Annual Audit Plan -- FY2005 - Department of the Treasury

Annual Audit Plan -- FY2005 - Department of the Treasury

Annual Audit Plan -- FY2005 - Department of the Treasury

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

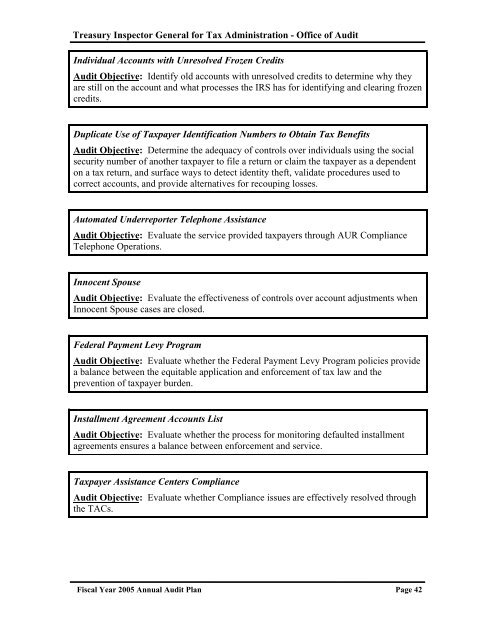

<strong>Treasury</strong> Inspector General for Tax Administration - Office <strong>of</strong> <strong>Audit</strong><br />

Individual Accounts with Unresolved Frozen Credits<br />

<strong>Audit</strong> Objective: Identify old accounts with unresolved credits to determine why <strong>the</strong>y<br />

are still on <strong>the</strong> account and what processes <strong>the</strong> IRS has for identifying and clearing frozen<br />

credits.<br />

Duplicate Use <strong>of</strong> Taxpayer Identification Numbers to Obtain Tax Benefits<br />

<strong>Audit</strong> Objective: Determine <strong>the</strong> adequacy <strong>of</strong> controls over individuals using <strong>the</strong> social<br />

security number <strong>of</strong> ano<strong>the</strong>r taxpayer to file a return or claim <strong>the</strong> taxpayer as a dependent<br />

on a tax return, and surface ways to detect identity <strong>the</strong>ft, validate procedures used to<br />

correct accounts, and provide alternatives for recouping losses.<br />

Automated Underreporter Telephone Assistance<br />

<strong>Audit</strong> Objective: Evaluate <strong>the</strong> service provided taxpayers through AUR Compliance<br />

Telephone Operations.<br />

Innocent Spouse<br />

<strong>Audit</strong> Objective: Evaluate <strong>the</strong> effectiveness <strong>of</strong> controls over account adjustments when<br />

Innocent Spouse cases are closed.<br />

Federal Payment Levy Program<br />

<strong>Audit</strong> Objective: Evaluate whe<strong>the</strong>r <strong>the</strong> Federal Payment Levy Program policies provide<br />

a balance between <strong>the</strong> equitable application and enforcement <strong>of</strong> tax law and <strong>the</strong><br />

prevention <strong>of</strong> taxpayer burden.<br />

Installment Agreement Accounts List<br />

<strong>Audit</strong> Objective: Evaluate whe<strong>the</strong>r <strong>the</strong> process for monitoring defaulted installment<br />

agreements ensures a balance between enforcement and service.<br />

Taxpayer Assistance Centers Compliance<br />

<strong>Audit</strong> Objective: Evaluate whe<strong>the</strong>r Compliance issues are effectively resolved through<br />

<strong>the</strong> TACs.<br />

Fiscal Year 2005 <strong>Annual</strong> <strong>Audit</strong> <strong>Plan</strong> Page 42