National Bank Limited - Credit Rating Agency of Bangladesh

National Bank Limited - Credit Rating Agency of Bangladesh

National Bank Limited - Credit Rating Agency of Bangladesh

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

%<br />

CRAB <strong>Rating</strong>s<br />

<strong>Bank</strong><br />

RATING REPORT (Surveillance)<br />

<strong>National</strong> <strong>Bank</strong> <strong>Limited</strong><br />

<strong>Rating</strong>s<br />

Long Term : A 1<br />

Short Term : ST-2<br />

Date <strong>of</strong> <strong>Rating</strong>: March 29, 2009<br />

Validity Date : March, 2010<br />

Previous <strong>Rating</strong>s<br />

Long Term : A 1<br />

Short Term : ST-2<br />

Date <strong>of</strong> <strong>Rating</strong> : March 06, 2008<br />

Analyst:<br />

Ehsanul Kabir<br />

Sr. Financial Analyst<br />

ehsan.kabir@crab.com.bd<br />

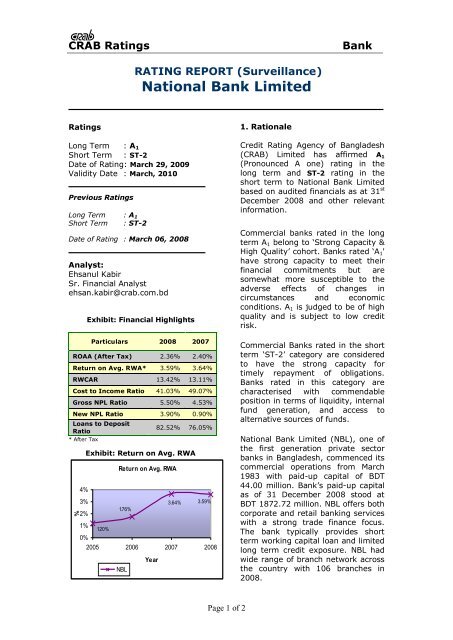

Exhibit: Financial Highlights<br />

Particulars 2008 2007<br />

ROAA (After Tax) 2.36% 2.40%<br />

Return on Avg. RWA* 3.59% 3.64%<br />

RWCAR 13.42% 13.11%<br />

Cost to Income Ratio 41.03% 49.07%<br />

Gross NPL Ratio 5.50% 4.53%<br />

New NPL Ratio 3.90% 0.90%<br />

Loans to Deposit<br />

Ratio<br />

* After Tax<br />

4%<br />

3%<br />

2%<br />

82.52% 76.05%<br />

Exhibit: Return on Avg. RWA<br />

Return on Avg. RWA<br />

1.76%<br />

3.64%<br />

3.59%<br />

1%<br />

1.20%<br />

0%<br />

2005 2006 2007 2008<br />

NBL<br />

Year<br />

1. Rationale<br />

<strong>Credit</strong> <strong>Rating</strong> <strong>Agency</strong> <strong>of</strong> <strong>Bangladesh</strong><br />

(CRAB) <strong>Limited</strong> has affirmed A 1<br />

(Pronounced A one) rating in the<br />

long term and ST-2 rating in the<br />

short term to <strong>National</strong> <strong>Bank</strong> <strong>Limited</strong><br />

based on audited financials as at 31 st<br />

December 2008 and other relevant<br />

information.<br />

Commercial banks rated in the long<br />

term A 1 belong to ‘Strong Capacity &<br />

High Quality’ cohort. <strong>Bank</strong>s rated ‘A 1 '<br />

have strong capacity to meet their<br />

financial commitments but are<br />

somewhat more susceptible to the<br />

adverse effects <strong>of</strong> changes in<br />

circumstances and economic<br />

conditions. A 1 is judged to be <strong>of</strong> high<br />

quality and is subject to low credit<br />

risk.<br />

Commercial <strong>Bank</strong>s rated in the short<br />

term ‘ST-2’ category are considered<br />

to have the strong capacity for<br />

timely repayment <strong>of</strong> obligations.<br />

<strong>Bank</strong>s rated in this category are<br />

characterised with commendable<br />

position in terms <strong>of</strong> liquidity, internal<br />

fund generation, and access to<br />

alternative sources <strong>of</strong> funds.<br />

<strong>National</strong> <strong>Bank</strong> <strong>Limited</strong> (NBL), one <strong>of</strong><br />

