INVESTMENT OPTIONS. - Legal & General

INVESTMENT OPTIONS. - Legal & General

INVESTMENT OPTIONS. - Legal & General

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Individual AND GROUP pensionS – Investment options<br />

23<br />

Any payments made to your plan during the<br />

operating period of your chosen Lifestyle Profile,<br />

will be allocated into the applicable funds in the<br />

proportions specified for that date.<br />

The following Profiles are available for all<br />

pension plans, except Trustee Investment Plans:<br />

WHAT PROFILES CAN I CHOOSE FROM?<br />

We have a range of profiles offering different<br />

fund mixes and switching periods. The details of<br />

each profile are set out over the following pages.<br />

You should refer to the Fund Information section<br />

starting on page 8 for details of the funds referred<br />

to in each table.<br />

HOW MANY PROFILES CAN I HAVE?<br />

You can only invest in one profile at any one time.<br />

Also, whilst you are invested in a Lifestyle Profile it’s<br />

not possible to invest in other funds. Once you start<br />

your plan it’s possible to switch between profiles<br />

at any time, or even stop the ‘lifestyle’ investment<br />

option and choose one or more of the funds<br />

available on the plan.<br />

IMPORTANT INFORMATION<br />

It’s important to remember that the objective of a<br />

Lifestyle Profile is to reduce the amount of risk that<br />

your pension fund is exposed to as you get nearer to<br />

your selected retirement date. It is not a guarantee<br />

that the value of your pension fund will not reduce<br />

during this period.<br />

PROFILE INFORMATION<br />

The following pages provide:<br />

• the fund the Lifestyle Profile starts in,<br />

• the fund(s) the Lifestyle Profile switches into<br />

(and what proportions if applicable),<br />

• how long before your selected retirement date<br />

the switching will begin, and<br />

• how often the switches will take place.<br />

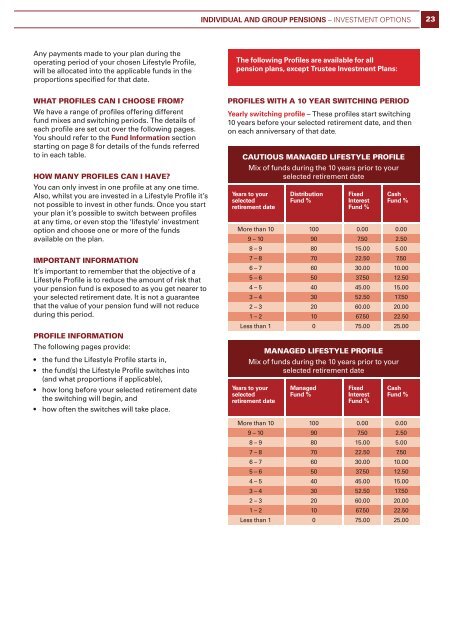

PROFILES WITH A 10 YEAR SWITCHING PERIOD<br />

Yearly switching profile – These profiles start switching<br />

10 years before your selected retirement date, and then<br />

on each anniversary of that date.<br />

CAUTIOUS MANAGED LIFESTYLE PROFILE<br />

Mix of funds during the 10 years prior to your<br />

selected retirement date<br />

Years to your<br />

selected<br />

retirement date<br />

More than 10<br />

9 – 10<br />

8 – 9<br />

7 – 8<br />

6 – 7<br />

5 – 6<br />

4 – 5<br />

3 – 4<br />

2 – 3<br />

1 – 2<br />

Less than 1<br />

Years to your<br />

selected<br />

retirement date<br />

Distribution<br />

Fund %<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Managed<br />

Fund %<br />

Fixed<br />

Interest<br />

Fund %<br />

0.00<br />

7.50<br />

15.00<br />

22.50<br />

30.00<br />

37.50<br />

45.00<br />

52.50<br />

60.00<br />

67.50<br />

75.00<br />

Fixed<br />

Interest<br />

Fund %<br />

Cash<br />

Fund %<br />

MANAGED LIFESTYLE PROFILE<br />

Mix of funds during the 10 years prior to your<br />

selected retirement date<br />

0.00<br />

2.50<br />

5.00<br />

7.50<br />

10.00<br />

12.50<br />

15.00<br />

17.50<br />

20.00<br />

22.50<br />

25.00<br />

Cash<br />

Fund %<br />

More than 10<br />

100<br />

0.00<br />

0.00<br />

9 – 10<br />

90<br />

7.50<br />

2.50<br />

8 – 9<br />

80<br />

15.00<br />

5.00<br />

7 – 8<br />

70<br />

22.50<br />

7.50<br />

6 – 7<br />

60<br />

30.00<br />

10.00<br />

5 – 6<br />

50<br />

37.50<br />

12.50<br />

4 – 5<br />

40<br />

45.00<br />

15.00<br />

3 – 4<br />

30<br />

52.50<br />

17.50<br />

2 – 3<br />

20<br />

60.00<br />

20.00<br />

1 – 2<br />

10<br />

67.50<br />

22.50<br />

Less than 1<br />

0<br />

75.00<br />

25.00