You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

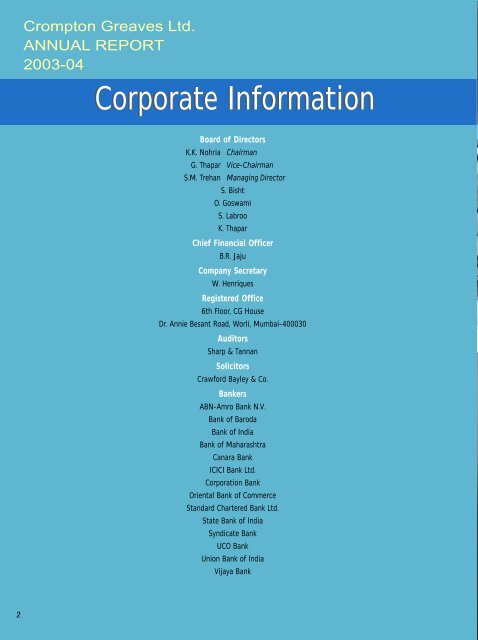

Crompton Greaves Ltd.<br />

ANNUAL REPORT<br />

<strong>2003</strong>-04<br />

Corporate Information<br />

Board of Directors<br />

K.K. Nohria Chairman<br />

G. Thapar Vice-Chairman<br />

S.M. Trehan Managing Director<br />

S. Bisht<br />

O. Goswami<br />

S. Labroo<br />

K. Thapar<br />

Chief Financial Officer<br />

B.R. Jaju<br />

Company Secretary<br />

W. Henriques<br />

Registered Office<br />

6th Floor, CG House<br />

Dr. Annie Besant Road, Worli, Mumbai-400030<br />

Auditors<br />

Sharp & Tannan<br />

Solicitors<br />

Crawford Bayley & Co.<br />

Bankers<br />

ABN-Amro Bank N.V.<br />

Bank of Baroda<br />

Bank of India<br />

Bank of Maharashtra<br />

Canara Bank<br />

ICICI Bank Ltd.<br />

Corporation Bank<br />

Oriental Bank of Commerce<br />

Standard Chartered Bank Ltd.<br />

State Bank of India<br />

Syndicate Bank<br />

UCO Bank<br />

Union Bank of India<br />

Vijaya Bank<br />

2

Crompton Greaves Limited (CG), a BM THAPAR Group Company, is one<br />

of India's largest private sector enterprises engaged in the manufacture<br />

and marketing of electrical engineering products.<br />

Products<br />

CG <strong>com</strong>prises four principal businesses: Power<br />

Systems, Industrial Systems, Consumer Products<br />

and Digital. Nearly two-third of its turnover<br />

accrues from product lines in which it enjoys a<br />

leadership position. CG is a single-point source<br />

for a variety of electric equipment and<br />

products. It addresses all the segments of the<br />

power industry from <strong>com</strong>plex industrial<br />

solutions to basic household requirements. Its<br />

product lines include:<br />

Power Systems<br />

Transformers, Switchgear and Engineering<br />

Projects.<br />

Industrial Systems<br />

Motors, Alternators and Rail Transportation.<br />

Consumer Products<br />

Fans, Luminaires, Light Sources and Pumps.<br />

Digital<br />

Tele<strong>com</strong> Equipments.<br />

Ownership<br />

CG is a part of the BM Thapar Group.<br />

Incorporated in 1937, CG is headquartered in a<br />

self-owned landmark building at Worli,<br />

Mumbai. As of 31st March, <strong>2004</strong>, 52.44 per<br />

cent of CG’s shareholding was owned by the<br />

promoters (the BM Thapar Group holds 38.69<br />

per cent shareholding; 13.75 per cent is held by<br />

the foreign promoter). The balance<br />

shareholding is broadly distributed between<br />

mutual funds, institutional investors, bodies<br />

corporate and general public.<br />

Plants<br />

CG’s manufacturing infrastructure covers 20<br />

facilities across five states viz: Goa, Gujarat,<br />

Karnataka, Maharashtra and Madhya Pradesh.<br />

Presence<br />

CG is the Indian market leader across a number<br />

of product groups in the electrical engineering<br />

sector. It enjoys an export presence across more<br />

than 60 countries, which includes the emerging<br />

South-East Asian and Latin American markets.<br />

3

Milestones <strong>2003</strong>-04<br />

1<br />

An 8 per cent increase in the<br />

turnover from Rs. 1726.39<br />

crores in 2002-03 to<br />

Rs. 1861.05 crores in <strong>2003</strong>-<br />

04. After discounting the<br />

de-growth in the Digital<br />

segment and the revenues<br />

from the Industrial<br />

Electronics, Capacitor and<br />

Informatics Divisions, whose<br />

operations were suspended<br />

last year, the effective growth<br />

is 13 per cent.<br />

3 5 7<br />

A 151 per cent increase in the<br />

profit after tax from<br />

Rs. 28.17 crores in 2002-03 to<br />

Rs. 70.83 crores in <strong>2003</strong>-04.<br />

A reduction in borrowings by<br />

27 per cent, from Rs. 459<br />

crores in 2002-03 to Rs. 334<br />

crores in <strong>2003</strong>-04.<br />

Long term debt rating of<br />

A+(Ind), assigned by FITCH<br />

Ratings India; indicating<br />

adequate credit quality and<br />

timely repayment capacity.<br />

A 170 per cent increase in A significant reduction in the<br />

Profit before Exceptional interest liability by 40 per<br />

Items and Tax from Rs. 31 cent, from Rs. 64.43 crores in<br />

crores in 2002-03 to Rs. 83.69 2002-03 to Rs. 38.48 crores in<br />

crores in <strong>2003</strong>-04.<br />

<strong>2003</strong>-04.<br />

2 4<br />

Upgradation of CG’s credit<br />

rating from F1 to F1+ by<br />

FITCH Ratings India, in respect<br />

of its <strong>com</strong>mercial paper/short<br />

term debt programme. This<br />

rating is the highest credit<br />

rating that can be assigned to<br />

this category of instrument.<br />

6<br />

An increase in the EBIDTA<br />

return on capital employed:<br />

from 22.7 per cent in 2002-03<br />

to 27 per cent in <strong>2003</strong>-04.<br />

8<br />

4

9<br />

Earnings per share improved<br />

from Rs. 5.38 per share to<br />

Rs.13.52 per share.<br />

11 13<br />

The market capitalisation as An increase in the<br />

on 31st March, <strong>2004</strong> was<br />

Rs. 807 crores, an increase of<br />

200 per cent over the previous<br />

year.<br />

Unexecuted Order Book from<br />

Rs. 691 crores at the close of<br />

2002-03 to Rs. 842 crores at<br />

the close of <strong>2003</strong>-04.<br />

15<br />

Profit before Interest and Tax<br />

of the Industrial Systems<br />

Group and Consumer<br />

Products Group increased by<br />

75 per cent to Rs. 40.80 crores<br />

and by 25 per cent Rs. 53.62<br />

crores respectively in<br />

<strong>2003</strong>-04.<br />

17<br />

The Fans and Lighting<br />

business acquired Superbrand<br />

status, a Unique Recognition<br />

amongst the country’s 134<br />

selected brands by<br />

Superbrands, UK.<br />

CG declared a dividend of<br />

Rs. 7/- per share in <strong>2003</strong>-04<br />

Increase in share price from<br />

Rs. 51.40 as on 31st March,<br />

(<strong>com</strong>prising an interim <strong>2003</strong> to Rs. 154.05 as on 31st<br />

dividend of Rs. 3/- and a final March, <strong>2004</strong> on the Mumbai<br />

dividend of Rs. 4/- per share).<br />

Stock Exchange.<br />

10 12<br />

An increase in order input<br />

from Rs. 1779 crores in 2002-<br />

03 to Rs. 2120 crores in <strong>2003</strong>-<br />

04.<br />

14<br />

Exports of the Industrial<br />

Systems Group increased<br />

from Rs. 16.45 crores in 2002-<br />

03 to Rs. 24.23 crores in<br />

<strong>2003</strong>-04, an increase of 47<br />

per cent.<br />

16<br />

CG has successfully<br />

established manufacturing<br />

facilities for 145 kV Gas<br />

Insulated Switchgear in<br />

collaboration with Hyundai,<br />

Korea. The development and<br />

subsequent testing of a<br />

prototype of 145 kV, 40 kA,<br />

2000A double bus<br />

transmission line feeder bay is<br />

in progress. The Industrial<br />

Transformer Division at<br />

Malanpur established a<br />

unified system, incorporating<br />

ISO 14001 and OHSAS 18001,<br />

making it one of the few Units<br />

in India to achieve this<br />

distinction.<br />

18<br />

5

Performance<br />

8 per cent turnover growth<br />

13 per cent core sector growth<br />

170 per cent increase in profit before<br />

exceptional items and tax<br />

151 per cent increase in the profit after tax<br />

151 per cent improvement in earnings per share<br />

70 per cent dividend for the year<br />

6

Enablers<br />

The enablers for this performance, were the<br />

consistent initiatives taken by CG in the<br />

following areas:<br />

✜ Launching business-enhancing products and<br />

services<br />

✜ Diversifying product portfolio<br />

✜ Sharpening technology insight to make<br />

products reliable, value-added and low cost<br />

✜ Investing in a quality reputation<br />

✜ Stringent fiscal management<br />

✜ Nurturing its human capital<br />

✜ Improving its manufacturing facilities<br />

✜ Deepening its distribution network<br />

✜ Achieving market leadership in major product<br />

segments<br />

✜ Leveraging its Strong Brand Equity<br />

✜ Encouraging professionalism in management<br />

and attitude<br />

The above drivers are elements of the long-term<br />

strategy for growth, evolved by CG, the initial<br />

impact of which is already reflected in the<br />

performance of the year.<br />

7

New revenue<br />

streams<br />

An ability to provide valueenhancing<br />

products and<br />

services is the most potent<br />

revenue driver for a<br />

<strong>com</strong>pany’s growth,<br />

translating into enhanced<br />

realisations and margins.<br />

8

An increasing proportion of prospective sales of CG are likely to be brand-driven.<br />

