Overview of EB Services and Parameters - Unicredit Bank

Overview of EB Services and Parameters - Unicredit Bank

Overview of EB Services and Parameters - Unicredit Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

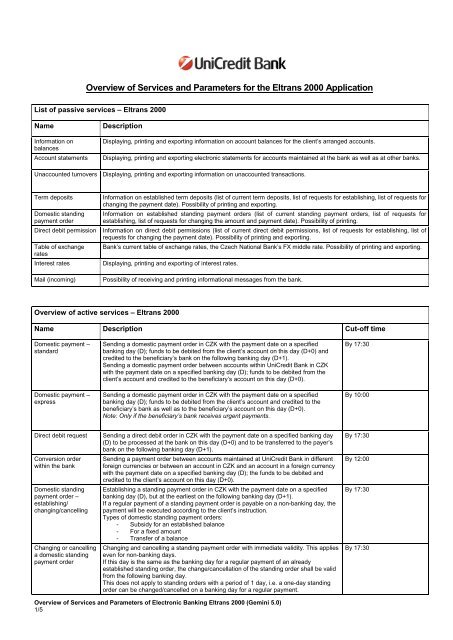

<strong>Overview</strong> <strong>of</strong> <strong>Services</strong> <strong>and</strong> <strong>Parameters</strong> for the Eltrans 2000 Application<br />

List <strong>of</strong> passive services – Eltrans 2000<br />

Name<br />

Information on<br />

balances<br />

Account statements<br />

Description<br />

Displaying, printing <strong>and</strong> exporting information on account balances for the client’s arranged accounts.<br />

Displaying, printing <strong>and</strong> exporting electronic statements for accounts maintained at the bank as well as at other banks.<br />

Unaccounted turnovers Displaying, printing <strong>and</strong> exporting information on unaccounted transactions.<br />

Term deposits<br />

Domestic st<strong>and</strong>ing<br />

payment order<br />

Direct debit permission<br />

Table <strong>of</strong> exchange<br />

rates<br />

Interest rates<br />

Mail (incoming)<br />

Information on established term deposits (list <strong>of</strong> current term deposits, list <strong>of</strong> requests for establishing, list <strong>of</strong> requests for<br />

changing the payment date). Possibility <strong>of</strong> printing <strong>and</strong> exporting.<br />

Information on established st<strong>and</strong>ing payment orders (list <strong>of</strong> current st<strong>and</strong>ing payment orders, list <strong>of</strong> requests for<br />

establishing, list <strong>of</strong> requests for changing the amount <strong>and</strong> payment date). Possibility <strong>of</strong> printing.<br />

Information on direct debit permissions (list <strong>of</strong> current direct debit permissions, list <strong>of</strong> requests for establishing, list <strong>of</strong><br />

requests for changing the payment date). Possibility <strong>of</strong> printing <strong>and</strong> exporting.<br />

<strong>Bank</strong>’s current table <strong>of</strong> exchange rates, the Czech National <strong>Bank</strong>’s FX middle rate. Possibility <strong>of</strong> printing <strong>and</strong> exporting.<br />

Displaying, printing <strong>and</strong> exporting <strong>of</strong> interest rates.<br />

Possibility <strong>of</strong> receiving <strong>and</strong> printing informational messages from the bank.<br />

<strong>Overview</strong> <strong>of</strong> active services – Eltrans 2000<br />

Name Description Cut-<strong>of</strong>f time<br />

Domestic payment –<br />

st<strong>and</strong>ard<br />

Domestic payment –<br />

express<br />

Sending a domestic payment order in CZK with the payment date on a specified<br />

banking day (D); funds to be debited from the client’s account on this day (D+0) <strong>and</strong><br />

credited to the beneficiary’s bank on the following banking day (D+1).<br />

Sending a domestic payment order between accounts within UniCredit <strong>Bank</strong> in CZK<br />

with the payment date on a specified banking day (D); funds to be debited from the<br />

client’s account <strong>and</strong> credited to the beneficiary’s account on this day (D+0).<br />

Sending a domestic payment order in CZK with the payment date on a specified<br />

banking day (D); funds to be debited from the client’s account <strong>and</strong> credited to the<br />

beneficiary’s bank as well as to the beneficiary’s account on this day (D+0).<br />

