Annual Audit Plan -- FY2005 - Department of the Treasury

Annual Audit Plan -- FY2005 - Department of the Treasury

Annual Audit Plan -- FY2005 - Department of the Treasury

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Treasury</strong> Inspector General for Tax Administration - Office <strong>of</strong> <strong>Audit</strong><br />

Appendix XV<br />

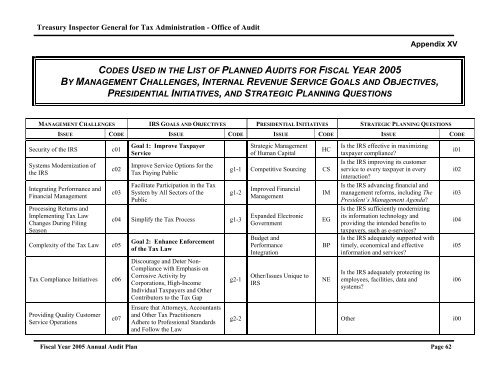

CODES USED IN THE LIST OF PLANNED AUDITS FOR FISCAL YEAR 2005<br />

BY MANAGEMENT CHALLENGES, INTERNAL REVENUE SERVICE GOALS AND OBJECTIVES,<br />

PRESIDENTIAL INITIATIVES, AND STRATEGIC PLANNING QUESTIONS<br />

MANAGEMENT CHALLENGES IRS GOALS AND OBJECTIVES PRESIDENTIAL INITIATIVES STRATEGIC PLANNING QUESTIONS<br />

Security <strong>of</strong> <strong>the</strong> IRS<br />

ISSUE CODE I SSUE CODE ISSUE CODE ISSUE CODE<br />

Systems Modernization <strong>of</strong><br />

<strong>the</strong> IRS<br />

Integrating Performance and<br />

Financial Management<br />

Processing Returns and<br />

Implementing Tax Law<br />

Changes During Filing<br />

Season<br />

Complexity <strong>of</strong> <strong>the</strong> Tax Law<br />

Tax Compliance Initiatives<br />

Providing Quality Customer<br />

Service Operations<br />

c01<br />

c02<br />

c03<br />

Goal 1: Improve Taxpayer<br />

Service<br />

Improve Service Options for <strong>the</strong><br />

Tax Paying Public<br />

Facilitate Participation in <strong>the</strong> Tax<br />

System by All Sectors <strong>of</strong> <strong>the</strong><br />

Public<br />

Strategic Management<br />

<strong>of</strong> Human Capital<br />

HC<br />

g1-1 Competitive Sourcing CS<br />

g1-2<br />

c04 Simplify <strong>the</strong> Tax Process g1-3<br />

c05<br />

c06<br />

c07<br />

Goal 2: Enhance Enforcement<br />

<strong>of</strong> <strong>the</strong> Tax Law<br />

Discourage and Deter Non-<br />

Compliance with Emphasis on<br />

Corrosive Activity by<br />

Corporations, High-Income<br />

Individual Taxpayers and O<strong>the</strong>r<br />

Contributors to <strong>the</strong> Tax Gap<br />

Ensure that Attorneys, Accountants<br />

and O<strong>the</strong>r Tax Practitioners<br />

Adhere to Pr<strong>of</strong>essional Standards<br />

and Follow <strong>the</strong> Law<br />

g2-1<br />

g2-2<br />

Improved Financial<br />

Management<br />

Expanded Electronic<br />

Government<br />

Budget and<br />

Performance<br />

Integration<br />

O<strong>the</strong>r/Issues Unique to<br />

IRS<br />

IM<br />

EG<br />

BP<br />

NE<br />

Is <strong>the</strong> IRS effective in maximizing<br />

taxpayer compliance?<br />

Is <strong>the</strong> IRS improving its customer<br />

service to every taxpayer in every<br />

interaction?<br />

Is <strong>the</strong> IRS advancing financial and<br />

management reforms, including The<br />

President’s Management Agenda?<br />

Is <strong>the</strong> IRS sufficiently modernizing<br />

its information technology and<br />

providing <strong>the</strong> intended benefits to<br />

taxpayers, such as e-services?<br />

Is <strong>the</strong> IRS adequately supported with<br />

timely, economical and effective<br />

information and services?<br />

Is <strong>the</strong> IRS adequately protecting its<br />

employees, facilities, data and<br />

systems?<br />

O<strong>the</strong>r<br />

i01<br />

i02<br />

i03<br />

i04<br />

i05<br />

i06<br />

i00<br />

Fiscal Year 2005 <strong>Annual</strong> <strong>Audit</strong> <strong>Plan</strong> Page 62