With this objective, CG continues its efforts at prudent de-risking through a predominant<br />

focus on its core <strong>com</strong>petence, the electrical engineering sector and<br />

attaining a respectable international presence.<br />

CG has shown preparedness in meeting evolving customer expectations through its<br />

initiatives of continuous product creation, product upgradation and new markets.<br />

CG has translated this into a number of business-strengthening actions:<br />

❐<br />

❐<br />

❐<br />

❐<br />

❐<br />

❐<br />

❐<br />

In-house R&D efforts, supplemented by technological tie-ups and consultancy<br />

arrangements for product and process upgradation<br />

An accelerated launch of new products representing new conveniences<br />

Shift in client focus from electricity boards to private sector utilities and<br />

corporates<br />

Re-direction of efforts of the Power Systems Group towards the spares, servicing<br />

and refurbishing business, which returned higher margins<br />

Co-branding products with international manufacturers for exports<br />

Endorsing processes and practices through confidence-enhancing international<br />

certifications<br />

Widening reach across countries and deepening reach within existing economies<br />

In <strong>2003</strong>-04, the Company created 44 new products and significant variants of its<br />

existing products. This supplemented the Company’s revenues during the year and<br />

will be an avenue for future growth.<br />

CG achieved breakthrough performance in the exports of Switchgear in the European<br />

and Far East markets against stiff <strong>com</strong>petition from international <strong>com</strong>panies. A wider<br />

international footprint will help the Company reduce its dependence on the fortunes<br />

of a handful of economies. It will also help the Company leverage the evolving<br />

standards in specialised markets, towards better products and superior services.<br />

9

Investing in a<br />

reputation for quality<br />

As countries and International<br />

<strong>com</strong>panies be<strong>com</strong>e increasingly<br />

sensitive about product quality,<br />

only those <strong>com</strong>panies that can<br />

demonstrate their <strong>com</strong>mitment<br />

to quality stand to attract<br />

large and profitable contracts.<br />

10

Aquality trustmark has emerged as CG’s biggest brand ambassador. This is<br />

reflected through quality certifications for its products and services.<br />

CG strengthened its quality <strong>com</strong>mitment through the following initiatives:<br />

✦<br />

✦<br />

✦<br />

✦<br />

✦<br />

✦<br />

Product approvals from KEMA (Netherlands), NEMA (USA), BASEEFA (UK), CESI<br />

(Italy), DOE (Department of Energy, USA), CPRI (India) and conformity to ANSI,<br />

CEMEP and IEEMA standards for its export market<br />

Integration of the Six Sigma methodology in its manufacturing processes, with<br />

the ultimate objective of achieving "Product Quality As Perceived By Customer"<br />

for 10 of the Company’s products which has resulted in a manifold improvement<br />

in the Critical to Quality (CTQ) parameters, with a substantial reduction in<br />

defects. This methodology will be extended to other products of the Company in<br />

the ensuing year<br />

ISO 9001:2000 certification for 22 out of the Company’s 26 divisions/regions<br />

ISO 14001 certification for Environment Management Systems for five divisions<br />

The Industrial Transformer Division at Malanpur is amongst the few units in India<br />

to have achieved both ISO 14001 and OHSAS 18001 (Certification for<br />

Occupational Health and Safety Management System)<br />

The Company’s Lighting Division is one of the few business units in India’s<br />

lighting industry to achieve dual certifications of ISO 9001:2000 and ISO 14001<br />

11

Stringent fiscal<br />

management<br />

In a continuously dynamic<br />

business environment, the<br />

more efficient <strong>com</strong>panies<br />

progressively limit offtake of<br />

borrowed funds and there is a<br />

shift in emphasis from funds<br />

mobilisation to holistic fund<br />

management.<br />

12

Prudent fiscal management is central to CG’s strategic intent. This direction has been<br />

achieved by a progressive reduction of the capital required to sustain the business and<br />

an ongoing liquidation and substitution of high cost funds with low cost alternatives and<br />

judicious funds management.<br />

FISCAL MANAGEMENT ACHIEVEMENTS, <strong>2003</strong>-04<br />

✜ Upgradation to the highest credit rating of F1+ from F1, awarded by FITCH<br />

Ratings India, in respect of its <strong>com</strong>mercial paper/short term debt instruments<br />

programme, for a higher quantum of Rs. 40 crores, as <strong>com</strong>pared with Rs. 30<br />

crores last year<br />

✜<br />

Long-term debt rating of A+(Ind), assigned by FITCH Ratings India; indicating<br />

adequate credit quality and timely repayment capacity<br />

✜ Borrowings declined by 27 per cent from Rs. 459 crores in 2002-03 to Rs. 334<br />

crores in <strong>2003</strong>-04<br />

✜<br />

Interest outflow significantly reduced by 40 per cent from Rs. 64.43 crores to Rs.<br />

38.48 crores<br />

✜ Debt-equity ratio strengthened from 1.6 to 1.0<br />

✜<br />

✜<br />

✜<br />

Gain on forex transactions of Rs. 6 crores, through an intelligent management of<br />

forex exposure through various instruments<br />

An improvement in the ROCE from 13.5 per cent in 2002-03 to 18.7 per cent in<br />

<strong>2003</strong>-04<br />

An improvement in the turnover: capital employed ratio from 2.11 in 2002-03 to<br />

2.50 in <strong>2003</strong>-04<br />

13

Businessstrengthening<br />

R&D<br />

R&D forms the foundation<br />

of product innovation and<br />

is the essential requirement<br />

for a modernised and<br />

diversified product<br />

portfolio.<br />

14

Aconsistent research-directed growth has been an ongoing feature of CG’s business over<br />

the last number of years, resulting in the absorption of world-class technologies<br />

leading to advanced product development. A management structure that provides for<br />

technology development at the corporate and divisional levels and progressive investment<br />

in R&D have strengthened CG’s research initiative.<br />

A collaborative working of divisional technologists and corporate analysts translated into<br />

the development of several new products. For instance, in <strong>2003</strong>-04, CG developed 15 new<br />

products in the Power Systems segment, 12 in the Industrial Systems segment, 15 in the<br />

Consumer Products segment and two in the Digital segment.<br />

PIONEERING PRODUCTS COMMERCIALISED DURING <strong>2003</strong>-04<br />

✦ The only Indian Company to introduce the Polymer concrete product line in the areas<br />

of Outdoor and Indoor Polycrete Encapsulated Vacuum Interrupters and various ratings<br />

of Outdoor Vacuum Circuit Breakers with Polycrete Vacuum Interrupter poles<br />

✦<br />

✦<br />

✦<br />

✦<br />

✦<br />

Hermetically sealed distribution transformers with corrugated tank construction<br />