Note: Only if the beneficiary’s bank receives urgent payments.<br />

By 17:30<br />

By 10:00<br />

Direct debit request<br />

Conversion order<br />

within the bank<br />

Domestic st<strong>and</strong>ing<br />

payment order –<br />

establishing/<br />

changing/cancelling<br />

Changing or cancelling<br />

a domestic st<strong>and</strong>ing<br />

payment order<br />

Sending a direct debit order in CZK with the payment date on a specified banking day<br />

(D) to be processed at the bank on this day (D+0) <strong>and</strong> to be transferred to the payer’s<br />

bank on the following banking day (D+1).<br />

Sending a payment order between accounts maintained at UniCredit <strong>Bank</strong> in different<br />

foreign currencies or between an account in CZK <strong>and</strong> an account in a foreign currency<br />

with the payment date on a specified banking day (D); the funds to be debited <strong>and</strong><br />

credited to the client’s account on this day (D+0).<br />

Establishing a st<strong>and</strong>ing payment order in CZK with the payment date on a specified<br />

banking day (D), but at the earliest on the following banking day (D+1).<br />

If a regular payment <strong>of</strong> a st<strong>and</strong>ing payment order is payable on a non-banking day, the<br />

payment will be executed according to the client’s instruction.<br />

Types <strong>of</strong> domestic st<strong>and</strong>ing payment orders:<br />

- Subsidy for an established balance<br />

- For a fixed amount<br />

- Transfer <strong>of</strong> a balance<br />

Changing <strong>and</strong> cancelling a st<strong>and</strong>ing payment order with immediate validity. This applies<br />

even for non-banking days.<br />

If this day is the same as the banking day for a regular payment <strong>of</strong> an already<br />

established st<strong>and</strong>ing order, the change/cancellation <strong>of</strong> the st<strong>and</strong>ing order shall be valid<br />

from the following banking day.<br />

This does not apply to st<strong>and</strong>ing orders with a period <strong>of</strong> 1 day, i.e. a one-day st<strong>and</strong>ing<br />

order can be changed/cancelled on a banking day for a regular payment.<br />

By 17:30<br />

By 12:00<br />

By 17:30<br />

By 17:30<br />

<strong>Overview</strong> <strong>of</strong> <strong>Services</strong> <strong>and</strong> <strong>Parameters</strong> <strong>of</strong> Electronic <strong>Bank</strong>ing Eltrans 2000 (Gemini 5.0)<br />

1/5

Direct debit permission<br />

– request for<br />

establishment<br />

Cancelling a direct<br />

debit permission<br />

Foreign payment order<br />

SEPA payment order<br />

Term deposit (one-time<br />

or rollover) –<br />

establishing<br />

Rollover term deposit –<br />

changing/cancelling<br />

Structured messages<br />

Mail (outgoing) – nonstructured<br />

messages<br />

Remote signature<br />

Payment cancellation<br />

Request for establishment <strong>of</strong> a direct debit permission with validity from the current<br />

banking day.<br />

If delivered to the bank on a non-banking day, the establishment, change or<br />

cancellation <strong>of</strong> a debit permission shall be valid on the next banking day.<br />

Cancelling a direct debit permission with validity from the current banking day. If<br />

delivered to the bank on a non-banking day, the establishment, change or cancellation<br />

<strong>of</strong> a debit permission shall be valid on the next banking day.<br />

Sending a foreign payment order to the beneficiary’s bank:<br />

a) with an amount in the same currency as the payer’s account currency, i.e. without<br />

conversion;<br />

b) with an amount in a currency other than the payer’s account currency, i.e. with<br />

conversion.<br />

If delivered to the bank on a non-banking day or after 12:00, the payment will be<br />

processed on the next banking day.<br />

Europayment – sending a crossborder payment in EUR up to 50,000, including within<br />

the EU <strong>and</strong> EEA.<br />

Sending a SEPA payment order to a beneficiary’s bank which is able to receive SEPA<br />

payments in EUR with costs assigned as SHA (=SLEV) payable on a specified banking<br />

day (D); funds to be debited from the client’s account on this day (D+0) <strong>and</strong> credited to<br />

the beneficiary’s bank at the latest within three banking days (D+3).<br />

If delivered to the bank on a non-banking day or after 12:00, the payment will be<br />

processed on the next banking day.<br />

Establishing a one-time or rollover term deposit on the client’s deposit account.<br />

