Opus Group Annual 2011 Report ENG

Opus Group Annual 2011 Report ENG

Opus Group Annual 2011 Report ENG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

8<br />

OPUS <strong>2011</strong><br />

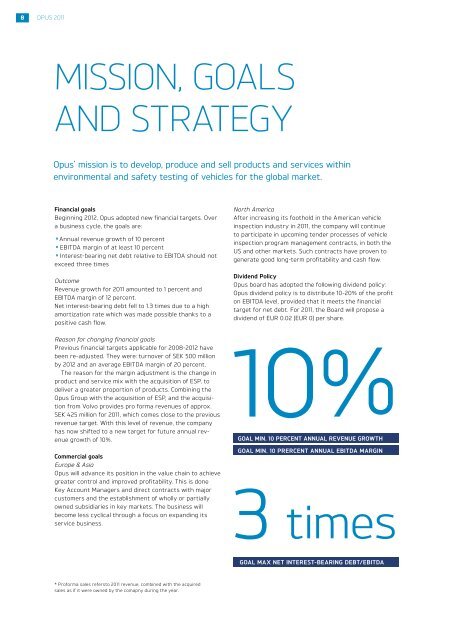

MISSION, GOALS<br />

AND STRATEGy<br />

<strong>Opus</strong>’ mission is to develop, produce and sell products and services within<br />

environmental and safety testing of vehicles for the global market.<br />

Financial goals<br />

Beginning 2012, <strong>Opus</strong> adopted new financial targets. Over<br />

a business cycle, the goals are:<br />

·<strong>Annual</strong> revenue growth of 10 percent<br />

·EBITDA margin of at least 10 percent<br />

·Interest-bearing net debt relative to EBITDA should not<br />

exceed three times<br />

Outcome<br />

Revenue growth for <strong>2011</strong> amounted to 1 percent and<br />

EBITDA margin of 12 percent.<br />

Net interest-bearing debt fell to 1.3 times due to a high<br />

amortization rate which was made possible thanks to a<br />

positive cash flow.<br />

North America<br />

After increasing its foothold in the American vehicle<br />

inspection industry in <strong>2011</strong>, the company will continue<br />

to participate in upcoming tender processes of vehicle<br />

inspection program management contracts, in both the<br />

US and other markets. Such contracts have proven to<br />

generate good long-term profitability and cash flow.<br />

Dividend Policy<br />

<strong>Opus</strong> board has adopted the following dividend policy:<br />

<strong>Opus</strong> dividend policy is to distribute 10-20% of the profit<br />

on EBITDA level, provided that it meets the financial<br />

target for net debt. For <strong>2011</strong>, the Board will propose a<br />

dividend of EUR 0.02 (EUR 0) per share.<br />

Reason for changing financial goals<br />

Previous financial targets applicable for 2008-2012 have<br />

been re-adjusted. They were: turnover of SEK 500 million<br />

by 2012 and an average EBITDA margin of 20 percent.<br />

The reason for the margin adjustment is the change in<br />

product and service mix with the acquisition of ESP, to<br />

deliver a greater proportion of products. Combining the<br />

<strong>Opus</strong> <strong>Group</strong> with the acquisition of ESP, and the acquisition<br />

from Volvo provides pro forma revenues of approx.<br />

SEK 425 million for <strong>2011</strong>, which comes close to the previous<br />

revenue target. With this level of revenue, the company<br />

has now shifted to a new target for future annual revenue<br />

growth of 10%.<br />

Commercial goals<br />

Europe & Asia<br />

<strong>Opus</strong> will advance its position in the value chain to achieve<br />

greater control and improved profitability. This is done<br />

Key Account Managers and direct contracts with major<br />

customers and the establishment of wholly or partially<br />

owned subsidiaries in key markets. The business will<br />

become less cyclical through a focus on expanding its<br />

service business.<br />

10%<br />

GOAL MIN. 10 PERCENT ANNUAL REVENUE GROWTH<br />

GOAL MIN. 10 PRERCENT ANNUAL EBITDA MARGIN<br />

3 times<br />

GOAL MAX NET INTEREST-BEARING DEBT/EBITDA<br />

* Proforma sales refersto <strong>2011</strong> revenue, combined with the acquired<br />

sales as if it were owned by the comapny during the year.