NEMA range of Motors for North American markets<br />

Flameproof Gas Group IIC Motors<br />

Trailable version of Electric Point Machine for traction application<br />

In addition to the above, a 420 kV Composite Insulator housed Current Transformer<br />

and Capacitor Voltage Transformer, the first of its kind in India, is undergoing various<br />

tests for future <strong>com</strong>mercialisation<br />

15

Economic<br />

Value Added (EVA)<br />

Crompton Greaves Limited reported a positive EVA of Rs. 19.86 crores for <strong>2003</strong>-04,<br />

an upward move with 67.88 per cent growth over 2002-03. This amply demonstrates<br />

that the Company enhanced value for its shareholders.<br />

The EVA is an internationally accepted value measurement tool. EVA measures the<br />

profitability of a <strong>com</strong>pany after taking into account the cost of capital. It represents<br />

the value added to shareholders by generation of operating profits (total pool of<br />

profits) in excess of the cost of capital employed in the business.<br />

25<br />

20<br />

15<br />

11.83<br />

12<br />

19.86<br />

10.18%<br />

10<br />

10<br />

8<br />

Rs. Crores<br />

5<br />

0<br />

-5<br />

3.70%<br />

6<br />

4<br />

Percentage<br />

-10<br />

-15<br />

(14.51)<br />

2<br />

-20<br />

0.50%<br />

0<br />

2002<br />

<strong>2003</strong><br />

<strong>2004</strong><br />

EVA (Rs. Crores)<br />

PAT as %age to Average capital employed<br />

16

Economic Value Added Analysis<br />

Year Ended March 31 Unit <strong>2004</strong> <strong>2003</strong> 2002<br />

1 Average capital employed (Rs. in cr) 695.58 761.93 831.11<br />

2 Average debt (Rs. in cr) 396.44 514.97 599.02<br />

3 Avg. debt/ Avg. capital employed 56.99% 67.59% 72.07%<br />

4 Beta variant Number 1.9580 0.9618 1.7142<br />

5 Risk free debt cost 6.00% 6.00% 7.30%<br />

6 Market premium 7.00% 8.00% 8.00%<br />

7 Cost of equity 19.71% 13.69% 21.01%<br />

8 Cost of debt (post tax) 6.22% 7.91% 7.99%<br />

9 Weighted average cost of capital 12.02% 9.79% 11.62%<br />

10 PAT as a percentage to Average capital 10.18% 3.70% 0.50%<br />

employed<br />

11 Economic Value Added (EVA)<br />

Operating profit before tax (Rs. in cr) 122.17 95.43 84.85<br />

Less: Tax (Current and deferred tax) (Rs. in cr) (18.69) (9.03) (2.75)<br />

Less: Cost of capital (Rs. in cr) (83.62) (74.57) (96.61)<br />

Economic Value Added (Rs. in cr) 19.86 11.83 (14.51)<br />

12Enterprise value<br />

Market value of equity (Rs. in cr) 806.84 269.21 240.93<br />

Less: Cash and cash equivalents (Rs. in cr) (76.15) (54.74) (61.20)<br />

Add: Closing debt (Rs. in cr) 333.65 459.22 570.71<br />

Enterprise value (Rs. in cr) 1,064.34 673.69 750.44<br />

13Ratios<br />

EVA as a percentage of Average capital employed 2.85% 1.55% -1.75%<br />

Enterprise value/ Average capital employed Number 1.53 0.88 0.90<br />

® EVA is a registered trademark of Sten Stewart & Co.<br />

The figures above are based on Indian GAAP financial statements.<br />

17

Directors’ Report<br />

To<br />

The Members,<br />

The Directors present their Sixty-seventh Report with the audited accounts for the<br />

year ended 31st March, <strong>2004</strong>.<br />

Operations<br />

Your Company has maintained a steady pace of growth, in its business areas,<br />

validating the effectiveness of its business strategies. The Company recorded a<br />

turnover growth of 8 per cent this year. The profit after tax has increased<br />

significantly by 151 per cent as <strong>com</strong>pared with last year.<br />

Financial Highlights<br />

Particulars 31.03.04 31.03.03 Growth<br />

Rs.crores Rs.crores %<br />

(a) Gross Sales 1861.05 1726.39 8<br />

(b) Less: Excise Duty 149.73 139.37<br />

1711.32 1587.02<br />

(c) Less: Operating Expenses 1553.75 1430.21<br />

(d) Operating Profit 157.57 156.81<br />

(e) Add: Dividend and Other In<strong>com</strong>e 27.02 13.46<br />

(f) Profit before Interest, Depreciation, Amortisation, 184.59 170.27<br />

Exceptional Items and Taxes<br />

(g) Less: Interest 38.48 64.43<br />

(h) Profit before Depreciation, Amortisation, 146.11 105.84<br />

Exceptional Items and Taxes<br />

(i) Less: Depreciation 44.22 45.25<br />

(j) Less: Miscellaneous Expenditure Amortised/ Charged 18.20 29.59<br />

(k) Profit before Exceptional Items and Taxes 83.69 31.00 170<br />

(l) Add: Exceptional Items (Net) 5.83 6.20<br />

(m) Profit Before Tax 89.52 37.20 141<br />

(n) Less: Provision for Current Year Tax 6.76 0.25<br />

(o) Less: Provision for Deferred Tax 11.93 8.78<br />

(p) Profit After Tax<br />

carried to Profit & Loss Account 70.83 28.17 151<br />

(q) Transfer to/from General Reserve -12.17 -2.76<br />

(r) Interim Dividend -15.71 0.00<br />

(s) Final Dividend -20.95 0.00<br />

(t) Corporate Tax on Dividend -4.69 0.00<br />

(u) Balance brought forward from previous year -13.49 -38.90<br />

Balance Carried To Balance Sheet 3.82 -13.49<br />

18

The Profit before Interest and Tax of the respective Business Groups, <strong>com</strong>pared with<br />

last year is given below:<br />

(Rs. Crores)<br />

SBU <strong>2003</strong>-04 2002-03<br />

Power Systems 64.03 63.04<br />

Industrial Systems 40.80 23.37<br />

Consumer Products 53.62 42.95<br />

Digital -10.36 3.65<br />

A detailed review of the operations and performance of each Business Group is<br />

contained in the Management Discussion & Analysis Report, which forms a part of<br />

this Report.<br />

Dividend<br />

The Board of Directors at its Meeting held on 28th October, <strong>2003</strong>, declared an<br />

Interim Dividend of Rs. 3/- per equity share (30 per cent) aggregating to a total<br />

Dividend payout of Rs.15.71 crores; the Record Date for this purpose was 21st<br />

November, <strong>2003</strong> and the Interim Dividend was paid on 24th November, <strong>2003</strong>.<br />

The Board of Directors re<strong>com</strong>mends a Final Dividend of Rs. 4/- per equity share (40<br />

per cent) for the year under review.<br />

Thus the total Dividend for the year amounts to Rs. 7/- per equity share (70 per<br />

cent).<br />

Reserves<br />

During the year, the Company implemented a Scheme of Capital Reduction, pursuant<br />

to which an amount of Rs. 1,52,05,62,049/- out of the Securities Premium Account<br />

was utilised for adjustment of the un-amortised miscellaneous expenditure, deferred<br />

tax asset and carried forward debit balance in the Profit & Loss Account, as on 31st<br />

July, <strong>2003</strong>. The Scheme was approved by the Members at the last Annual General<br />

Meeting held on 22nd July, <strong>2003</strong> and by the Hon’ble High Court of Judicature at<br />

Mumbai by its Order dated 15th September, <strong>2003</strong>.<br />

The Reserves at the beginning of the year were Rs. 389.65 crores. The Reserves at the<br />

end of the year are Rs. 288.11 crores, after making a provision of Rs. 10.27 crores on<br />

account of Deferred Tax Liability.<br />

Directorate<br />

The Life Insurance Corporation of India withdrew its nomination of Mr PC Gupta’s<br />

directorship on the Company’s Board of Directors, consequent to which Mr Gupta<br />

ceased to be a Director with effect from 27th December, <strong>2003</strong>. The Board places on<br />

record its appreciation for the guidance, support and valuable contributions of Mr<br />

Gupta during his tenure as a Director of the Company.<br />

Mr G Thapar was appointed as Vice Chairman of the Company with effect from 27th<br />

January, <strong>2004</strong>. Mr Thapar retires by rotation at the forth<strong>com</strong>ing Annual General<br />

Meeting, and being eligible, offers himself for re-appointment to the Board.<br />

19

Mr S Labroo and Dr O Goswami were appointed as Additional Directors on the<br />

Company’s Board of Directors with effect from 28th October, <strong>2003</strong> and 27th January,<br />

<strong>2004</strong> respectively. They hold office upto the date of the forth<strong>com</strong>ing Annual General<br />

Meeting, and considering that the Company will benefit from their continuance as<br />

Directors, their appointments are being re<strong>com</strong>mended.<br />

In terms of Clause 49 of the Listing Agreement with Stock Exchanges, the details of<br />

the Directors to be re-appointed and appointed are contained in the ac<strong>com</strong>panying<br />

Notice of the forth<strong>com</strong>ing Annual General Meeting.<br />

Research and Development<br />

Sustenance and continuous enhancement of technological <strong>com</strong>petitiveness of our<br />

products and processes forms the basis for our Research and Development (R&D)<br />

activities. This has resulted in development of new products and technologies, many<br />

of which have already been <strong>com</strong>mercialised. During the year, the R&D activities<br />

focused on the development of new products and processes, and, improvement of<br />

reliability, performance and cost effectiveness of present products and processes. Our<br />

continuous investment in R&D has increased the <strong>com</strong>petitive advantage of our<br />

products and technologies in the domestic and international markets. Detailed<br />

information on the new products and processes developed through R&D are<br />

chronicled in the Annexure to this Report.<br />

Subsidiary Companies<br />

CG-PPI Adhesive Products Ltd and CTR Manufacturing Industries Ltd are subsidiaries<br />

of CG Capital & Investments Ltd, which is a 100 per cent subsidiary of the Company.<br />

Hence, in terms of the provisions of the Companies Act, 1956, these <strong>com</strong>panies are<br />

also the Company’s subsidiaries.<br />

The Company has obtained an exemption under Section 212 of the Companies Act,<br />

