ANNUAL REPORT 2009 - GAM Holding AG

ANNUAL REPORT 2009 - GAM Holding AG

ANNUAL REPORT 2009 - GAM Holding AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

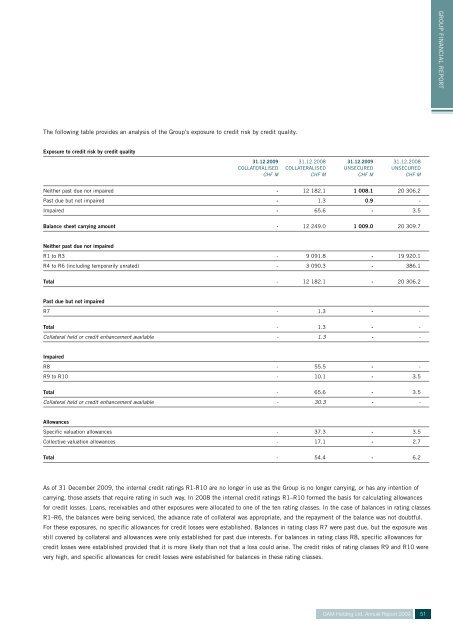

The following table provides an analysis of the Group’s exposure to credit risk by credit quality.<br />

Exposure to credit risk by credit quality<br />

31.12.<strong>2009</strong> 31.12.2008 31.12.<strong>2009</strong> 31.12.2008<br />

COLLATERALISED COLLATERALISED UNSECURED UNSECURED<br />

CHF M CHF M CHF M CHF M<br />

Neither past due nor impaired - 12 182.1 1 008.1 20 306.2<br />

Past due but not impaired - 1.3 0.9 -<br />

Impaired - 65.6 - 3.5<br />

Balance sheet carrying amount - 12 249.0 1 009.0 20 309.7<br />

Neither past due nor impaired<br />

R1 to R3 - 9 091.8 - 19 920.1<br />

R4 to R6 (including temporarily unrated) - 3 090.3 - 386.1<br />

Total - 12 182.1 - 20 306.2<br />

Past due but not impaired<br />

R7 - 1.3 - -<br />

Total - 1.3 - -<br />

Collateral held or credit enhancement available - 1.3 - -<br />

Impaired<br />

R8 - 55.5 - -<br />

R9 to R10 - 10.1 - 3.5<br />

Total - 65.6 - 3.5<br />

Collateral held or credit enhancement available - 30.3 - -<br />

Allowances<br />

Specific valuation allowances - 37.3 - 3.5<br />

Collective valuation allowances - 17.1 - 2.7<br />

Total - 54.4 - 6.2<br />

As of 31 December <strong>2009</strong>, the internal credit ratings R1-R10 are no longer in use as the Group is no longer carrying, or has any intention of<br />

carrying, those assets that require rating in such way. In 2008 the internal credit ratings R1–R10 formed the basis for calculating allowances<br />

for credit losses. Loans, receivables and other exposures were allocated to one of the ten rating classes. In the case of balances in rating classes<br />

R1–R6, the balances were being serviced, the advance rate of collateral was appropriate, and the repayment of the balance was not doubtful.<br />

For these exposures, no specific allowances for credit losses were established. Balances in rating class R7 were past due, but the exposure was<br />

still covered by collateral and allowances were only established for past due interests. For balances in rating class R8, specific allowances for<br />

credit losses were established provided that it is more likely than not that a loss could arise. The credit risks of rating classes R9 and R10 were<br />

very high, and specific allowances for credit losses were established for balances in these rating classes.<br />

<strong>GAM</strong> <strong>Holding</strong> Ltd. Annual Report <strong>2009</strong><br />

51<br />

GROUP FINANCIAL <strong>REPORT</strong>