latest digital edition of Nordic unquote

latest digital edition of Nordic unquote

latest digital edition of Nordic unquote

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>unquote</strong><br />

expansion<br />

Company<br />

Based in Helsinki, 3 Step IT Group Oy is a service company specialising in the management <strong>of</strong> the<br />

acquisition, use and replacement <strong>of</strong> technology and other fixed assets. The company has operations in<br />

12 countries and has shown strong growth since it was established in 1997.<br />

With approximately 170 employees, 3 Step IT generated net sales <strong>of</strong> €220m in 2009.<br />

People<br />

Antti Kummu worked on the deal for Finnish Industry Investment. Elina Lehtonen is head <strong>of</strong> unit at<br />

Etera Mutual Pension Insurance Company.<br />

Advisers<br />

Equity – KPMG (Financial due diligence); Krogerus (Legal).<br />

buyouts<br />

Leveraged buyouts and buy-ins involving equity investments by formalised private equity investors through the formation <strong>of</strong> a newco based in the<br />

<strong>Nordic</strong> regions.<br />

Accent acquires stake in new aviation group<br />

Transaction<br />

Accent Equity Partners has acquired a 50% stake in Aviator Airport Alliance, a newly formed group <strong>of</strong><br />

<strong>Nordic</strong> aviation service providers.<br />

The value <strong>of</strong> the deal was not disclosed but was reported to be in the investor’s target deal range <strong>of</strong><br />

€5-50m. <strong>Nordic</strong> Aero <strong>of</strong> Sweden and Røros Flyservice and Norport Ground Handling <strong>of</strong> Norway are<br />

the companies forming the group. The Accent Equity 2008 fund provided equity for the transaction.<br />

The deal originated approximately six months ago, when Accent and the Norwegian companies<br />

made contact. Following that, it made an approach to <strong>Nordic</strong> Aero. Accent had both strategic- and<br />

transaction-focused teams working in parallel on the deal and, according to the investor, this transaction<br />

placed high demand on execution.<br />

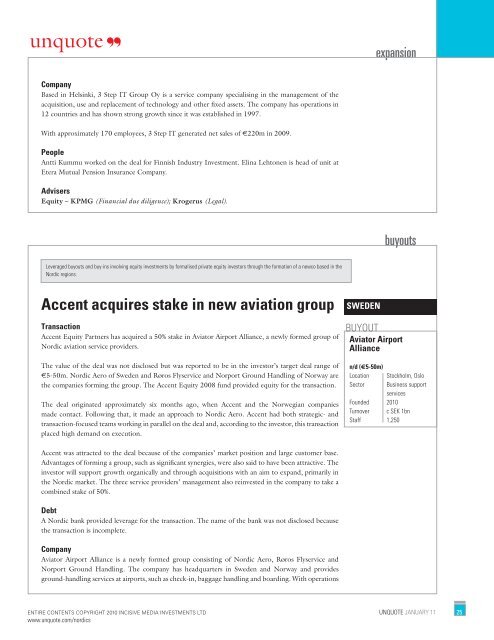

SWEDEN<br />

BUYOUT<br />

Aviator Airport<br />

Alliance<br />

n/d (€5-50m)<br />

Location Stockholm, Oslo<br />

Sector Business support<br />

services<br />

Founded 2010<br />

Turnover c SEK 1bn<br />

Staff 1,250<br />

Accent was attracted to the deal because <strong>of</strong> the companies’ market position and large customer base.<br />

Advantages <strong>of</strong> forming a group, such as significant synergies, were also said to have been attractive. The<br />

investor will support growth organically and through acquisitions with an aim to expand, primarily in<br />

the <strong>Nordic</strong> market. The three service providers’ management also reinvested in the company to take a<br />

combined stake <strong>of</strong> 50%.<br />

Debt<br />

A <strong>Nordic</strong> bank provided leverage for the transaction. The name <strong>of</strong> the bank was not disclosed because<br />

the transaction is incomplete.<br />

Company<br />

Aviator Airport Alliance is a newly formed group consisting <strong>of</strong> <strong>Nordic</strong> Aero, Røros Flyservice and<br />

Norport Ground Handling. The company has headquarters in Sweden and Norway and provides<br />

ground-handling services at airports, such as check-in, baggage handling and boarding. With operations<br />

ENTIRE CONTENTS COPYRIGHT 2010 INCISIVE MEDIA INVESTMENTS LTD UNQUOTE JANUARY 11 25<br />

www.<strong>unquote</strong>.com/nordics