1956, from annexing to this Report, the Annual Reports of the above three subsidiary<br />

<strong>com</strong>panies for the year ended 31st March, <strong>2004</strong>. However, if any Member of the<br />

Company or its subsidiaries so desires, the Company will make available, the annual<br />

accounts of the subsidiaries to them, on request. The same will also be available for<br />

inspection at the Registered Office of the Company and of its subsidiaries, during<br />

working hours upto the date of the Annual General Meeting.<br />

Consolidation of Accounts<br />

As required by Accounting Standards AS-21 and AS-23 of the Institute of Chartered<br />

Accountants of India, the financial statements of the Company reflecting the<br />

consolidation of the Accounts of the Company, its three Subsidiaries mentioned<br />

above, and six Associate Companies, are annexed to this Report. The Associate<br />

Companies are Brook Crompton Greaves Ltd, CG Lucy Switchgear Ltd, CG Maersk<br />

Information Technologies Pvt Ltd, CG Smith Software Pvt Ltd, International<br />

Components India Ltd and Hitachi CG Motor Engineering Pvt Ltd.<br />

For the purposes of this disclosure, all Joint Venture Companies have been treated as<br />

Associate Companies. These consolidated financial statements conform to the<br />

requirements of both these Accounting Standards.<br />

Conservation of Energy, Technology Absorption and<br />

Foreign Exchange Earnings and Outgo<br />

As required by the Companies (Disclosure of Particulars in the Report of Board of<br />

Directors) Rules, 1988, the relevant data pertaining to conservation of energy,<br />

20

technology absorption and foreign exchange earnings and outgo are given in the<br />

prescribed format as an Annexure to this Report.<br />

Particulars of Employees<br />

The statement of particulars required pursuant to Section 217(2A) of the Companies<br />

Act, 1956 read with the Companies (Particulars of Employees) (Amendment) Rules,<br />

2002, forms a part of this Report. However, as permitted by the Companies Act,<br />

1956, the Report and Accounts are being sent to all Members and other entitled<br />

persons excluding the above Statement. Those interested in obtaining a copy of the<br />

said Statement may write to the Company Secretary at the Registered Office and the<br />

same will be sent by post. The Statement is also available for inspection at the<br />

Registered Office during working hours upto the date of the Annual General Meeting.<br />

Auditors’ Report & Certificate<br />

The Company's explanations to the Auditors' observations in their Report have been<br />

detailed in Notes Nos. 1, 27 and 34(a) in the Notes on Accounts contained in<br />

Schedule B to the Accounts, which forms part of the Annual Report. The Auditors<br />

have also certified the Company’s <strong>com</strong>pliance of the requirements of Corporate<br />

Governance in terms of Clause 49 of the Listing Agreement and the same is enclosed<br />

as an Annexure to the Report on Corporate Governance.<br />

Directors’ Responsibility Statement<br />

The Directors would like to assure the Members that the financial statements for the<br />

year under review conform in their entirety to the requirements of the Companies<br />

Act, 1956.<br />

The Directors confirm that:<br />

♣ the Annual Accounts have been prepared in conformity with the applicable<br />

Accounting Standards;<br />

♣ the Accounting Policies selected and applied on a consistent basis, give a true<br />

and fair view of the affairs of the Company and of the profit for the financial<br />

year;<br />

♣ sufficient care has been taken that adequate accounting records have been<br />

maintained for safeguarding the assets of the Company; and for prevention and<br />

detection of fraud and other irregularities;<br />

♣ the Annual Accounts have been prepared on a going concern basis.<br />

Auditors<br />

The Company's Auditors, Sharp & Tannan, hold office upto the conclusion of the<br />

forth<strong>com</strong>ing Annual General Meeting and, being eligible, are re<strong>com</strong>mended for reappointment<br />

on terms to be negotiated by the Audit Committee of the Board of<br />

Directors. They have furnished the requisite certificate to the effect that their reappointment,<br />

if effected, will be in accordance with Section 224(1B) of the<br />

Companies Act, 1956.<br />

Fixed Deposits<br />

Currently, the Company has discontinued acceptance of fresh deposits and also<br />

renewal of existing deposits. 500 persons had not claimed repayment of their<br />

matured deposits amounting to Rs. 55.70 lacs as at 31st March, <strong>2004</strong>. At the date of<br />

this Report, an amount of Rs. 20.77 lacs therefrom has been claimed and repaid<br />

and/or renewed.<br />

21

Intime Spectrum Registry Limited continue to be the Company’s Registrars for all<br />

matters related to the Company’s Fixed Deposit Scheme. The contact details of Intime<br />

Spectrum are mentioned in the Report on Corporate Governance annexed hereto.<br />

Share Registrar & Transfer Agent<br />

The Company’s share registry function is being looked after by Sharepro Services,<br />

which is a SEBI-registered Registrar & Transfer Agent. The contact details of Sharepro<br />

Services are mentioned in the Report on Corporate Governance annexed hereto.<br />

Investors are requested to address their queries, if any, in this regard, to Sharepro<br />

Services; however, in case of difficulties, they are wel<strong>com</strong>e to contact the Company’s<br />

Investor Services Department, the contact particulars of which are contained in the<br />

ac<strong>com</strong>panying Notice of the forth<strong>com</strong>ing Annual General Meeting.<br />

Health & Safety Policy<br />

The Company accords high priority to the health, safety and environment of its<br />

factories and establishments and has in place a Health & Safety Policy, which<br />

addresses the regulatory requirements and includes preventive measures in respect<br />

thereof. The Company’s Industrial Transformer Division at Malanpur received the<br />

OHSAS 18001 Certification for its occupational health and safety management<br />

system; the Company is planning certification of its other Divisions as well. Safety<br />

awareness programmes are regularly undertaken, which, together with safety audits<br />

and continual safety training form an integral part of the systems and processes<br />

implemented in this area.<br />

Listing Arrangements<br />

After obtaining the approval of the Members at the last Annual General Meeting held<br />

on 22nd July, <strong>2003</strong> and in accordance with the Securities and Exchange Board of<br />

India (Delisting of Securities) Guidelines, <strong>2003</strong>, the Company made an application for<br />

delisting of its shares to Calcutta, Delhi and Madras Stock Exchanges. Delisting from<br />

the Delhi and Madras Stock Exchanges has been approved; the Company’s approval<br />

from the Calcutta Stock Exchange is expected shortly. Hence, the Company’s shares<br />

are effectively listed and traded on the Mumbai and National Stock Exchanges. The<br />

Company’s GDRs are listed on the London Stock Exchange. The payment of listing<br />

fees is up-to-date.<br />

Acknowledgements<br />

The Directors take this opportunity to express their sincere appreciation for the<br />

dedicated service and contributions of the employees towards the stability and<br />

growth of the Company.<br />

The Directors also thank all the members, dealers, customers, suppliers, financial<br />

institutions, bankers and other business associates for their continued support<br />

towards the efficient operations of the Company.<br />

On behalf of the Board of Directors<br />

Mumbai, 26th May, <strong>2004</strong><br />

KK NOHRIA<br />

Chairman<br />

22

Annexure to<br />

Directors’ Report<br />

Under Section 217(1)(e) of the Companies Act, 1956<br />

A. Conservation of Energy<br />

(a) Energy conservation measures taken:<br />

The thrust on energy conservation continued with increasing usage of natural<br />

gas for heating, smart switching for lighting, controlling of air conditioning<br />

loads, and maintenance of power factor upto 0.99.<br />

The typical initiatives taken in changing over to energy efficient<br />

manufacturing processes are:<br />

Introduction of magnetic saver flux unit for canteen and thermopacs<br />

Installation of automatic power factor correction and thyristorised<br />

capacitor control panels<br />

Installation of soft starter for 75 HP <strong>com</strong>pressor motor<br />

Optimisation of hydraulic power packs for machines<br />

(b) Additional investments and proposals, if any, being implemented for<br />

reduction in consumption of energy:<br />

The captive generating unit running on gas procured for Baroda Lamps Works<br />

Division, at an investment of Rs.300 lacs, will be operational in the year<br />

<strong>2004</strong>-05.<br />

(c) Impact of the measures at (a) and (b) for reduction of energy<br />

consumption and consequent impact on the cost of production:<br />

Through better energy efficient manufacturing process and better power<br />

quality management, considerable cost savings have been achieved. This<br />

saving, however, has no appreciable impact on the cost of goods as the<br />

production processes are not energy intensive.<br />

B. Technology Absorption<br />

Research and Development (R&D)<br />

1. Specific areas of significance in which R&D is carried out by the Company<br />

During the year under review, R&D activities were focused on design analysis<br />

and automation, development of new products and processes, and enhancing<br />

reliability and performance of existing products.<br />

2. Benefits derived as a result of the above R&D<br />

New products developed<br />

Power Systems<br />

✜ Advanced static VAR <strong>com</strong>pensator and active harmonic filter (STATCOM)<br />

