latest digital edition of Nordic unquote

latest digital edition of Nordic unquote

latest digital edition of Nordic unquote

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>unquote</strong><br />

buyouts<br />

Company<br />

Gothenburg-based Björnkläder is a specialised retailer <strong>of</strong> workwear and personal protective equipment<br />

through its Grolls retail store network. Operating 24 stores in Sweden and one in Finland and Estonia,<br />

the company <strong>of</strong>fers a wide range <strong>of</strong> workwear brands in addition to its own brand, Björnkläder. Founded<br />

in 1905, the company employs 185 people and generated revenues <strong>of</strong> approximately SEK 480m and an<br />

operating pr<strong>of</strong>it <strong>of</strong> SEK 26m in the 12 months to 30 October 2010.<br />

People<br />

Lars Verneholt, Ol<strong>of</strong> Cato and Mattias Letmark worked on the deal for Litorina.<br />

Advisers<br />

Equity – Vinge, Johan Winnerblad, Maria-Pia Hope, Johan Johansson, Paul Dali, Johan Mattsson,<br />

Peter Alstergren (Legal); PricewaterhouseCoopers (Financial due diligence); Vadestra (Commercial<br />

due diligence).<br />

Vendor – Handelsbanken (Corporate finance).<br />

Via Venture acquires stake in Miroi<br />

Transaction<br />

Venture capital investor Via Venture Partners has backed the buyout <strong>of</strong> Swedish adult education and<br />

job matching services provider Miroi i-learning AB.<br />

The deal value has not been disclosed, but is believed to be in the region <strong>of</strong> SEK 50m. Via Venture<br />

now owns 70% <strong>of</strong> Miroi i-learning through holding company Miroi AB, with management retaining<br />

a 30% stake. According to the investor, this type <strong>of</strong> deal, where a venture firm backs a small buyout,<br />

is likely to increase in the future. It originated because the company’s management was facing a<br />

generational shift and was looking for a new owner. Avantus Corporate Finance advised Miroi during<br />

the sales process.<br />

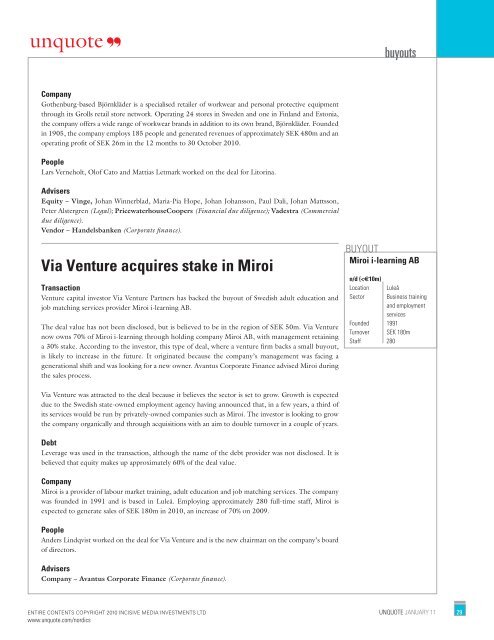

BUYOUT<br />

Miroi i-learning AB<br />

n/d (