Annual Audit Plan -- FY2005 - Department of the Treasury

Annual Audit Plan -- FY2005 - Department of the Treasury

Annual Audit Plan -- FY2005 - Department of the Treasury

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

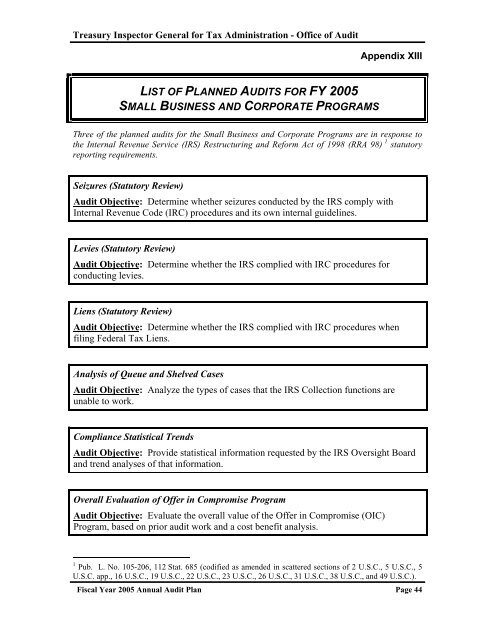

<strong>Treasury</strong> Inspector General for Tax Administration - Office <strong>of</strong> <strong>Audit</strong><br />

Appendix XIII<br />

LIST OF PLANNED AUDITS FOR FY 2005<br />

SMALL BUSINESS AND CORPORATE PROGRAMS<br />

Three <strong>of</strong> <strong>the</strong> planned audits for <strong>the</strong> Small Business and Corporate Programs are in response to<br />

<strong>the</strong> Internal Revenue Service (IRS) Restructuring and Reform Act <strong>of</strong> 1998 (RRA 98) 1 statutory<br />

reporting requirements.<br />

Seizures (Statutory Review)<br />

<strong>Audit</strong> Objective: Determine whe<strong>the</strong>r seizures conducted by <strong>the</strong> IRS comply with<br />

Internal Revenue Code (IRC) procedures and its own internal guidelines.<br />

Levies (Statutory Review)<br />

<strong>Audit</strong> Objective: Determine whe<strong>the</strong>r <strong>the</strong> IRS complied with IRC procedures for<br />

conducting levies.<br />

Liens (Statutory Review)<br />

<strong>Audit</strong> Objective: Determine whe<strong>the</strong>r <strong>the</strong> IRS complied with IRC procedures when<br />

filing Federal Tax Liens.<br />

Analysis <strong>of</strong> Queue and Shelved Cases<br />

<strong>Audit</strong> Objective: Analyze <strong>the</strong> types <strong>of</strong> cases that <strong>the</strong> IRS Collection functions are<br />

unable to work.<br />

Compliance Statistical Trends<br />

<strong>Audit</strong> Objective: Provide statistical information requested by <strong>the</strong> IRS Oversight Board<br />

and trend analyses <strong>of</strong> that information.<br />

Overall Evaluation <strong>of</strong> Offer in Compromise Program<br />

<strong>Audit</strong> Objective: Evaluate <strong>the</strong> overall value <strong>of</strong> <strong>the</strong> Offer in Compromise (OIC)<br />

Program, based on prior audit work and a cost benefit analysis.<br />

1 Pub. L. No. 105-206, 112 Stat. 685 (codified as amended in scattered sections <strong>of</strong> 2 U.S.C., 5 U.S.C., 5<br />

U.S.C. app., 16 U.S.C., 19 U.S.C., 22 U.S.C., 23 U.S.C., 26 U.S.C., 31 U.S.C., 38 U.S.C., and 49 U.S.C.).<br />

Fiscal Year 2005 <strong>Annual</strong> <strong>Audit</strong> <strong>Plan</strong> Page 44