✜ Upgradation of Cast Resin dry type transformers upto 1600 kVA<br />

✜ 420 kV current transformer and capacitor voltage transformer housed in<br />

<strong>com</strong>posite insulator – first time in India<br />

23

✜<br />

✜<br />

✜<br />

✜<br />

✜<br />

✜<br />

✜<br />

✜<br />

✜<br />

✜<br />

✜<br />

✜<br />

❐<br />

❐<br />

❐<br />

❐<br />

❐<br />

❐<br />

❐<br />

❐<br />

❐<br />

❐<br />

❐<br />

❐<br />

72kV, 145kV and 170kV bushing, type tested at KEMA, Netherlands<br />

230kV inductive voltage transformers and 230kV current transformers<br />

conforming to ANSI standards<br />

Standard voltage transformer for 50 Hz and 60 Hz, type tested at KEMA<br />

Magnetic actuator mechanism for 25kV, single pole, SF6 circuit breaker<br />

Upgradation of spring/spring SF6 gas circuit breaker upto 245 kV, 40 kA,<br />

type tested at CESI-Italy<br />

72.05 kV, 31.5/40 kA, spring/spring SF6 gas circuit breaker, type tested at<br />

KEMA for IEC 62271-100<br />

36 kV outdoor, 12kV and 36 kV indoor, polycrete encapsulated vacuum<br />

interrupter, first time in India<br />

12 kV, 20 kA, 1250 A and 36 kV, 26.3 kA, 2000 A, outdoor vacuum circuit<br />

breakers with polycrete vacuum interrupter poles, type tested for short<br />

circuit tests at CPRI- Bhopal<br />

Range extensions: 12 kV polycrete current transformers – 5 frames, 36 kV<br />

polycrete current transformers – 3 frames<br />

12, 24 and 36 kV polycrete potential transformer<br />

12 kV, indoor and outdoor vacuum contactor<br />

12 kV damping reactor, a power quality product<br />

Industrial Systems<br />

Trailable version of electric point machine for traction application<br />

875 kW, 4 pole, 6.6 kV safety motor with pre-start purging<br />

3400kW, 4 pole, 6.6 kV slip ring motor<br />

Extension of global series energy efficient motors – new frame GD450<br />

Upto 1800 HP, 8 pole, 6.6 kV motors in frame KMR 560 for re-rolling mill<br />

applications<br />

Drip-proof range of low voltage internal slip-ring motors<br />

Special 30 kW DC motor for dynamic breaking resistor application used in<br />

Railways<br />

0.8 PF 3/4 HP single-phase improved efficiency motors for petrol pumps<br />

Improved version of motors for front-loading type washing machines<br />

Pole stampings for windmill generator, segmental and pole stampings for<br />

hydraulic and thermal generators, maximum width of 900 mm<br />

Lightweight and <strong>com</strong>pact 125 to 160 kVA brushless alternators, with<br />

aluminium body construction<br />

Six new signalling relays of different specifications for application in<br />

Railways<br />

24

✦<br />

Consumer Products<br />

Harmonic-free remote control regulator for fan<br />

✦ Ceiling fans - improved version 24" Whirlwind, 48" HS Decora, 48"/56"<br />

Whirlwind Decora, 48" Olga, 48"/56" Cool Breeze<br />

✦ High-speed ceiling fans with metallic shade/lacquer coat, with and<br />

without light – Neptune and Venus<br />

✦ Plastic pedestal/wall fans – 16" Hi-Flo<br />

✦ Decorative, aesthetic and cost effective luminaires for fluorescent lamps<br />

(Mini Lite and Impression)<br />

✦ Street Lights – Die-cast aluminium with better optical control (Citivision)<br />

and staircase optics with better ingress protection (Acceleration)<br />

✦ Landscape Lighting – for junction and garden lighting (Lotus) and post top<br />

lantern with rotational moulded bowl (Orchid)<br />

✦ Flood Lights – <strong>com</strong>pact (Floodlux), economical (Twinlux), hoardings and<br />

area lighting (Profile 1 and Profile 2)<br />

✦ Energy Efficient Luminaires – low voltage 100V (Cromstart Plus), retrofit<br />

gear to switch energy consumption based on need from 250W to 150W<br />

between peak to off-peak hours (Street Smart), long-life energy efficient<br />

VPIT open type fluorescent ballast (Ultra Low Loss)<br />

✦ Reduced glare (Decor) and ultra-slim mirrorlite luminaires (Ecor)<br />

✦ Emergency power packs for fluorescent tubelights<br />

✦ Pumps – MBDL12 (1 HP) 1phase centrifugal moonset with riveted<br />

impellers, CSA approved Mini II; Mini II R - 0.5 HP, cost effective 100 mm<br />

and 78 mm borewell pumps, 150 mm Eco series submersible pumps<br />

✦ 12.5 HP to 30.0 HP submersible moonset pumps for use in open wells<br />

✦ De-watering pumps for solid handling and for effluent treatment plants<br />

✦ 1.5 HP petrol-start-kerosene-run engine pumpset<br />

Digital<br />

• New version 2/34 Mbps Optimux system<br />

• 2 Mbps optical modem that supports single mode and multi-mode optical<br />

fibre with G.703, V.35, V.11 user interfaces for low capacity data<strong>com</strong><br />

networks<br />

New processes implemented<br />

✦<br />

✦<br />

✦<br />

✦<br />

Improved impregnation process cycle for higher productivity of HT motors<br />

Progression tooling for stamping laminations of medium frame motors<br />

Modified heat treatment cycle for steel with high percentage of<br />

phosphorus and silicon using CO/CO 2 environment<br />

Modified coating process of oxide layer for insulation (blueing) of semi<br />

processed steel by using dry steam<br />

25

✦<br />

Automated version of expandable mandrel for smoother boring of stator<br />

core packs, to ensure uniform air gap and stator/rotor concentricity<br />

Technology <strong>com</strong>petence achieved<br />

♣ A novel partial-discharge detection system for performance evaluation of<br />

inverter fed induction motors<br />

♣ Prediction of temperature rise of stator winding for three-phase induction<br />

motor<br />

♣ Design of low noise cooling fans for TEFC induction motors<br />

♣ 3-D modeling of power transformers<br />

♣ Analytical capability for power transformer’s electrical design for 3-D<br />

leakage, field distribution, stray loss control, transient voltage and<br />

circulating current distribution<br />

♣ Analytical capability with solid-edge software to enhance 3-D design<br />

capabilities of switchgear products<br />

♣ Structural design of seismic withstand capability under dynamic<br />

conditions by 3-D FEM on ‘ANSYS’ software for power transformer<br />

♣ Design of point machines with different strokes and load parameters<br />

♣ Design of special low RPM (250-RPM) DC motors in 500/3 frame<br />

♣ Fastec auto-stitch tooling with auto skewing of rotor, using servo motor<br />

and CNC controls for high speed lines<br />

♣ Multi-part tooling for segmental and pole stampings upto width of 900<br />

mm<br />

Patents<br />

During the year the Company filed one patent application. In addition to<br />

this, five applications made in the previous years are pending registration.<br />

3. Future plan of action<br />

In the <strong>com</strong>ing year, the Company’s focus will be on meeting increasing<br />

customer demands for products that are eco-friendly, energy efficient and<br />

with intelligent monitoring and control systems. Development of materials<br />

and processes is another major area of activity to improve product<br />

performance and to enhance productivity. Focus will also be on development<br />

of packages and tools for design and performance prediction to enable faster<br />

response to market requirements.<br />

4. Expenditure on R&D<br />

(Rs. Crores)<br />

31st March, <strong>2004</strong><br />

(a) Capital 2.86<br />

(b) Revenue 13.25<br />

(c) Total (a + b) 16.11<br />

(d) Total R&D expenditure:<br />

• as a percentage of total turnover 0.86 %<br />

• as a percentage of profit before tax 18.00 %<br />

26

Technology absorption, adaptation and innovation<br />

1. Efforts and Benefits<br />

Efforts by the Company’s in-house research and development team and<br />

networking with the various collaborators have resulted in improved design,<br />

development and production of the Company’s indigenous products and<br />

processes and related cost effectiveness. This has led to increased<br />

<strong>com</strong>petitiveness and acceptability in markets, both in India and abroad. New<br />

products on the anvil are intelligent electronic devices for power apparatus,<br />

brushless DC motors for consumer appliances and pumps, wind generators and<br />

dry type distribution transformers.<br />

Import substitution during the year<br />

Indigenisation of imported raw materials viz., HID discharge tubes, fluorescent<br />

power for light sources.<br />

2. Imported Technology<br />

Year of Product Imported Status of<br />

Import from Absorption<br />

2001-2002 Gas Insulated Hyundai Heavy Industries In progress.<br />

Switchgear Co. Ltd., Korea.<br />

C. Foreign Exchange Earnings and Outgo<br />

(a) Activities relating to exports; initiatives taken to increase exports; development<br />

of new export markets for products and services; and export plans:<br />

The Company’s activities and initiatives relating to exports are contained in<br />

