INVESTMENT OPTIONS. - Legal & General

INVESTMENT OPTIONS. - Legal & General

INVESTMENT OPTIONS. - Legal & General

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

8 Individual AND GROUP pensionS – Investment options<br />

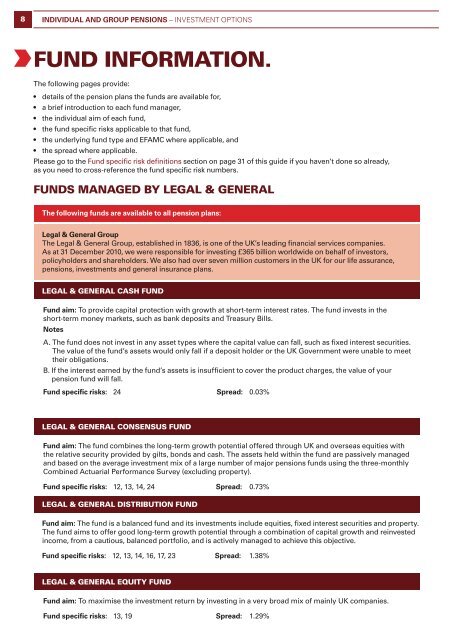

FUND INFORMATION.<br />

The following pages provide:<br />

• details of the pension plans the funds are available for,<br />

• a brief introduction to each fund manager,<br />

• the individual aim of each fund,<br />

• the fund specific risks applicable to that fund,<br />

• the underlying fund type and EFAMC where applicable, and<br />

• the spread where applicable.<br />

Please go to the Fund specific risk definitions section on page 31 of this guide if you haven’t done so already,<br />

as you need to cross-reference the fund specific risk numbers.<br />

FUNDS MANAGED BY LEGAL & GENERAL<br />

The following funds are available to all pension plans:<br />

<strong>Legal</strong> & <strong>General</strong> Group<br />

The <strong>Legal</strong> & <strong>General</strong> Group, established in 1836, is one of the UK’s leading financial services companies.<br />

As at 31 December 2010, we were responsible for investing £365 billion worldwide on behalf of investors,<br />

policyholders and shareholders. We also had over seven million customers in the UK for our life assurance,<br />

pensions, investments and general insurance plans.<br />

LEGAL & GENERAL CASH FUND<br />

Fund aim: To provide capital protection with growth at short-term interest rates. The fund invests in the<br />

short-term money markets, such as bank deposits and Treasury Bills.<br />

Notes<br />

A. The fund does not invest in any asset types where the capital value can fall, such as fixed interest securities.<br />

The value of the fund’s assets would only fall if a deposit holder or the UK Government were unable to meet<br />

their obligations.<br />

B. If the interest earned by the fund’s assets is insufficient to cover the product charges, the value of your<br />

pension fund will fall.<br />

Fund specific risks: 24 Spread: 0.03%<br />

LEGAL & GENERAL CONSENSUS FUND<br />

Fund aim: The fund combines the long-term growth potential offered through UK and overseas equities with<br />

the relative security provided by gilts, bonds and cash. The assets held within the fund are passively managed<br />

and based on the average investment mix of a large number of major pensions funds using the three-monthly<br />

Combined Actuarial Performance Survey (excluding property).<br />

Fund specific risks: 12, 13, 14, 24 Spread: 0.73%<br />

LEGAL & GENERAL DISTRIBUTION FUND<br />

Fund aim: The fund is a balanced fund and its investments include equities, fixed interest securities and property.<br />

The fund aims to offer good long-term growth potential through a combination of capital growth and reinvested<br />

income, from a cautious, balanced portfolio, and is actively managed to achieve this objective.<br />

Fund specific risks: 12, 13, 14, 16, 17, 23 Spread: 1.38%<br />

LEGAL & GENERAL EQUITY FUND<br />

Fund aim: To maximise the investment return by investing in a very broad mix of mainly UK companies.<br />

Fund specific risks: 13, 19 Spread: 1.29%