the first generation private sector<br />

banks in <strong>Bangladesh</strong>, commenced its<br />

commercial operations from March<br />

1983 with paid-up capital <strong>of</strong> BDT<br />

44.00 million. <strong>Bank</strong>’s paid-up capital<br />

as <strong>of</strong> 31 December 2008 stood at<br />

BDT 1872.72 million. NBL <strong>of</strong>fers both<br />

corporate and retail banking services<br />

with a strong trade finance focus.<br />

The bank typically provides short<br />

term working capital loan and limited<br />

long term credit exposure. NBL had<br />

wide range <strong>of</strong> branch network across<br />

the country with 106 branches in<br />

2008.<br />

Page 1 <strong>of</strong> 2

CRAB <strong>Rating</strong>s<br />

<strong>Bank</strong><br />

Net interest income dominated the revenue stream with 41% <strong>of</strong> total income.<br />

Other key sources <strong>of</strong> revenue were commission and exchange (29%) and interest<br />

income / dividend from investment (15%). NBL’s cost to income ratio reduced by<br />

8.04 percentage points and stood at 41.03%. NBL managed to restrict its<br />

operating expense even increasing staff expenses (by 11.88%) mainly because <strong>of</strong><br />

8.38% decline in other operating expenses.<br />

The bank’s net pr<strong>of</strong>it after tax has an increasing trend and stood at BDT<br />

1,516.68 million in 2008. Although ROAA before tax increased in 2008, after tax<br />

ROAA reduced marginally mainly because <strong>of</strong> higher growth in tax provision. NBL’s<br />

after tax return on risk weighted assets (RWA) also witnessed slight reduction in<br />

2008 and stood at 3.59% (2007: 3.64%).<br />

The bank is mainly funded by customer deposit and internal capital generation.<br />

About 30% <strong>of</strong> total deposits <strong>of</strong> the bank comprised current and savings deposits.<br />

But NBL enjoyed lower cost <strong>of</strong> deposits (6.76%) compared to PCB average<br />

(8.74% 1 ). The bank maintained satisfactory liquidity position in 2008. Loans and<br />

advances to deposit ratio <strong>of</strong> the bank was 82.52% at the end <strong>of</strong> 2008. The bank<br />

was the net lender to the call money market throughout 2008 except in May.<br />

NBL experienced substantial growth (36.16%) in loans and advances portfolio<br />

and reached at BDT 49,665.07 million by the end <strong>of</strong> 2008. The bank’s credit<br />

portfolio was reasonably diversified in terms <strong>of</strong> intrinsic and concentration risk.<br />

NBL’s loan portfolio in 2008 was dominated by local trade financing (32.02%)<br />

followed by import financing (20.46%). The bank’s top 50 funded loans advances<br />

in 2008 hold 35.83% (2007: 36.27%) <strong>of</strong> total loans and advances portfolio.<br />

The <strong>Bank</strong>’s gross non-performing loan (NPL) ratio in 2008 increased to 5.50%<br />

from 4.53% in 2007. Gross NPL ratio increased mainly because <strong>of</strong> higher growth<br />

in fresh NPL generation despite 36.16% growth in loans and advances. It is to be<br />

mentioned that apart from cash recovery, the bank had written <strong>of</strong>f BDT 472.78<br />

million and rescheduled BDT 151.30 million to reduce its closing NPL balance in<br />

2008. Special Mention Accounts (SMA) to total loans & advances ratio <strong>of</strong> the <strong>Bank</strong><br />

reduced to 1.97% in 2008 (2007: 2.16%).<br />

The <strong>Bank</strong> is reasonably capitalized with risk weighted capital adequacy ratio<br />

13.42% by the end <strong>of</strong> 2008 (2007:13.11%) against regulatory requirement 10%.<br />

The <strong>Bank</strong> increased its capital adequacy ratio to hold adequate capital in as per<br />

regulatory requirement which is to be attained by June 2011. Risk weighted<br />

assets to total assets ratio increased to 67.26% in 2008 (2007: 63.58%) which<br />

indicated that the bank had invested in more risky assets in 2008.<br />

NBL’s investment portfolio comprised government securities, quoted and<br />

unquoted shares, debentures, fixed capital investment in Myanmar as well as<br />

investment in NBL capital market service (CMS) fund. The bank invested BDT<br />

1000 million with CMS. But NBL did not classify the margin loans based on<br />

outstanding period. Moreover, the bank does not have any provision policy for<br />

margin loan loss.<br />

NBL has its strength in liquidity position and capital generation. On the other<br />

hand, principal concern for the bank is higher growth in non performing loans.<br />

NBL also lacks IT infrastructure for centralised MIS support.<br />

1 As on September 2008<br />

Page 2 <strong>of</strong> 2