the Management Discussion and Analysis Report that forms a part of the<br />

Annual Report.<br />

(b) Total foreign exchange earned and used :<br />

Rs. Crores<br />

Total foreign exchange earned 282.60<br />

Total foreign exchange used 111.80<br />

On behalf of the Board of Directors<br />

Mumbai, 26th May, <strong>2004</strong><br />

KK NOHRIA<br />

Chairman<br />

27

Report on<br />

Corporate Governance<br />

1. Company’s Philosophy on Corporate Governance<br />

Your Company continues to manage its business affairs with integrity,<br />

openness and accountability to the best possible advantage of its shareholders,<br />

whilst simultaneously balancing the interests of its other stakeholders.<br />

As a reinforcement of this <strong>com</strong>mitment, and as a formal expression thereof,<br />

the Company:<br />

♣<br />

♣<br />

has already codified a ‘Rules of Procedure for Management’, which<br />

documents the decision-making levels with respect to areas of importance<br />

in the Company’s day-to-day operations.<br />

is in an advanced stage of finalising a ‘CG Values’ document, which<br />

enshrines the five CG Values of Performance Excellence, Leading Edge<br />

Knowledge, Nurturance, Customer Orientation and Intellectual Honesty.<br />

Every CG employee is expected to practice with sincerity and consistency, the<br />

principles contained in these two documents, as his/her contribution towards<br />

the Company’s journey of good governance.<br />

The Company’s systems are constantly reviewed and enhanced for greater<br />

control, reliability and integration, better product and service quality, cost<br />

efficiencies and information transparency. These endeavours are expected to<br />

lead to higher operational efficiencies and optimise shareholder value in the<br />

long term.<br />

2. Board of Directors<br />

As on 31st March, <strong>2004</strong>, the Board of Directors <strong>com</strong>prised the Managing<br />

Director and six Non-Executive Directors.<br />

During the year, five Board Meetings were held, on 22nd April, <strong>2003</strong>; 22nd<br />

May, <strong>2003</strong>; 22nd July, <strong>2003</strong>; 28th October, <strong>2003</strong> and 27th January, <strong>2004</strong>. The<br />

Company’s last Annual General Meeting was held on 22nd July, <strong>2003</strong>.<br />

The particulars of Directors, their attendance during the financial year <strong>2003</strong>-04<br />

and also other Directorships (including Private Limited Companies, but excluding<br />

28

Alternate Directorships) and Board Committee Representations of Public Limited<br />

Companies are as under:<br />

Name of the Particulars Attendance Other Board<br />

Director Board Last Representations<br />

Meetings AGM Directorships Committees<br />

Mr KK Nohria Non-Executive; 5 ✓ 18 3<br />

Chairman<br />

Independent<br />

Mr G Thapar Indian Promoter Nominee; 5 ✓ 10 6<br />

Vice Chairman<br />

Non-Executive<br />

Mr SM Trehan Executive 5 ✓ 6 1<br />

Managing Director<br />

Mr S Bisht Institutional Nominee; 5 ✕ 2 3<br />

Non-Executive; Independent<br />

Dr O Goswami Non-Executive; 1 NA 4 5<br />

(From 27.01.<strong>2004</strong>) Independent<br />

Mr P C Gupta Institutional Nominee; 4 ✓ NA NA<br />

(Upto 27.12.<strong>2003</strong>) Non-Executive; Independent<br />

Mr S Labroo Non-Executive; 1 NA 13 1<br />

(From 28.10.<strong>2003</strong>) Independent<br />

Mr J Shaw Foreign Promoter Nominee; - NA NA NA<br />

(Upto 22.05.<strong>2003</strong>) Non-Executive<br />

Mr K Thapar Indian Promoter Nominee; 5 ✓ 11 5<br />

Non-Executive<br />

3. Audit Committee<br />

The Audit Committee <strong>com</strong>prises four Independent Non-Executive Directors. After<br />

withdrawal of Mr PC Gupta’s nomination by the Life Insurance Corporation of<br />

India with effect from 27th December, <strong>2003</strong>, Mr S Labroo and Dr O Goswami<br />

were appointed as Members of the Audit Committee at the Board Meeting held<br />

on 27th January, <strong>2004</strong>. Presently, the Committee <strong>com</strong>prises Mr KK Nohria<br />

(Chairman), Mr S Bisht, Dr O Goswami and Mr S Labroo. The Chief Financial<br />

Officer, the Chief of Internal Audit and a representative of the Statutory Auditors<br />

attend the meetings of the Audit Committee. The Company Secretary is Secretary<br />

to the Committee.<br />

During the year, besides the regular review of the financial reporting processes,<br />

financial statements and internal control systems of the Company, the Audit<br />

Committee focussed on the effective implementation of the rating system for the<br />

Company’s Divisions, devised last year and issues arising therefrom. Other areas<br />

for attention were materials consumption analysis, evaluation of the benefits<br />

from e-sourcing, creditors analysis and review of risk exposure in various business<br />

areas. The Committee held regular interactions with external Auditors to benefit<br />

from their professional views on the Company’s Accounts.<br />

During the financial year <strong>2003</strong>-04, four Audit Committee Meetings were held on<br />

22nd May, <strong>2003</strong>, 22nd July, <strong>2003</strong>, 28th October, <strong>2003</strong> and 27th January <strong>2004</strong>.<br />

29

The <strong>com</strong>position and details of attendance of the Audit Committee are as under:<br />

Name of the Status No. of Meetings<br />

Director<br />

attended<br />

Mr KK Nohria Chairman 4<br />

Mr S Bisht Member 3<br />

Dr O Goswami Member NA<br />

(From 27.01.<strong>2004</strong>)<br />

Mr PC Gupta Member 3<br />

(Upto 27.12.<strong>2003</strong>)<br />

Mr S Labroo Member NA<br />

(From 27.01.<strong>2004</strong>)<br />

4. Remuneration Committee & Directors’ Remuneration<br />

Although not mandatory in terms of the Listing Agreement with Stock Exchanges,<br />

the Company has a Remuneration Committee <strong>com</strong>prising three Non-Executive<br />

Directors. After, the withdrawal of Mr PC Gupta’s nomination by the Life<br />

Insurance Corporation of India, Mr G Thapar was appointed as member of the<br />

Remuneration Committee at the Board Meeting held on 26th May, <strong>2004</strong>.<br />

Presently, the Committee <strong>com</strong>prises: Mr KK Nohria (Chairman), Mr S Bisht and Mr<br />

G Thapar.<br />

Although the Listing Agreement requires the Remuneration Committee to only<br />

review the remuneration paid to Executive Directors, the Committee, as part of its<br />

terms of reference, also reviews the remuneration of Senior Executives. During<br />

the financial year, the Committee met on 22nd July, <strong>2003</strong>, at which all the<br />

members were present.<br />

Executive Directors<br />

The Members, at the 65th Annual General Meeting of the Company held on 28th<br />

August, 2002, had approved a remuneration package <strong>com</strong>prising salary and a<br />

basket of perquisites for Mr SM Trehan, Managing Director. In view of the<br />

considerable improvement in the Company’s business operations and financial<br />

position by virtue of Mr Trehan’s notable efforts, the Board of Directors have<br />

proposed a revision to the remuneration package of the Managing Director as<br />

indicated below:<br />

(a) <strong>com</strong>mencing with the year ended 31st March, <strong>2004</strong>, the Managing Director be<br />

entitled to earn performance incentive/<strong>com</strong>mission, subject to a maximum of<br />

six months’ salary;<br />

(b) In addition to the above, an amount of Rs. 30 lacs be paid to the Managing<br />

Director in recognition of his contributions as Managing Director, to the<br />

Company’s financial and operational turnaround; such amount, be treated as<br />

remuneration for the year ended 31st March, <strong>2004</strong>.<br />

The above proposals, approved by the Board of Directors, are being placed before<br />

the Members, at the forth<strong>com</strong>ing Annual General Meeting of the Company.<br />

Performance incentive/<strong>com</strong>mission is a variable <strong>com</strong>ponent of the remuneration<br />

package; the Board of Directors have decided the actual amount for the year.<br />

30

The details of remuneration paid to the Managing Director for the financial year<br />

<strong>2003</strong>-04 is as under:<br />

Salary Perquisites Retirement Performance Others Total<br />

Rs. Rs. Benefits Incentive/ Rs. Rs.<br />

Rs. Commission Rs.<br />

Mr SM Trehan, 48,00,000 7,98,191 12,99,200 24,00,000* 30,00,000* 1,22,97,391<br />

Managing Director<br />

*The remuneration amounts under ‘Performance Incentive/Commission’ and<br />

‘Others’ are subject to Members approval at the 67th Annual General Meeting.<br />

A service contract exists with the Managing Director which contains his service<br />

terms and conditions including remuneration, notice period, severance fees etc, as<br />

approved by the Members.<br />

Non-Executive Directors<br />

The Members, at the 63rd Annual General Meeting of the Company held on 10th<br />