If delievered on a non-banking day, it is regarded as an instruction delievered on the<br />

next banking day.<br />

Types <strong>of</strong> term deposits:<br />

- Unchanging – The principal on the account is fixed.<br />

- Savings – The principal is increased by the accumulated interest <strong>and</strong> the agreed<br />

savings amount.<br />

- With allocation <strong>of</strong> earned interest <strong>and</strong> a deposit limit – The interest earned is paid<br />

from the principal increased by the accumulated interest; the principal on the<br />

account shall not fall below the agreed limit.<br />

- Capitalised – The principal is increased by the accumulated interest.<br />

- With allocation <strong>of</strong> earned interest – The interest earned is paid from the principal<br />

increased by the accumulated interest.<br />

- Balance – All funds exceeding the chosen balance are transferred to the principal.<br />

Changing or cancelling an automatic rollover term deposit with validity from the<br />

following period.<br />

Application for a letter <strong>of</strong> credit<br />

Application for drawdown <strong>of</strong> a loan<br />

Application for loan renewal<br />

Application to change a foreign payment order<br />

Instructions for the documentary payments <strong>and</strong> guarantees department<br />

Messages can be used to request the bank to open a current account, establish a term<br />

deposit, give notice <strong>of</strong> a cash withdrawal, confirm orders for executing operations on<br />

financial markets, execute an FX deal, do overnight transactions, etc. We recommend<br />

prior agreement with a bank advisor. Outgoing mail also can be used to send<br />

attachments (e.g. Excel files). The client also can prepare documents in advance <strong>and</strong><br />

send them in the form most suitable for him or her.<br />

Besides the possibility to use the collective signature right, the client also is able to use<br />

the so-called remote signature function – Eltrans2000@Sign. For example, the Eltrans<br />

2000 application user creates payment order <strong>and</strong> confirms it partially. After subsequent<br />

connection with the bank, the order shall appear in the list <strong>of</strong> insufficiently signed orders<br />

in the Eltrans2000@Sign application (internet banking). The Eltrans2000@Sign user<br />

can attach the signature to the document or cancel the document. After the final<br />

signature is attached, the transaction is sent automatically to the banking system for<br />

final processing.<br />

Possibility to cancel a domestic payment in CZK, provided it has not yet been executed<br />

by the bank.<br />

By 17:30<br />

By 12:00<br />

By 12:00<br />

By 17:30<br />

Maturity date: max. 2 banking<br />

days following the current<br />

banking day<br />

By 17:30<br />

Changing <strong>and</strong> cancelling can<br />

be carried out at latest 2<br />

banking days before maturity.<br />

According to the conditions<br />

agreed in the contract<br />

Until the bank executed the<br />

payment<br />

Note: If an active transaction is delivered on a non-banking day or after the terms presented above, the transaction will be processed on the next<br />

banking day.<br />

<strong>Overview</strong> <strong>of</strong> <strong>Services</strong> <strong>and</strong> <strong>Parameters</strong> <strong>of</strong> Electronic <strong>Bank</strong>ing Eltrans 2000 (Gemini 5.0)<br />

2/5

<strong>Overview</strong> <strong>of</strong> parameters – Application Eltrans 2000<br />

Minimum technical<br />

requirements<br />

Hardware:<br />

PC with the following parameters:<br />

• Pentium processor (133 MHz when using access db, 166 MHz when using SQL db) or a comparable processor<br />

from a different producer (minimum requirements for processor performance also depend on the operating system)<br />

• 32 MB RAM (when using access db) or 64 MB RAM (when using SQL db) operating memory (minimum<br />

requirements for size <strong>of</strong> operating memory also depend on the operating system)<br />

• 30 MB <strong>of</strong> hard disk space for Eltrans 2000<br />

• CD–ROM (for installation)<br />

• Colour monitor with a resolution <strong>of</strong> 800x600 pixels (at least 1024x768 recommended), keyboard, mouse<br />

• Connected printer (for printing statements <strong>and</strong> other outputs)<br />

• Modem or network card<br />

S<strong>of</strong>tware:<br />

The following operating systems:<br />

• MS Windows 98, 98SE, Windows NT 4.0 (SP 6A), Windows 2000 (SP3 <strong>and</strong> SP4), Windows ME, Windows XP,<br />

Windows Vista<br />

• Windows NT 4.0 Terminal Server (only in combination with MS SQL Server)<br />

• Windows 2000 Server/Terminal <strong>Services</strong> (only in combination with MS SQL Server)<br />

• Windows 2003 Server/Terminal <strong>Services</strong> (only in combination with MS SQL Server)<br />

• Internet Explorer 5.5 or higher (IE6 or IE7 recommended)<br />

• TCP/IP protocol installed<br />

• Other important components are included in the application installation package.<br />

