Annual Audit Plan -- FY2005 - Department of the Treasury

Annual Audit Plan -- FY2005 - Department of the Treasury

Annual Audit Plan -- FY2005 - Department of the Treasury

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

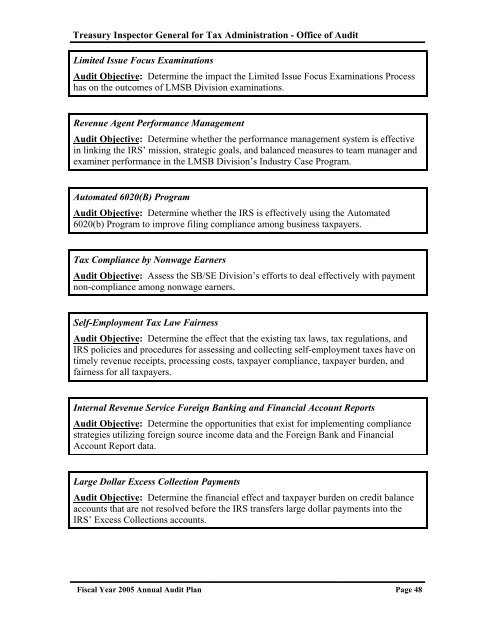

<strong>Treasury</strong> Inspector General for Tax Administration - Office <strong>of</strong> <strong>Audit</strong><br />

Limited Issue Focus Examinations<br />

<strong>Audit</strong> Objective: Determine <strong>the</strong> impact <strong>the</strong> Limited Issue Focus Examinations Process<br />

has on <strong>the</strong> outcomes <strong>of</strong> LMSB Division examinations.<br />

Revenue Agent Performance Management<br />

<strong>Audit</strong> Objective: Determine whe<strong>the</strong>r <strong>the</strong> performance management system is effective<br />

in linking <strong>the</strong> IRS’ mission, strategic goals, and balanced measures to team manager and<br />

examiner performance in <strong>the</strong> LMSB Division’s Industry Case Program.<br />

Automated 6020(B) Program<br />

<strong>Audit</strong> Objective: Determine whe<strong>the</strong>r <strong>the</strong> IRS is effectively using <strong>the</strong> Automated<br />

6020(b) Program to improve filing compliance among business taxpayers.<br />

Tax Compliance by Nonwage Earners<br />

<strong>Audit</strong> Objective: Assess <strong>the</strong> SB/SE Division’s efforts to deal effectively with payment<br />

non-compliance among nonwage earners.<br />

Self-Employment Tax Law Fairness<br />

<strong>Audit</strong> Objective: Determine <strong>the</strong> effect that <strong>the</strong> existing tax laws, tax regulations, and<br />

IRS policies and procedures for assessing and collecting self-employment taxes have on<br />

timely revenue receipts, processing costs, taxpayer compliance, taxpayer burden, and<br />

fairness for all taxpayers.<br />

Internal Revenue Service Foreign Banking and Financial Account Reports<br />

<strong>Audit</strong> Objective: Determine <strong>the</strong> opportunities that exist for implementing compliance<br />

strategies utilizing foreign source income data and <strong>the</strong> Foreign Bank and Financial<br />

Account Report data.<br />

Large Dollar Excess Collection Payments<br />

<strong>Audit</strong> Objective: Determine <strong>the</strong> financial effect and taxpayer burden on credit balance<br />

accounts that are not resolved before <strong>the</strong> IRS transfers large dollar payments into <strong>the</strong><br />

IRS’ Excess Collections accounts.<br />

Fiscal Year 2005 <strong>Annual</strong> <strong>Audit</strong> <strong>Plan</strong> Page 48