August, 2000, approved payment of <strong>com</strong>mission to Non-Executive Directors not<br />

exceeding 1 per cent of the net profits of the Company per annum, <strong>com</strong>puted in<br />

the manner provided in Section 309(5) of the Companies Act, 1956. In terms of<br />

this approval, the Board of Directors has decided the actual amount of<br />

<strong>com</strong>mission and its distribution amongst the Non-Executive Directors.<br />

With effect from 27th January, <strong>2004</strong>, as permitted by Article 113(2) of the<br />

Company’s Articles of Association read with Notification No. GSR 580(E) dated<br />

24th July, <strong>2003</strong>, issued by the Department of Company Affairs, the sitting fees<br />

paid to Non-Executive Directors were increased to Rs. 20,000/- per Board and<br />

Committee Meeting, in the context of the increasing demands on the time of and<br />

contributions required from Non-Executive Directors.<br />

The details of remuneration paid to the Non-Executive Directors for the financial<br />

year <strong>2003</strong>-04 is as under:<br />

Name of the Director Sitting Fees Commission Total<br />

Rs. Rs. Rs.<br />

Mr KK Nohria 1,00,000 2,25,000 3,25,000<br />

Mr G Thapar 45,000 32,85,000 33,30,000<br />

Mr S Bisht 75,000 2,25,000 3,00,000<br />

Dr O Goswami 20,000 50,000 70,000<br />

(From 27.01.<strong>2004</strong>)<br />

Mr PC Gupta 40,000 1,80,000 2,20,000<br />

(Upto 27.12.<strong>2003</strong>)<br />

Mr S Labroo 5,000 50,000 55,000<br />

(From 28.10.<strong>2003</strong>)<br />

Mr K Thapar 45,000 32,85,000 33,30,000<br />

The apportionment of <strong>com</strong>mission to Mr G Thapar and Mr K Thapar is higher, in<br />

view of their significant additional involvement in Company matters, as <strong>com</strong>pared<br />

to other Non-Executive Directors, in their role as members of the Management<br />

Committee.<br />

The Company presently does not have any Stock Option Plans or Schemes thereunder.<br />

31

5. Shareholders/Investors Grievance Committee<br />

The Committee <strong>com</strong>prises Mr KK Nohria (Chairman) and Mr SM Trehan, Managing<br />

Director. Mr W Henriques, Company Secretary, has been designated by the Board<br />

as the Compliance Officer. The Committee reviews the redressal of shareholders’<br />

and investors’ <strong>com</strong>plaints related to transfers and transmission of shares, nonreceipt<br />

of annual reports, dividends and other share related matters, the<br />

periodicity and effectiveness of the share transfer process, statutory certifications,<br />

depository related issues and activities of the Registrar and Transfer Agent. In<br />

addition to review by this Committee, the Company continues its existing practice<br />

of reporting to the Directors at each Board Meeting, the number and category of<br />

shareholder <strong>com</strong>plaints received and the status of their resolution.<br />

The Company has received six shareholders’ <strong>com</strong>plaints during the financial year,<br />

which were satisfactorily resolved; there are no outstanding <strong>com</strong>plaints or shares<br />

pending transfer as on 31st March, <strong>2004</strong>.<br />

6. General Body Meetings<br />

The details of the last three Annual General Meetings are as under:<br />

Financial Year Location Date Time<br />

2000-2001 Patkar Hall, Mumbai 400 020 24th July, 2001 4.00 p.m.<br />

2001-2002 Patkar Hall, Mumbai 400 020 28th August, 2002 3.30 p.m.<br />

2002-<strong>2003</strong> Patkar Hall, Mumbai 400 020 22nd July, <strong>2003</strong> 3.30 p.m.<br />

Special Resolutions transacted at the last three Annual General Meetings held on:<br />

24th July, 2001<br />

Location of the Register and Index of Members and Debenture Holders and<br />

the other documents mentioned in Section 163 of the Companies Act, 1956,<br />

being shifted from the Company’s Registered Office to any office of a Share<br />

Transfer Agent registered with Securities and Exchange Board of India, within<br />

Mumbai, if appointed.<br />

28th August, 2002<br />

• Re-appointment of Mr SM Trehan as Managing Director for a period of<br />

three years from 3rd May, 2002 to 2nd May, 2005, as per terms and<br />

conditions set out in the Explanatory Statement annexed to the<br />

Resolution.<br />

• Location of the Register and Index of Members and Debenture Holders and<br />

other documents mentioned in Section 163 of the Companies Act, 1956,<br />

at the Company’s Administrative Office situated at Kanjur Marg (East),<br />

Mumbai 400 042, instead of at its Registered Office.<br />

22nd July, <strong>2003</strong><br />

• Amendment of the Company’s Articles of Association to permit utilisation<br />

of Securities Premium Account for any application as permitted by Law<br />

and approval to the Company for implementation of a Scheme of Capital<br />

Reduction by utilising the Securities Premium Account for adjustment of<br />

Miscellaneous Expenditure to the extent not written off or adjusted,<br />

Deferred Tax Asset, and Debit balance in the Profit & Loss Account as at<br />

32

31st March, <strong>2003</strong> and variations thereto upto 31st July, <strong>2003</strong>.<br />

• Voluntary delisting of the Company’s shares from the Calcutta Stock<br />

Exchange Association Limited, Delhi Stock Exchange Association Limited<br />

and Madras Stock Exchange Limited.<br />

No Special Resolutions were implemented through postal ballot during the year<br />

under review, nor are any Resolutions presently proposed.<br />

7. Disclosures<br />

✦<br />

✦<br />

Considering the size and nature of operations, there were no related party<br />

transactions of a materially significant nature in terms of the Listing<br />

Agreement with Stock Exchanges, that may have a potential conflict with the<br />

interests of the Company at large.<br />

The Company has <strong>com</strong>plied with all requirements of the Listing Agreement<br />

with Stock Exchanges as well as the Regulations and Guidelines prescribed by<br />

SEBI. There were no penalties or strictures imposed on the Company by any<br />

statutory authorities for non-<strong>com</strong>pliance on any matter related to capital<br />

markets, during the last three years.<br />

8. Means of Communication<br />

The Company’s quarterly results in the format prescribed by the Stock Exchanges<br />

are approved and taken on record by the Board within the prescribed time frame,<br />

and sent immediately to all Stock Exchanges on which the Company’s shares are<br />

listed. These results are published in leading newspapers – The Economic Times,<br />

Financial Express and Business Standard in English and the Maharashtra Times in<br />

vernacular, and are also uploaded on the Electronic Data Information Filing And<br />

Retrieval System, as required by the Listing Agreement with Stock Exchanges.<br />

Information about the Company in general, its financial results, and other<br />

information including official press releases can be accessed at the Company’s<br />

website www.cglonline.<strong>com</strong>.<br />

Meetings are held with institutional investors and research analysts, as necessary.<br />

The Management Discussion and Analysis Report forms an integral part of the<br />

Annual Report.<br />

9. General Shareholder Information<br />

✜ Annual General Meeting Thursday, 22nd July, <strong>2004</strong> at 3.30 p.m.<br />

Date, time and venue Patkar Hall, Nathibai Thackersey Road, New Marine Lines, Mumbai 400 020<br />

✜ Financial Calendar<br />

First Quarter Results end July<br />

Second Quarter Results end October<br />

Third Quarter Results end January<br />

Last Quarter Results and<br />

Annual Audited Results May<br />

✜ Dates of Book Closure 10th July, <strong>2004</strong> to 22nd July, <strong>2004</strong><br />

✜ Dividend Payment Date In respect of both physical as well as shares in demat form, the final<br />

dividend, if declared, will be paid before Friday, 30th July, <strong>2004</strong>, to those<br />

Members whose names appear in the Company records at the close of<br />

the business hours on Friday, 9th July, <strong>2004</strong>.<br />

33

✜ Listing Details<br />

After obtaining the approval from Members at the last Annual General Meeting<br />

held on 22nd July, <strong>2003</strong>, the Company made an application for delisting of its<br />

shares to the Calcutta Stock Exchange, Delhi Stock Exchange and Madras Stock<br />

Exchange. Approval from the Delhi and Madras Stock Exchanges have been<br />

received and the approval from the Calcutta Stock Exchange is expected<br />

shortly. Hence, the Company’s shares are effectively listed and traded on the<br />

Mumbai and National Stock Exchanges only. The Company’s GDRs are listed on<br />

the London Stock Exchange.<br />

The details of the Stock Exchanges on which the Company’s shares are listed are<br />

as under:<br />

Name Address Stock Code<br />

The Stock Exchange, Mumbai Phiroze Jeejeebhoy Towers, 500093<br />

Dalal Street, Mumbai 400 001<br />

National Stock Exchange of India Ltd Exchange Plaza, Bandra-Kurla Complex, CROMPGREAV<br />