Data transfer:<br />

For executing the transfer<br />

through an analogue telephone line:<br />

• one free serial port (COM 1, COM 2, ..., COM8)<br />

• modem on the PC on which the programme will be installed (AT compatible, min. 2400 bps, error correction<br />

according to V.42 or MNP4 specification)<br />

• cable for connecting the modem <strong>and</strong> the free communication port on the PC<br />

• cable for connecting the modem to the telephone line<br />

through an ISDN line:<br />

• ISDN end-user equipment – It is necessary to verify whether the CAPI 2.0 driver is available for the given operating<br />

system <strong>and</strong> whether the equipment supports this st<strong>and</strong>ard.<br />

• cable for connecting the ISDN end-user equipment <strong>and</strong> the line<br />

through TCP/IP protocol:<br />

This type <strong>of</strong> communication uses the internet as a communication medium. Communication proceeds directly to a<br />

specific IP address <strong>and</strong> the bank’s server port.<br />

through HTTP protocol:<br />

This type <strong>of</strong> communication uses the internet as a communication medium. Unlike TCP/IP, it enables quick setup <strong>of</strong> the<br />

connection to the banking system (it is not necessary to authorise a specific IP address <strong>and</strong> the bank’s server port, thus<br />

avoiding complicated setup on the client’s server).<br />

System security<br />

Export/import<br />

The extent <strong>of</strong> users’ authorisation to work in the Eltrans system is precisely defined by the client’s administrator. During<br />

transfer, data are protected by special DES/RSA algorithms. Furthermore, the client uses for his or her authorisation<br />

specially created access certificates. This makes it possible to easily identify even multiple users within one company.<br />

(Access certificates may be stored on alternative data storage devices – e.g. USB tokens, chip cards <strong>and</strong> the like.<br />

Before using a token or chip card, we recommend familiarising oneself with the device’s features <strong>and</strong> its proper use in<br />

accordance with the technical documentation provided with the device.) The user may log into Eltrans in three ways –<br />

using a user name <strong>and</strong> password, the digital certificate, or the access password to the internal computer network in the<br />

company (the best method is determined by the company’s administrator).<br />

The <strong>Bank</strong> reserves the right to change the format <strong>of</strong> exported <strong>and</strong> imported data.<br />

<strong>Unicredit</strong> <strong>Bank</strong>’s http://www.unicreditbank.cz<br />

website:<br />

<strong>EB</strong> HelpDesk – elbn@unicreditgroup.cz<br />

email address<br />

Client line Technical support: +420 221 112 241<br />

Processing <strong>of</strong> payment files: +420 221 112 242<br />

<strong>EB</strong> HelpDesk hours <strong>of</strong> 7:00–18:00<br />

operation – banking<br />

days (Mon–Fri)<br />

<strong>Overview</strong> <strong>of</strong> <strong>Services</strong> <strong>and</strong> <strong>Parameters</strong> <strong>of</strong> Electronic <strong>Bank</strong>ing Eltrans 2000 (Gemini 5.0)<br />

3/5

B) OVERVIEW OF SERVICES AND PARAMETERS – ELTRANS@SIGN<br />

<strong>Overview</strong> <strong>of</strong> passive services – ELTRANS@SIGN internet tool<br />

Name<br />

Information on<br />

balances<br />

Account statements<br />

Description<br />

Displaying <strong>and</strong> printing information on the balances on all the client’s arranged accounts.<br />

Displaying, printing <strong>and</strong> exporting electronic statements from accounts maintained at the bank.<br />

Unaccounted turnovers Displaying <strong>and</strong> printing unaccounted turnovers.<br />

Term deposits<br />

Domestic st<strong>and</strong>ing<br />

orders<br />

Direct debit<br />

permissions<br />

Mail (incoming)<br />

Details, history <strong>and</strong> printing <strong>of</strong> information on established term deposits.<br />

Details, history <strong>and</strong> printing <strong>of</strong> information on established st<strong>and</strong>ing orders.<br />

Details, history <strong>and</strong> printing <strong>of</strong> information on direct debit permissions.<br />

Possibility <strong>of</strong> receiving informational messages from the bank.<br />

<strong>Overview</strong> <strong>of</strong> active services – ELTRANS@SIGN internet tool<br />

Name Description Limit<br />

Remote signature<br />

The Eltrans 2000 application user creates a payment file (containing payment<br />

instructions) <strong>and</strong> attaches the first signature to it. After being sent to the bank’s<br />

server, the file will appear in the list <strong>of</strong> partially signed documents in the<br />

