Content - Singapore Customs

Content - Singapore Customs

Content - Singapore Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

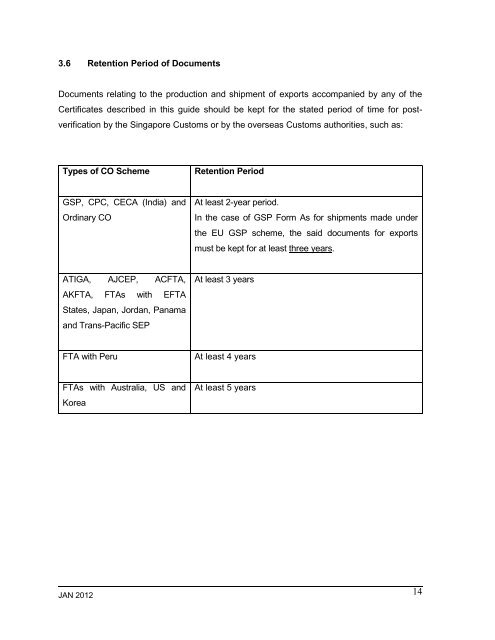

3.6 Retention Period of Documents<br />

Documents relating to the production and shipment of exports accompanied by any of the<br />

Certificates described in this guide should be kept for the stated period of time for postverification<br />

by the <strong>Singapore</strong> <strong>Customs</strong> or by the overseas <strong>Customs</strong> authorities, such as:<br />

Types of CO Scheme<br />

Retention Period<br />

GSP, CPC, CECA (India) and<br />

Ordinary CO<br />

At least 2-year period.<br />

In the case of GSP Form As for shipments made under<br />

the EU GSP scheme, the said documents for exports<br />

must be kept for at least three years.<br />

ATIGA, AJCEP, ACFTA,<br />

AKFTA, FTAs with EFTA<br />

States, Japan, Jordan, Panama<br />

and Trans-Pacific SEP<br />

At least 3 years<br />

FTA with Peru<br />

At least 4 years<br />

FTAs with Australia, US and<br />

Korea<br />

At least 5 years<br />

JAN 2012<br />

14