Bandra (E), Mumbai 400 051<br />

The Company’s payment of listing fees are up-to-date.<br />

International Securities Identification Number (ISIN)<br />

INE067A01011 (NSDL & CDSL)<br />

✜ Market Price Data – The Stock Exchange, Mumbai<br />

Month Highest (Rs.) Lowest (Rs.) Closing (Rs.)<br />

of the Month of the Month (1st trading day<br />

of the Month)<br />

April <strong>2003</strong> 64.90 51.75 54.05<br />

May <strong>2003</strong> 66.50 55.35 61.00<br />

June <strong>2003</strong> 86.80 59.55 60.55<br />

July <strong>2003</strong> 87.50 70.00 83.60<br />

August <strong>2003</strong> 110.50 74.00 75.05<br />

September <strong>2003</strong> 117.00 88.00 105.55<br />

October <strong>2003</strong> 115.70 93.00 101.10<br />

November <strong>2003</strong> 142.60 108.00 109.60<br />

December <strong>2003</strong> 183.00 135.00 138.95<br />

January <strong>2004</strong> 176.90 136.20 168.50<br />

February <strong>2004</strong> 144.00 128.30 131.15<br />

March <strong>2004</strong> 165.75 131.25 157.25<br />

✜ Share Performance Vs BSE Sensex<br />

Crompton<br />

Sensex<br />

175<br />

6000<br />

Closing Share Prices in (Rs.)<br />

125<br />

75<br />

5000<br />

4000<br />

3000<br />

Sensex<br />

25<br />

1/4/03<br />

2/5/03<br />

2/6/03<br />

1/7/03<br />

1/8/03<br />

1/9/03<br />

1/10/03<br />

3/11/03<br />

1/12/03<br />

1/1/04<br />

3/2/04<br />

1/3/04<br />

31/3/04<br />

2000<br />

34

✜<br />

Registrar and Agents<br />

For Shares<br />

The entire share registry activities of the Company are handled by a SEBI<br />

registered Registrar & Transfer Agent - Sharepro Services. The contact details<br />

of Sharepro Services are as under:<br />

Sharepro Services<br />

Unit: Crompton Greaves Ltd<br />

912, Raheja Centre<br />

Free Press Journal Road<br />

Nariman Point, Mumbai 400 021<br />

Tel: 22881568/69,22825163<br />

Fax: 22825484<br />

Email: sharepro_services@roltanet.<strong>com</strong><br />

For Fixed Deposits<br />

The Registrar details are as under:<br />

Sharepro Services<br />

Unit: Crompton Greaves Ltd<br />

Satam Estate, 3rd Floor,<br />

Above Bank of Baroda,<br />

Chakala, Andheri (E), Mumbai 400 099<br />

Tel: 28215168/28215169<br />

Fax: 28375646<br />

Email: sharepro@vsnl.<strong>com</strong><br />

Intime Spectrum Registry Limited<br />

C-13 Pannalal Silk Mills Compound, LBS Marg, Bhandup (West),<br />

Mumbai 400 078.<br />

Tel: 25923837<br />

Fax: 25672693<br />

Email: fd@intimespectrum.<strong>com</strong><br />

✜<br />

Share Transfer System<br />

The Company’s shares are <strong>com</strong>pulsorily traded in dematerialised form. In the<br />

case of transfers in physical form which are lodged at the Registrar & Transfer<br />

Agent’s Office, these are processed within a maximum period of 30 days from<br />

the date of receipt.<br />

All share transfers and other share related issues are approved by a Director<br />

authorised by the Board; approvals are on a weekly basis; during the financial<br />

year <strong>2003</strong>-04, 53 approvals were obtained.<br />

The total number of shares in physical form transferred during the year under<br />

review was 70,504.<br />

✜ Distribution of Shareholding as on 31st March, <strong>2004</strong><br />

No of shares No of shareholders % of shareholders<br />

Up to 500 33,537 93.71<br />

501 - 1000 1,318 3.69<br />

1001 - 2000 501 1.40<br />

2001 - 3000 151 0.43<br />

3001 - 4000 58 0.16<br />

4001 - 5000 34 0.09<br />

5001 - 10000 76 0.21<br />

10001 and above 110 0.31<br />

35,785 100.00<br />

35

✜ Categories of Shareholders on 31st March, <strong>2004</strong><br />

Category No of shares of Rs.10/- each %<br />

Promoters<br />

* Indian (including persons acting in concert) 2,02,59,660 38.69<br />

* Foreign 72,00,000 13.75<br />

Indian Institutional Investors 36,38,415 6.95<br />

Bodies Corporate 13,78,854 2.63<br />

Foreign Institutional Investors 16,43,362 3.14<br />

NRIs, OCBs, GDRs 10,35,724 1.98<br />

Mutual Funds 1,10,28,179 21.07<br />

General Public 59,29,936 11.31<br />

Directors 2,52,526 0.48<br />

5,23,66,656 100.00<br />

✜<br />

✜<br />

✜<br />

✜<br />

Dematerialisation of Shares<br />

As on 31st March, <strong>2004</strong>, 96.31 per cent of the total shares of the Company<br />

have been dematerialised.<br />

Outstanding GDRs/Warrants or any Convertible Instruments<br />

The outstanding GDRs are represented by underlying equity shares that are a<br />

part of the existing equity capital. No convertible instruments are outstanding<br />

as on 31st March, <strong>2004</strong>, and therefore there will be no consequential impact<br />

on equity.<br />

Plant Locations<br />

Detailed information on plant locations, products, establishments and service<br />

centres with their contact details, is provided at the end of the Annual Report.<br />

Address for Correspondence<br />

Corporate Secretarial Department<br />

The Corporate Secretarial Department is located at the Company’s Registered<br />

Office situated at 6th Floor, CG House, Dr Annie Besant Road, Worli,<br />

Mumbai 400 030.<br />

Investor Services Department<br />

In addition to the Share Registrar & Transfer Agent, our Investor Services<br />

Department, which is located at the Company’s Registered Office, will be<br />

happy to assist, in case investors experience any difficulties in their<br />

interaction with Sharepro Services.<br />

Contact person : Mr AR Patil, Deputy Manager - Corporate Secretarial<br />

Time<br />

: 2.00 pm to 5.00 pm (Mondays to Fridays)<br />

Tel : 24237804, 24237805<br />

Fax : 24237788<br />

E-mail<br />

: avinash.patil@cgl.co.in<br />

✜<br />

Non Mandatory Requirements<br />

The Company has implemented the following non mandatory requirements<br />

re<strong>com</strong>mended under Clause 49 of the Listing Agreement:<br />

✦<br />

Chairman’s Office<br />

A Chairman’s Office with requisite facilities is provided and maintained at<br />

the Company’s expense for use by its Non-Executive Chairman. The<br />

36

✦<br />

Company also reimburses all expenses incurred in furtherance of the<br />

Company’s business interests.<br />

Remuneration Committee<br />

A Remuneration Committee <strong>com</strong>prising three Non-Executive Directors is<br />

already functional, for review and decisions on remuneration packages of<br />

Executive Directors and Senior Executives of the Company.<br />

Financial results as published in the newspapers are made available to the<br />

Members on request.<br />

On behalf of the Board of Directors<br />

Mumbai, 26th May, <strong>2004</strong><br />

KK NOHRIA<br />

Chairman<br />

Certificate on<br />

Corporate Governance<br />

To<br />

The Members<br />

Crompton Greaves Limited<br />

CG House<br />

Dr Annie Besant Road<br />

Worli<br />

Mumbai 400 030<br />

Dear Sirs,<br />

We have reviewed the implementation of the requirements of Corporate Governance<br />

by the Company, as prescribed by the Listing Agreement with Stock Exchanges, for<br />

the year ended 31st March, <strong>2004</strong>, with the relevant records and other documents<br />

maintained by the Company, furnished to us for our review and the report on<br />

Corporate Governance as approved by the Board of Directors.<br />

On the basis of the above and according to the information and explanations given<br />

to us, in our opinion, the Company has <strong>com</strong>plied with Clause 49 of the Listing<br />

Agreement with Stock Exchanges, in respect thereof.<br />

SHARP & TANNAN<br />

Chartered Accountants<br />

L. Vaidyanathan<br />

Partner<br />

Mumbai, 26th May, <strong>2004</strong> Membership No: 16368<br />

37

Management<br />

Discussion<br />

and Analysis Report<br />

Revenues grew 8<br />

per cent whilst<br />

profit after tax<br />

accelerated by 151<br />

per cent.<br />

38

The Company is in the consolidation stage in its journey of growth. In <strong>2003</strong>-04,<br />

revenues grew 8 per cent to Rs. 1861.05 crores, whilst profit after tax accelerated by<br />

151 per cent from Rs. 28.17 crores to Rs. 70.83 crores.<br />

The Company’s primary businesses concentrate on the engineering sector. A growth<br />

of these segments is largely linked to the national economic growth in general and<br />

the performance of the manufacturing, power generation & agricultural sectors and<br />

government expenditure in infrastructure in particular, all of which are showing signs<br />

of recovery. In addition to specific corporate initiatives, this external impetus has also<br />

played a role in the Company’s improved performance.<br />

As at March <strong>2003</strong>, the Company had certain amounts of Unamortised Miscellaneous<br />