Eltrans@Sign system (internet tool for additional signature <strong>of</strong> Eltrans 2000 files). In<br />

this list, the Eltrans@Sign user is able to examine <strong>and</strong> cancel the document as well<br />

as to attach the signature. After the final signature is attached, the transaction is sent<br />

automatically to the banking system for final processing.<br />

The number <strong>and</strong> combination <strong>of</strong><br />

signatures <strong>of</strong> the collective<br />

signature right may be defined<br />

within the order to set up<br />

signature rights in the Eltrans<br />

2000 application .<br />

<strong>Overview</strong> <strong>of</strong> <strong>Services</strong> <strong>and</strong> <strong>Parameters</strong> <strong>of</strong> Electronic <strong>Bank</strong>ing Eltrans 2000 (Gemini 5.0)<br />

4/5

<strong>Overview</strong> <strong>of</strong> parameters – ELTRANS@SIGN internet tool<br />

Minimum technical<br />

requirements<br />

Hardware:<br />

PC with the following parameters:<br />

• 486 processor or a comparable processor from a different producer (minimum requirements for processor<br />

performance depend also on the operating system)<br />

• 32 MB RAM operating memory (minimum requirements for size <strong>of</strong> operating memory depend also on the operating<br />

system)<br />

• Hard disk space – See operating system requirements.<br />

• Colour monitor with a resolution <strong>of</strong> 1024x768 pixels, keyboard, mouse<br />

• Connected printer (for printing statements, balances <strong>and</strong> other outputs)<br />

• Modem or network card<br />

System security<br />

<strong>Unicredit</strong> <strong>Bank</strong>’s<br />

website:<br />

<strong>EB</strong> HelpDesk –<br />

email address<br />

S<strong>of</strong>tware:<br />

The following operating systems:<br />

• MS Windows 98, 98SE, Windows NT 4.0, Windows 2000, Windows ME, Windows XP, Windows Vista<br />

• Windows NT 4.0 Terminal Server<br />

• Windows 2000 Server/Terminal <strong>Services</strong><br />

• Windows 2003 Server/Terminal <strong>Services</strong><br />

• Internet Explorer 5.0 or higher<br />

• Micros<strong>of</strong>t Virtual machine version 3810 or Java Runtime Environment from Sun Microsystems version 1.5 or 1.6<br />

Note: By using Java Sun, Eltrans@Sign can also be operated on some alternative browsers supporting the HTML 4.0<br />

st<strong>and</strong>ard (such as Firefox <strong>and</strong> Opera) <strong>and</strong> alternative operating systems (Mac OS <strong>and</strong> Linux – in this case,<br />

however, the bank does not provide full technical support).<br />

Data transfer:<br />

• Internet connection with SSL-enabled communication<br />

The account owner specifies in writing the access <strong>and</strong> signature rights to individual accounts for individual users. To use<br />

Eltrans@Sign, it is necessary to obtain from UniCredit <strong>Bank</strong> by means <strong>of</strong> the registration authority two certificates – an<br />

“SSL certificate” for verifying access, or the user’s identity, <strong>and</strong> a “signature certificate” for confirming transactions sent<br />

to the bank. The user has the possibility to store the certificates on alternative storage devices, e.g. USB tokens, chip<br />

cards <strong>and</strong> the like. The solution is proposed such that any type <strong>of</strong> device fulfilling security st<strong>and</strong>ard PKCS#11 can be<br />

used. Before using a token or chip card, we recommend familiarising oneself with the device’s features <strong>and</strong> its proper<br />

use in accordance with the technical documentation provided with the device. The user name <strong>and</strong> password for<br />

accessing the application comprise another integral feature <strong>of</strong> the system’s security. If 3 consecutive or 10 total failed<br />

attempts at identification are made, the application will be blocked.<br />

http://www.unicreditbank.cz<br />

elbn@unicreditgroup.cz<br />

Client line Technical support: +420 221 112 241<br />

Processing <strong>of</strong> payment files: +420 221 112 242<br />

<strong>EB</strong> HelpDesk hours <strong>of</strong> 7:00–18:00<br />

operation – banking<br />

days (Mon–Fri)<br />

<strong>Overview</strong> <strong>of</strong> <strong>Services</strong> <strong>and</strong> <strong>Parameters</strong> <strong>of</strong> Electronic <strong>Bank</strong>ing Eltrans 2000 (Gemini 5.0)<br />

5/5