22 29 34<br />

2009 2010 2011 2012 2013 2014<br />

<strong>Air</strong>bus under Finance Lease ATR under Finance Lease <strong>Air</strong>bus under Operating Lease<br />

Ave. fleet age (1)<br />

3.5 years<br />

Notes: (1) As of 30 June 2011<br />

Added 2 <strong>Air</strong>bus A320 aircraft under operating leases for delivery in 2012.<br />

Exercised option to purchase 7 <strong>Air</strong>bus A320 aircraft for delivery in 2015 <strong>and</strong> 2016.<br />

Placed order for 30 <strong>Air</strong>bus A321neo aircraft for delivery from 2017 to 2021.<br />

M<strong>and</strong>ate given for the financing of the next three <strong>Air</strong>bus A320 aircraft for delivery between September<br />

2011 <strong>and</strong> January 2012<br />

18

Thank you.

Appendix

Summary of Balance Sheet<br />

Php Millions<br />

As of Dec-31 As of Jun-30<br />

2010 2011<br />

Cash <strong>and</strong> cash equivalents 9,763 8,942<br />

Financial assets at fair value through profit or loss 3,879 3,870<br />

Receivables 862 720<br />

Expendable parts, materials <strong>and</strong> supplies 370 497<br />

Prepaid expenses <strong>and</strong> other current assets 264 339<br />

Current Assets 15,139 14,366<br />

Property <strong>and</strong> equipment-net 33,986 36,623<br />

Available for sale 115 112<br />

Investment in a joint venture 370 386<br />

Other noncurrent assets 328 564<br />

Total Noncurrent Assets 34,798 37,686<br />

Total Assets 49,937 52,052<br />

Accounts payable <strong>and</strong> accrued expenses 5,598 6,319<br />

Due to related parties 36 36<br />

Current portion long-term debt 2,056 2,157<br />

Unearned transportation revenue 4,606 5,019<br />

Current Liabilities 12,296 13,531<br />

Long term debt-net of current portion 16,377 16,473<br />

Other noncurrent liabilties 3,357 3,695<br />

Total Noncurrent Liabilties 19,734 20,168<br />

Total Liabilities 32,030 33,699<br />

Paid-up capital 613 613<br />

Additional paid-up capital 8,406 8,406<br />

Treasury stocks -159<br />

Net unrealized gain (loss) on AFS investment -3 -5<br />

Retained earnings 8,891 9,497<br />

Equity 17,907 18,353<br />

21<br />

Total Liabilities <strong>and</strong> Equity 49,937 52,052

Summary of Cash Flows<br />

Php Millions<br />

For the Six Months<br />

30-Jun-10<br />

30-Jun-11<br />

CASHFLOWS FROM OPERATING ACTIVITIES<br />

Income (loss) before income tax 3,171 2,743<br />

Net adjustments 1,449 648<br />

Operating income before working capital changes 4,620 3,392<br />

Net changes in working capital 1,200 1,056<br />

Net cash generated from operations 5,820 4,447<br />

Interest paid -413 -350<br />

Interest received 34 329<br />

Net cash provided by operating activities 5,440 4,426<br />

CASHFLOWS FROM INVESTING ACTIVITIES<br />

Decrease (increase) in:<br />

Advances to a related party -3,663 0<br />

Acquisition of property <strong>and</strong> equipment -530 -1,968<br />

Other noncurrent assets -76 -237<br />

Net cash used in investing activities -4,269 -2,204<br />

CASHFLOWS FROM FINANCING ACTIVITIES<br />

Increase (decrease) in:<br />

Repayments of long term debt -922 -1,042<br />

Payment of treasury shares of stock 0 -159<br />

Cash dividends 0 -1,834<br />

Net cash provided by financing activities -922 -3,034<br />

NET FOREIGN EXCHANGE DIFFERENCE -7 -10<br />

NET INCREASE (DECREASE) IN CASH AND CASH 242 -822<br />

CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD 3,841 9,763<br />

CASH AND CASH EQUIVALENTS AT END OF PERIOD 4,083 8,942<br />

22

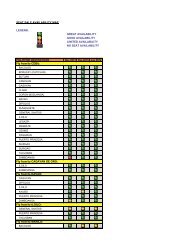

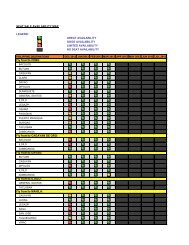

Increased Capacity in the Philippine Market<br />

Aggressive expansion plans announced by local competitors<br />

Notes:<br />

1 Estimates based on industry sources <strong>and</strong> press releases of local carriers<br />

23