Content - Singapore Customs

Content - Singapore Customs

Content - Singapore Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

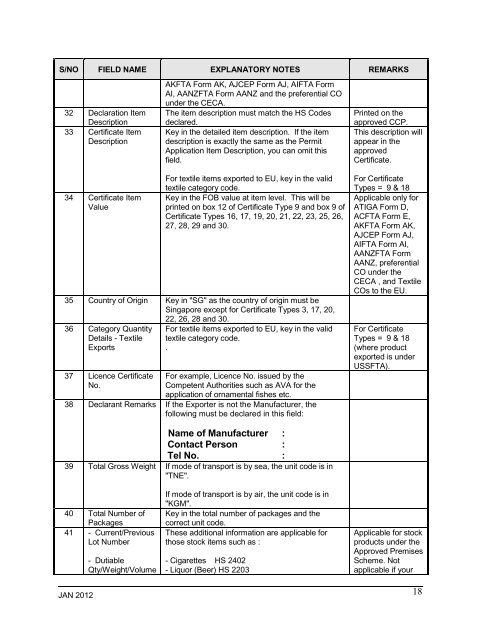

S/NO FIELD NAME EXPLANATORY NOTES REMARKS<br />

32 Declaration Item<br />

Description<br />

33 Certificate Item<br />

Description<br />

AKFTA Form AK, AJCEP Form AJ, AIFTA Form<br />

AI, AANZFTA Form AANZ and the preferential CO<br />

under the CECA.<br />

The item description must match the HS Codes<br />

declared.<br />

Key in the detailed item description. If the item<br />

description is exactly the same as the Permit<br />

Application Item Description, you can omit this<br />

field.<br />

Printed on the<br />

approved CCP.<br />

This description will<br />

appear in the<br />

approved<br />

Certificate.<br />

34 Certificate Item<br />

Value<br />

For textile items exported to EU, key in the valid<br />

textile category code.<br />

Key in the FOB value at item level. This will be<br />

printed on box 12 of Certificate Type 9 and box 9 of<br />

Certificate Types 16, 17, 19, 20, 21, 22, 23, 25, 26,<br />

27, 28, 29 and 30.<br />

35 Country of Origin Key in "SG" as the country of origin must be<br />

<strong>Singapore</strong> except for Certificate Types 3, 17, 20,<br />

22, 26, 28 and 30.<br />

36 Category Quantity<br />

Details - Textile<br />

Exports<br />

37 Licence Certificate<br />

No.<br />

For textile items exported to EU, key in the valid<br />

textile category code.<br />

.<br />

For example, Licence No. issued by the<br />

Competent Authorities such as AVA for the<br />

application of ornamental fishes etc.<br />

38 Declarant Remarks If the Exporter is not the Manufacturer, the<br />

following must be declared in this field:<br />

For Certificate<br />

Types = 9 & 18<br />

Applicable only for<br />

ATIGA Form D,<br />

ACFTA Form E,<br />

AKFTA Form AK,<br />

AJCEP Form AJ,<br />

AIFTA Form AI,<br />

AANZFTA Form<br />

AANZ, preferential<br />

CO under the<br />

CECA , and Textile<br />

COs to the EU.<br />

For Certificate<br />

Types = 9 & 18<br />

(where product<br />

exported is under<br />

USSFTA).<br />

Name of Manufacturer :<br />

Contact Person :<br />

Tel No. :<br />

39 Total Gross Weight If mode of transport is by sea, the unit code is in<br />

"TNE".<br />

40 Total Number of<br />

Packages<br />

41 - Current/Previous<br />

Lot Number<br />

- Dutiable<br />

Qty/Weight/Volume<br />

If mode of transport is by air, the unit code is in<br />

"KGM".<br />

Key in the total number of packages and the<br />

correct unit code.<br />

These additional information are applicable for<br />

those stock items such as :<br />

- Cigarettes HS 2402<br />

- Liquor (Beer) HS 2203<br />

Applicable for stock<br />

products under the<br />

Approved Premises<br />

Scheme. Not<br />

applicable if your<br />

JAN 2012<br />

18